- Price/Earnings to Growth Ratio Analysis

The manufacturing sector was the worst hit sector of the economy during the covid year because lock down hindered their operations as against other sectors like banking and telecoms that were able to operate remotely.

The market did not expect much from this sector for the second quarter of 2020 as lockdown was a major challenge. Against all odds a few of these manufacturing firms came out with fantastic results.

The economy has since fully resumed activities with all sectors in full operation. It is without doubt that the Q2 2021 earnings of manufacturing firms will perform better than what they reported during the covid year.

Just about 5 companies have released their Q2 2021 results so far. We are likely to see more results hitting the market in coming weeks. In the last two publications, we did Q2 earnings forecast for the banking and insurance firms using PEG ratio analysis. Our forecast for this edition will be for manufacturing firms.

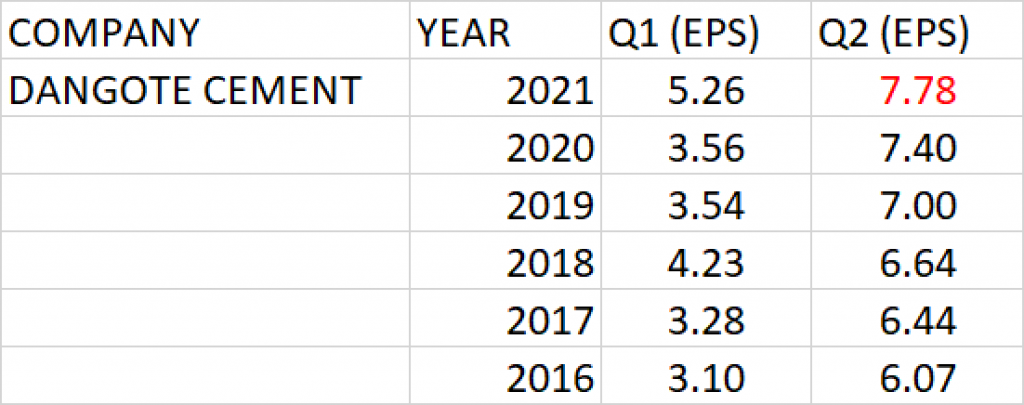

DANGOTE CEMENT

Despite the lockdown in the covid year, Dangote Cement recorded growth in its topline and bottom line figures for Q2 2020, beating market expectation.

The earnings history of Dangote Cement for Q1 and Q2 for the past 5 years show that the firm has been consistent in improving on its earnings per share year on year. The cement manufacturing giant maintained consistent growth within a financial year, Q1 to Q2. In other words, there was not a lower performance in a current quarter than the preceding quarter within a financial year.

Q2 earnings per share (EPS) of Dangote Cement over the last 5 years has a growth rate of 5.08%.

At the current share price of N230 and Q2’20 earnings per share of N7.40, P.E ratio is estimated at 31.07x.

PEG ratio against the expected Q2 2021 earnings is 6.12.

Q2 Earnings per share of about N7.78 is projected for Dangote Cement.

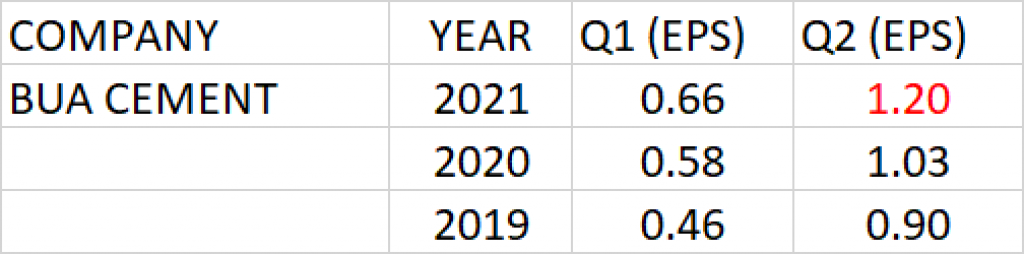

BUA CEMENT

Earnings history of BUA Cement for Q1 and Q2 since 2019 has ranged between 46 kobo and N1.03.

Over the last 2 years, its Q2 earnings per share (EPS) has a growth rate of 14.44%.

At the current share price of N71 and Q2’20 earnings per share of 1.03, P.E ratio is calculated as 68.93x.

PEG ratio against the expected Q2 2021 earnings is 4.77.

Q2 2021 earnings per share of N1.20 is projected for BUA Cement.

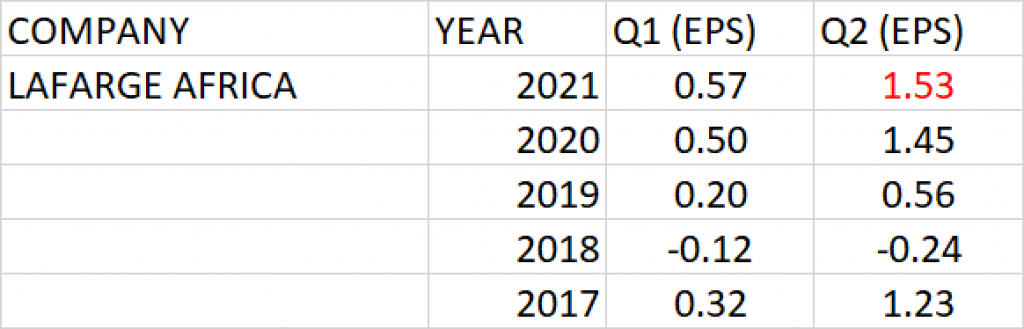

LAFARGE AFRICA (WAPCO)

Earnings history of Lafarge Africa (WAPCO) for Q1 and Q2 for the past 4 years has ranged between 12 kobo and N1.45.

Q2 earnings per share (EPS) of the Cement Company over the last 4 years has a growth rate of 5.64%.

At the current share price of N21.64 and Q2’20 earnings per share of N1.45, P.E ratio is calculated as 14.95x.

PEG ratio against the expected Q2 2021 earnings is 2.65.

Q2 2021 earnings per share of N1.53 is projected for Lafarge Africa.

FIDSON HEALTHCARE

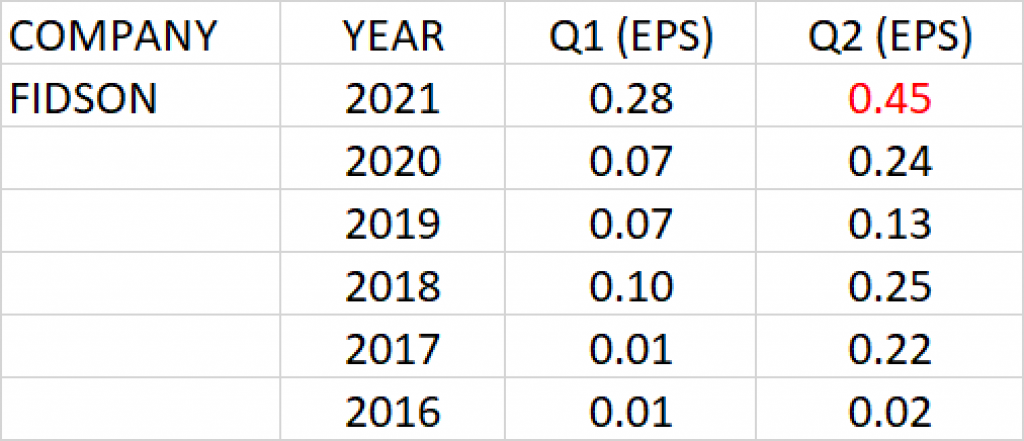

Fidson Healthcare Plc significantly grew its Q1 2021 earnings per share by 281.39% to 28 kobo from the EPS of 7 kobo.

Earnings history of Fidson Healthcare Plc for Q1 and Q2 for the past 5 years has ranged between 28 kobo and 1 kobo.

Q2 earnings per share (EPS) of the company over the last 5 years has a growth rate of 86.12%.

At the current share price of N6.09 and Q2’20 earnings per share of 24 kobo, P.E ratio is calculated as 25.38x.

PEG ratio against the expected Q2 2021 earnings is 0.29, being less than 1 implies that Fidson at current price is undervalued.

Q2 2021 earnings per share of 45 kobo is projected for Fidson Healthcare.

MAY & BAKER

The First Quarter earnings per share of May & Baker for 2021 grew significantly by over 400% to 14 kobo from 2 kobo.

Earnings history of May & Baker Nigeria for Q1 and Q2 for the past 5 years has ranged between 1 kobo and 25 kobo.

Q2 earnings per share (EPS) of the company over the last 5 years has a growth rate of 88.03%.

At the current share price of N4.43 and Q2’20 earnings per share of 25 kobo, the P.E ratio is calculated as 17.72x.

PEG ratio against the expected Q2 2021 earnings is 0.2, being less than 1 implies that May & Baker at current price is undervalued.

Q2 2021 earnings per share of 45 kobo is projected for May & Baker.

BERGER PAINTS

Earnings history of Berger Paints for Q1 and Q2 for the past 5 years has ranged between 50 kobo and less than 8 kobo.

Q2 earnings per share (EPS) of the company over the last 5 years has a growth rate of -9.64%.

At the current share price of N8.9 and Q2’20 earnings per share of 14 kobo, P.E ratio is calculated as 62.77x.

PEG ratio against the expected Q2 2021 earnings is -6.51.

Q2 2021 earnings per share of 13 kobo is projected for Berger Paints.

BETA GLASS

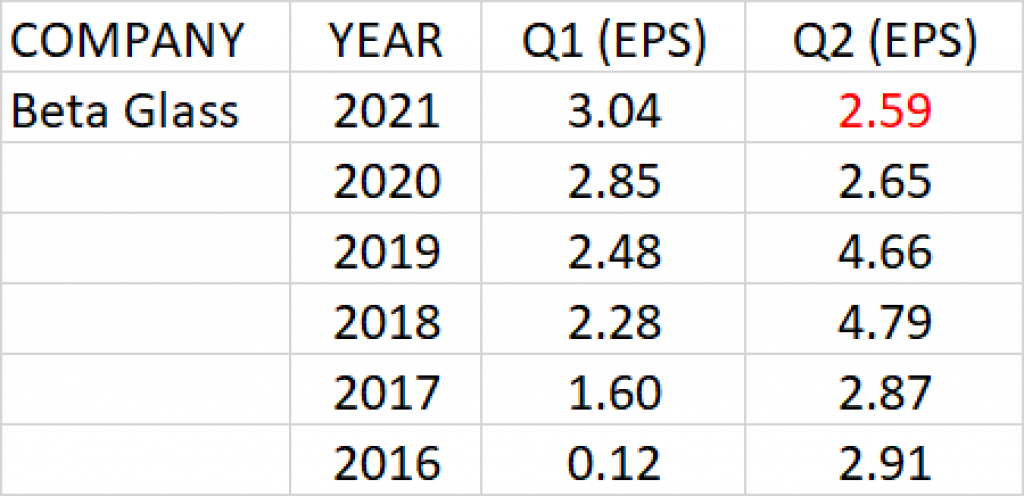

Earnings history of Beta Glass Plc for Q1 and Q2 for the past 5 years has ranged between N4.79 and less than 12 kobo.

Q2 earnings per share (EPS) of the company over the last 5 years has a growth rate of -2.31%.

At the current share price of N52.95 and Q2’20 earnings per share of N2.65, the P.E ratio is calculated as 19.98x.

PEG ratio against the expected Q2 2021 earnings is -8.65.

Q2 2021 earnings per share of N2.59 is projected for Beta Glass.

CAP Plc

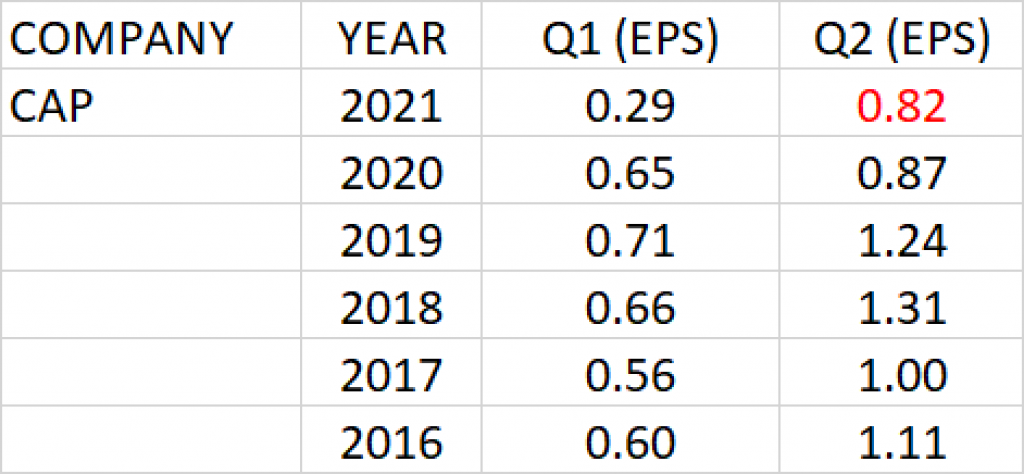

Earnings history of CAP for Q1 and Q2 for the past 5 years has ranged between N1.31 and 56 kobo

Q2 earnings per share (EPS) of the company over the last 5 years has a growth rate of -5.91%.

At the current share price of N20.80 and Q2’20 earnings per share of 87 kobo, P.E ratio is calculated as 23.97x.

PEG ratio against the expected Q2 2021 earnings is -4.06.

Q2 2021 earnings per share of 82 kobo is projected for CAP Plc.

NESTLE

Earnings history of CAP for Q1 and Q2 for the past 4 years has ranged between N33.11 and N10.55.

Q2 earnings per share (EPS) of the company over the last 4 years has a growth rate of 9.65%.

At the current share price of N1540 and Q2’20 earnings per share of N27.53, the P.E ratio is calculated as 55.93x.

PEG ratio against the expected Q2 2021 earnings is 5.80.

Q2 2021 earnings per share of about N30.19 is projected for Nestle Nigeria Plc.

NASCON ALLIED INDUSTRIES

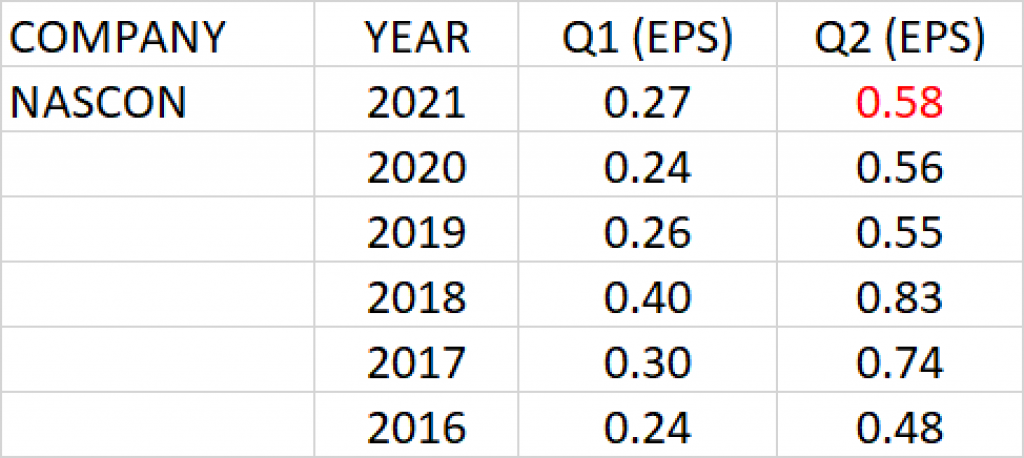

Earnings history of Nascon Allied Industries for Q1 and Q2 for the past 5 years has ranged between 83 kobo and 24 kobo

Q2 earnings per share (EPS) of the company over the last 5 years has a growth rate of 3.93%.

At the current share price of N15 and Q2’20 earnings per share of 56 kobo, P.E ratio is calculated as 26.71x.

PEG ratio against the expected Q2 2021 earnings is 6.80.

Q2 2021 earnings per share of about 58 kobo is projected for Nascon Allied Industries.

DANGOTE SUGAR

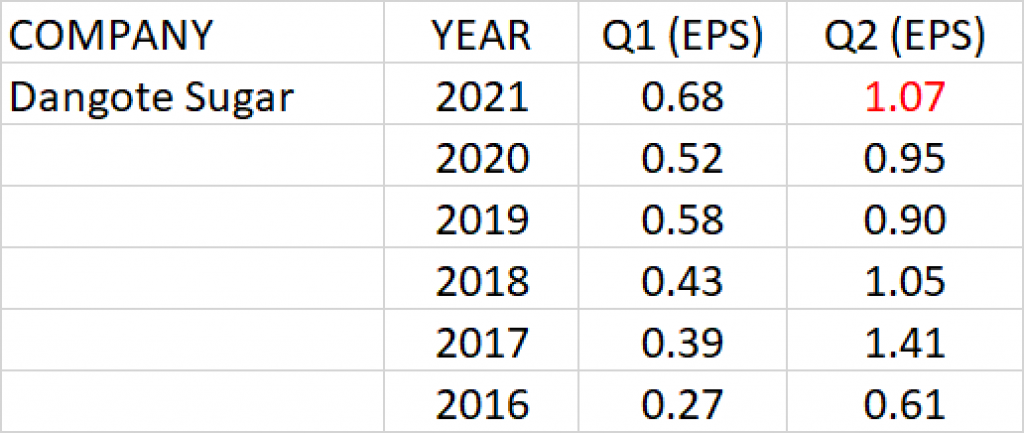

Earnings history of Dangote Sugar Refineries Plc for Q1 and Q2 for the past 5 years has ranged between N1.41 and 27 kobo.

Q2 earnings per share (EPS) of the company over the last 5 years has a growth rate of 11.71%.

At the current share price of N17.45 and Q2’20 earnings per share of 95 kobo, P.E ratio is calculated as 18.30x.

PEG ratio against the expected Q2 2021 earnings is 1.56.

Q2 2021 earnings per share of about N1.07 is projected for Dangote Sugar.

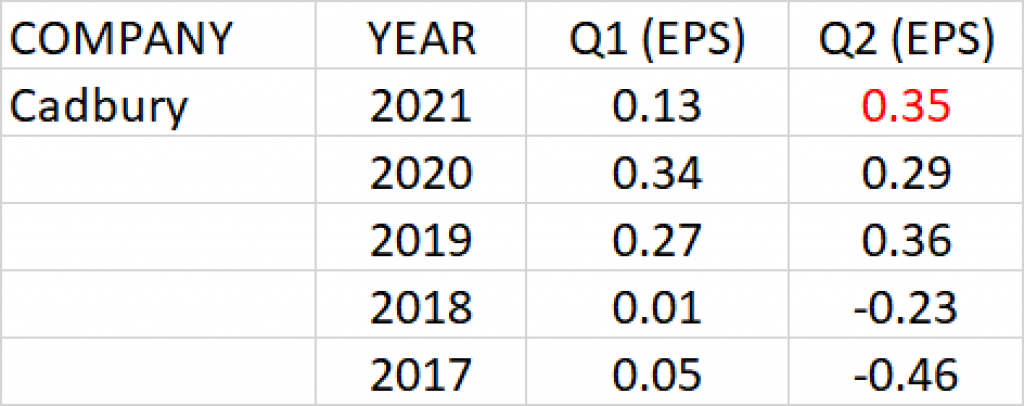

CADBURY

Earnings history of Cadbury Nigeria Plc for Q1 and Q2 for the past 4 years has ranged between 36 kobo and -46 kobo.

Q2 earnings per share (EPS) of the company over the last 5 years has a growth rate of 23.26%.

At the current share price of N8.60 and Q2’20 earnings per share of 29 kobo, P.E ratio is calculated as 30.10x.

PEG ratio against the expected Q2 2021 earnings is 1.27.

Q2 2021 earnings per share of about 35 kobo is projected for Cadbury Nigeria Plc.