- Access Bank leads in turnover growth

- Guaranty Trust emerge top in profit margin

The much anticipated audited reports for Full Year 2020 of the companies yet to release their results finally landed last week as the market was bombarded with results in order to beat the deadline of March 31st.

Performance of earnings released so far has been mixed in terms of dividend pay-out. A number of firms improved on their dividend pay-out, while others retained the previous dividend and just about few reduced their dividend. In the banking sector, results released was impressive as most of them improved on their dividend pay-out except for UBA that reduced its dividend by 48% year on year.

PERFORMANCE IN PROFIT AFTER TAX (PAT)

Profit after tax (PAT) can be termed as the net profit available for the shareholders after paying all the expenses and taxes by the company.

- United Bank for Africa grew its profit after tax by 27.70% year on year from N89.089 billion to N113.765 billion, emerging best in terms of growth in profit after tax among others in the banking industry.

- First Bank of Nigeria Holdings (FBNH) emerged second best in terms of growth in profit after tax as profit grew by 21.81% year on year from N73.665 billion to N89.73 billion.

- FCMB grew its profit after tax by 13.11% to N19.61 billion from N17.34 billion, emerging third on the ranking in terms of profitability.

- Access Bank achieved profit after tax of N106 billion, up by 12.71% from N94.056 billion achieved in 2019, emerging fourth in ranking in terms growth in PAT.

- Stanbic IBTC grew its profit after tax by 10.90% from N75.035 billion to N83.21 billion.

- Zenith Bank grew profit after tax by 10.40% year on year to N230.565 billion from N208.843 billion.

- Sterling Bank achieved profit after tax of N11.242 billion, up by 6.04% from N10.602 billion achieved the previous year.

- Guaranty Trust Bank grew its profit after tax by 2.33% year on year to N201.44 billion from N196.85 billion reported in 2019.

- Union Bank declined in profit after tax by 6.05% to N18.672 billion from N19.875 billion reported the previous year.

- Fidelity Bank declined in profit after tax by 6.24% to N26.650 billion from N28.425 billion.

- Ecobank declined in profit after tax by 66.08% to N33.74 billion from N99.46 billion.

PERFORMANCE IN EARNINGS PER SHARE

Earnings per share (EPS) is calculated as a company’s profit after tax divided by the outstanding number of shares. The resulting number serves as an indicator of a company’s profitability.

- Earnings per share of UBA increased by 27.70% to N3.33 from N2.60, emerging as overall best in terms of growth in earnings per share in the banking sector.

- First Bank of Nigeria Holdings (FBNH) emerged second best in terms of growth in earnings per share as EPS grew by 21.81% year on year from N2.50 to N2.05.

- FCMB grew its earnings per share by 13.11% to 99 kobo from N88 kobo, emerging third on the ranking in EPS growth.

- Access Bank achieved earnings per share of N2.98, up by 12.71% from the EPS of N2.65 achieved in 2019, emerging fourth in ranking in terms of growth.

- Stanbic IBTC grew its earnings per share by 10.90% from N7.49 to N6.76.

- Zenith Bank grew its earnings per share by 10.40% year on year to N7.34 from N6.65.

- Sterling Bank achieved the earnings per share of 39 kobo, up by 6.04% from the EPS of 37 kobo achieved the previous year.

- Guaranty Trust Bank grew its earnings per share by 2.33% year on year to N6.84 from N6.69 reported in 2019.

- Union Bank declined in earnings per share by 6.05% to 64 kobo from 68 kobo reported the previous year.

- Fidelity Bank declined in earnings per share by 6.24% to 92 kobo from 98 kobo.

- Ecobank declined in earnings per share by 66.08% to N1.84 from N5.42.

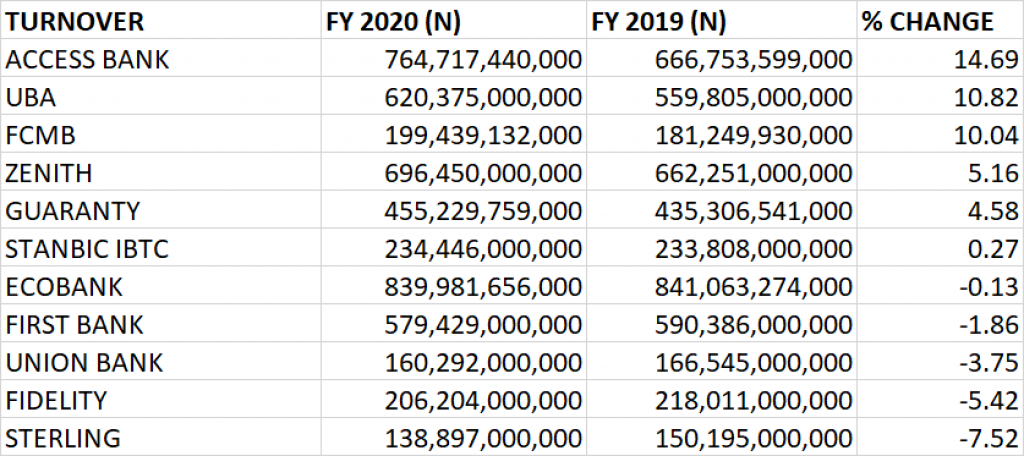

PERFORMANCE IN TURNOVER GROWTH

- Access Bank emerged top in terms of turnover growth among other banking stocks as it grew its Gross Earnings by 14.69% year on year to N764.72 billion from N666.75 billion.

- Second on the list is UBA with Gross Earnings of N620.375 billion, up by 10.82% from N559.805 billion in 2019.

- FCMB is third among banks that grew their turnover in year 2020. The Gross Earnings of the Bank increased by 10.04% year on year to N199.439 billion from N181.25 billion.

- Zenith Bank is fourth in ranking of turnover growth as it grew its Gross Earnings by 5.16% to N696.45 billion from N662.25 billion.

- Guaranty Trust Bank emerged fifth among banks that grew their turnover in the 2020 financial year as Gross Earnings increased by 4.58% to N455.23 billion from N435.31 billion.

- Stanbic IBTC marginally grew its earnings per share by 0.27% to N234.446 billion from N233.808 billion.

- Ecobank, First Bank, Union Bank, Fidelity Bank and Sterling bank declined in their turnover year on year by 0.13%, 1.86%, 3.75%, 5.42% and 7.52% respectively.

PROFIT MARGIN

Profit margin is one of the commonly used profitability ratios to gauge the degree to which a company or a business activity makes money. It represents what percentage of sales has turned into profits. It is calculated by dividing Profit after tax (PAT) by turnover, multiplied by 100.

- Guaranty Trust Bank emerged top among others with a profit margin of 44.25% in year 2020. Compared to the profit margin of 45.22% in 2019, GT Bank’s profit margin for 2020 financial year is slightly lower by 0.97 percentage point as against 2019.

- Stanbic IBTC achieved a profit margin of 35.49%, emerging second among others in the banking sector in terms of profit margin. Compared to the profit margin of 32.09%in 2019, there is an improvement of 3.4 percentage point in 2020.

- Zenith Bank in 2020 financial year achieved a profit margin of 33.11%, emerging third among others.

- UBA achieved a profit margin of 18.34% emerging fourth among others.

- First Bank made a profit margin of 15.49% in 2020 financial year.

- Access Bank has a profit margin of 13.86%

- Fidelity Bank has a profit margin of 12.92%

- Union Bank has a profit margin of 11.65%.

- FCMB has a profit margin of 9.83%

- Sterling Bank has a profit margin of 8.09%

- Ecobank has a profit margin of 4.02%

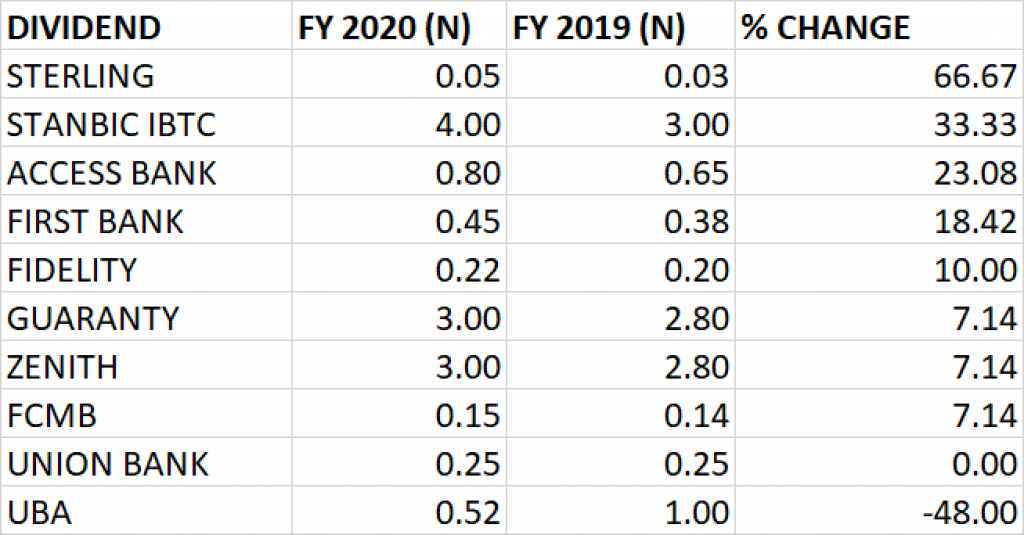

DIVIDEND GROWTH & DIVIDEND YIELD

Most of the banks that declared dividend in 2020 financial year increased their dividend from what they previously paid. Except for UBA that reduced its dividend pay-out by 48% despite impressive growth in top line and bottom line figures.

- Sterling Bank increased their dividend pay-out by 66.67% to 5kobo from 3 kobo, emerging top in dividend growth. At the share price of N1.85, Sterling Bank has a dividend yield of 2.70%.

- Stanbic IBTC increased their dividend pay-out by 33.33% to N4 from N3. At the share price of N50.95, dividend yield of Stanbic IBTC stands at 7.85%.

- Access Bank increased their dividend by 23.08% to 80 kobo from 65 kobo. At the share price of N8.1, the dividend yield of Access Bank stands at 9.88%.

- First Bank increased their dividend by 18.42% to 80 kobo from 65 kobo. At the share price of N7.25, the dividend yield of FBNH stands at 6.21%.

- Fidelity Bank increased their dividend by 10% to 22 kobo from 20 kobo. At the share price of N2.58, the dividend yield of Fidelity Bank stands at 8.53%.

- Guaranty Trust Bank increased their dividend by 7.14% to N3.00 from N2.80. At the share price of N29.95, the dividend yield of Guaranty Trust Bank stands at 10.02%.

- Zenith Bank increased their dividend by 7.14% to N3.00 from N2.80. At the share price of N22.1, the dividend yield of Zenith Bank stands at 13.57%.

- FCMB increased their dividend by 7.14% to 15 kobo from 14 kobo. At the share price of N2.83, the dividend yield of FCMB stands at 5.30%.

- Union Bank maintained their previous dividend pay-out of 25 kobo. At the share price of N5.05, dividend yield of Union Bank stands at 4.95%

- UBA reduced their dividend pay-out by 48% to 52 kobo from N1. At the share price of N7.05, dividend yield of UBA stands at 7.38%.

- Overall, Zenith Bank has the highest dividend yield of 13.57%. This is followed by Guaranty Trust Bank with a dividend yield of 10.02%.

Hello and happy easter,

I really appreciate your detailed analysis on this sector,however I will appreciate something similar to this from the other sectors since virtually are results from the serious companies are out so that this can help us better educate ourselves and others