- GTCO, Zenith most attractive banking stocks

- Comparative Analysis of Banking Sector in Q3 2024

Wole Olajide, ACS

Performance of banks listed on the Nigerian Exchange in the Third Quarter of 2024 was quite impressive as all the banks so far captured have reported growth in their top line and bottom line figures for the 9 months period.

Most of these banks actually submitted their Q3 2024 reports last week to end the month of October in order to beat regulatory deadline. The coming week will sure have impact on the prices of these stocks based on their impressive performance.

FCMB is yet to file its Q3 2024 report as at Thursday, October 31, 2024. We shall however proceed with the ranking of the available financial institutions that have filed their Q3 reports on the floor of the Nigerian Exchange.

The ranking of the performance of the banking sector for Q3 2024 is done using the following metrics: turnover, Profit after tax (PAT), turnover growth, PAT growth, Earnings per share (EPS), Price-to-earnings ratio (P/E ratio), Earnings yield and profit margin

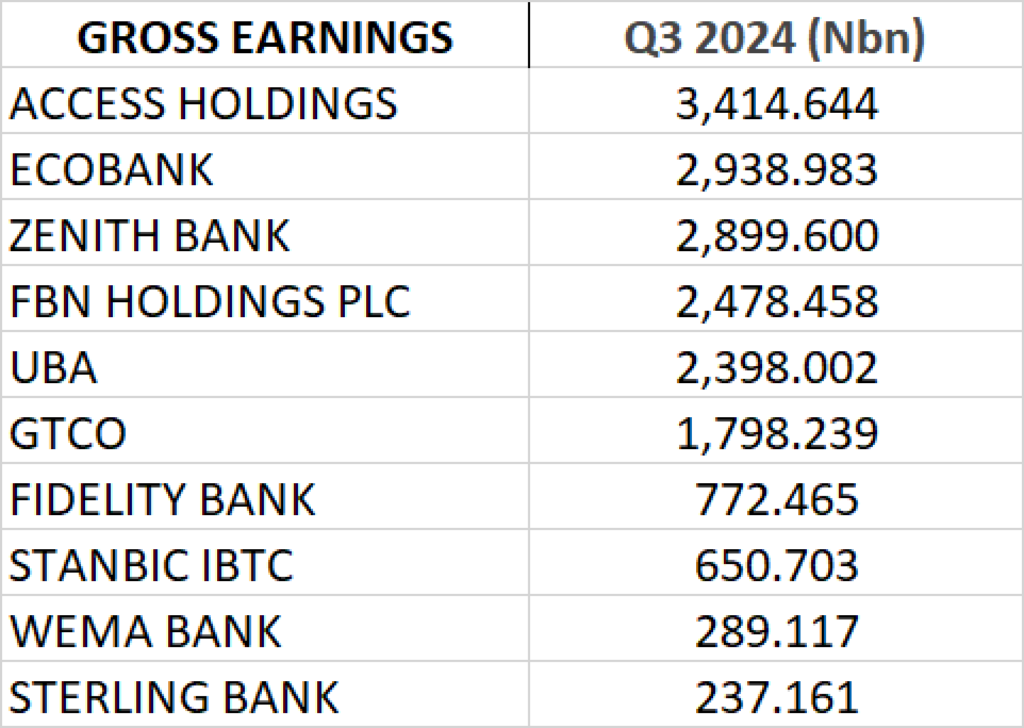

TURNOVER/ GROSS EARNINGS

Access Holdings reported Gross Earnings of N3.415 trillion for the 9 months period, emerging as the Financial Institution with highest turnover for the period under review.

Ecobank Transnational Incorporated is second in the rank in terms of turnover with Gross Earnings of N2.939 trillion reported for the 9 months period.

Zenith, FBNH, UBA and GTCO emerged third, fourth, fifth and sixth respectively with Gross Earnings of N2.9 trillion, N2.478 trillion, N2.398 trillion and N1.798 trillion respectively.

Banks that recorded turnover below the N1 trillion mark include: Fidelity Bank (N772.465bn), Stanbic IBTC (N650.703bn), Wema Bank (N289.117) and Sterling (N237.161bn) respectively.

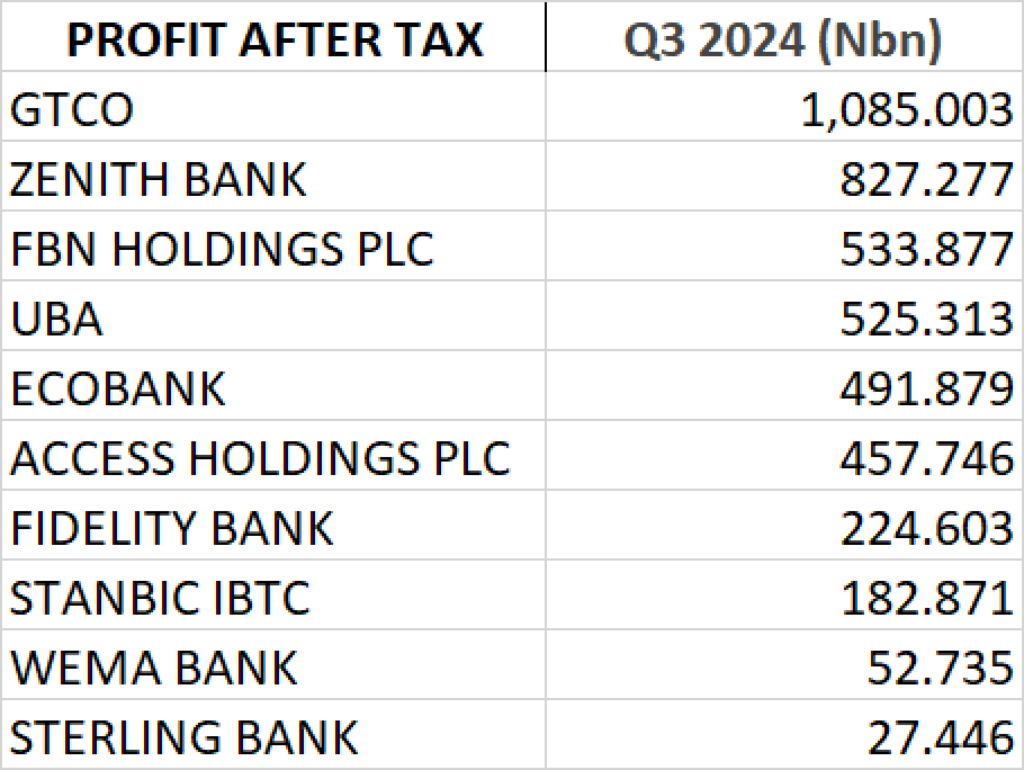

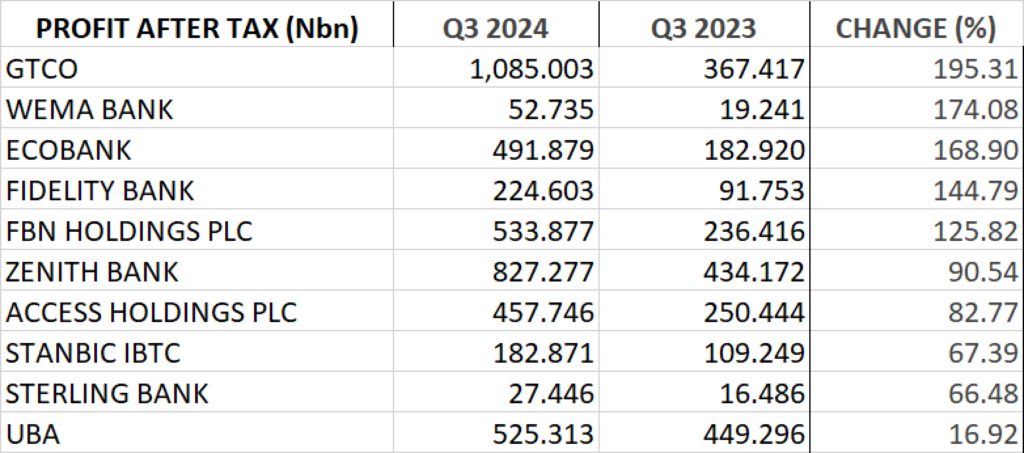

PROFIT AFTER TAX

- GTCO emerged top in profit after tax for the period under review. The bank reported N1.085 trillion as profit for the 9 months period.

- Second in the rank is Zenith Bank with Profit after Tax of N827.277 billion.

- Third in the rank is FBNH which recorded N533.877 billion as profit after tax for the 9 months period

- Fourth, Fifth and sixth on the rank are UBA, Ecobank and Access Holdings with profit after tax of N525.313 billion, N491.879 billion and N457.746 billion respectively.

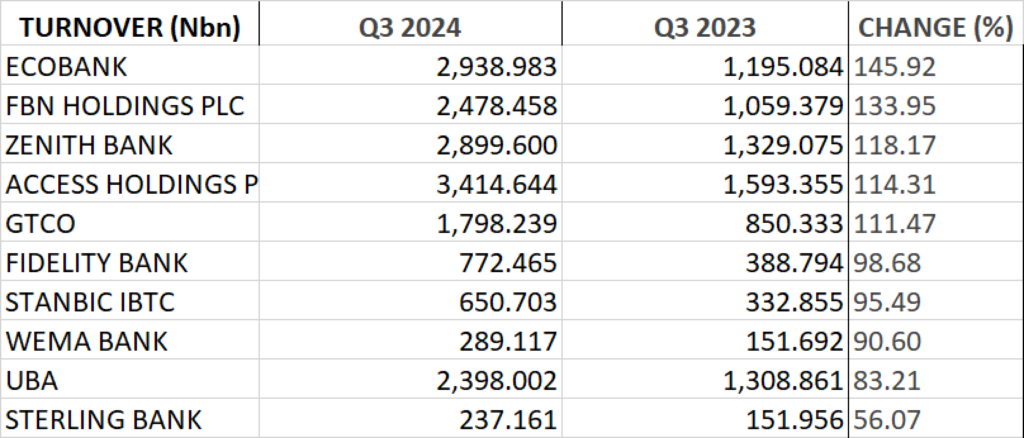

PERFOMANCE IN TURNOVER GROWTH

- Ecobank emerged first in terms of turnover growth in Third Quarter of 2024 as it reported Gross Earnings of N2.939 trillion, up by 145.92% from N1.195 trillion reported the previous year.

- Second in rank in terms of growth in turnover is FBNH. The bank achieved Gross Earnings of N2.478 trillion for the 9 months period. This is a growth of 133.95% from N1.059 trillion achieved the previous year.

- Zenith Bank emerged third in terms of turnover growth. The Bank reported Gross earnings of N2.9 trillion for the 9 months period, up by 118.17% from N1.329 trillion reported the previous year.

- Access Holdings is fourth in the ranking for turnover growth. Gross Earnings of N3.415 trillion was recorded for the 9 months period, up by 114.31% from N1.593 trillion reported the previous year.

- GTCO emerged fifth in terms of turnover growth with Gross Earnings of N1.798 trillion, up by 111.47% from N850.333 billion reported the previous year.

PERFORMANCE IN PAT GROWTH

- GTCO grew its profit after tax, year on year by 195.31% to N1.085 trillion from N367.417 billion reported the previous year, emerging as first in terms of PAT growth.

- Wema Bank ranked second in terms of growth in profit after tax. The financial institution reported profit after tax of N52.735 billion, up by 174.08% from N19.241 billion reported the previous year.

- Ecobank Bank grew its profit after tax by 168.9% year on year to N491.879 billion from N182.92 billion reported in Q3 2023.

- Fidelity Bank grew its profit after tax by 144.79% to N224.6 billion from N91.75 billion achieved the previous year.

- Fifth on the ranking is FBN Holdings with a PAT growth of 125.82% year on year. The big elephant recorded profit after tax of N533.877 billion in Q3 2024 from N236.416 billion reported the previous year.

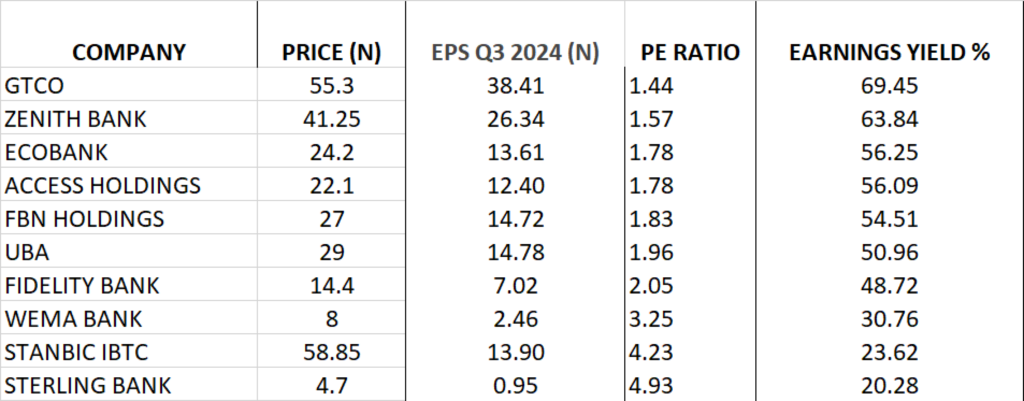

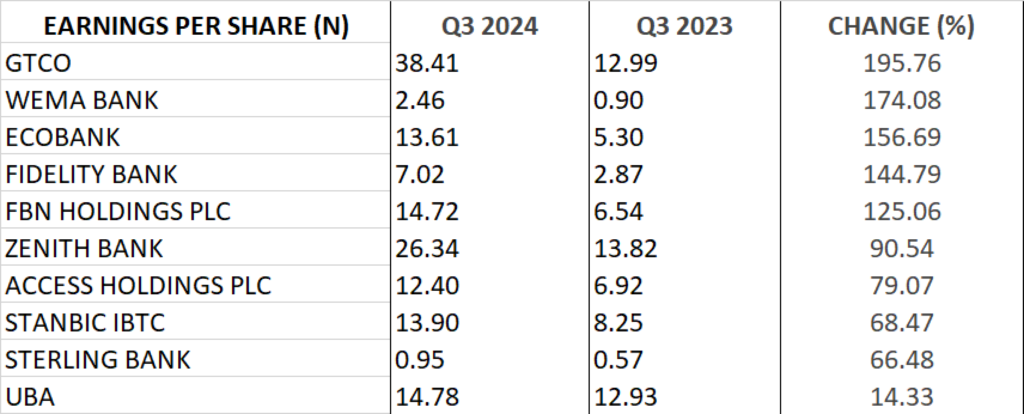

PERFORMANCE IN EARNINGS PER SHARE (EPS), P/E RATIO AND EARNINGS YIELD

- GTCO is currently trading at N55.30. With the Q3 2024 earnings per share (EPS) of N38.41, a low P/E ratio of 1.44x and earnings yield of 69.45% makes GTCO the most attractive banking stocks among others.

- Zenith Bank is currently trading at N41.25. With EPS of N26.34, the P/E ratio of the Zenith Bank stands at 1.57x with earnings yield of 63.84%.

- Ecobank is currently trading at N24.2. With the EPS of N13.61, the P/E ratio of the financial institution stands at 1.78x with earnings yield of 56.25%.

- Access Holdings is currently trading at N22.1. With the EPS of N12.40, the P/E ratio of Access stands at 1.78x with earnings yield of 56.09%.

- FBN Holdings is currently trading at N27. With the EPS of N14.72, the P/E ratio of FBNH stands at 1.83x with earnings yield of 54.51%.

- UBA is trading at N29. With the EPS of N14.78, the P/E ratio of UBA stands at 1.96x with earnings yield of 50.96%.

- Fidelity Bank is trading at N14.4. With the EPS of N7.02, the P/E ratio of Fidelity Bank stands at 2.05x with earnings yield of 48.72%.

- Wema Bank is trading at N8. With the EPS of N2.46, the P/E ratio of Wema Bank stands at 3.25x with earnings yield of 30.76%.

- Stanbic IBTC Holdings is trading at N58.85. With the EPS of N13.90, the P/E ratio is 4.23x with earnings yield of 23.62%.

- Sterling Bank is trading at N4.70. With the EPS of N0.95, the P/E ratio stands at 4.93x with earnings yield of 20.28%

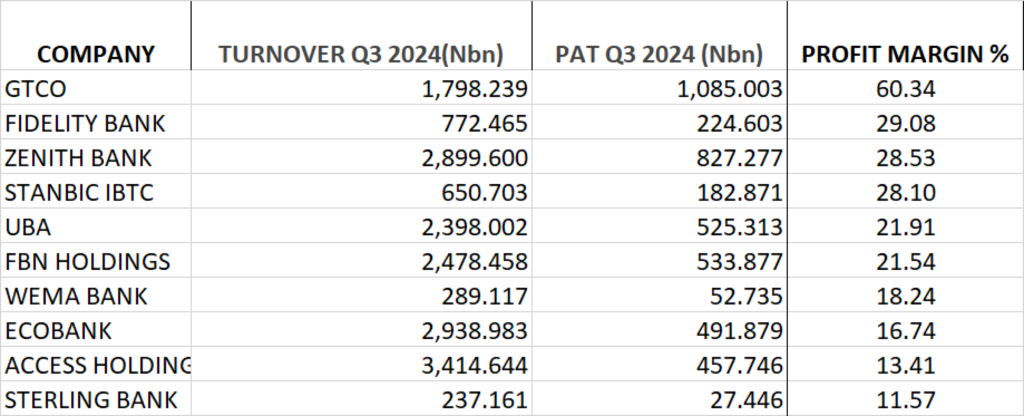

PROFIT MARGIN

Profit margin is a financial ratio that measures the percentage of profit earned by a company in relation to its revenue. Expressed as a percentage, it indicates how much profit the company makes for every revenue generated.

Profit margin is important because this percentage provides a comprehensive picture of the operating efficiency of a business or an industry.

It is calculated as Profit after Tax, divided by Revenue or Turnover, multiplied by 100.

GTCO achieved profit margin of 60.34%, emerging top in the industry for the period under review. This is followed by Fidelity Bank, Zenith Bank, Stanbic IBTC, and UBA with the profit margin of 29.08%, 28.53%, 28.10% and 21.91% respectively.