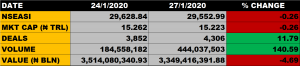

The Nigerian equities market on Monday closed lower, buoyed by loses in major bank stocks and other big wigs that closed flat at the close of trade. Apart from Wema bank that gained 1.41% as well as Jaiz bank that appreciated by 4.55%, other banks such as: FBHN, Access, UBA, Zenith and Sterling Bank shed their share prices while, big wigs like MTN Nigeria, Dangote Cement and Guaranty Bank closed flat making the All share index to drop by 0.26% to close at 29,552.99 points below the previous close of 29,628.84 points on Friday.

The Market capitalisation declined by 0.26% to close at N15.223 trillion against the previous close of N15.262 trillion.

Aggregate volume of traded stocks closed at 444 million units, up by 140.59% away from the previous close of 184.5 million units.

The value of traded stocks declined by 4.69%, closing at N3.349 billion against the previous close of N3.514 billion.

Total number of deals at the close of trade was 4,306, up by 11.79% from the previous close of 3,852 deals on Friday.

Market Breadth

The market Breadth closed positive as 14 stocks gained while 13 stocks declined in their share prices.

Percentage Gainers

Nigeria Aviation Handling Company led the price percentage gainers’ list with 9.80% growth to close at N2.69 against the previous close of N2.45.

NPF Micro Finance, NEIMETH, Linkage Assurance and Vita Foam among other gainers also grew their share prices by 9.73%, 8.51%, 8.33% and 6.00% respectively.

Percentage Losers

Unilever Plc led price percentage losers, shedding 9.97% of its share price to close at N15.80 from the previous close of N17.55.

Eternal Oil, Royal Exchange, Julius Berger and Sterling Bank among others also shed their share prices by 9.52%, 9.09%, 6.28% and 5.15% respectively.

Volume Drivers

- Zenith Bank traded about 45 million units of its shares in 548 deals, valued at about N988 million.

- Guaranty traded about 26 million units of its shares in 282 deals, valued at N856 million.