- Price/Earnings to Growth Ratio Analysis

The third quarter earnings of listed firms on the Nigerian Exchange have started hitting the market as UCAP among a few others last week published their Q3 results. We are expecting to see more results been released this week and coming weeks.

Just like we have always advised that investment should be done against expectation and not on realities, smart investors have been taking position against Q3 results and this can be linked to the current positive vibration in the market.

In the last two editions, we did Q3 forecast for the banking and manufacturing sectors. Our Q3 2021 earnings forecast for this edition is focused on the insurance sector, using Price/Earnings to Growth (PEG) ratio analysis.

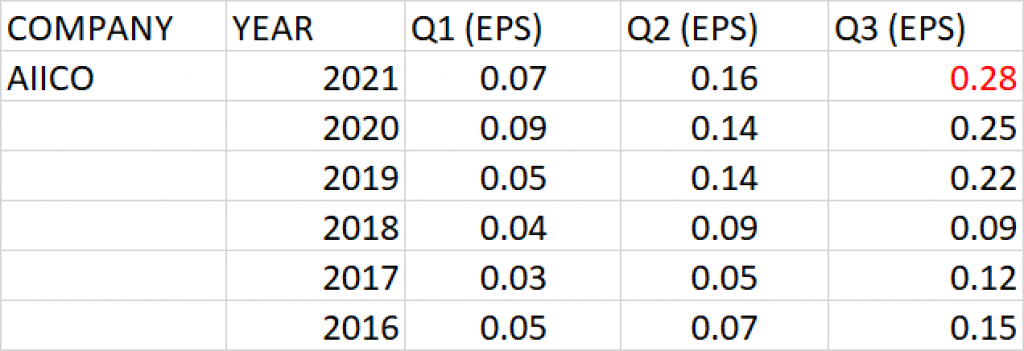

AIICO INSURANCE

Earnings history of the AIICO Insurance for Q1, Q2 and Q3 for the past 5 years has ranged between 5 kobo and 25 kobo.

Q3 earnings per share (EPS) of the underwriting firm over the last 5 years has a growth rate of 13.62%.

At the current share price of 95 kobo and Q3’20 earnings per share of 25 kobo, P.E ratio is calculated as 3.8x.

PEG ratio against the expected Q3 2021 earnings is 0.28; being less than 1 implies that AIICO Insurance at current price is underpriced.

Q3 2021 earnings per share of 28 kobo is projected for AIICO Insurance.

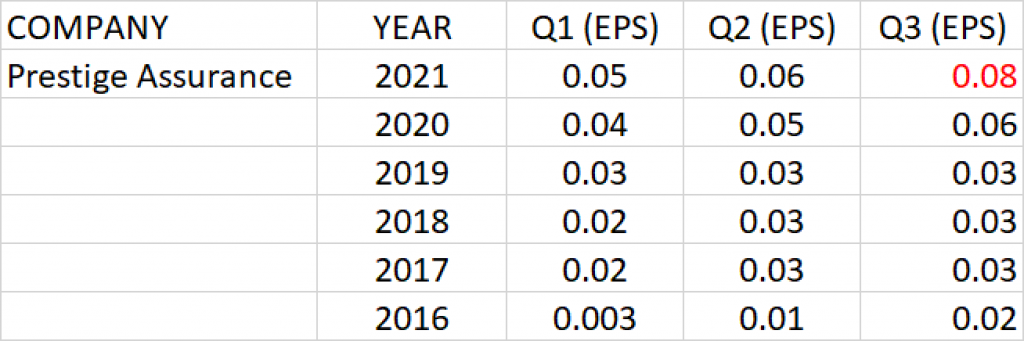

PRESTIGE ASSURANCE

Prestige Assurance over the last 5 years have reported EPS ranging between 6 kobo and 1 kobo with earnings growth rate of 31.61%

At the current share price of 47 kobo and Q3’20 earnings per share of 6 kobo, P.E ratio is calculated as 7.83x.

PEG ratio against the expected Q3 2021 earnings is 0.25.

Q3 2021 earnings per share of 8 kobo is projected for Prestige Assurance.

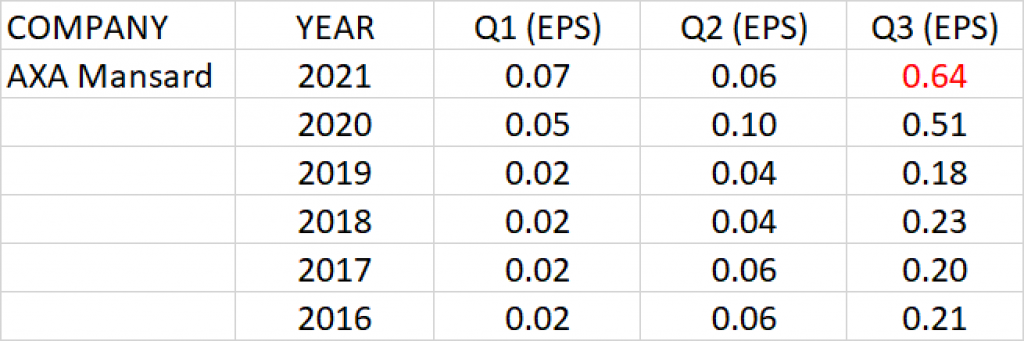

AXA MANSARD INSURANCE

The share reconstruction of AXA Mansard will obviously bring about improved earnings of the Company going forward as share outstanding of the company has been reduced to 9 billion from 36 billion.

Q3 earnings per share (EPS) of the company over the last 5 years has a growth rate of 24.84%.

At the current share price of N2.3 and Q3’20 earnings per share of 51 kobo, P.E ratio is calculated as 4.51x.

PEG ratio against the expected Q3 2021 earnings is 0.18.

Q3 2021 earnings per share of 64 kobo is projected for AXA Mansard.

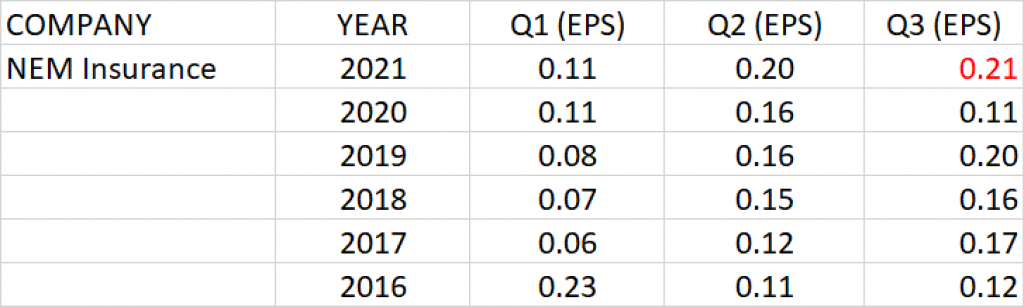

NEM INSURANCE

NEM Insurance over the last 5 years have reported EPS ranging between 23 kobo and 6 kobo for Q1, Q2 and Q3.

Q3 earnings per share (EPS) of the company over the last 5 years has a growth rate of 5%.

At the current share price of N1.93 and Q3’20 earnings per share of 11 kobo, P.E ratio is calculated as 17.55x.

PEG ratio against the expected Q3 2021 earnings is 3.51.

Q3 2021 earnings per share of 21 kobo is projected for NEM Insurance.

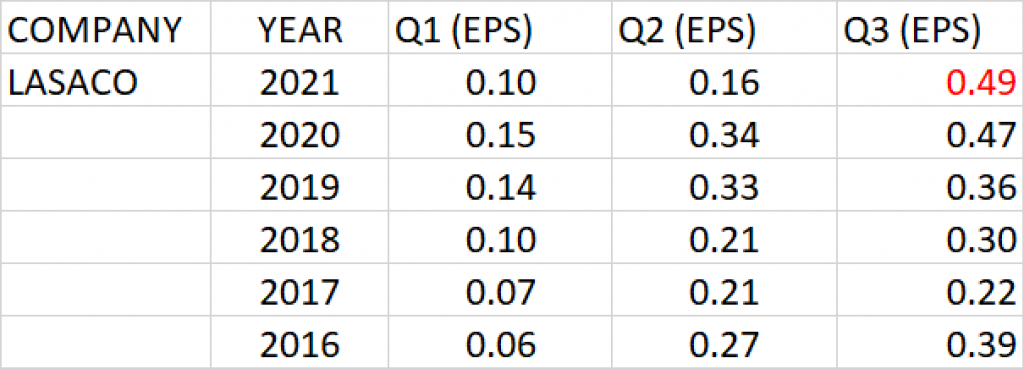

LASACO ASSURANCE

Earnings history of the LASACO Assurance for Q1, Q2 and Q3 for the past 5 years has ranged between 6 kobo and 47 kobo

Q3 earnings per share (EPS) of the firm over the last 5 years has a growth rate of 4.78%.

At the current share price of N1.24 and Q3’20 earnings per share of 47 kobo, P.E ratio is calculated as 2.64x.

PEG ratio against the expected Q3 2021 earnings is 0.55; being less than 1 implies that LASACO Assurance at current price is underpriced.

Q3 2021 earnings per share of 49 kobo is projected for LASACO Assurance.

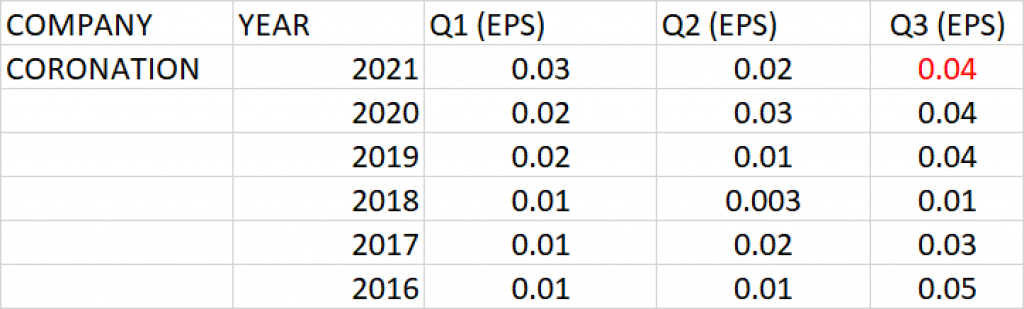

CORONATION INSURANCE

Coronation Insurance over the last 5 years have reported EPS ranging between 5 kobo and 1 kobo with negative earnings growth rate of -.5.43%

At the current share price of 50 kobo and Q3’20 earnings per share of 4 kobo, P.E ratio is calculated as 12.50x.

PEG ratio against the expected Q3 2021 earnings is -2.3.

Q3 2021 earnings per share of 4 kobo is projected for Coronation Insurance.

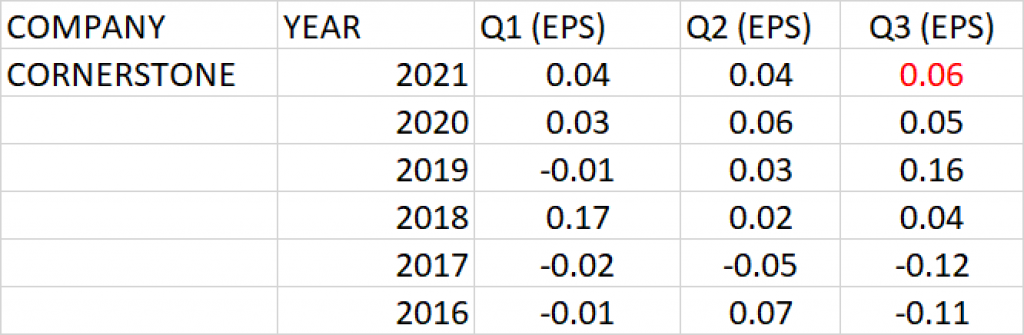

CORNERSTONE INSURANCE

Earnings history of the Cornerstone Insurance for Q1, Q2 and Q3 for the past 5 years has ranged between 6 kobo and -11 kobo

Q3 earnings per share (EPS) of the company over the last 5 years has a growth rate of 11.80%.

At the current share price of 56 kobo and Q3’20 earnings per share of 5 kobo, P.E ratio is calculated as 11.2x.

PEG ratio against the expected Q3 2021 earnings is 0.95; being less than 1 implies that Cornerstone Insurance at current price is underpriced.

Q3 2021 earnings per share of 6 kobo is projected for Cornerstone Insurance.

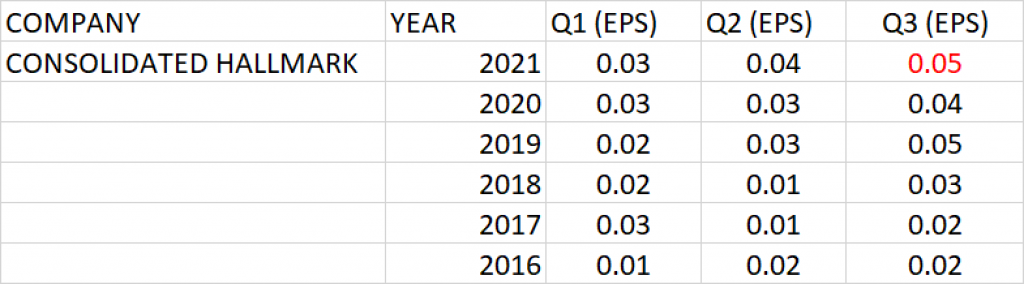

CONSOLIDATED HALLMARK INSURANCE

Consolidated Hallmark Insurance over the last 5 years have reported EPS ranging between 5 kobo and 2 kobo with earnings growth rate of 18.92%

At the current share price of 60 kobo and Q3’20 earnings per share of 4 kobo, P.E ratio is calculated as 15x.

PEG ratio against the expected Q3 2021 earnings is 0.79.

Q3 2021 earnings per share of 5 kobo is projected for Consolidated Hallmark Insurance.

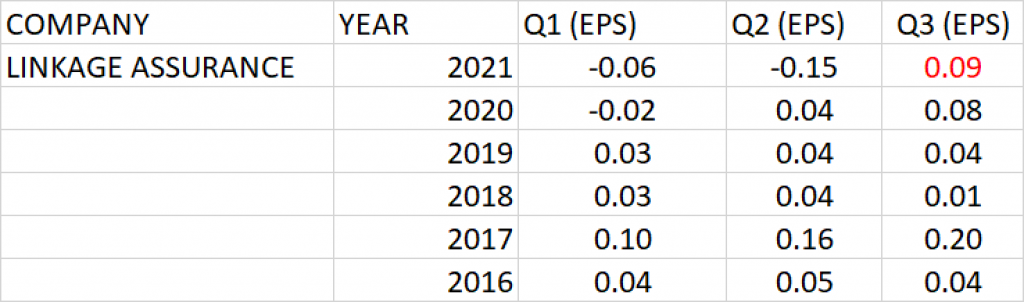

LINKAGE ASSURANCE

Earnings history of the Linkage Assurance for Q1, Q2 and Q3 for the past 5 years has ranged between 16 kobo and -15 kobo

Q3 earnings per share (EPS) of the company over the last 5 years has a growth rate of 18.92%.

At the current share price of 57 kobo and Q3’20 earnings per share of 8 kobo, P.E ratio is calculated as 7.13x.

PEG ratio against the expected Q3 2021 earnings is 0.38; being less than 1 implies that Linkage Assurance at current price is underpriced.

Q3 2021 earnings per share of 9 kobo is projected for Linkage Assurance.

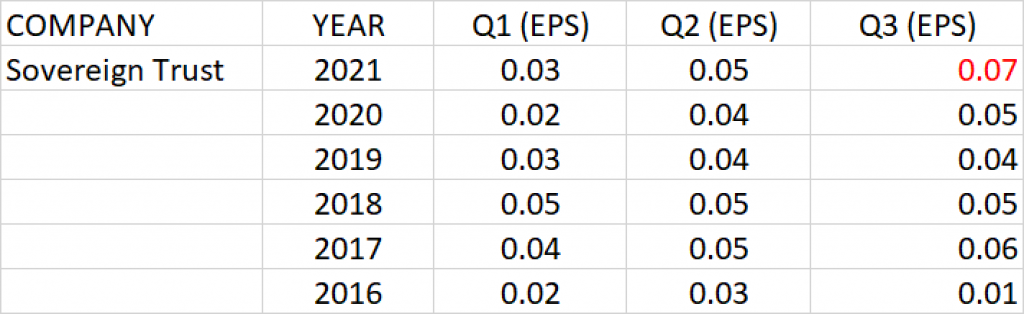

SOVEREINGN TRUST INSURANCE

Sovereign Trust Insurance over the last 5 years have reported EPS ranging between 6 kobo and 1 kobo with earnings growth rate of 49.53%

At the current share price of 24 kobo and Q3’20 earnings per share of 5 kobo, P.E ratio is calculated as 4.8x.

PEG ratio against the expected Q3 2021 earnings is 0.10.

Q3 2021 earnings per share of 7 kobo is projected for Sovereign Trust Insurance

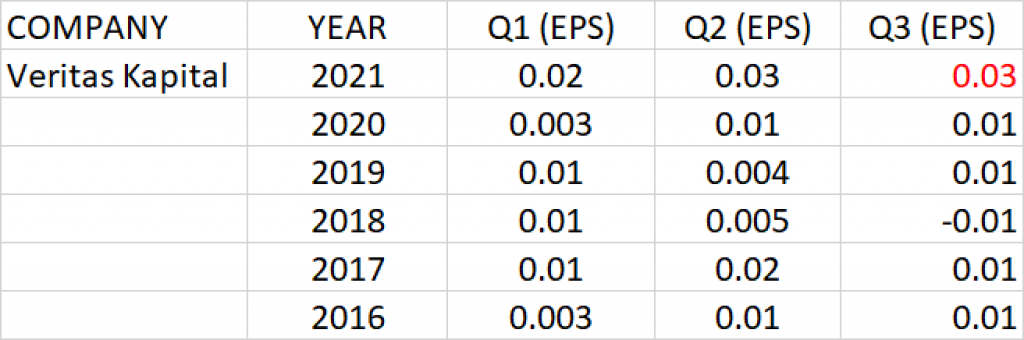

VERITAS KAPITAL ASSURANCE

Earnings history of the Veritas Kapital Assurance for Q1, Q2 and Q3 for the past 5 years has ranged between 3 kobo and 1 kobo

Q3 earnings per share (EPS) of the company over the last 5 years has a growth rate of 0.43%.

At the current share price of 23 kobo and Q3’20 earnings per share of 1 kobo, P.E ratio is calculated as 23x.

Q3 2021 earnings per share of 3 kobo is projected for Veritas Kapital Assurance.

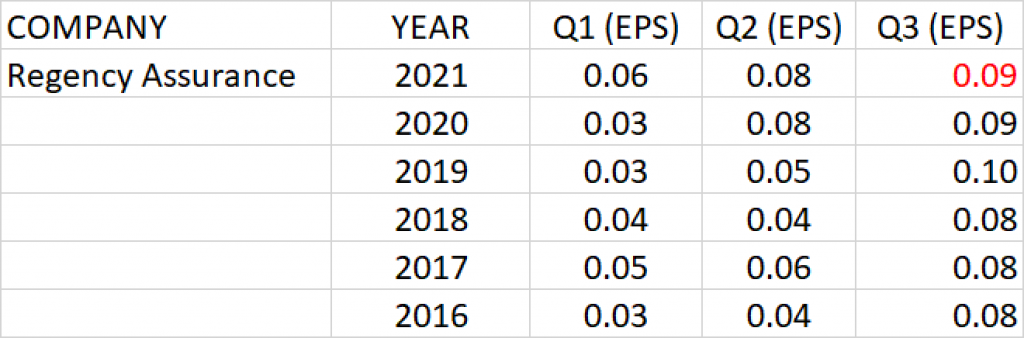

REGENCY ASSURANCE

Earnings history of the Regency Assurance for Q1, Q2 and Q3 for the past 5 years has ranged between 10 kobo and 3 kobo with earnings growth rate of 2.99%.

At the current share price of 40 kobo and Q3’20 earnings per share of 9 kobo, P.E ratio is calculated as 4.44x.

PEG ratio against the expected Q3 2021 earnings is 1.48.

Q3 2021 earnings per share of 9 kobo is projected for Regency Assurance.

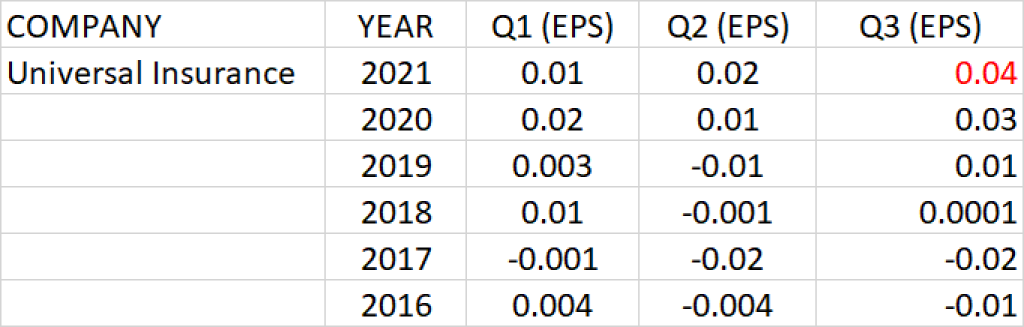

UNIVERSAL INSURANCE

Universal Insurance over the last 5 years have reported EPS ranging between 3 kobo and -1 kobo with earnings growth rate of 40%

At the current share price of 22 kobo and Q3’20 earnings per share of 3 kobo, P.E ratio is calculated as 7.33x.

PEG ratio against the expected Q3 2021 earnings is 0.18.

Q3 2021 earnings per share of 4 kobo is projected for Universal Insurance.

Thank you for the research provided on different sectors over the past weeks this is much appreciated.I want to appeal to you to equally provide figures for gross earnings or turnover to assist with knowing the market dominance of these companies as well as the dividend yield on them stating their five year record to see if pfas qualify to invest in them which will help push their prices up.thank you