The Second Quarter of the year in a matter of days will be over; and at that Q2 earnings of listed firms should start hitting the market from the second week of July.

In the past two editions, we did Q2 earnings forecast for the Banking sector and the Manufacturing sector. Our Q2 2022 earnings forecast for this edition is focused on the insurance sector, using Price/Earnings to Growth (PEG) ratio analysis.

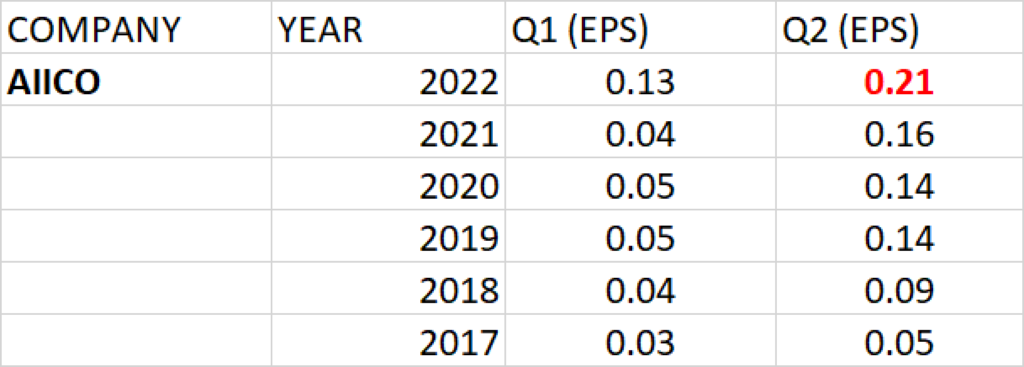

AIICO INSURANCE

Earnings history of the AIICO Insurance for Q2 in the past 5 years has ranged between 16 kobo and 5 kobo with earnings growth rate of 33.75%.

At the share price of 0.64 kobo and Q2 2021 earnings per share of 16 kobo, P.E ratio is calculated as 4x.

PEG ratio against the expected Q2 2022 earnings is 0.12; being less than 1 implies that AIICO Insurance at current price is underpriced.

Q2 2022 earnings per share of 21 kobo is projected for AIICO Insurance.

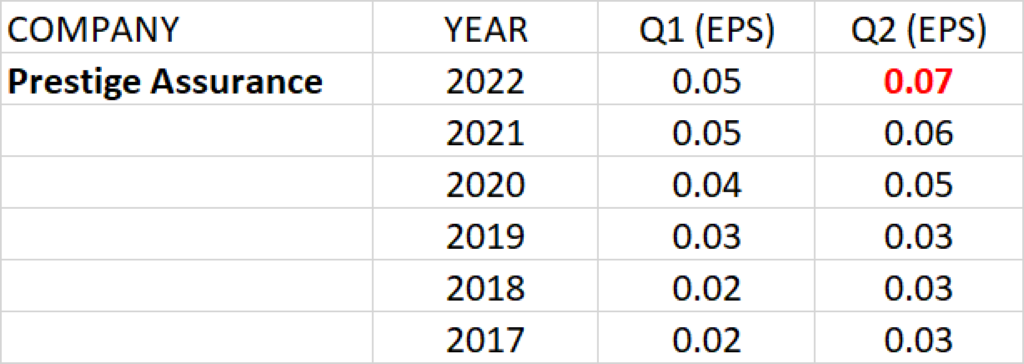

PRESTIGE ASSURANCE

Prestige Assurance over the last 5 years have reported Q2 earnings per share ranging between 6 kobo and 3 kobo with earnings growth rate of 18.92%

At the share price of 40 kobo and Q2 2021 earnings per share of 6 kobo, P.E ratio is calculated as 6.67x.

PEG ratio against the expected Q2 2022 earnings is 0.35.

Q2 2022 earnings per share of 7 kobo is projected for Prestige Assurance.

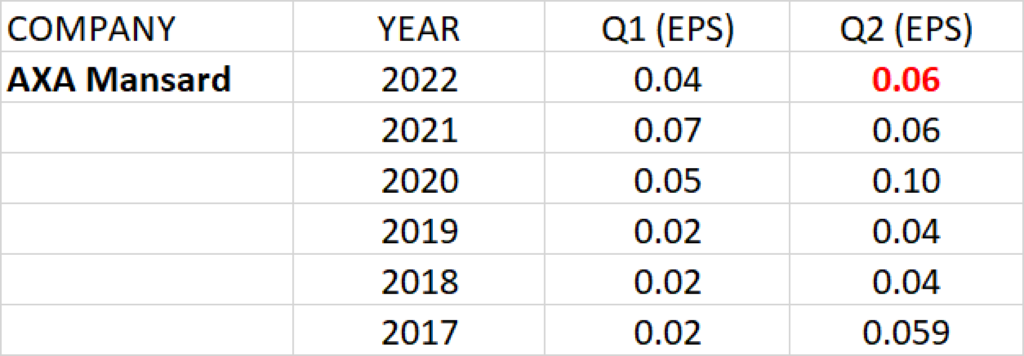

AXA MANSARD INSURANCE

Q2 earnings per share (EPS) of AXA Mansard over the last 5 years has ranged between 4 kobo and 10 kobo with earnings growth rate of 0.42%.

At the share price of N2.04 and Q2 2021 earnings per share of 6 kobo, P.E ratio is calculated as 34x.

Q2 2022 earnings per share of 6 kobo is projected for AXA Mansard.

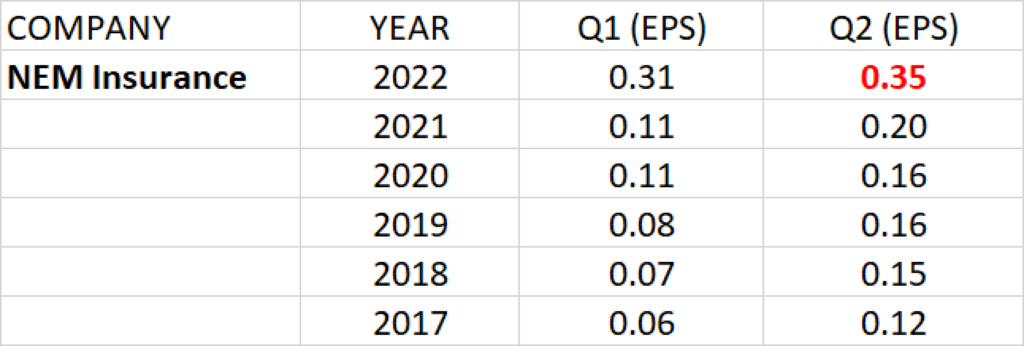

NEM INSURANCE

NEM Insurance over the last 5 years have reported EPS ranging between 12 kobo and 20 kobo for Q2 with earnings growth rate of 13.62%.

At the share price of N3.64 and Q2 2021 earnings per share of 20 kobo, P.E ratio is calculated as 18.20x.

PEG ratio against the expected Q2 2022 earnings is 1.34.

Q2 2022 earnings per share of 35 kobo is projected for NEM Insurance.

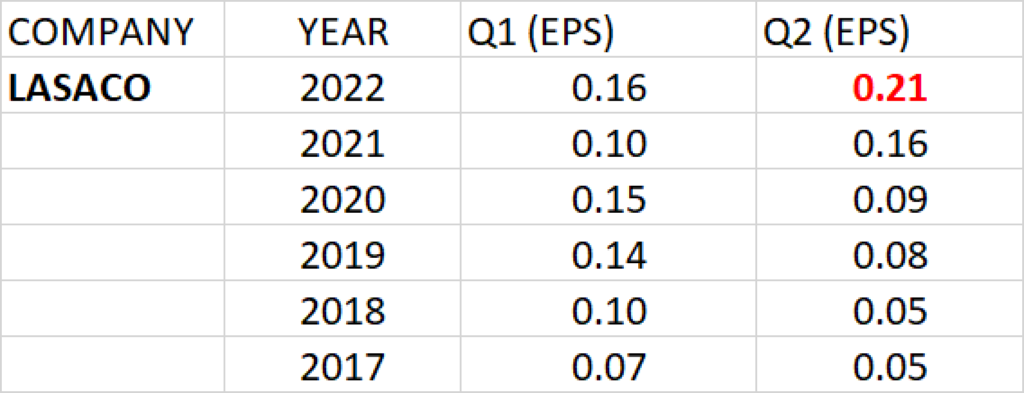

LASACO ASSURANCE

Earnings history of the LASACO Assurance for Q2 for the past 5 years has ranged between 5 kobo and 16 kobo with earnings growth rate of 33.75%.

At the share price of N1.03 and Q2 2021 earnings per share of 16 kobo, P.E ratio is calculated as 6.44x.

PEG ratio against the expected Q2 2022 earnings is 0.19; being less than 1 implies that LASACO Assurance at current price is underpriced.

Q2 2022 earnings per share of 21 kobo is projected for LASACO Assurance.

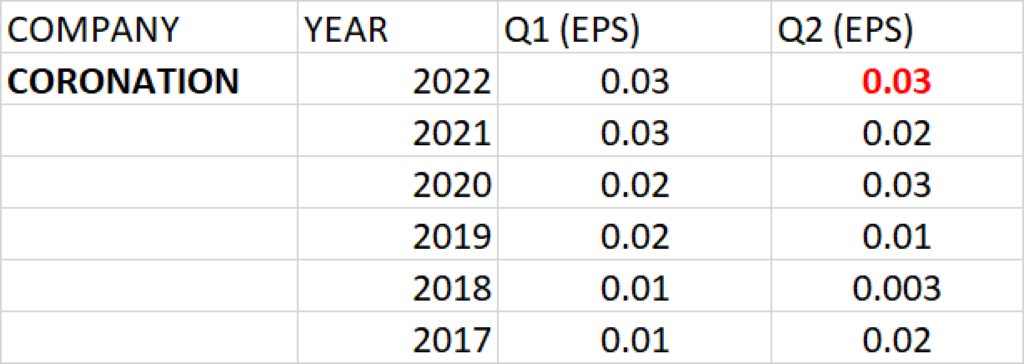

CORONATION INSURANCE

Coronation Insurance over the last 5 years have reported EPS ranging between 3 kobo and 1 kobo with earnings growth rate of 1.53%

At the share price of 40 kobo and Q2 2021 earnings per share of 2 kobo, P.E ratio is calculated as 20x.

PEG ratio against the expected Q2 2022 earnings is 13.07.

Q2 2022 earnings per share of 3 kobo is projected for Coronation Insurance.

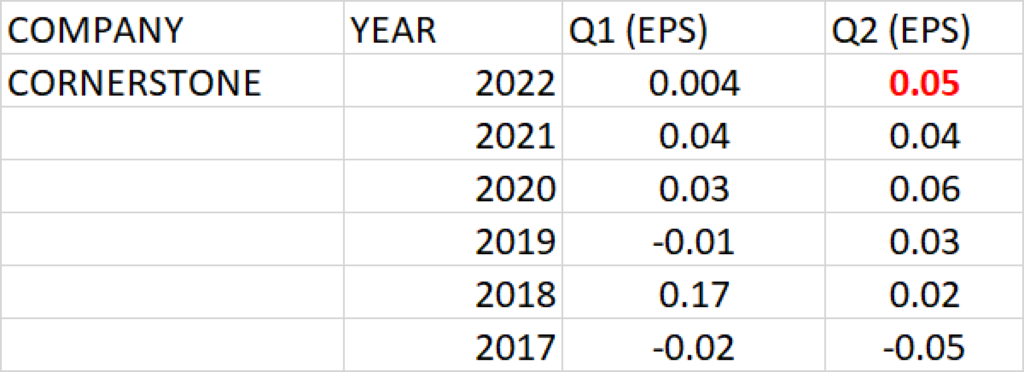

CORNERSTONE INSURANCE

Earnings history of the Cornerstone Insurance for Q2 for the past 5 years has ranged between 6 kobo and 2 kobo with growth rate of 25.70%.

At the share price of 62 kobo and Q2 2021 earnings per share of 4 kobo, P.E ratio is calculated as 15.5x.

PEG ratio against the expected Q2 2022 earnings is 0.60; being less than 1 implies that Cornerstone Insurance at current price is underpriced.

Q2 2022 earnings per share of 5 kobo is projected for Cornerstone Insurance.

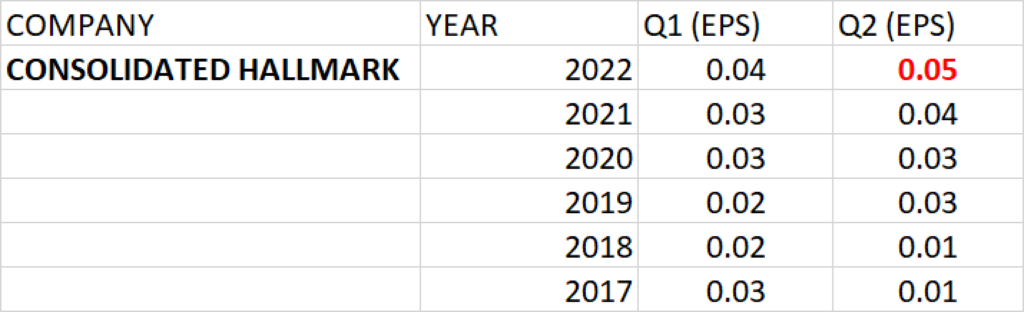

CONSOLIDATED HALLMARK INSURANCE

Consolidated Hallmark Insurance over the last 5 years have reported EPS ranging between 4 kobo and 1 kobo with earnings growth rate of 33.33%.

At the share price of 67 kobo and Q2 2021 earnings per share of 4 kobo, P.E ratio is calculated as 16.75x.

PEG ratio against the expected Q2 2022 earnings is 0.50.

Q2 2022 earnings per share of 5 kobo is projected for Consolidated Hallmark Insurance.

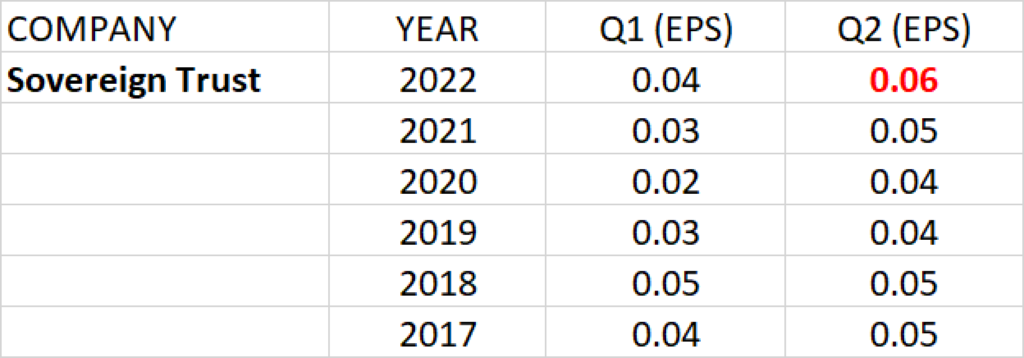

SOVEREIGN TRUST INSURANCE

Sovereign Trust Insurance over the last 5 years have reported Q2 EPS ranging between 5 kobo and 4 kobo with earnings growth rate of 11.80%

At the share price of 25 kobo and Q2 2022 earnings per share of 5 kobo, P.E ratio is calculated as 5.0x.

PEG ratio against the expected Q2 2022 earnings is 0.42.

Q2 2022 earnings per share of 6 kobo is projected for Sovereign Trust Insurance

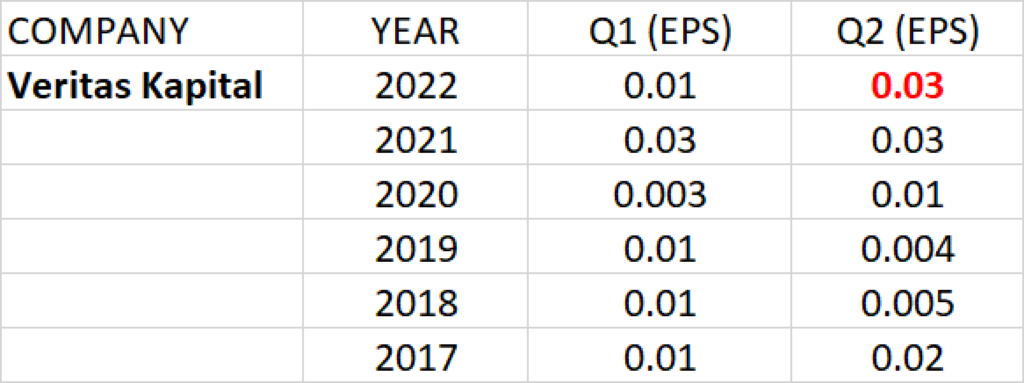

VERITAS KAPITAL ASSURANCE

Earnings history of the Veritas Kapital Assurance for Q2 for the past 5 years has ranged between 3 kobo and 1 kobo with earnings growth rate of 10.67%.

At the share price of 20 kobo and Q2 2021 earnings per share of 3 kobo, P.E ratio is calculated as 6.67x.

Q2 2022 earnings per share of 3 kobo is projected for Veritas Kapital Assurance.

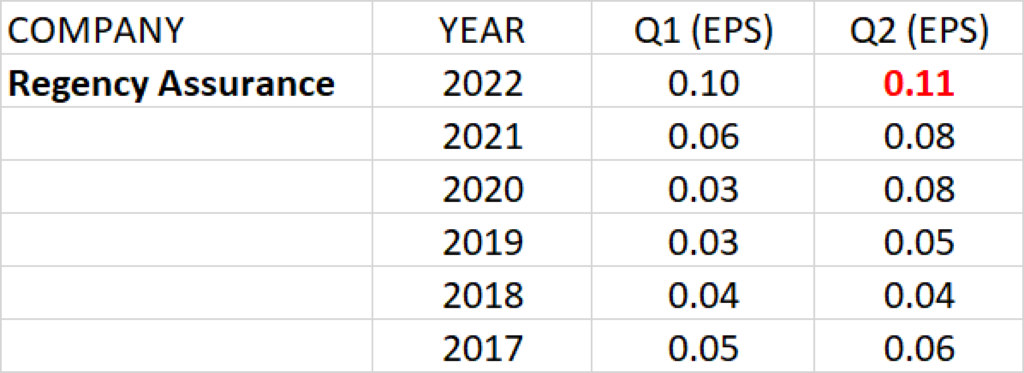

REGENCY ASSURANCE

Earnings history of the Regency Assurance for Q2 for the past 5 years has ranged between 8 kobo and 4 kobo with earnings growth rate of 7.46%.

At the share price of 26 kobo and Q2 2021 earnings per share of 8 kobo, P.E ratio is calculated as 3.25x.

PEG ratio against the expected Q2 2022 earnings is 0.44.

Q2 2022 earnings per share of 11 kobo is projected for Regency Assurance.