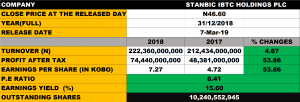

STANBIC IBTC HOLDINGS has recorded N74.4billion (PAT) in its 2018 audited full year report, implying 53.86% growth above N48.3billion garnered in the preceding year of 2017.

The bank’s 2018 full year financial reports that was made public, on Thursday, 7th of March, 2018 revealed 4.67% growth in Gross Earnings’ figure of N212.4 billion recorded in the corresponding period the previous year to N222.3 billion recorded in the current period under review

The earnings per share also appreciated by 53.86% from previous year’s N4.72kobo to current year’s N7.27kobo.

The current period’s PE Ratio is at 6.41X and the earnings yield of 15.60%.

The Management proposed a final Dividend of N1.50 per ordinary share of 50 kobo each, subject to deduction of appropriate withholding tax and regulatory approval, will be paid to the shareholders whose names appear in the Register of Members as at the close of business on Wednesday 20th March 2018.

STANBIC IBTC HOLDINGS PLC, a financial holding company, providing banking and other financial services to corporate and individual customers in Nigeria. The company operates through Personal and Business Banking, Corporate and Investment Banking, and Wealth segments. The Personal and Business Banking segment accepts deposits; and offers residential accommodation loans and instalment finance to personal market customers, and vehicles and equipment finance to the business market. It also provides transactional and lending products, such as electronic banking, cheque accounts, and other lending products, as well as credit and debit card facilities.