- GTCO leads in profit margin

- Comparative Analysis of Banking Sector in Q3 2023

Wole Olajide

Performance of banks listed on the Nigerian Exchange in the Third Quarter of 2023 was quite impressive as most of the banks reported growth in their top line and bottom line figures for the 9 months period.

Prices of these stocks have also appreciated based on their impressive Q3 2023 results, coupled with other positive economic signals.

Ecobank and FCMB just released their long awaited Q3 results in the just concluded week, otherwise the ranking of Q3 performance of banking stocks would have been done earlier than this.

The ranking of the performance of the banking sector for Q3 2023 is done using the following metrics: turnover, Profit after tax (PAT), turnover growth, PAT growth, Earnings per share (EPS), Price-to-earnings ratio (P/E ratio), Earnings yield and profit margin

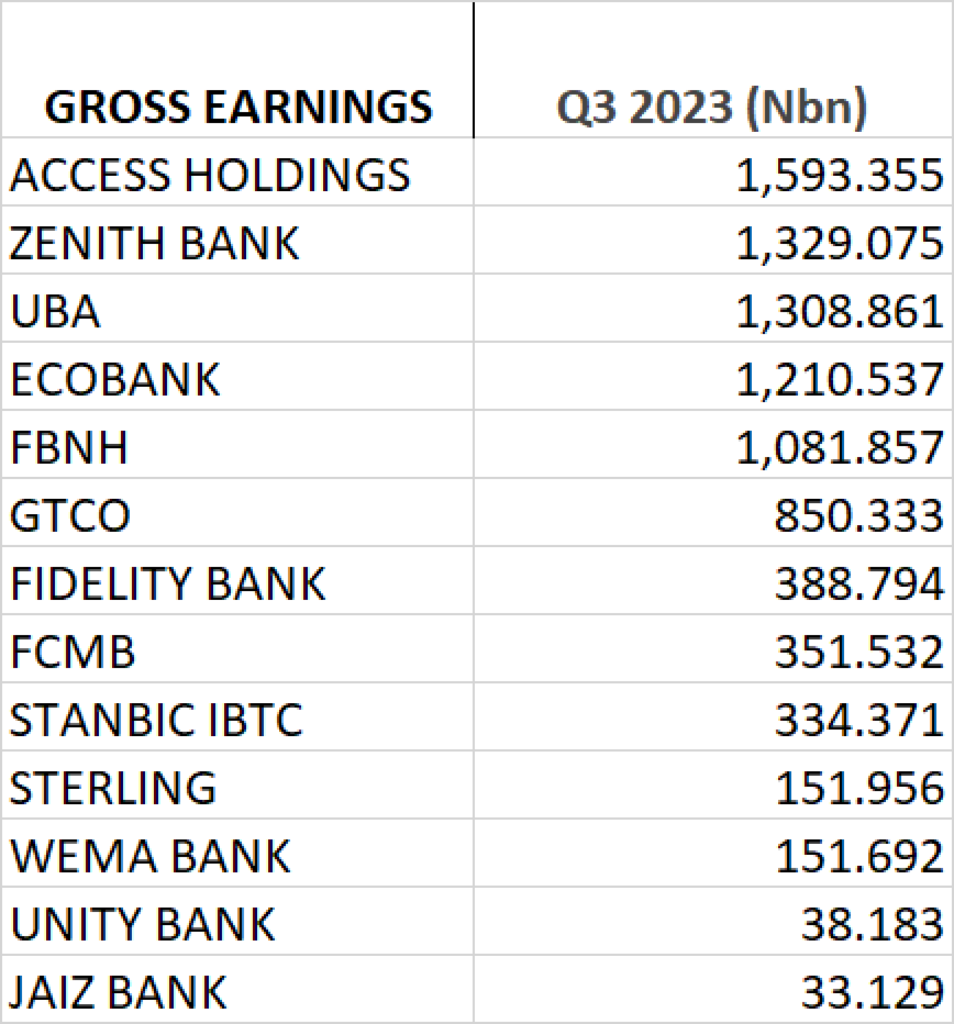

TURNOVER/ GROSS EARNINGS

Access Holdings reported Gross Earnings of N1.593 trillion for the 9 months period, emerging as the bank with highest turnover for the period under review.

Zenith Bank is second in the rank in terms of turnover with Gross Earnings of N 1.329 trillion reported for the 9 months period.

UBA, Ecobank and FBNH emerged third, fourth and fifth respectively with Gross Earnings of N1.309 trillion, N1.211 trillion and N1.082 trillion respectively.

Banks that recorded turnover below the N1 trillion mark include: GTCO (N850.3bn), Fidelity Bank (N388.79bn), FCMB (N351.53bn), Stanbic IBTC (N334.37bn), Sterling (N151.96bn), Wema Bank (N151.69), Unity Bank (N38.18bn) and Jaiz Bank (N33.13bn) respectively.

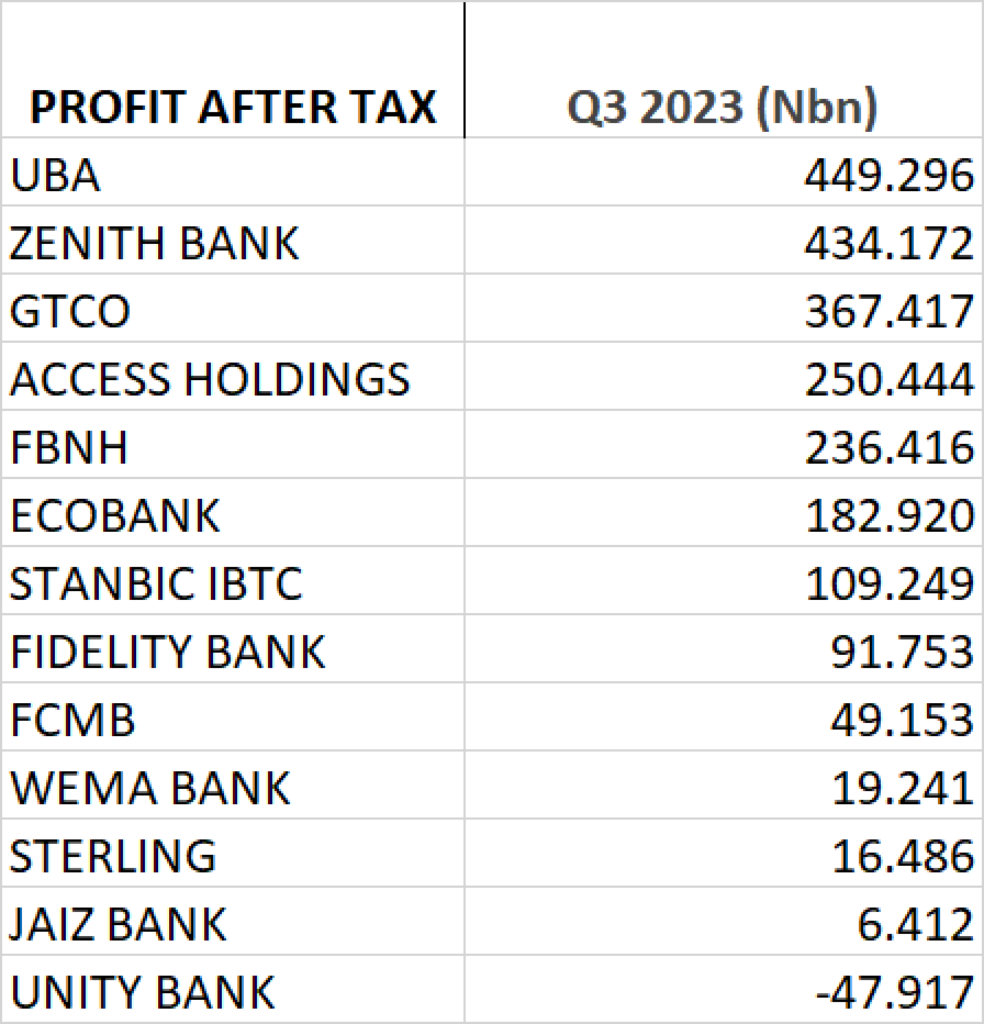

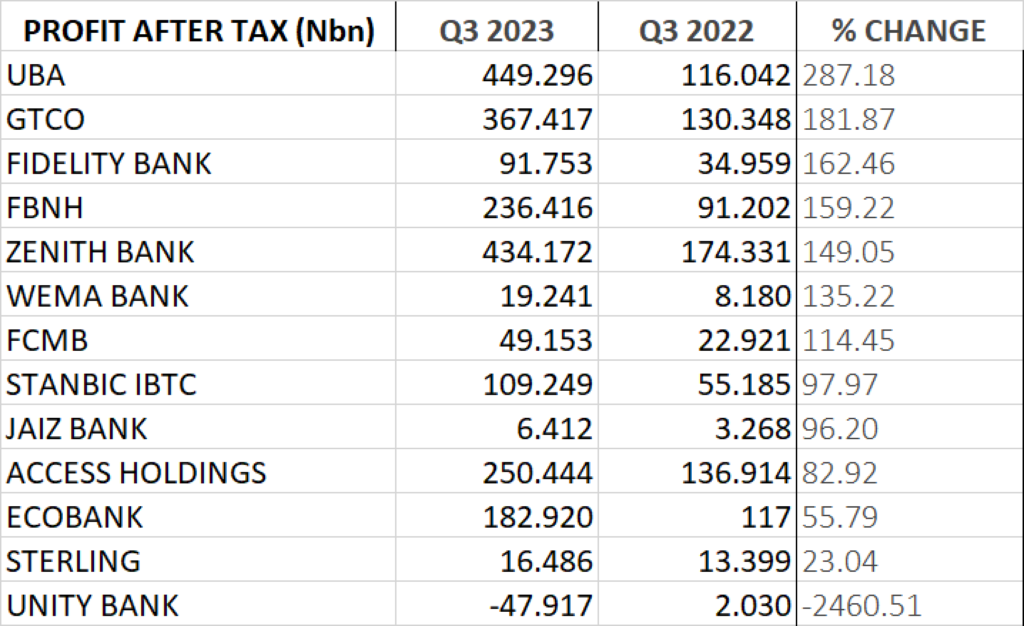

PROFIT AFTER TAX

- UBA emerged top in profit after tax for the period under review. The bank reported N449.296 billion as profit for the 9 months period.

- Second in the rank is Zenith Bank with Profit after Tax of N434.172 billion in Q3 2023.

- Third in the rank is GTCO which recorded N367.417 billion as profit after tax for the 9 months period

- Fourth and Fifth on the rank are Access Holdings and FBNH with the profit after tax of N250.444 billion and N236.416 billion respectively.

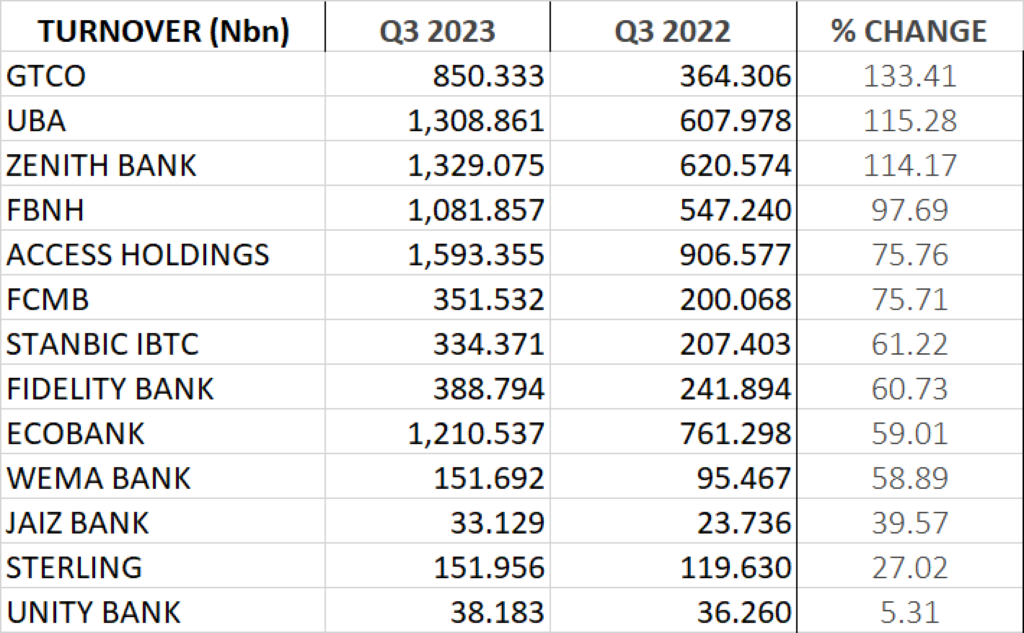

PERFOMANCE IN TURNOVER GROWTH

- GTCO emerged first in terms of turnover growth in third quarter of 2023 as it reported Gross Earnings of N850.333 billion, up by 133.41% from N364.306 billion reported the previous year.

- Second in rank in terms of growth in turnover is UBA. The bank achieved Gross Earnings of N1.309 trillion for the 9 months period. This represents a growth of 115.28% from N607.978 billion achieved the previous year.

- Zenith Bank emerged third in terms of turnover growth. The Bank reported Gross earnings of N1.329 trillion for the 9 months period, up by 114.17% from N620.574 billion reported the previous year.

- FBNH is fourth in the ranking for turnover growth. Gross Earnings of N1.081 trillion was recorded for the 9 months period, up by 97.69% from N547.240 billion reported the previous year.

- Access Holdings emerged fifth in terms of turnover growth with Gross Earnings of N1.593 trillion, up by 75.76% from N906.577 billion reported the previous year.

PERFORMANCE IN PAT GROWTH

- UBA grew its profit after tax, year on year by 287.18% to N449.296 billion from N116.042 billion reported the previous year, emerging as best in terms of PAT growth.

- GTCO ranked second in terms of growth in profit after tax. The financial institution reported profit after tax of N367.417 billion, up by 181.87% from N130.348 billion reported the previous year.

- Fidelity Bank grew its profit after tax by 162.46% year on year to N91.753 billion from N34.959 billion reported in Q3 2022.

- FBNH grew its profit after tax by 159.22% to N236.416 billion from N91.202 billion achieved the previous year.

- Fifth on the ranking is Zenith Bank with a PAT growth of 149.05% year on year, recording N434.172 from N174.333 reported the previous year.

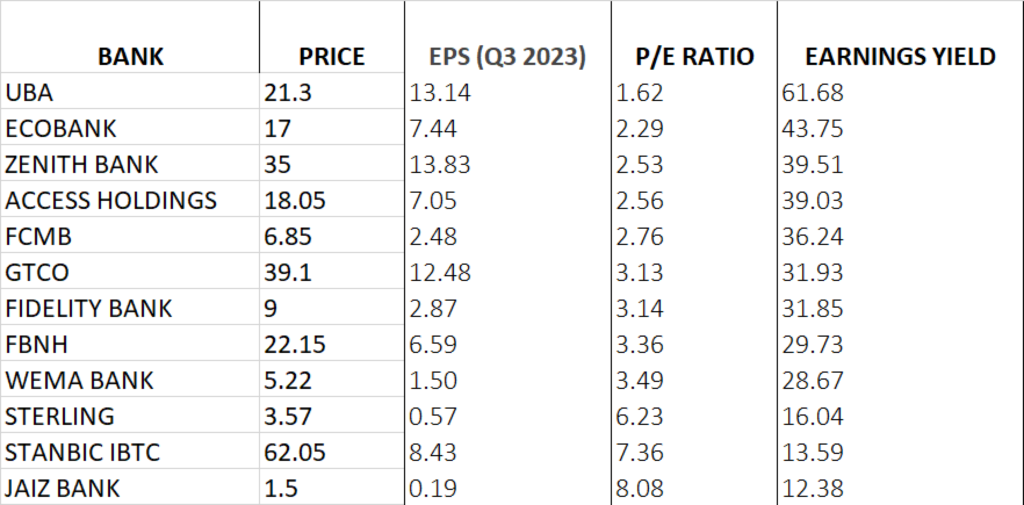

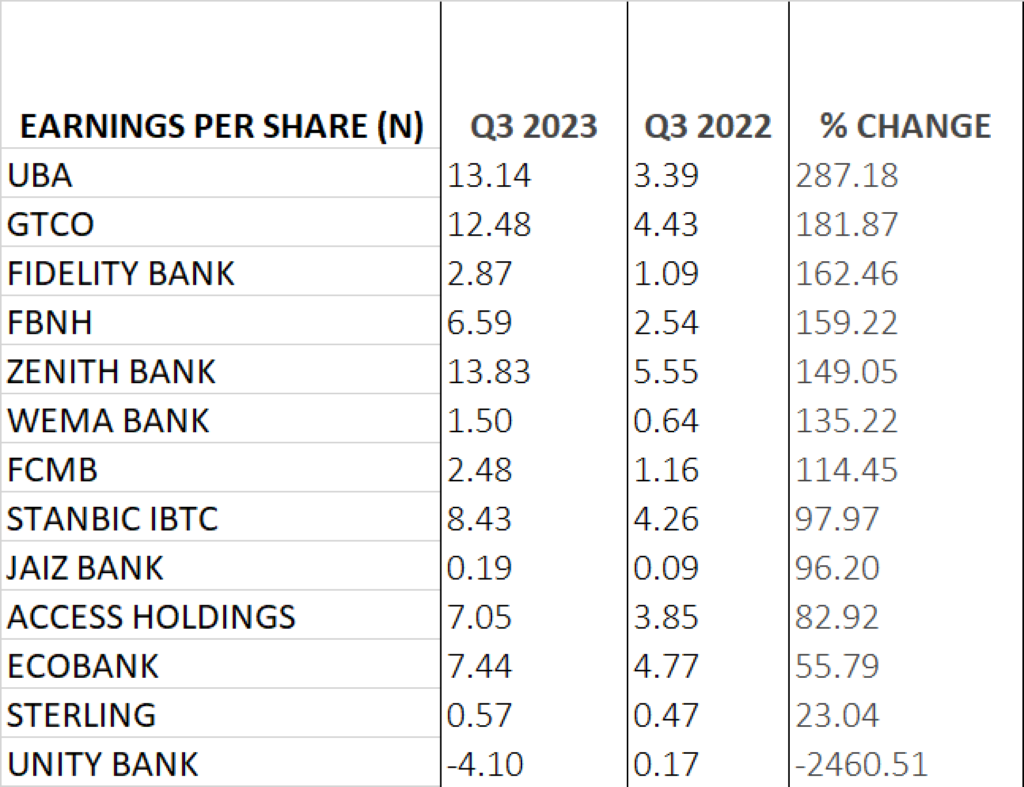

PERFORMANCE IN EPS, P/E RATIO AND EARNINGS YIELD

- UBA is currently trading at N21.3. With the Q3 2023 earnings per share (EPS) of N13.14, a low P/E ratio of 1.62x and earnings yield of 61.68% makes UBA very attractive.

- Ecobank is currently trading at N17. With EPS of N7.44, the P/E ratio of the Ecobank stands at 2.29x with earnings yield of 43.75%.

- Zenith Bank is currently trading at N35. With the EPS of N13.83, the P/E ratio of the Zenith Bank stands at 2.53x with earnings yield of 39.51%.

- Access Holdings is currently trading at N18.05. With the EPS of N7.05, the P/E ratio of Access stands at 2.56x with earnings yield of 39.03%.

- FCMB is currently trading at N6.85. With the EPS of N2.48, the P/E ratio of FCMB stands at 2.76x with earnings yield of 36.24%.

- GTCO is trading at N39.1. With the EPS of N12.48, the P/E ratio of GTCO stands at 3.13x with earnings yield of 31.93%.

- Fidelity Bank is trading at N9. With the EPS of N2.87, the P/E ratio of Fidelity stands at 3.14x with earnings yield of 31.85%.

- FBNH is trading at N22.12. With the EPS of N6.59, the P/E ratio of FBNH stands at 3.36x with earnings yield of 29.73%.

- Wema Bank is trading at N5.22. With the EPS of N1.50, the P/E ratio of Wema Bank stands at 3.49x with earnings yield of 28.67%.

- Sterling Bank is trading at N3.57. With the EPS of N0.57, the P/E ratio stands 6.23x with earnings yield of 16.04%

- Stanbic IBTC Holdings is trading at N62.05. With the EPS of N8.43, the P/E ratio is 7.36x with earnings yield of 13.59%.

- Jaiz Bank is currently trading at N1.50. With the EPS of N0.19, the P/E ratio is 8.08x with earnings yield of 12.38%.

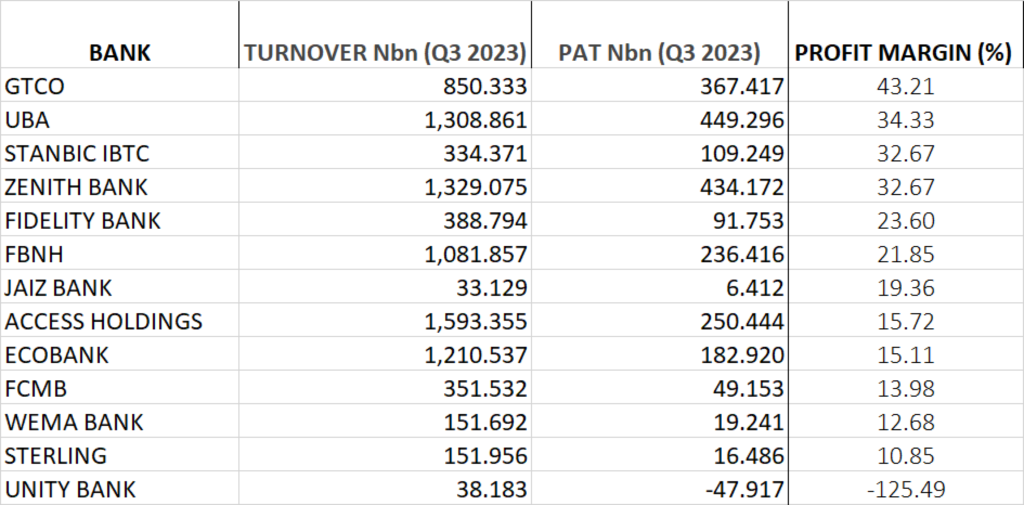

PROFIT MARGIN

Profit margin is a financial ratio that measures the percentage of profit earned by a company in relation to its revenue. Expressed as a percentage, it indicates how much profit the company makes for every revenue generated.

Profit margin is important because this percentage provides a comprehensive picture of the operating efficiency of a business or an industry.

It is calculated as Profit after Tax, divided by Revenue or Turnover, multiplied by 100.

GTCO achieved the profit margin of 43.21%, emerging top in the banking sector for the period under review. This is followed by UBA, Stanbic IBTC, Zenith Bank and Fidelity Bank with the profit margin of 34.33%, 32.67%, 32.67% and 23.60% respectively.