The Nigerian equities market in the first half of the year closed on a negative note as the All Share Index declined by 8.80%. Though the market began the year with a good performance as the All Share Index gained 7.46% in January, 7.94% in April and 9.76% in May, it recorded losses in February, March and June with a decline of 9.11%, 18.65% and 3.12% respectively.

The second quarter of 2020 ended amidst partial lockdown of the economy caused by covid-19 pandemic. We are already in the third quarter and the economy is not yet fully opened as the government is trying to put in place measures to fully reopen the economy.

The second quarter results of the quoted companies are yet to be released, and they are likely to reflect the impact of covid-19 on economic activities. Poor results could depress the market, hence decline in prices of stocks are expected for most equities. Banking stocks may however have a different story compared to other sectors as their second quarter results may not be badly affected by the impact of covid-19. Banks were able to operate remotely while other firms were on lockdown as they were able to leverage on technology already in place before the coronavirus outbreak. Banks saved a lot of costs during the lockdown. People still did their transactions via other banking channels like ATM, transfer. Most transactions during the lockdown, even purchase of data were done with the involvement of banks. While banks are were making their money, they were also saving cost. Therefore, relatively good Q2 earnings will reflect on the performance of banking stocks going forward.

Opportunities in financial institutions

- Financial institutions are very liquid. 90% of banks quoted on NSE are highly liquid, which means you can enter and get out as much as you like.

- They are fundamentally strong stocks. 90% of financial institution are fundamentally strong because they do the same business which is financial intermediary. The number of unbanked, most especially in the urban area is very low. You can hardly see somebody that does not have a bank account. Banks’ products are well embraced. Most Bank stocks are fundamentally sound; whether you look at it from their prices, management and products.

- It is actually the banking sector that is moving the market because they herald the bulls. The moment the market want to go up, it is from the banking sector that you quickly understand; and if the bears are coming, it is also from the banking sector that you will understand it. So they lead when the bulls are coming and also show when the bears are coming.

Risks in financial institutions

The risk that can be attached to Nigerian banks is the CBN policy. Like the other time, banks were debited for default in CRR. There was another policy of Loan to Deposit ratio that was increased from 60% to 75%. Those policies are removing money from them. Banks are in the business of buying and selling deposits. They take deposit from customers and give it out for a spread. When you are now forcing them to take their deposit to CBN, that is 70% of what they have collected from outside, that means you are crippling their ability to make money. Banks cannot operate outside CBN guideline.

Every stock on the floor of the Nigerian Stock Exchange is exposed to the same economy and they have the same sensitivity to the economy alike. For instance, when there was lockdown, there was no company that was not affected. Therefore the risk that is specific to the banking sector is the CBN policy. Everything that comes out from the CBN either affect banks positively or negatively.

Q2 Earnings Projections for Banks

The market is waiting for Q2 results to determine what will happen in Q3. The lockdown happened in the second quarter of the year. So the market want to see what the impact of that lockdown on Q2 results.

If it happens that Q2 results for banks come out with good performance, then it means that they are isolated. Even while the economy was in lockdown, banks were doing businesses by deploying technology in their operations. If their results are good for second quarter, then it means they are good to go as Q2 result will determine the direction of the market.

Our projections of Q2 earnings for banks will be based on their PEG ratios. PEG ratio (price/earnings to growth ratio) is a valuation metric for determining the relative trade-off between the price of a stock, the earnings generated per share (EPS), and the company’s expected growth. In other words, it is not enough for anyone to invest on just the strength of a company’s previous or latest earnings but these in addition to the expected earnings.

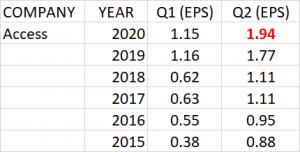

ACCESS BANK

Access Bank’s post-merger audited report was half year 2019 and the bank recorded a strong performance as earnings per share grew by 59.05% to N1.77 from N1.11 achieved in half year 2018.

Under the watch of Herbert Wigwe, a household name as far as banking is concerned, Access Bank has consistently grew its earnings over the years and the price of the stock has performed over time.

- Earnings history of Access Bank Plc for Q1 and Q2 for the past 5 years show that the bank has been consistent in improving on its earnings per share year on year.

- Consistent growth is observed in the bank’s results within a financial year, Q1 to Q2. In other words, there was not a lower performance in a current quarter than the preceding quarter within a financial year.

- Q2 earnings per share (EPS) of the bank over the last 5 years has an average growth rate of 21.07%.

- Relative to the current share price of N6.2 and Q2’19 earnings per share of N1.77, P.E ratio is estimated at 3.50x.

- PEG ratio against the expected Q2 earnings is 0.17 and it implies that the share price of Access Bank at current price is underpriced.

- Q2 Earnings per share of N1.94 is projected for Access Bank Plc.

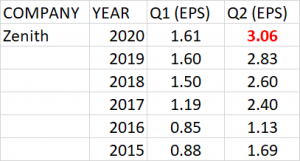

ZENITH BANK

Zenith Bank has performed over the years with consistent growth in turnover, profit after tax and earnings per share especially with good dividend pay-out record. The Bank has been consistent with both interim and final dividend and most times their dividend yield is always above 10%.

- Earnings history of the Bank for Q1 and Q2 for the past 5 years show that the bank has been consistent in improving on its earnings per share year on year.

- Consistent growth is observed in the bank’s results within a financial year, Q1 to Q2. In other words, there was not a lower performance in a current quarter than the preceding quarter within a financial year.

- Q2 earnings per share (EPS) of the bank over the last 5 years has an average growth rate of 24.08%.

- Relative to the current share price of N15.75 and Q2’19 earnings per share of N2.83, P.E ratio is evaluated as 5.56x.

- PEG ratio against the expected Q2 earnings is 0.23, which makes the share price of Zenith Bank underpriced at current price.

- Q2 earnings per share of N3.06 is projected for Zenith Bank.

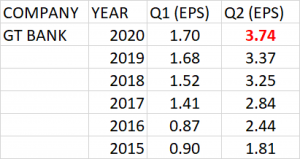

GUARANTY TRUST BANK

Guaranty Trust bank in the last five years has shown consistent growth in Q2 profit after tax and earnings per share. The bank has been consistent with dividend payout of both interim and final.

Guaranty Trust Bank have a very good Corporate Governance and there shareholding structure is working for them. Business Continuity in Guaranty Trust Bank is higher because the shareholding structure is not skewed to one person. The price of the stock has performed over time.

- Earnings history of the Bank for Q1 and Q2 for the past 5 years show that the Guaranty Trust Bank has been consistent growing its earnings per share.

- Consistent growth is observed in the bank’s results within a financial year, Q1 to Q2. In other words, there was not a lower performance in a current quarter than the preceding quarter within a financial year.

- Q2 earnings per share (EPS) of the bank over the last 5 years has an average growth rate of 17.3%.

- Relative to the current share price of N21.50 and Q2’19 earnings per share of N3.37, P.E ratio is calculated as 6.38x.

- PEG ratio against the expected Q2 earnings is 0.37, which makes the share price of Guaranty Trust Bank underpriced at current price.

- Q2 earnings per share of N3.74 is projected for Guaranty Trust Bank.

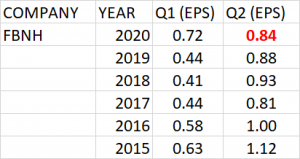

FIRST BANK OF NIGERIA HOLDINGS (FBNH)

The share price of FBNH has performed over the years and the stock is very resilient. There is hardly no portfolio that you don’t find First Bank, no matter how small the unit is. The effort the management of the bank have put into cleaning their book of non-performing loan is very credible.

- Q2 earnings history of FBNH for the past 5 years shows consistent decline in earnings per share, though there was a record of 15.68% growth in Q2 2018.

- Consistent growth is observed in the bank’s results within a financial year, Q1 to Q2. In other words, there was not a lower performance in a current quarter than the preceding quarter within a financial year.

- Q2 earnings per share (EPS) of the bank over the last 5 years has an average decline rate of 5%.

- Relative to the current share price of N5 and Q2’19 earnings per share of N0.88, P.E ratio of the bank is calculated as 5.67x.

- PEG ratio of less than 1 implies that the share price of the bank is underpriced.

- Based on the trend in Q2 earnings per share of the Bank, an EPS of N0.84 is projected for FBNH in Q2’20 financials.

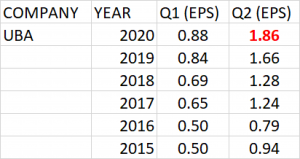

UNITED BANK FOR AFRICA

United Bank for Africa has been consistent over the years in payment of dividend both interim and final. It has also performed well as far as price appreciation is concerned. The management of UBA is tight which is obviously linked Tony Elumelu. That means that the corporate Governance will be to the utmost for UBA.

- Earnings history of the Bank for Q1 and Q2 for the past 5 years show that the UBA has been consistent growing its earnings per share.

- Consistent growth is observed in the bank’s results within a financial year, Q1 to Q2.

- Q2 earnings per share (EPS) of the bank over the last 5 years has an average growth rate of 18.48%.

- Relative to the current share price of N6.10 and Q2’19 earnings per share of N1.66, P.E ratio is evaluated as 3.68x.

- PEG ratio against the expected Q2 earnings is 0.20, which makes the share price of UBA underpriced at current price.

- Q2 earnings per share of N1.86 is projected for UBA.

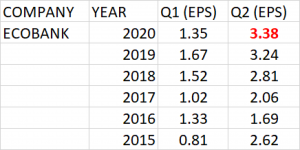

ECOBANK

Earnings history of Ecobank Transnational International for Q1 and Q2 since 2017 shows consistent growth in the bank’s earnings per share. Following the successful acquisition of Oceanic Bank by the Ecobank group in 2011, Ecobank Nigeria has emerged strong in terms of assets, customer base, deposits and branches.

- Consistent growth is observed in the bank’s results within a financial year, Q1 to Q2.

- Q2 earnings per share (EPS) of the bank over the last 5 years has an average growth rate of 9.50%.

- Relative to the current share price of N4.35 and Q2’19 earnings per share of N3.24, P.E ratio is calculated as 1.34x.

- PEG ratio against the expected Q2 earnings is 0.14, which makes the share price of Ecobank underpriced at current price of N4.35.

- Q2 earnings per share of N3.38 is projected for Ecobank.

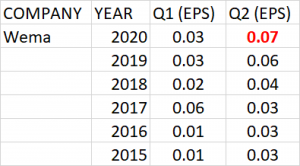

WEMA BANK

An in-depth study of the Wema Bank’s operation in the last ten years revealed that much has been done in rebranding, repositioning and refocusing even in the face of challenging economy and unstable policies that saw the bank at a time opting for a regional license before a subsequent upgrade.

The strength of the bank remains its foundation, visible repositioning in the previous years and the seamless succession.

- Wema Bank maintained Q2 earnings per share at 3 kobo from 2015 till 2017. Then from 2018 to 2019, Q2 EPS of the bank grew by 28.84% and 43.21% respectively.

- Relative to the current share price of N0.51 and Q2’19 earnings per share of N0.06, P.E ratio of the bank is calculated as 8.75x.

- Q2 earnings per share of 7 kobo is projected for Wema Bank.

FIDELITY BANK

Focused on select niche corporate banking sectors as well as Micro, Small and Medium Enterprises (MSMEs), Fidelity Bank is rapidly implementing a digital based retail banking strategy which has resulted in exponential growth in savings deposits over the last 6 years, with over 40 percent customer enrollment on the Bank’s flagship mobile/internet banking products.

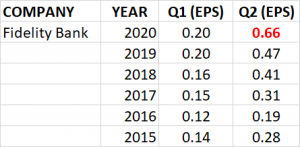

- Earnings history of Fidelity Bank shows consistent growth in the bank’s results within a financial year, Q1 to Q2.

- Q2 earnings per share (EPS) of the bank over the last 5 years has an average growth rate of 19.66%.

- Relative to the current share price of N1.76 and Q2’19 earnings per share of N0.47, P.E ratio is evaluated as 3.73x.

- PEG ratio against the expected Q2 earnings is 0.19, which makes the share price of Fidelity Bank underpriced at current price.

- Q2 earnings per share of N0.66 is projected for Fidelity Bank.

STANBIC IBTC

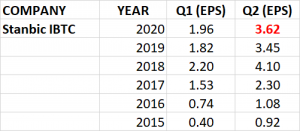

The financial report of Stanbic IBTC from 2015 till 2018, shows consistent growth in in its Q1 and Q2 earnings per share. However in 2019, EPS declined both in Q1 and Q2 by 16.98% and 15.87% respectively.

- Relative to the current share price of N29 and Q2’19 earnings per share of N3.45, P.E ratio of the bank is evaluated as 8.41x.

- PEG ratio against the expected Q2 earnings is 0.17, which makes the share price of the bank underpriced at current price.

- Q2 earnings per share of N3.62 is projected for Stanbic IBTC.

FCMB

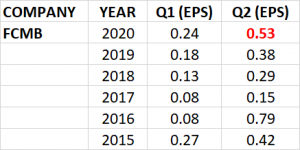

Earning history of First City Monument Bank shows growth in the Banks Q1 and Q2 EPS from 2017 till date.

- Q2 earnings per share (EPS) of the bank over the last 5 years has an average growth rate of 32.3%.

- Relative to the current share price of N1.9 and Q2’19 earnings per share of N0.38, P.E ratio of the Bank is calculated as 5.00x.

- PEG ratio against the expected Q2 earnings is low, which suggests that the current price could be considered cheap.

- Q2 earnings per share of N0.53 is projected for FCMB.

STERLING BANK

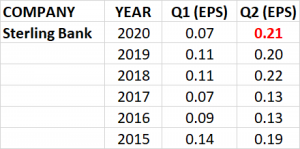

Sterling Bank evolved from a merger of 4 other banks – Indo-Nigeria Merchant Bank, Magnum Trust Bank, NBM Bank and Trust Bank of Africa – as part of the 2006 consolidation of the Nigerian banking industry. Under the new leadership of Abubakar Suleiman, the One Customer Bank has been up on its game to give value its investors and stakeholders.

- In 2016, earnings per share declined both in Q1 and Q2 respectively. In 2017, Q1 EPS declined further, but Q2 earnings per share was retained at 13 kobo. In 2018, earnings per share in Q1 and Q2 grew by 57.14% and 63.44% respectively. In 2019, Q1 EPS was retained at 11 kobo while Q2 EPS declined by 8.88%.

- Q2 earnings per share (EPS) of the bank over the last 5 years has an average growth rate of 6.22%. Therefore there is potential growth in the earnings per share of the bank.

- Relative to the current share price of N1.25 and Q2’19 earnings per share of N0.20, P.E ratio of the Bank is calculated as 6.36x.

- PEG ratio of the bank is 1.02, which is quite high and it implies that the current price of the stock is overpriced.

- Q2 earnings per share of N0.21 is projected for Sterling Bank.

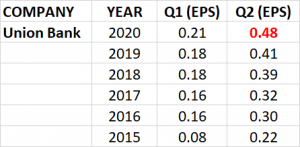

UNION BANK PLC:

Union Bank of Nigeria is one of Nigeria’s long-standing financial institutions, established in 1917. Second quarter earnings of the bank for the past 5 years shows consistent growth in its earnings per share.