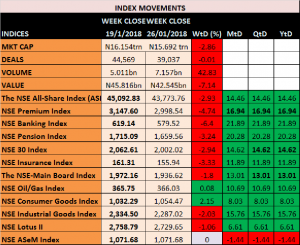

As trading activities in January, the first month of 2018 draws to a close, equities on the Nigerian bourse took a breather from the gyrations of the first three weeks leading to a decline of 2.93% in the All Share Index of The Nigerian Stock Exchange for the week ended Friday January 26, 2018. NSEASI had opened the week at 45,092.83, went as high as 45,321.8 on Monday before a descent for the day and another three straight trading sessions until a recovery in the last Trading session for the week. In other words, of the five trading sessions last week, the market recorded four days of losses between Monday and Thursday within which a decline of 3.47% was recorded. A growth of 0.56% recorded on Friday brought the week’ performance to a loss of 2.93%.

GAINERS AND LOSERS:

Though low cap stocks still largely dominated percentage price gainers’ list, price growth for the week under review was not significant as in the previous three weeks. Whereas highest percentage gain recorded in the preceding week was 53.57%, highest percentage gain recorded last week was 10.91 by WAPIC which closed at a price of 61kobo Friday. The stock price appreciated in four of the five trading sessions last week. Notably, WAPIC is making its highest price gain of 61kobo since 2015 though it has touched 63kobo this year. Year to Date 2018, it has grown by 22%.

Two equities from the Dangote dynasty showed up on the first ten best percentage gainers 9.80% and 9.63% respectively. The equities are Dangote Sugar which closed the week at N21.96 from an open of N20 and NASCON which closed the week at N20.83 from an open of N19.

Diamond bank plc, with a loss of 26.05% led thirty nine others on the losers’ chat. It closed the week at a price of N2.64 from the week’s open of N3.57. Significantly, Diamond lost for the entire five trading sessions of the week under review. Despite this loss however, the stock had recorded a growth of 76% so far in 2018. Champion Breweries, Transcorp and Sterling Bank Plc all shed a portion of their previous gains. While Transcorp and Sterling recovered Friday after four days of straight losses, Champion Breweries was down for five straight trading sessions last week. Decline in the price of Honeywell Flour last week was the second straight week after it led the market in percentage gain in the week ended Friday January 12, 2018. For last week, it was a decline of 15.51% to close at N2.67 from a year high of N3.69 recorded on January 15, 2018. Guaranty lost 10.44% in the week to close at N49. It remains the highest priced bank stock.

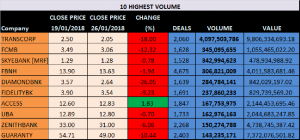

VOLUME AND VALUE DRIVERS:

Outstandingly, FBNH led the market in deals last week recording 4,675 deals. Guaranty was next with 2,403 trades.

In volume, Transcorp was far ahead all others with a total unit of 4.097billion. Of these units, 3.861billion units were traded on Monday January 22, 2018. With the volume traded in the week, Transcorp also recorded the highest value of N9.806billion for the week under review.

STOCK OF THE WEEK:

Technically speaking, picking the stock of the week in a turbulent market does not always come easy in the sense that most equities with attractive deals, volume and value in most cases do end as price losers. After a thorough scrutiny of overall performances of equities last week;

ACCESS BANK PLC is the STOCK OF THE WEEK.

![]()

Access Bank Plc’ performances in the week under review seemed mild but positive. The bank’ stock did not significantly lead in performance metrics but did not in any way appear on the losers’ chat.

PRICE PERFORMANCE:

For the five trading sessions last week, Access Bank stock price was up three and down, two days. At the close of trading Friday, it was a marginal growth of 1.83% from an open of N12.60 to a close of N12.83. Year to Date, it has been a growth of 22.8% in addition to the 78.0% recorded in 2017.

Access’ stock price does not indiscriminately gyrate. Currently in a progressive mode, it is however not in a rush. Technically, the stock closed last Friday above its Short time moving average. Short time moving average is currently above mid-time and above long time moving averages. The relationship between price and moving averages is bullish in short-term, and bullish in mid-long term hence, any short term price decline is only an opportunity to buy more.

EARNINGS PERFORMANCE:

From 48kobo 2017 Q1 earnings, its Q3 earning is N1.94. Juxtaposing this with current price, P/E Ratio is 6.61. At that, going by the relationship between price and earnings, seeing also the possibilities in its audited report, Access is still largely buyable even as fresh investment and to existing investors, every decline beyond current level creates an opportunity to invest more.

OTHER MARKET INDICATORS:

How the weak the market was in the week under review reflected much in the indicators as only NSE Consumer Goods and Oil and Gas indexes closed in the green. Though volume grew by 42.83% but if the 3.861billion units of Transcorp traded on Monday January 22, 2018 were subtracted, volume traded in the week also would have declined when compared to performance of the preceding week.

Banking sub-sector of the market trailed others in performance as NSE Banking Index declined by 6.4%. significantly, Unity with 3.28% WoW, Access with 1.83% WoW and ETI with 0.71% WoW growth, all others in the industry closed in red with Diamond Bank plc leading with a decline of 26.05% WoW.

OTHER MARKET INFORMATION:

- OANDO PLC:

Alhaji Dahiru Mangal, a major shareholder in Oando and the petitioner to the Securities and Exchange Commission was announced to have withdrawn his petition to the SEC after all the issues raised by him, Alhaji Mangal in his petition to the Securities and Exchange Commission (‘SEC’) have been successfully addressed and clarified by the Company. Consequently, an amicable agreement was reached, brokered by the Emir of Kano Alhaji Muhammadu Sanusi II (CON).

- WAPIC:

The company announced that it has become the official insurer to and a co-sponsor of the Nigerian Football Federation- NFF. By this, Wapic becomes the official insurer of the Nigerian national football team, the Super Eagles and other national teams. According to the company, an MOU has been signed to this effect.

- PAINTCOM:

The company announced a court ordered EGM between the company and its shareholders. The meeting, among other deliberations is to consider the paying off of the company’s shareholders and subsequently delist such shares from the Stock Exchange. The meeting is scheduled to be held at Lagos Commerce and Industry Conference Centre, Alausa Lagos on February 15, 2018.

- NEIMETH PLC:

The company released its audited report for the year ended September 30, 2017. The turnover declined to N1.534 billion in 2017 from N2.001billion in same period of 2016. The company declared a loss after tax of N411.8 million from PAT of N65.093 in 2016. Its earning per share from the loss is -24kobo from 4kobo in the preceding year.

READ: https://stocksng.com/herbert-wigwe-excellence-personified/

The company also released its Q1 result for the period ended December 31, 2017. The Turnover increased from N 137,394 in December 2016 to N 394,298 in same period of 2017. The Loss after tax of (N248,365) was cleared as PAT of N13,553 was declared. The EPS from the PAT is 1kobo.

SCHEDULED BOARD MEETINGS THIS WEEK:

- UBA PLC:

The Board of Directors of UBA Plc is scheduled to meet this week Monday January 29, 2018 to consider the financial result for the year ended December 31, 2017.

- STANBIC IBTC:

A meeting of the Board of Directors of Stanbic IBTC Holdings PLC (the Company) is scheduled to hold on Thursday 01 February 2018 at 10:00am. The meeting will discuss amongst other items, the Company’s Consolidated and Separate Audited Financial Statements for the period ended 31 December 2017 as well as a Dividend Proposal.

- CONTINENTAL RE:

The Board of Directors will be meeting on Wednesday January 31, 2018 to consider the company’s audited account for the period ended December 31, 2017 and on dividend payout.

- ACCESS BANK PLC:

A meeting of the Board of Directors of the bank is scheduled to hold on Tuesday January 30, 2018 to consider the audited account of the bank for the period ended December 31, 2017 inclusive of final dividend for the year.