- Price/Earnings to Growth Ratio Analysis

Insurance business in Nigeria generally can be said to be underperforming as most people do not take it seriously. Despite several awareness campaign on the importance of taking insurance policy to secure, property, life and investment against future eventualities, people still perceive taking insurance as waste of resources because the future occurrence they are trying to protect may not happen. Except for third party insurance policy for vehicles that people are compelled to take, other insurance policies over the years have experienced low patronage.

In developed countries, insurance firms are far bigger than banks; in fact most of them own banks. Interestingly, it is the opposite in Nigeria as some banks own insurance firms as part of their subsidiaries. Sadly enough, insurance firms in Nigeria are regard as ‘poor cousins of banks’.

The good news is that, the next investment destination we might actually see is the insurance sector as a lot of financial engineering were done by insurance companies last year. At that, many insurance firms now have working capital at their disposal, based on the financial engineering that they just did. The current information is that government policy will be positive to the insurance companies going forward.

As the market anticipates Q2 earnings of listed firms on NGX, just like we did Q2 earnings forecast for banking stocks in our previous publication, our forecast for this edition will be for insurance firms.

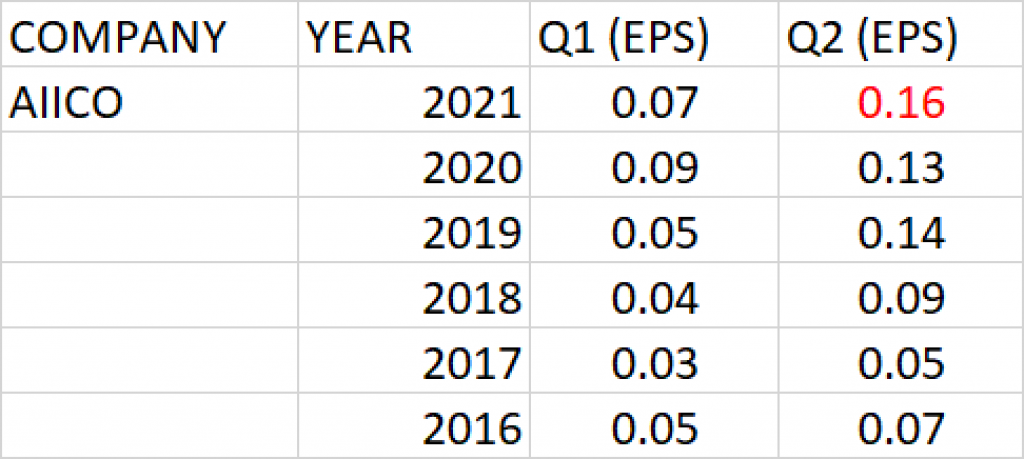

AIICO INSURANCE

Earnings history of AIICO Insurance Plc for Q1 and Q2 for the past 5 years show that the firm has been consistent in improving on its earnings per share year on year.

The underwriting firm maintained consistent growth within a financial year, Q1 to Q2. In other words, there was not a lower performance in a current quarter than the preceding quarter within a financial year.

Q2 earnings per share (EPS) of AIICO over the last 5 years has a growth rate of 16.74%.

At the current share price of N1.05 and Q2’20 earnings per share of 13 kobo, P.E ratio is estimated at 7.78x.

PEG ratio against the expected Q2 2021 earnings is 0.46; being less than 1 implies that AIICO at current price is undervalued.

Q2 Earnings per share of about 16 kobo is projected for AIICO Insurance Plc.

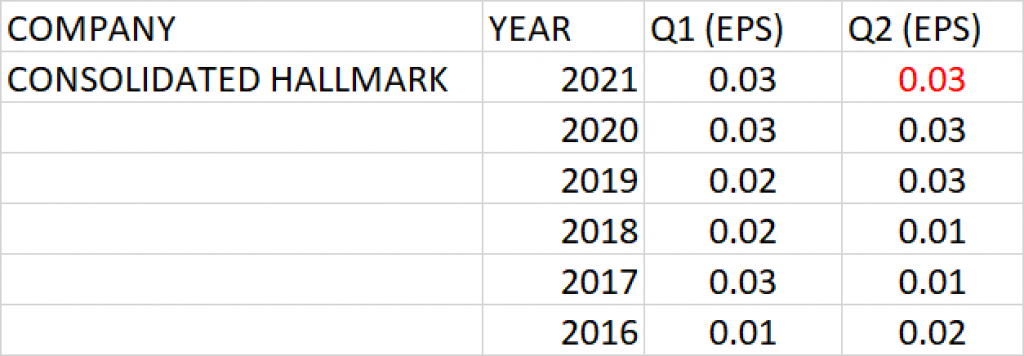

CONSOLIDATED HALLMARK INSURANCE

Earnings history of the underwriting firm for Q1 and Q2 for the past 5 years has ranged between 3 kobo and 1 kobo

Q2 earnings per share (EPS) of Consolidated Hallmark Insurance over the last 5 years has a growth rate of 10.67%.

At the current share price of 70 kobo and Q2’20 earnings per share of 3 kobo, P.E ratio is calculated as 25.37x.

PEG ratio against the expected Q2 2021 earnings is 2.38; being greater than 1 implies that Consolidated Hallmark Insurance at current price is overpriced.

Q2 2021 earnings per share of 3 kobo is projected for Consolidated Hallmark Insurance.

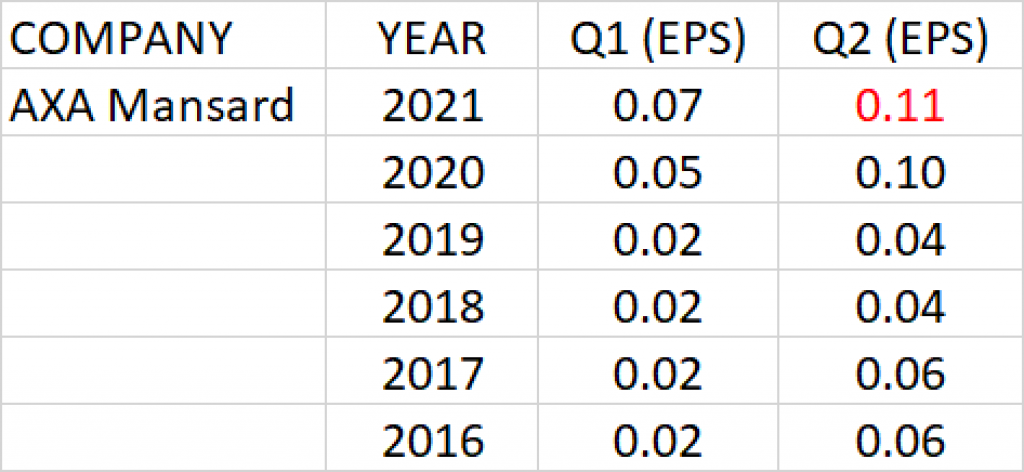

AXA MANSARD INSURANCE

Earnings history of AXA Mansard Insurance for Q1 and Q2 for the past 5 years has ranged between 10 kobo and 2 kobo.

Q2 earnings per share (EPS) of the underwriting firm over the last 5 years has a growth rate of 13.62%.

At the current share price of 89 kobo and Q2’20 earnings per share of 10 kobo, P.E ratio is calculated as 8.89x.

PEG ratio against the expected Q2 2021 earnings is 0.65.

Q2 2021 earnings per share of 11 kobo is projected for AXA Mansard Insurance.

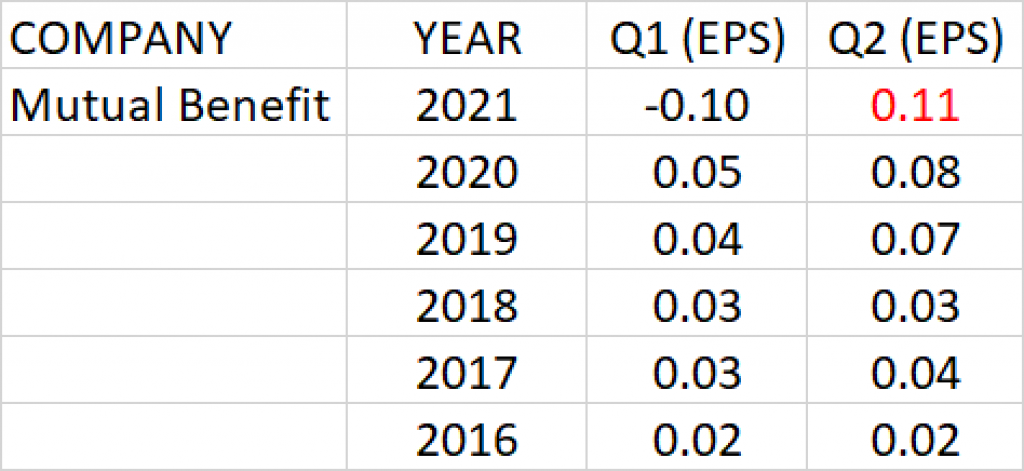

MUTUAL BENEFIT ASSURANCE

Earnings history of Mutual Benefit Assurance for Q2 for the past 5 years has ranged between 8 kobo and 2 kobo.

Q2 earnings per share (EPS) of the underwriting firm over the last 5 years has a growth rate of 41.42%.

At the current share price of 40 kobo and Q2’20 earnings per share of 8 kobo, P.E ratio is calculated as 5.12x.

PEG ratio against the expected Q2 2021 earnings is 0.12.

Q2 2021 earnings per share of 11 kobo is projected for Mutual Benefit Assurance.

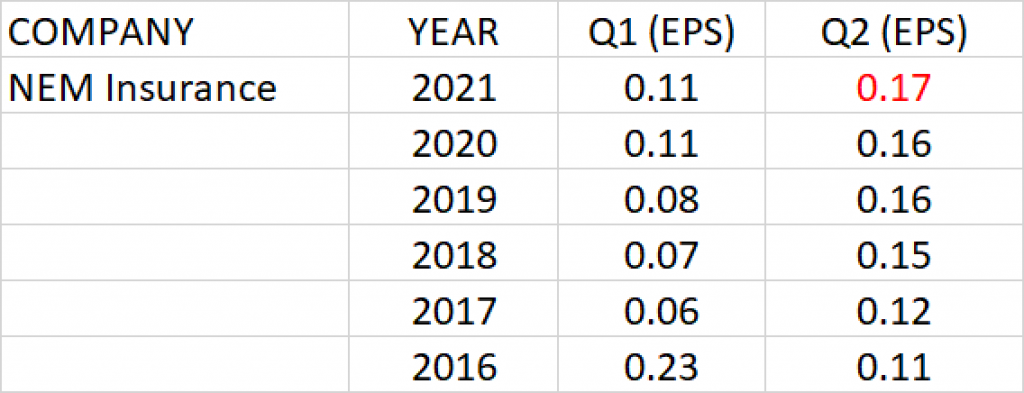

NEM INSURANCE

Earnings history of NEM Insurance for Q1 and Q2 for the past 5 years has ranged between 23 kobo and 11 kobo.

Q2 earnings per share (EPS) of the underwriting firm over the last 5 years has a growth rate of 9.82%.

At the current share price of N2 and Q2’20 earnings per share of 16 kobo, P.E ratio is calculated as 12.84x.

PEG ratio against the expected Q2 2021 earnings is 1.31.

Q2 2021 earnings per share of 17 kobo is projected for NEM Insurance.

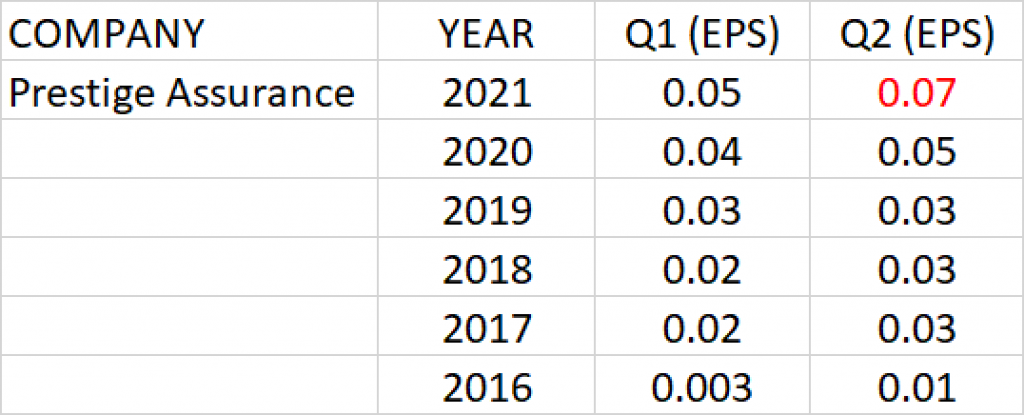

PRESTIGE ASSURANCE

Earnings history of Prestige Assurance for Q1 and Q2 for the past 5 years has ranged between 5 kobo and less than 1 kobo.

Q2 earnings per share (EPS) of the underwriting firm over the last 5 years has a growth rate of 49.53%.

At the current share price of 45 kobo and Q2’20 earnings per share of 5 kobo, P.E ratio is calculated as 9.61x.

PEG ratio against the expected Q2 2021 earnings is 0.19.

Q2 2021 earnings per share of 7 kobo is projected for Prestige Assurance.

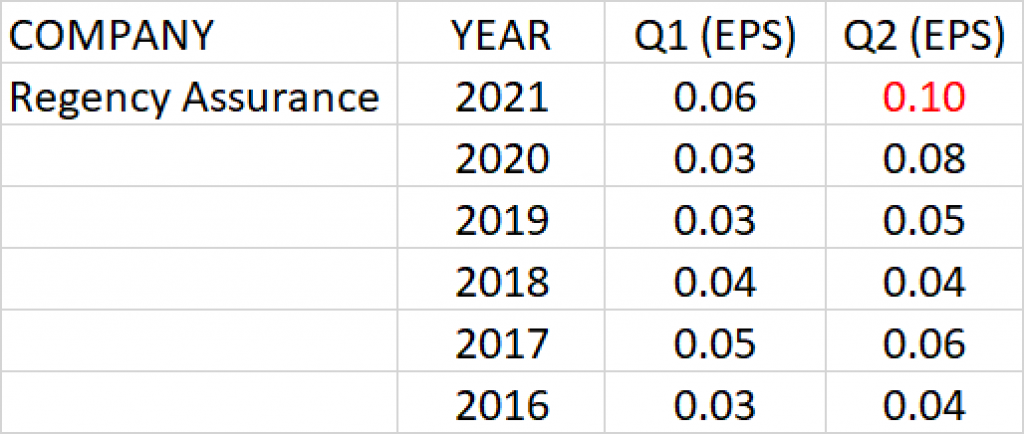

REGENCY ASSURANCE

Earnings history of Regency Assurance for Q1 and Q2 for the past 5 years has ranged between 8 kobo and less than 3 kobo.

Q2 earnings per share (EPS) of the underwriting firm over the last 5 years has a growth rate of 18.92%.

At the current share price of 45 kobo and Q2’20 earnings per share of 8 kobo, P.E ratio is calculated as 5.45x.

PEG ratio against the expected Q2 2021 earnings is 0.29.

Q2 2021 earnings per share of 10 kobo is projected for Regency Assurance.

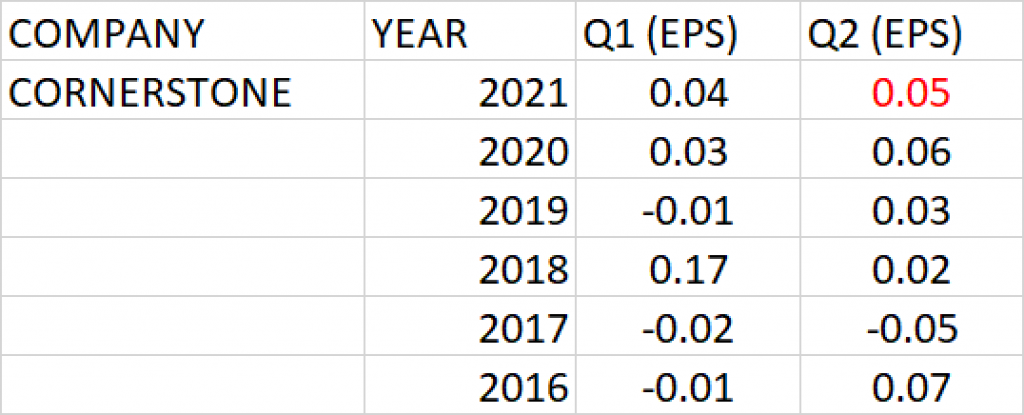

CORNERSTONE INSURANCE

Earnings history of Cornerstone Insurance for Q1 and Q2 for the past 5 years has ranged between 7 kobo and -5 kobo

Q2 earnings per share (EPS) of the underwriting firm over the last 5 years has a growth rate of -3.78%.

At the current share price of 55 kobo and Q2’20 earnings per share of 6 kobo, P.E ratio is calculated as 9.17x.

PEG ratio against the expected Q2 2021 earnings is -2.43.

Q2 2021 earnings per share of 5 kobo is projected for Cornerstone Insurance.

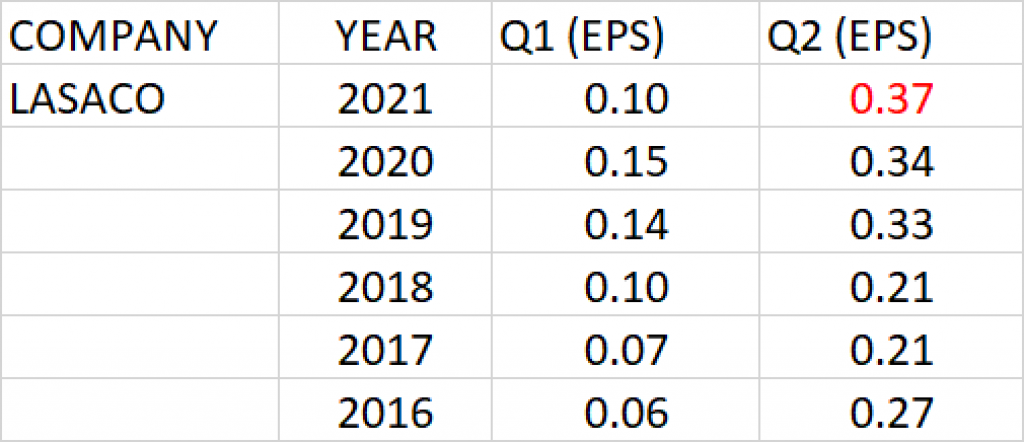

LASACO

Earnings history of LASACO Assurance Plc for Q1 and Q2 for the past 5 years show that the firm has been consistent in improving on its earnings per share year on year.

The underwriting firm maintained consistent growth within a financial year, Q1 to Q2. In other words, there was not a lower performance in a current quarter than the preceding quarter within a financial year.

Q2 earnings per share (EPS) of LASACO over the last 5 years has a growth rate of 5.93%.

At the current share price of N1.50 and Q2’20 earnings per share of 34 kobo, P.E ratio is estimated at 4.35x.

PEG ratio against the expected Q2 2021 earnings is 0.73; being less than 1 implies that LASACO at current price is undervalued.

Q2 Earnings per share of about 37 kobo is projected for LASACO Assurance Plc.

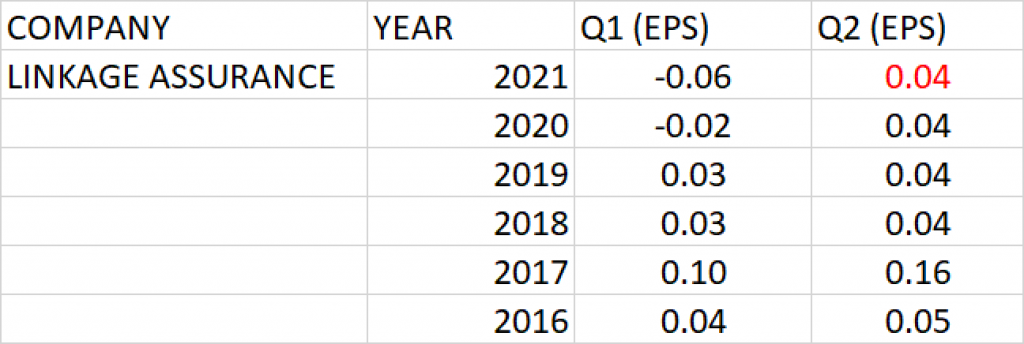

LINKAGE ASSURANCE

Earnings history of Linkage Assurance for Q1 and Q2 for the past 5 years has ranged between 5 kobo and -6 kobo

Q2 earnings per share (EPS) of the underwriting firm over the last 5 years has a growth rate of -5.43%.

At the current share price of 74 kobo and Q2’20 earnings per share of 4 kobo, P.E ratio is calculated as 18.82x.

PEG ratio against the expected Q2 2021 earnings is -3.47.

Q2 2021 earnings per share of 4 kobo is projected for Linkage Assurance.

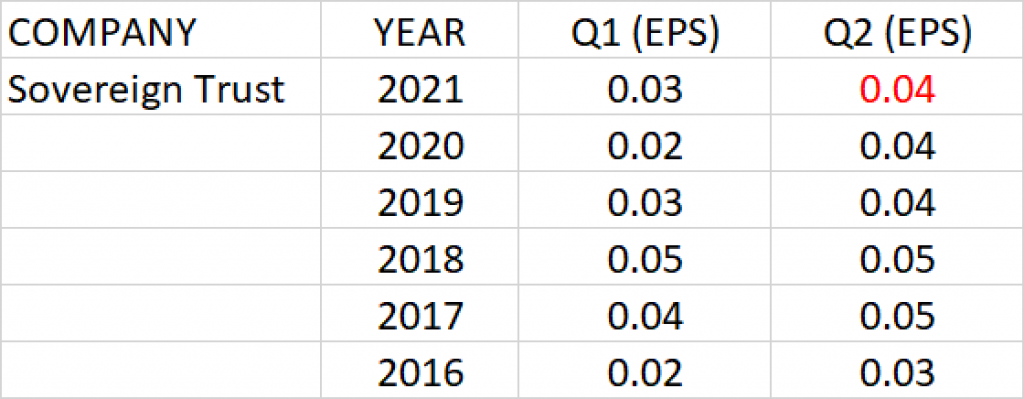

SOVEREIGN TRUST INSURANCE

Earnings history of Sovereign Trust Insurance for Q1 and Q2 for the past 5 years has ranged between 5 kobo and 2 kobo

Q2 earnings per share (EPS) of the underwriting firm over the last 5 years has a growth rate of 7.46%.

At the current share price of 30 kobo and Q2’20 earnings per share of 4 kobo, P.E ratio is calculated as 7.60x.

PEG ratio against the expected Q2 2021 earnings is 1.02.

Q2 2021 earnings per share of 4 kobo is projected for Sovereign Trust Insurance.

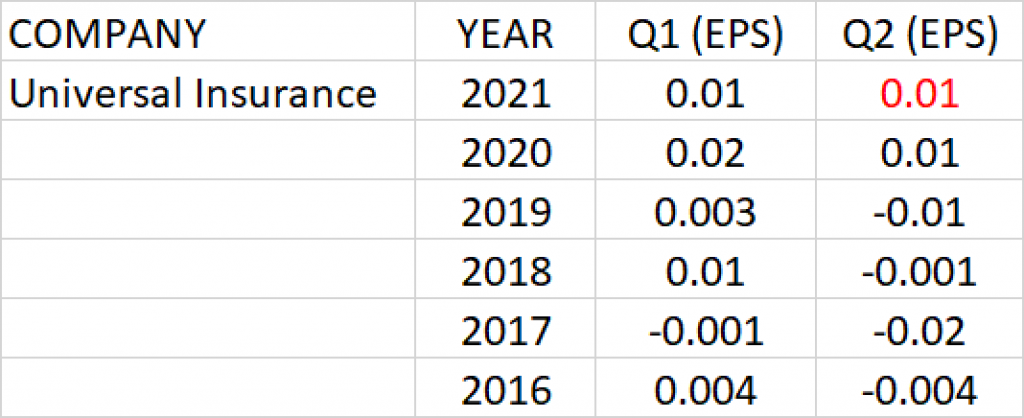

UNIVERSAL INSURANCE

Earnings history of Universal Insurance for Q1 and Q2 for the past 5 years has ranged between 2 kobo and -2 kobo

Q2 earnings per share (EPS) of the underwriting firm over the last 5 years has a growth rate of -25.74%.

At the current share price of 20 kobo and Q2’20 earnings per share of 1 kobo, P.E ratio is calculated as 15.33x.

PEG ratio against the expected Q2 2021 earnings is -0.60.

Q2 2021 earnings per share of 1 kobo is projected for Universal Insurance.

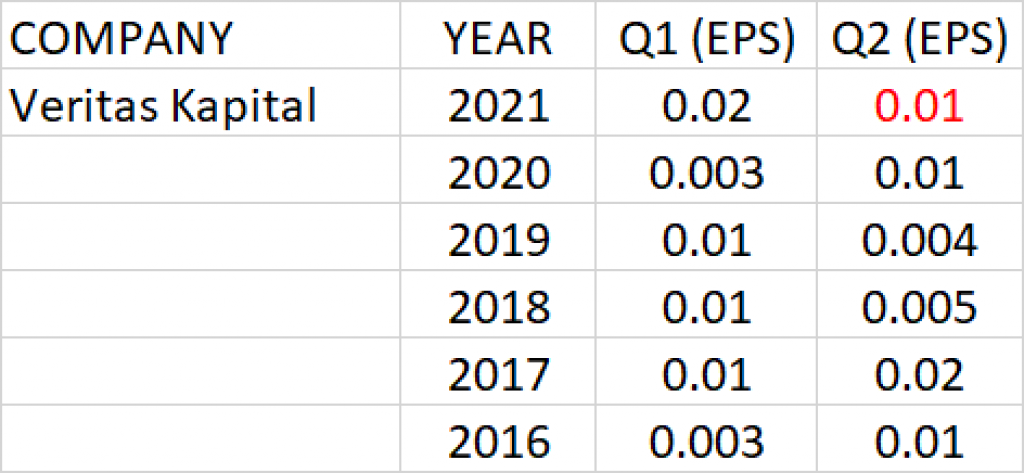

VERITAS KAPITAL INSURANCE

Earnings history of Veritas Kapital Insurance for Q1 and Q2 for the past 5 years has ranged between 2 kobo and less than 1 kobo.

Q2 earnings per share (EPS) of the underwriting firm over the last 5 years has a growth rate of -13.43%.

At the current share price of 25 kobo and Q2’20 earnings per share of 1 kobo, P.E ratio is calculated as 37.68x.

PEG ratio against the expected Q2 2021 earnings is -2.81.

Q2 2021 earnings per share of 1 kobo is projected for Veritas Kapital Insurance.

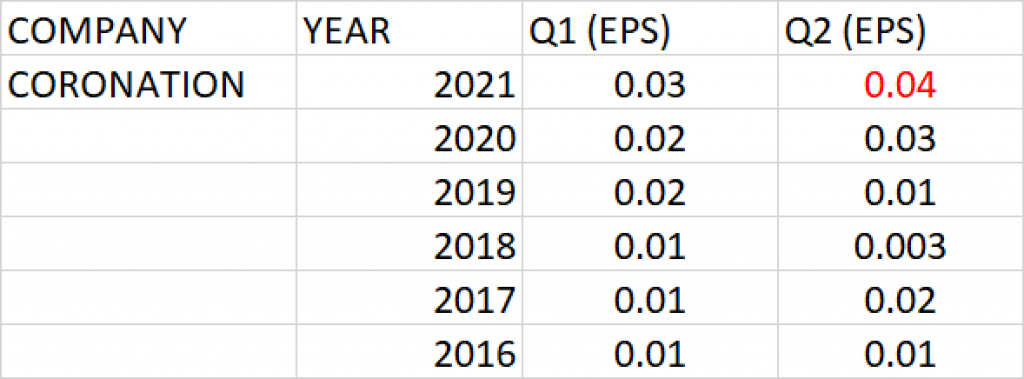

CORONATION INSURANCE

Earnings history of Coronation Insurance for Q1 and Q2 for the past 5 years has ranged between 3 kobo and less than 1 kobo.

Q2 earnings per share (EPS) of the underwriting firm over the last 5 years has a growth rate of 31.6%.

At the current share price of 59 kobo and Q2’20 earnings per share of 3 kobo, P.E ratio is calculated as 21.63x.

PEG ratio against the expected Q2 2021 earnings is 0.68.

Q2 2021 earnings per share of 4 kobo is projected for Coronation Insurance.

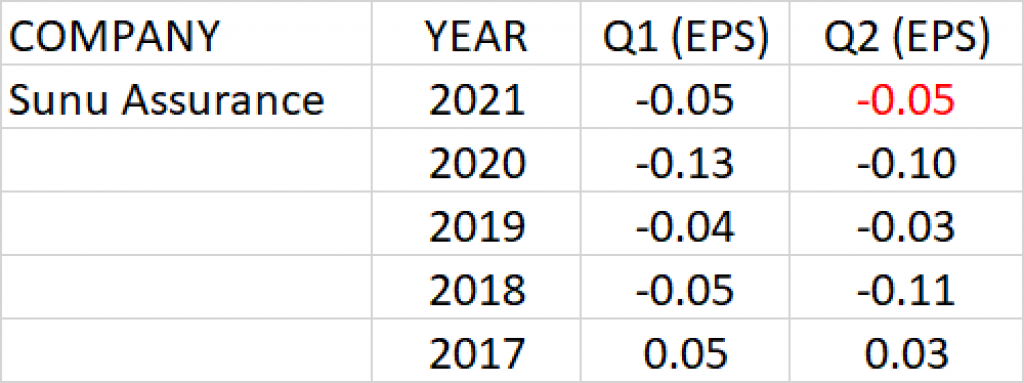

SUNU ASSURANCE

Earnings history of Sunu Assurance for Q1 and Q2 for the past 5 years has ranged between 3 kobo and -5 kobo.

Q2 earnings per share (EPS) of the underwriting firm over the last 5 years has a growth rate of -49.37%.

At the current share price of 47 kobo and Q2’20 earnings per share of -10 kobo, P.E ratio is calculated as -47x.

Q2 2021 earnings per share of -5 kobo is projected for Sunu Assurance.