The market has eventually entered the Fourth Quarter of the year and in a matter of days, Q3 results of listed firms on the Nigerian Exchnage will start hitting the market.

Prices of stocks have been coming down, creating entry opportunities for discerning investors. Investment in stocks is done against expectation and not on realities. It is worthy to note that expectation is the mother of all investment strategies.

In the last edition, we did Q3 earnings forecast for banking stocks. Our projections for this edition is for the manufacturing firms.

Our projections of Q3 earnings for manufacturing firms is based on their PEG ratios. PEG ratio (price/earnings to growth ratio) is a valuation metric for determining the relative trade-off between the price of a stock, the earnings per share (EPS), and the company’s expected growth. In other words, it is not enough for anyone to invest on just the strength of a company’s previous or latest earnings but these in addition to the expected earnings.

FIDSON HEALTHCARE

Q3 earnings per share of Fidson Healthcare over the last 5 years ranged between N1.11 and 0.37 with earnings growth rate of 33.45%.

At the current share price of N9.05 and Q3’21 earnings per share of N1.11, its P.E ratio is estimated at 8.15x.

PEG ratio against the expected Q3 2022 earnings is 0.24.

Q3 2022 earnings per share of about N1.48 is projected for Fidson Healthcare.

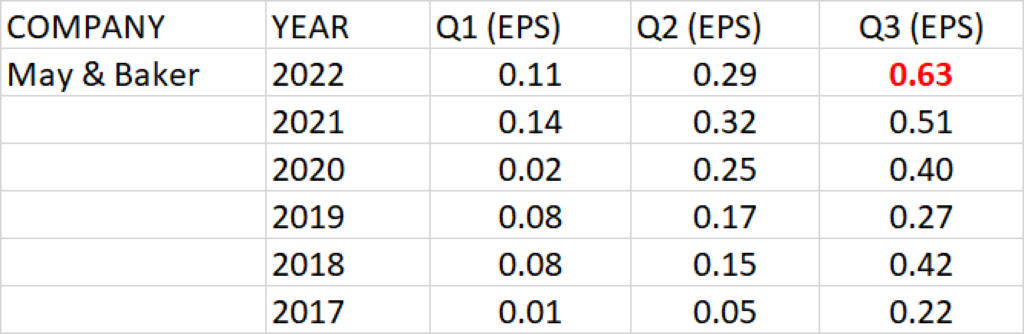

MAY & BAKER

Q3 earnings per share of May & Baker over the last 5 years ranged between 51 kobo and 22 kobo with earnings growth rate of 23.39%.

At the current share price of N4.10, PEG ratio against the expected Q3 2022 earnings is 0.34.

Q3 2022 Earnings per share of about N0.63 is projected for May & Baker.

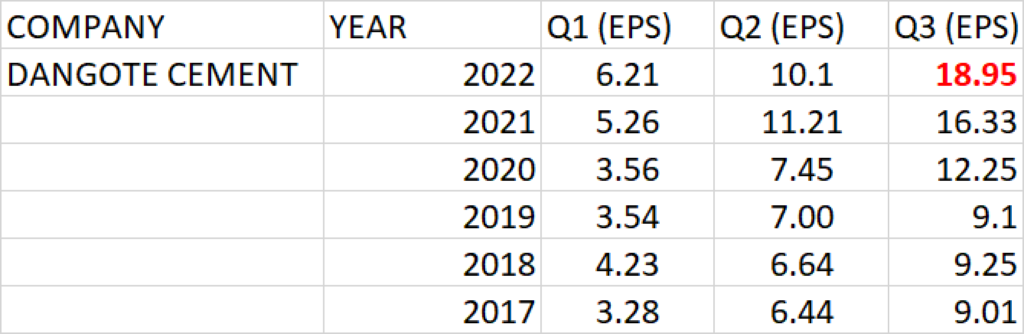

DANGOTE CEMENT

Dangote Cement over the last 5 years has Q3 earnings per share (EPS) ranging between N16.30 and N9.10 with earnings growth rate of 16.03%.

At the current share price of N245 and Q3’21 earnings per share of N16.33, its P.E ratio is estimated at 15x.

PEG ratio against the expected Q3 2022 earnings is 0.94.

Q3 earnings per share of about N18.95 is projected for Dangote Cement.

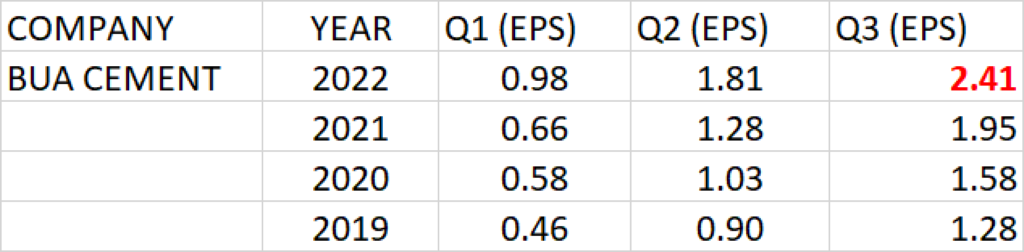

BUA CEMENT

BUA Cement over the last 3 years has Q3 earnings per share (EPS) ranging between N1.95 and N1.28 with earnings growth rate of 23.44%.

At the current share price of N52 and Q3’21 earnings per share of N1.95, its P.E ratio is estimated at 26.67x.

PEG ratio against the expected Q3 2022 earnings is 1.14.

Q3 earnings per share of about N2.41 is projected for BUA Cement.

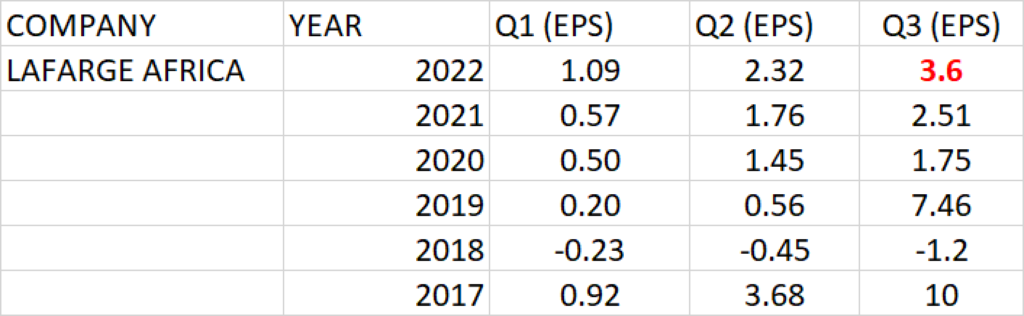

LAFARGE AFRICA (WAPCO)

Q3 earnings per share of Lafarge Africa over the last 5 years ranged between N2.51 and –N1.2 with earnings growth rate of 43.43%.

At the current share price of N24.50 and Q3’21 earnings per share of N2.51, its P.E ratio is estimated at 9.76x.

PEG ratio against the expected Q3 2022 earnings is 0.22.

Q3 earnings per share of about N3.6 is projected for Lafarge Africa.

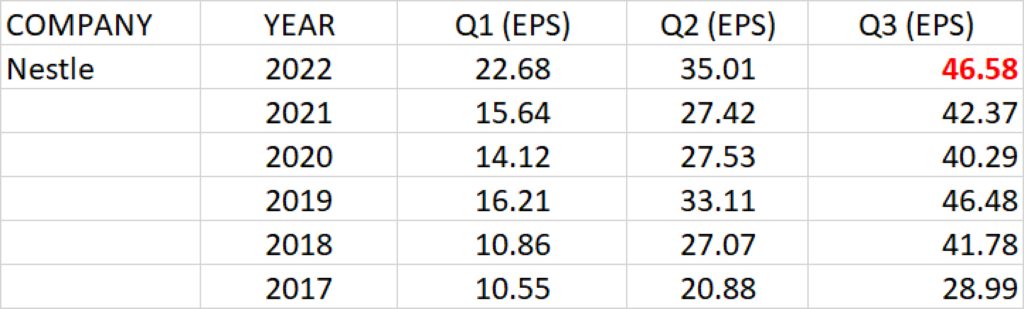

NESTLE

Q3 earnings per share of Nestle over the last 5 years ranged between N42.37 and N28.99 with earnings growth rate of 9.95%.

At the current share price of N1215 and Q3’21 earnings per share of N40.29, its P.E ratio is estimated at 28.68x.

PEG ratio against the expected Q3 2022 earnings is 2.88.

Q3 Earnings per share of about N46.58 is projected for Nestle.

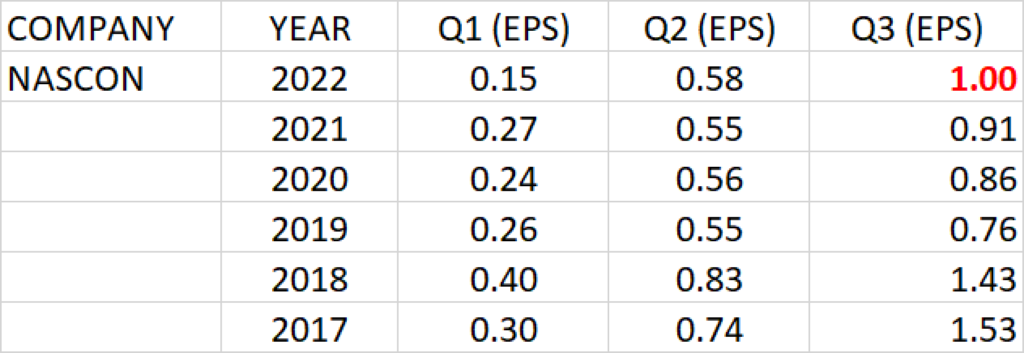

NASCON ALLIED INDUSTRIES

Q3 earnings per share of Nascon Allied Industries over the last 5 years ranged between N1.53 and 76 kobo with earnings growth rate of 6.44%.

At the current share price of N11 and Q3’21 earnings per share of N0.91, its P.E ratio is estimated at 12.09x.

PEG ratio against the expected Q3 2022 earnings is 1.28.

Q3 Earnings per share of about N1.00 is projected for Nascon Allied Industries.

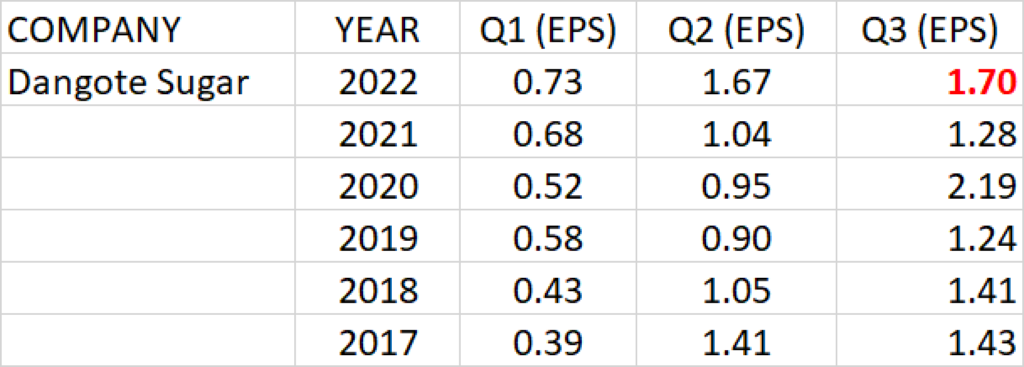

DANGOTE SUGAR

Q3 earnings per share of Dangote Sugar over the last 5 years ranged between N2.19 and N1.24 kobo with earnings growth rate of 1.60%.

At the current share price of N16.05 and Q3’21 earnings per share of N1.28, its P.E ratio is estimated at 12.54x.

PEG ratio against the expected Q3 2022 earnings is 7.84.

Q3 earnings per share of about N1.70 is projected for Dangote Sugar.

OKOMU

Q3 earnings per share of Okomu Oil Palm Company over the last 5 years ranged between N12.16 and N4.31 with earnings growth rate of 16.07%.

At the current share price of N188.3 and Q3’21 earnings per share of N12.16, its P.E ratio is estimated at 15.49x.

PEG ratio against the expected Q3 2021 earnings is 0.96.

Q3 2022 Earnings per share of about N20.48 is projected for Okomu Oil.

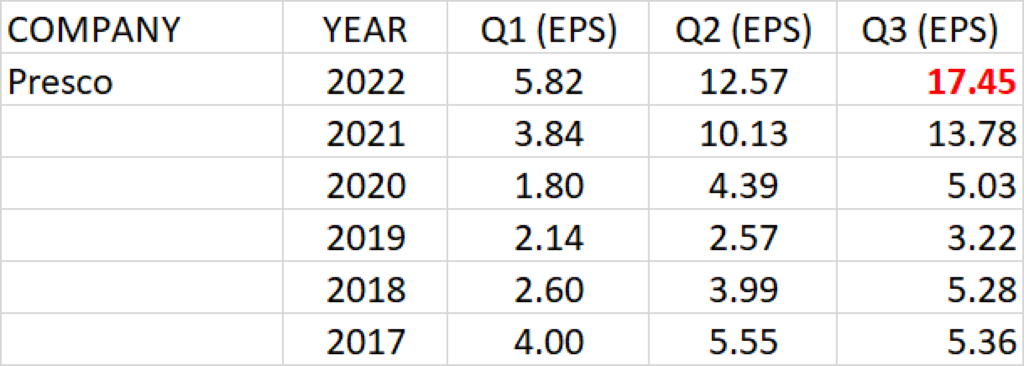

PRESCO

Q3 earnings per share of Presco over the last 5 years ranged between N13.78 and N3.22 with earnings growth rate of 26.63%.

At the current share price of N142.6 and Q3’21 earnings per share of N13.78, its P.E ratio is estimated at 10.35x.

PEG ratio against the expected Q3 2022 earnings is 0.39.

Q3 Earnings per share of about N17.45 is projected for Presco.

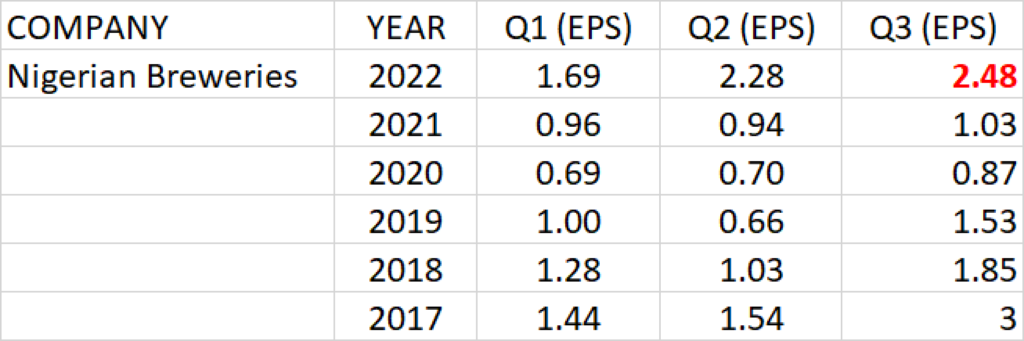

NIGERIAN BREWERIES

Q3 earnings per share of Nigerian Breweries over the last 5 years ranged between 87 kobo and N3 with earnings growth rate of 8.81%.

At the current share price of N48.4 and Q3’21 earnings per share of N1.03, its P.E ratio is estimated at 46.99x.

PEG ratio against the expected Q3 2022 earnings is 5.33.

Q3 Earnings per share of about N2.48 is projected for Nigerian Breweries.

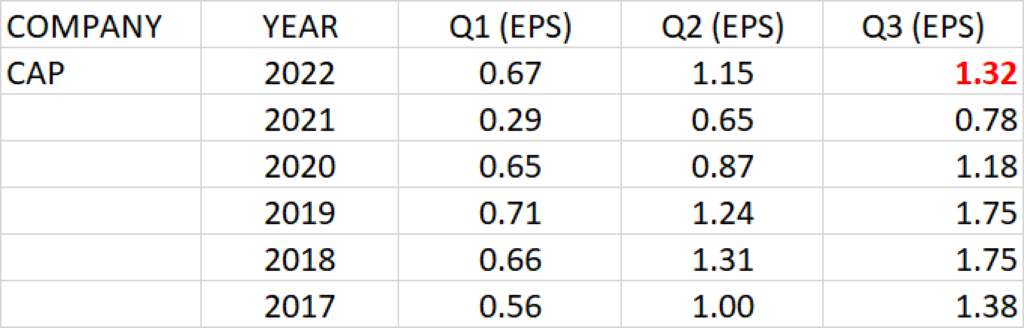

CAP PLC

Q3 earnings per share of CAP Plc over the last 5 years ranged between N1.75 and N0.78 with earnings growth rate of 14.46%.

At the current share price of N17.75 and Q3’21 earnings per share of N0.78, its P.E ratio is estimated at 22.76x.

PEG ratio against the expected Q3 2021 earnings is 1.57.

Q3 Earnings per share of about N1.32 is projected for CAP Plc.