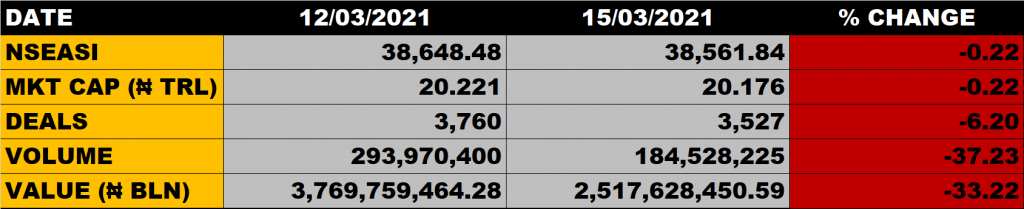

The Nigerian equity market on Monday resumed its downtrend as the All Share Index depreciated further by 0.22% to settle at 38,561.84 points from the previous close of 38,648.48 points. The Market Capitalisation shed N45 billion to close at N20.176 trillion from the previous close of N20.221 trillion.

An aggregate of 184.5 million units of shares were traded in 3,527 deals, valued at N2.52 billion. The Market Breadth closed negative as 17 equities emerged as gainers against 18 equities that declined in their share prices.

The down trending market can be attributed to the exit of PFAs from the equity market to the money market and bond market in search for superior yields.

Commenting on the current market state, the Chief Dealer of Global View Capital Limited, Aruna Kebira pointed out that PFAs being the major market participants do not traded with emotion, rather they trade with focus on better yield. Hence, there is capital fight from the equity market into the money market.

The capital market guru stated thus:

“The money market is doing better now. The Treasury Bills rate has improved from 5.5% to 6.5%. That 100 basis point increase means a lot for people holding up to about N1 billion. Not undermining the fact that after the foreign investors have left, the major participants in the market are the PFAs. PFAs are only entitled to 1% to the fund they are managing if they don’t do anything on it. So they have to sweat that money to be able to live that luxury live that they want to live. They don’t have emotion for the capital market neither do they have emotion for the money market; there problem is that where will the yield come from? Where is the yield better? So they move their money from the equity market to the money market, wherever the yield is better. When there are indices where the yield is horrible in the capital market, they will move their money from there.

“One of the things we should know is that the equity market is risky, so if they want to compensate for the risk, premium is needed. Where they cannot get the premium, PFA will not go there. The money market on the other hand is risk free; it means that your money plus a percentage comes to you. In the equity market, you can put N100 million and return back with N70 million. But in the money market, when you put N100 million at 1%, you are sure that you are coming out with your N100 million, even that is the least, you can recover your money. It is better for them to play in the money market than in the equity market. The moment the money market becomes more attractive they pitch their tent there immediately”.

“The March FGN Savings Bond is now 6.181%, Treasury Bills is now 6.5%. All these were coming from as low as 3% and 0.3% respectively. So naturally, there will be a flow from equity market to these markets. So it is the exit that is causing this downturn in the equity market. Nobody wants to take N2.70 from Zenith Bank and lose N5. Another issue about the dividend is, how many have we seen? People are now asking: where is GT Bank? Are they going to do better than what they did last year? Will they do better than Zenith Bank? What is First Bank going to do? UBA paid 35 kobo dividend. They said UBA and Access Bank are now pairs; will Assess Bank come back and do 35 kobo or even less than that? Fidelity Bank and FCMB have not come out; what did they do last year? UBA came down from 50 kobo to 35 kobo; will a typical Fidelity Bank come from 20 kobo to 9 kobo? So it’s that sentiment from investors that is affecting the market”.

“Going forward, Cash is king as regards the current market mood. If you are in a loss of more than 10%, hold your position because whatever goes down must go up. Those that have sold should hold their cash and wait for when the market bottoms out”.

Stocks to Watch

- Access Bank traded flat at N7.8. It is trading 25.71% away from its 52 weeks high of N10.5, hence there is uptrend potential in Access Bank. With the book value of N19.12, Access Bank is considered cheap at the current share price.

- FBN Holdings grew to N7.35 from N7.1. It is trading 18.33% away from its 52 weeks high of N9 which implies an uptrend potential for the share price of the big elephant. Considering its book value of N19.84, relative to the current share price, shows that FBNH is cheap at the current price and has a lot of growth potential embedded in it.

- Zenith Bank’s share price dropped to N21.20 from N21.35. It is trading 25.61% away from its 52 weeks high of N28.5. There is uptrend potential of 24.74% in the share price of Zenith Bank. With the book value of N35.59 relative to the current share price, Zenith Bank is considered cheap.

- UBA grew to N7.20 from N7.15. It is trading 26.53% away from its 52 weeks high of N9.8. With the book value of N19.16 as against its current share price, UBA is considered cheap and has uptrend potential.

- Guaranty Trust Bank dropped to N29.95 from N30.75. It is trading 22.11% away from its 52 weeks high of N38.45 and this implies an uptrend potential for the bank.

- WAPCO traded flat at N22. It is trading 30.16% away from its 52 weeks high of N31.5. There is uptrend potential in the share price of Wapco as records have it that it has touched N52 some years back.

Percentage Gainers

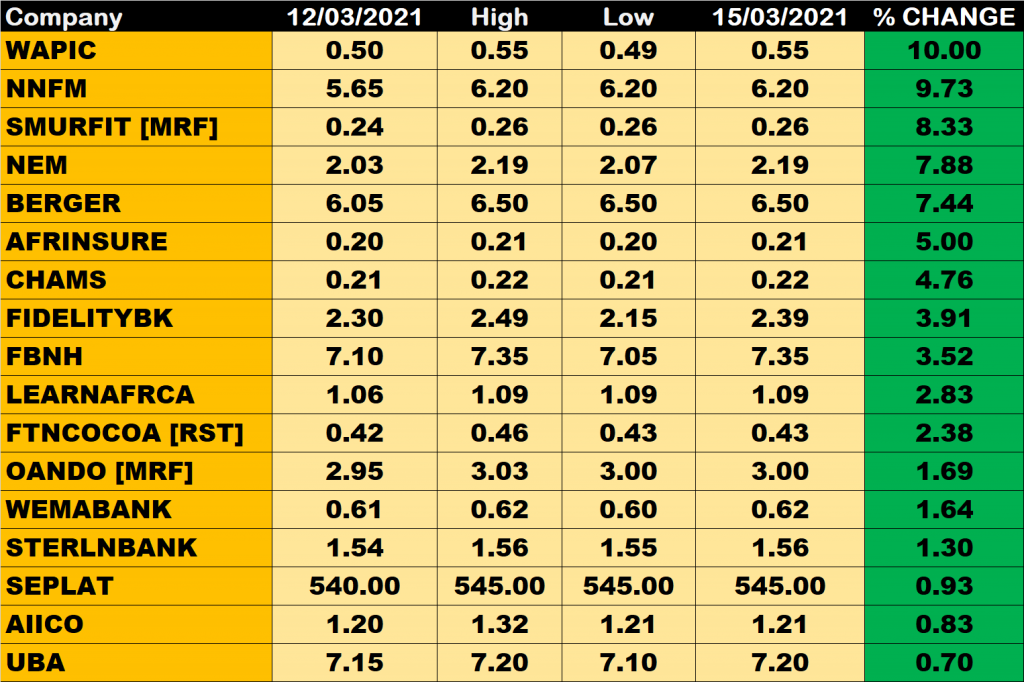

Coronation Insurance Plc led other gainers with 10% growth to close at N0.55 from the previous close of N0.50.

Northern Nigerian Flour Mills (NNFM) and Smart Product Nigeria Plc among other gainers also grew their share prices by 9.73% and 8.33% respectively.

Percentage losers

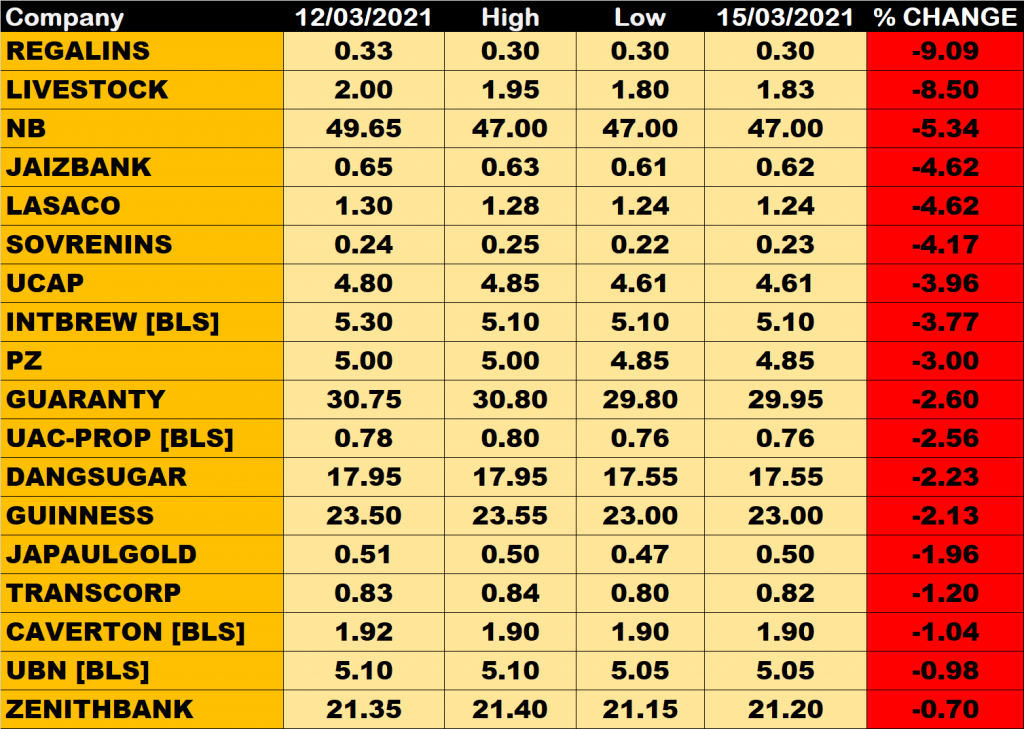

Regency Assurance led other price decliners as it shed 9.09% of its share price to close at N0.30 from the previous close of N0.33.

Livestock Feeds and Nigerian Breweries among other price decliners also shed their share prices by 8.50% and 5.34% respectively.

Volume Drivers

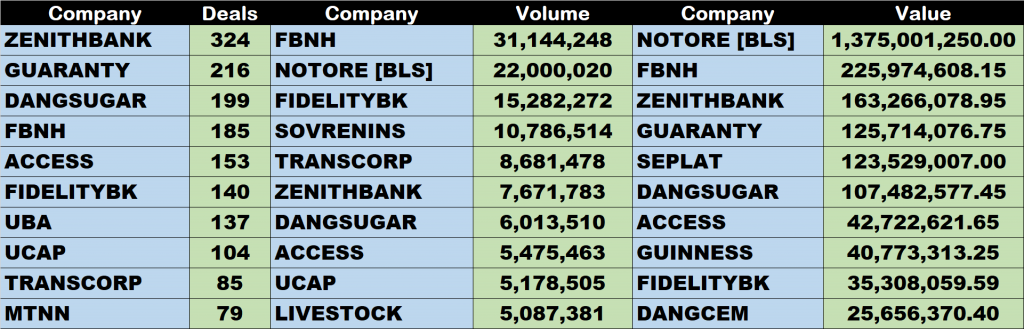

- FBN Holdings Plc traded about 31.14 million units of its shares in 185 deals, valued at N225.97 million.

- Notore Chemical Industries Plc traded 22 million units of its shares in 4 deals, valued at N1.375 billion.

- Fidelity Bank traded about 15.28 million units of its shares in 140 deals, valued at N35.3 million.