Wole Olajide

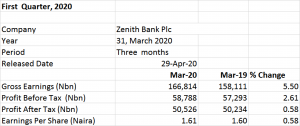

Zenith Bank in its recently published financial report for the three months ended 31 March 2020 gave an outlook, expectation and future impact of the Covid- 19 pandemic on its business operations.

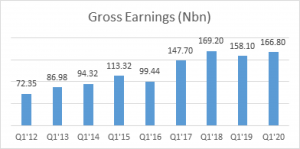

In the unaudited financial statement, the financial giant reported gross earnings of N166.8 billion, up by 5.5 percent when compared to the gross earnings of N158.1 billion reported in the first quarter of 2019.

Profit before tax rose by 2.61 percent to N58.79 billion from N57.29 billion reported in Q1 2019. Profit after tax for the period under review was N50.53 billion, up by 0.58 percent from N50.23 billion reported in Q1 2019.

The earnings per share of the financial institution is N1.61, up by 0.58 percent from the earnings per share of N1.60 in the first quarter of 2019.

Recall that Zenith Bank in its full year 2019 financial report, recorded a profit after tax (PAT) of N208.8 billion, an increase of 7.97% from the N193 billion recorded in the previous year.

The Group also recorded a growth in gross earnings of 5.06% rising to N662.3 billion from N630.3 billion reported in the previous year. The gross earnings growth was driven by a 29% rise in non-interest income from N179.9 billion in 2018 to N231.1 billion in 2019; an indication of a growth in foreign exchange income.

Fees on electronic products grew significantly with a 108% Year on Year growth from N20.4 billion in 2018 to N42.5 billion in 2019 year. This suggests that higher incomes are pulled in from the bank’s payment platforms and automated teller machines. The rise reflects growth in digital retail activities. Profit before tax increased by 5.01% growing from N232 billion to N243 billion in FY’19

Trend and Impact of COVID-19 on financial conditions of Zenith Bank

In the notes to the consolidated and interim financial statement for the three months ended 31 March 2020, Zenith Bank highlighted the impact of the COVID-19 pandemic on its business operation. According to the bank:

- Lower economic activities and revision of rate of interest on government intervention loans has resulted in the immediate reduction of traditional income stream.

- Expected low cash flows is engendering the possible restructuring of loans and critical review of performance of customers by sector and segments.

- Key sectors that will be affected in the books of the bank are Oil and Gas; Hospitality, Travel and Aviation; Leisure and Entertainment; Construction and; some aspects of manufacturing.

- Key sectors that would benefit from the events are Healthcare and Pharmaceutical Companies and Fast-Moving Consumer Goods Companies and; Agriculture.

- It is also creating opportunities for growth in both volume and Income from E-channels and other online service offerings.

Outlook and expectation of future impact of the pandemic

- The impact will greatly influence the group’s present and future business models, with significant emphasis on digital banking services, digital payment channels and virtual meetings, especially in the 2020 financial year and beyond.

- The bank will continue to assess the business disruption capabilities and abilities to work from home for its employees amid the pandemic. The resilience factors across operations; lending and lending customers; Trade finance; and key financial indicators (mainly with increased buffers) is been reviewed and fine-tuned.

- Declining monthly FAAC allocation to tiers of government may negatively impact the bank’s liquidity position and asset quality in that sector.

- Possible decline in Capital Adequacy Ratio from increased Risk Weighted Asset arising from foreign currency translation.

- Expected higher yield from FGN Bonds as government increases borrowings to meet infrastructural project financing.

- Impaired capacity to repay loans and possible higher-than-expected NPLs in the affected sectors of the economy.

- Increased cybersecurity and socio-political issues.

Zenith Bank’s current actions and response to the uncertainties of Covid-19 pandemic

The bank in swift response to current economic realities took several measures to ‘stay safe’. This include:

- Implementation on more robust Business Continuity Plan and Resilience activities. The bank has also developed a strategic crisis-action plan to guide the organization’s response across all Covid-19 scenarios – short, medium and long term.

- Continue all strategic activities and meetings through a secured online tool, with special focus on continuous review of the Impacts of Covid-19 while leveraging emerging opportunities while developing processes for the health and safety of employees and customers.

- Several stress tests and scenarios have been developed to assess the possible impacts of Covid-19 on our liquidity, capital adequacy and earning capacity. Systems and strategies are being put in place to respond to expected impact on the bank’s balance sheet and trading activities and monitoring all assets and liabilities classes to reveal current performance and ensure appropriate actions to meet the bank’s financial obligations and preserve shareholders’ funds.

- Building and enhancing virtual operating models & processes and promoting innovation and creativity in digital service delivery using data analysis and technology to drive business.

- Strengthen risk management practices and regularly assess the performance of Business Continuity Plan (BCP).

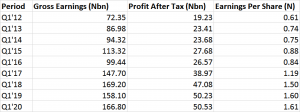

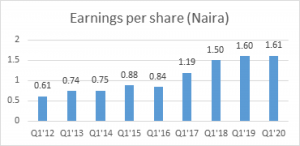

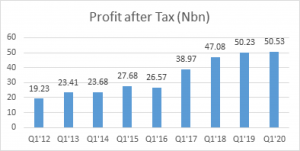

Trend in Gross Earnings, PAT and EPS

Following the trend of First Quarter (Q1) results released by Zenith Bank since 2012, we observed a steady growth in its gross earnings, profit after tax and earnings per share for 5 straight years from 2016 to 2020. This implies steady growth in Q1 top line and bottom line figures for 5 years.

In April 2020 during the lockdown, Zenith Bank introduced an automated voice banking service, an interactive voice response (IVR) solution which enables customers to perform basic banking transactions by dialing a dedicated phone line through their registered phone numbers and following the prompts.

By simply dialing +234 (1) 278 7000 from the phone number linked to their accounts and following the prompts, customers can pay DSTV/GOTV bills, restrict their accounts or block their cards, request account statement via email, view the last five transactions, transfer funds, buy airtime, and do lots more.

Zenith Bank Plc was established in May 1990, and commenced operations in July of the same year as a commercial bank. The Bank became a public limited company on June 17, 2004 and was listed on the Nigerian Stock Exchange (NSE) on October 21, 2004 following a highly successful Initial Public Offering (IPO). Zenith Bank Plc currently has a shareholder base of about one million and is Nigeria’s biggest bank by tier-1 capital.

With the vision to become the leading Nigerian, technology-driven, global financial institution that provides distinctive range of financial services, the group has been on the quest to build the zenith brand into a reputable international financial institution recognized for innovation, superior performance and creation of premium value for all stakeholders.