Zenith Bank is a leading financial institution in Nigeria and a leader in the deployment of various channels of banking technology.

The Bank has performed over the years with consistent growth in turnover, profit after tax and earnings per share especially with good dividend pay-out record. The Bank has been consistent with both interim and final dividend.

The share price of Zenith Bank in the last one year has touched a high of N28.50 and a low of N10.70. At the current share price of N27.2, Zenith has grown by 154.21% from a year low of N10.70. It is trading 4.56% away from its year high of N28.50.

In terms of price appreciation, some might want to bail out due to fact that it is trading close to its year high and look for another entry opportunity when the price comes down. However, in terms of dividend yield, a position in Zenith Bank is bound to return up to about 10% dividend yield.

Full Year earnings of the bank for 2020 will soon be released and it is bound to be good based on past impressive result over the last five years. Zenith is likely to pay a final dividend of N2.50 in addition to the interim dividend of 30 kobo already paid.

With the book value of N32.94, relative to the current share price of N27.2, Zenith Bank is underpriced and has a lot of growth potential.

In the first quarter of 2020, Zenith reported a Profit after tax of N50.53 billion, up by 0.58 percent from N50.23 billion reported in Q1 2019.

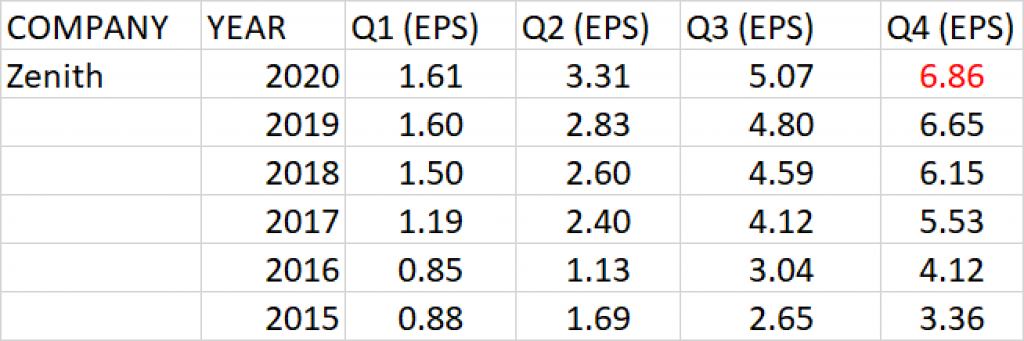

The earnings per share for Q1’20 was N1.61, up by 0.58 percent from the earnings per share of N1.60 in the first quarter of 2019.

In the second quarter of 2020, Profit after tax of Zenith Bank grew by 16.81% to N103.83 billion from N88.88 billion achieved in the second quarter of 2019.

Earnings per share (EPS) increased to N3.31 from the EPS of N2.83 achieved in the second quarter of 2019.

In the third quarter of 2020, Profit after tax of the Bank grew by 5.70% year on year, to N159.3 billion from N150.7 billion reported in 2019.

Earnings per share grew to N5.07 from the EPS of N4.8, which translates to 5.7% growth year on year.

Q4 earnings per share (EPS) of the bank over the last 5 years has a geometric average growth rate of 18.61%.

PEG ratio against the expected Q4 earnings is 0.21, which makes the share price of Zenith Bank underpriced at current price.

Earnings per share of about N6.86 is projected for Zenith Bank in its Full Year 2020 audited report.

We expect Zenith Bank to pay final dividend of N2.50 in addition to the interim dividend of 30 kobo already paid. This would amount to total dividend of N2.80, same as the previous year.