Understanding the basics of investment in the capital market is key and considered the first step to achieving investment goals. Moving away from the basics, Irrespective of ones level of experience and knowledge of the market, one cannot at any point trade successfully without any form of analysis. On the floor of the Nigerian Stocks Exchange, there are over 160 listed equities and the honest fact is that no investor, either institutional or retail investor could be said to have invested in all these equities. Investors all over the world only take their time to find out which of these equities is bound to yield good returns. This is where any form of Analysis comes to play. Technical Analysis is a good approach to find the entry and exit time for intraday trading or short term. You can make good profits using different technical indicators efficiently. However, if you want to find a multi-bagger stock to invest, which can give you good returns year after year, then the fundamental analysis is the actual tool that you have to utilize.

This is because to get multiple times returns (say 5x or 10x), you need to remain invested in a stock for the long term. While the technical indicators will show you exit signs in the short term whenever there’s a downtrend or small setbacks, however, you have to remain invested in that stock if the company is fundamentally strong. In such cases, you have to be confident that the stock will grow and give good returns in the future and avoid short-term under-performance. Short-term market fluctuations, unavoidable factors, or mishappenings won’t affect the fundamentals of the strong company in the long term.

We have often been advised to take position in fundamentally sound stocks but the big task I guess is how to identify these fundamentally sound stocks among numerous stocks listed on the floor of the Nigerian Stock Exchange, and that is why we deem it fit to delve into this subject.

Fundamental analysis is used to measure the intrinsic value of an equity by examining related economic and financial factors including the balance sheet, strategic initiatives, micro economic indicators, and consumer behavior associated with that firm.

Fundamental analysts study anything that can affect the stocks’ value, from macroeconomic factors such as the state of the economy and industry conditions to micro economic factors like the effectiveness of the company’s management.

So, how does one identify fundamentally sound stocks?

These are few things one must have in mind when you think of stock Fundamentals:

- Quality of the management

When evaluating an equity investment, understanding the quality and skill of a company’s management is key to estimating future success and profitability.

Technically speaking, the management of a publicly traded company is in charge of creating value for shareholders and it is normal for management to possess that supreme qualities to run the company in the interest of the owners. Of course, it is unrealistic to believe that management only thinks about the shareholders. Managers are human too and are like anybody else, looking for personal gain. Problems arise when the interests of the managers conflicts sharply from the interests of the shareholders.

Looking at the stock price alone, can give false signals. In fact, several great companies all over the world have soaring stock prices despite corrupt and inept management operating behind the scenes. There is no magic formula for evaluating management, but there are factors to which one should pay attention.

While it’s hard for retail investors to meet and truly evaluate managers, you can look at the corporate website and check the resumes of the top guys and the board members.

Insider buying and Stock Buybacks is also a good factor to consider. If insiders are buying shares in their own companies, it’s usually because they know something that normal investors do not. Insiders buying stock regularly show investors that managers are willing to put their money where their mouths are. The key here is to pay attention to how long the management holds shares. Flipping shares to make a quick buck is one thing; investing for the long term is another.

Checking the track record of the top management, especially the CEO is very vital too. There are business one should can enter into just knowing who is behind such business through his or her track records.

- Corporate Governance

Corporate governance describes the policies in place within an organization denoting the relationships and responsibilities between management, directors and stakeholders. For instance, the reason why Guaranty Trust Bank selling over Zenith Bank is corporate governance and the shareholding structure. Due to the ownership structure in Zenith Bank, investors do fear what will happen to Zenith Bank should anything happen to Jim Ovia. Corporate Governance is not as high in Zenith Bank compared to Guaranty Trust Bank because Jim Ovia’s vote will be a veto vote. So whatever he wants, if he raise up his hand, it is done. But in Guaranty Trust Bank, no person actually hold the veto vote, it will be a shared vote at the end of the day.

- Quality of earnings

Another thing to look at is the company’s earnings. Is the company’s earnings growing or stagnated over a long time and without anything. What is the quality of earnings they are bringing?

Current or recent earnings is the fixation of many investors. These are nothing more than snapshots of where a company is, or was, at a given point in time. To see where companies are likely headed, look for earnings momentum. That is the slowing or acceleration of earnings growth from one period to the next as demonstrated by patterns.

Look for these patterns by examining earnings reports over the previous eight quarters, and reading analysts’ projections for future earnings. If a company posted its best earnings of the last five years, two years ago, and has been lackluster since, it may be under increasing competitive pressure.

It is said that when a small boy fail an examination, he will come home and say he has lost is report card. But he if came first, before he gets home, he would have already announced that this is my report card. It also depends on hour early these companies release their result.

Just like Zenith and Guaranty among others that will release their result on time because they have something to showcase.

- Price movement

Also check the behaviour pattern of the prices of companies you intend to invest in. When the market is bad, all stocks will be affected, but the moment the market becomes good, some stocks are leaders that will herald the rally in the market. That is when you will see the MTN raising their head, you see the Dangote Cement raising their head, you will see Zenith, Guaranty, First Bank, UBA.

- Product

You need to pay attention to the products of the firm you intend to invest in. For instance in the cement industry, WAPCO has lost its market share to Dangote Cement substantially in the southwest.

Another example is the Oil Palm business. There is no substitute for palm oil; Okomu and Presco will continue to enjoy that. So if you need palm oil, you either buy from Okumu or Presco.

- Industry the firm belongs to

The industry a firm belongs is critical to its growth. For instance, the industry the oil companies belong is affecting them.

Oil companies at the moment are not fundamentally sound because their fundamental which is their product is being hampered by world’s crude price. They can’t grow the way they use to grow. Oil firm used to be determinant of the direction of the market, but since crude oil came down, they have lost it.

Transcorp is having its challenges because of the sector it belongs to.

If CBN throws any clog in the wheel of banks now, it can hamper every bank, then their fundamental becomes weak.

Below are few fundamentally sound stocks that have performed over time on the floor of the Nigerian Stock Exchange:

- ACCESS BANK

Over the past 26 years, Access Bank Plc. has evolved from an obscure Nigerian Bank into a world-class African financial institution. Today, the bank is one of the five largest banks in Nigeria in terms of assets, loans, deposits and branch network.

I have heard people umpteen times betting on the qualities of Access bank management even when it seems there was an undesirable news around the company. The believe has always being that with the calibre of people at the helm of affair, the bank would always overcome.

The bank from its humble beginning is now renowned to have swallowed giants and becoming one of the strongest financial institution in Africa. First, in 2005, Access Bank acquired Marina Bank and Capital Bank (formerly commercial bank Crédit Lyonnais Nigeria) by merger. Then came the acquisition of the great Intercontinental Bank. You can even see the synergy the acquisition of Diamond Bank has brought. If you compare their turnover when they were ordinary ACCESS and the turnover when they are now Diamond-Access, it has increased. Again you look at the growth in earnings over time. Though their dividend pay-out shrink. Dividend pay-out is a function of the management decision, not that it’s actually performance. May be because of the acquisition of Diamond Bank, they needed to withhold money for internal operation. So that’s why the drop in dividend, not that they did not make the money. There is difference between the ability to make the money and what you want to do with it. Access Bank have performed over time. If you rank them, Access belongs to tier 1 Bank. Herbert Wigwe’s name is a household name as far as banking is concerned. He is taught to be intelligent and he is a good manager. They leveraged on the outlets of diamond bank, so they can penetrate and deploy their product direct to the people. The price of the stock has also performed over time.

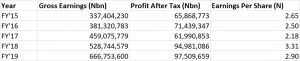

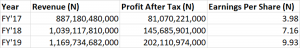

Below is its 5 years earnings history:

- NESTLE

For about six decades now, Nestle has being the choice companion for families within Nigeria and the diaspora. The company has positioned itself as one of the largest food and beverage companies on the continent. It produces an extensive range of products for the retail and wholesale sectors. Famous brands in the food category include Maggi, Golden Morn, Nan, Lactogen, Nutrend and Cerelac. Brands in the beverages segment include Milo, Chocomilo, Nescafe, Nestle Pure Life and Nido.

Considering the expansive growth of Nigeria’s population alone, which is projected to reach 300 million by the year 2030, as well as the growing middle class, the FMCG sector has a very positive outlook. Consequently, Nestle’s leadership in the industry and its huge market size expectedly gives it a huge advantage

The company’s strong fundamentals is predominantly govern by its position as a market leader, its years of experience, and its existence in the FMCG sector.

The company’s shareholding structure is another brilliant advantage as it has minor float size and most holding the stock rarely want to sell. This is responsible for how high the stock price soars on the trading floor.

In earnings, the company has consistently proven its rewarding capacity with a timely and periodic dividend payout.

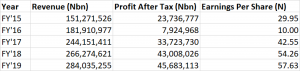

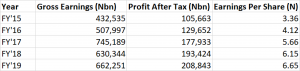

Below is its 5 years earnings history:

- DANGOTE CEMENT

Dangote himself has been a big icon in all the businesses that he belongs to. Whether we like it or not, Dangote Cement is number 1 cement as far as Nigeria is concerned. If we compare its turnover with other cement company, Dangote Cement has the biggest turnover.

If we consider the dividend, Dangote paid as high as N16. If we look at the price performances, Dangote Cement has performed in price over a long range of time.

Cement as far as development in the country is concerned will continue to sell. Dangote is very close to the power that be. If there is any construction project of any government, it must be Dangote Cement.

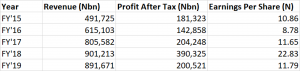

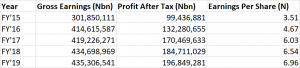

Below is its 5 years earnings history:

- FIRST BANK OF NIGERIA HOLDINGS (FBNH)

Forget about the fact the big elephant is suffering from non-performing loan. There used to be this adage that says, “If FBNH fails today, then go and check, the Central Bank failed yesterday”. Every government money is inside FBNH. Over time they have been able to penetrate all the nooks and crannies of the society. The effort they have put into cleaning their book of non-performing loan is very credible. If what happened to FBNH happens to 3 other banks, they will die. What FBNH has written off as non-performing loan is enough to start another five banks, and they are still standing; and they can still even pay dividend. There current management is up to the task. First Bank has good products. There is hardly no portfolio that you don’t find First Bank, no matter how small the unit is. The price has performed over the years and the stock is very resilient.

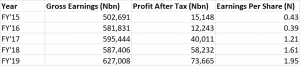

Below is its 5 years earnings history:

- MTN NIGERIA

They had to bring MTN’s par value to 20 kobo. On the floor of the Nigerian Stock Exchange, par value is 50 kobo. They brought MTN down to 20 kobo so that the pricing will be right. If MTN has been listed at 50 kobo, we won’t have been able to buy.

Whether we like it or not, MTN is the preferred network as far as communication network in Nigeria is concerned. MTN paid interim and final dividend even while they were Limited.

MTN always pioneer most of the revolution as far as mobile network is concerned.

They are currently partnering with Netflix. You can stream Netflix on MTN. It is indeed the biggest network as far as communication is concerned in Nigeria and they are consistent in dividend payment.

Below is its 3 years earnings history:

- ZENITH BANK

If you look at Zenith Bank’s dividend payment from 2015 to 2020. You will discover that in 2015, Zenith Bank paid the dividend of N1.77, the last dividend paid was N2.80. Their dividend yield is fantastic; it is always above 10%.They are always consistent with interim and final dividend payment.

Even if it stands around Jim Ovia, they have a good management and they also have good product. When this bank started, it was like an elite bank as the minimum balance in your account should be N50,000. Now that they want to reach everybody, you can even open the account with zero balance. They have performed over the years. There turnover, profit after tax and earnings per share have grown over there years.

Below is its 5 years earnings history:

- GUARANTY TRUST BANK

Guaranty Trust Bank have a very good Corporate Governance. There shareholding structure is working for them. They have grown over the years. The market is pricing Guaranty over Zenith Bank because the shareholding structure in Guaranty is not skewed to one person.

Business Continuity in Guaranty Trust Bank is higher because the shareholding structure is not listed to one man. Corporate Governance in Guaranty Trust Bank is very high as far as the market is concerned. The price of GT Bank has performed very well over time. The share price has gotten a high as N60 in 2018 and it is N25 now. There have been consistent growth in turnover, profit after tax and earnings per share of the bank.

Below is its 5 years earnings history:

- UBA

You have to tie UBA to Elumelu and the Heirs Holdigngs. The owners of Heirs Holdings has never failed in any of the business they handle: UBA, Africa Prudential, UCAP, Transcorp and the rest.

UBA has actually grown and they have been consistent in dividend payment. It has also performed as far as price is concerned. The management of UBA is tight as the management of of Tony Elumelu is tight; that means that the corporate Governance will be to the utmost.

Other fundamentally sound stocks include:

- OKOMU OIL PALM

- NIGERIAN BREWERIES

- BUA CEMENT

- FCMB

- FIDELITY BANK

Fundamentals changes. It doesn’t mean that when you are fundamentally strong today, you are going to be fundamentally strong forever. There is no bad stocks forever and there is no good stocks forever. If peradventure that the price of crude oil for any reason go back to $140, then the fundamentals of oil firms will change.

When we say fundamentally sound stocks, it does not mean that the one you are taking position in, you are expecting for it to be fundamentally sound forever. You keep reviewing fundamentals from period to period, say 3 months, 6 months, 9 months, 1 year and still know that they are fundamentally strong.