THE MARKET LAST WEEK:

The four-day trading week ended with Nigerian Stock Exchange’ All Share Index declining by 1.60% as it closed at 40,841.14 from the close of 41,504.51 in the preceding week. Market capitalisation also recorded same performance, closing at N14.753 trillion from N14.993 trillion in the previous week.

YEAR TO DATE:

Year-to-Date, the NSEASI has recorded a 6.8% growth.

A cursory analysis of Month-on-Month performances so far in the year shows that January 2018 remains yet the best in the year as the index grew in the month, by 16% while March recorded highest monthly loss of 4.2%. In February, it was a decline of 2.3% while April, which is just a week old has a record of 1.6% decline.

MARKET STATE AND OUTLOOK:

- Most earnings from quoted and listed companies are more positive than negative. Portfolio reshuffling and intermittent profit taking will continue to dominate activities on the floor of the Nigerian Stock Exchange.

- MPC meeting was eventually held with rates left unchanged. Possibilities are that performances of financial markets and flow of investments will remain same until month of May when another MPC meeting is scheduled to hold.

- Decline in February and March with the much recorded so far in April are advantages to those that missed the rally of January.

- 2019 elections and political intrigues will continue to determine investment decisions in the short term.

- Q1 earnings should be expected to begin to hit the market in the next one or two weeks. This should extend to the month of May. Earnings performances of the results will go a long way to determining overall market performance.

- Notably, some institutions and foreign holders of stocks in the Nigerian market, who do not so much believe in the country, might seize opportunities of good earnings to bail out with hopes of returning after the elections of 2019.

FACTS ABOUT MARKET ACTIVITIES:

- Good companies in the long run will always generate good stocks. Target good companies by considering fundamentals.

- Decline in price of stock of a good company is a great buy opportunity.

- You don’t need to rush. Buyers’ market is much in force.

- If you bought into stock of a good company only to see price declining, stay cool. It is only a matter of time but note, stock of a good company.

POSSIBILITIES THIS WEEK:

- The market had closed Friday with a decline in all sector indexes and other key indicators. This is expected to be the take off point on Monday though with lots of possibilities.

- Closing bids and offers sizes Friday were more in favour of slow moving market at the start Monday. Hope of at least slight improvement into the week remains firm.

- Technically, charts are indicating low moving market. This to a large extent makes room for investment at good prices.

STOCKS TO WATCH FOR THE WEEK

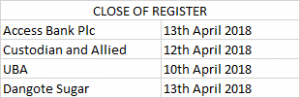

- ACCESS BANK PLC: If figures that emanated from the last trading session of last week are to be considered, Access Bank Plc’ stock price is bound to open the week weak. On the whole, hinged on charts position, the week is bound to be shared between green and red. At current price of N12, going by full 2017 full year earnings per share of N2.14, PER is 5.6 while earnings yield is 17.8%. Comparatively, though the EPS is lower than the previous, it is superior than the price and of others in same industry. Access’ Q1 stands to show significant improvement.

- AFRICA PRUDENTIAL PLC: The company’s board meeting to approve its Q1 result is just next week. At current price of N4.09 on audited earnings of 86kobo with 21% earnings yield and 4.75 PER, the stock is by any standard cheap for medium and long term purchase. The last dividend yield of about 10% is also too good. Indicators are showing that it is getting to overbought level but others are showing signals that there are few more possible price upward movements. Its closing bid size last Friday portends likely strong open Monday.

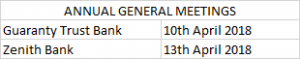

- ZENITH BANK PLC: The price was marked for dividend last week. Its AGM is this week. Going by the bid size at close of trade Friday, a likely strong open Monday is possible. As far as indicators are concerned, Zenith is within a buy range without fear. If a price drop is experienced after a purchase, it would be time for accumulation of the stock for medium to long term hold. Going by the 2017 full year earnings of N5.67, its PER at current price stands at 4.81 while the earnings yield is about 21%. An investor can’t get it more right, investing in Zenith at current price. Comparatively, Zenith price should not be below N40.

- GUARANTY TRUST BANK PLC: Friday’s closing bid size favours a strong open Monday, this is also expected to continue Tuesday as the shareholders gather for its AGM Tuesday, on same day the dividend payment will be due. From N5.79 EPS at full year 2017, current price of N44.10 brings earnings yield to 13.13% while PER is 7.62. Technically, indicators are more in support of price shed. If that occurs, premised on notable price performance, it becomes buyable.

- AIICO: The higher the price, after three days of straight gains brings the stock nearer to overbought level. It is advisable to sell with hope of a re-entry, so say the indicators though basic statistics are looking bright. Closing bid size Friday however signifies a strong open Monday. at current price of 68kobo, a 5kobo dividend gives 7.35% while earnings yield at 18 kobo EPS is 26.47% with PER at current price and earnings is 3.8. With these figures, AIICO at current price is a bargain particularly if current price is sustained.

- DANGOTE SUGAR REFINERY PLC: Going by this company’s full year earnings of N3.31 and dividend of N1.25, at current price of N21.45, the stock is good more so as most indicators are within buyable range. The PER is 6.9 while the earnings yield is 15.43% and dividend yield 5.82%. Closing bids size Friday is indicative of possible strong open Monday.

- HONEYWELL FLOUR MILLS PLC: Wide gaps available for an upward price movement, so say the indicators. Closing bids size Friday seems to be in support of this hence, a strong open is expected Monday. The last report was its Q3 reports showing 35kobo EPS, this when considered relative to current price of N2.41 and likely performance at full year makes the stocks suitable for stock to watch.

- LASACO INSURANCE PLC: While other stocks were recording good appreciation in January, LASACO was actually recording decline. In January, it was a decline of 16% and another 21.4% in February. It was flat in March but so far in April, it has been a record 21.20% growth in price. This is premised on the company’s 12 kobo 2017 full year EPS and 4 kobo dividend proposal. Notably, its net asset in the audited account is N1.11. No wonder the price began a rally from 33kobo on March 29, 2018 and has not looked back till date. A back of the envelope analysis of the audited reports’ basic statistic gives even at current price of 40 kobo, earnings yield of 30%, PER of 3.33 and from the 4 kobo dividend comes a 10% dividend yield. Comparatively, this stands as one of the best results so far declared in the market in 2018. The closing bids size Friday is an indication that this week looks good for the stock though a few indicators are showing possibilities of a price shed.

- MAY AND BAKER PLC: It is true that the company is gearing up for a rights issue. Strategic consultations are ongoing prior to seeking regulatory approval. The company’s audited reports to the market, a 20kobo dividend was declared from a full year earnings per share of 38kobo from just 4kobo declared in the prior year. These, relative to current price of N2.79 lead to 7.34 PER, 13.62% earnings yield and 7.17% dividend yield. These are the more plausible when compared with how low May and Baker had being over the years. Technically speaking however, the stock might arrive at an overbought level after one or two more days of gains. Watch out for the stock.

- UCAP: The doji candlestick pattern with which the stock price closed Friday signifies either way direction. Ditto other indicators. Consequently, the week would be shared among green and red days for the stock. Monday stands to be strong in the open. Pending then release of the company’s Q1 reports, 71kobo EPS at 2017 full year on N3.42 price gives 20.76% earnings yield and 4.82 PER. UCAP is sure cheap going by this basic statistics.