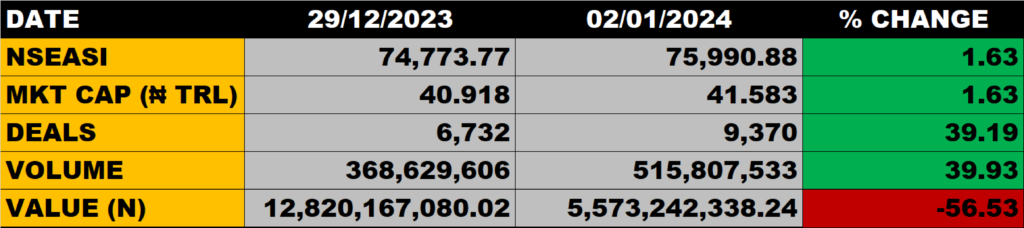

Trading of equities on the floor of the Nigerian Exchange on Tuesday 2nd January, 2024, closed on a positive note.

The All Share Index appreciated by 1.63% to settle at 75,990.88 points from the previous close of 74,773.77 points.

Investors gain N665 billion as Market Capitalisation grew by 1.63% to close at N41.583 trillion from N40.918 trillion.

An aggregate of 515,807,533 units of shares was traded in 9,370 deals valued at 5,573,242,338.24

Market Breadth

The market breadth closed positive as 49 equities gained while 18 equities declined in share prices.

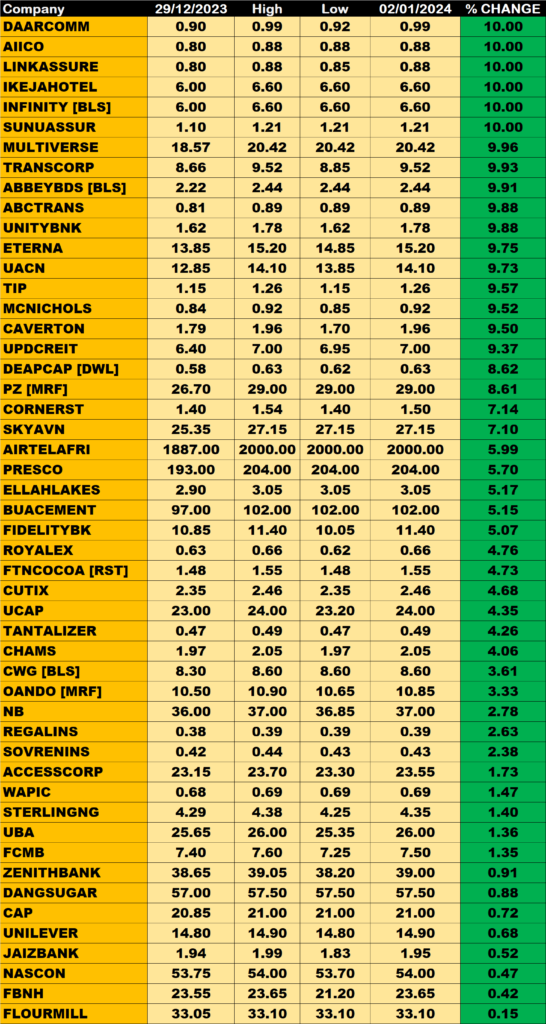

Percentage Gainers

AIICO Insurance, Daar Commuincations, Ikeja Hotel, Linkage Assurance and Sunu Assurances Nigeria Plc led other gainers with 10% growth each to close at N0.88, N0.99, N6.60, N0.88 and N1.21 from their previous price of N0.80, N0.90, N6.00, N0.80 and N1.10 respectively

Multiverse Mining and Exploration, Transcorp and Abbey Mortgage Bank Plc amongst other gainers also grew their share prices by 9.96%, 9.93 and 9.91% respectively.

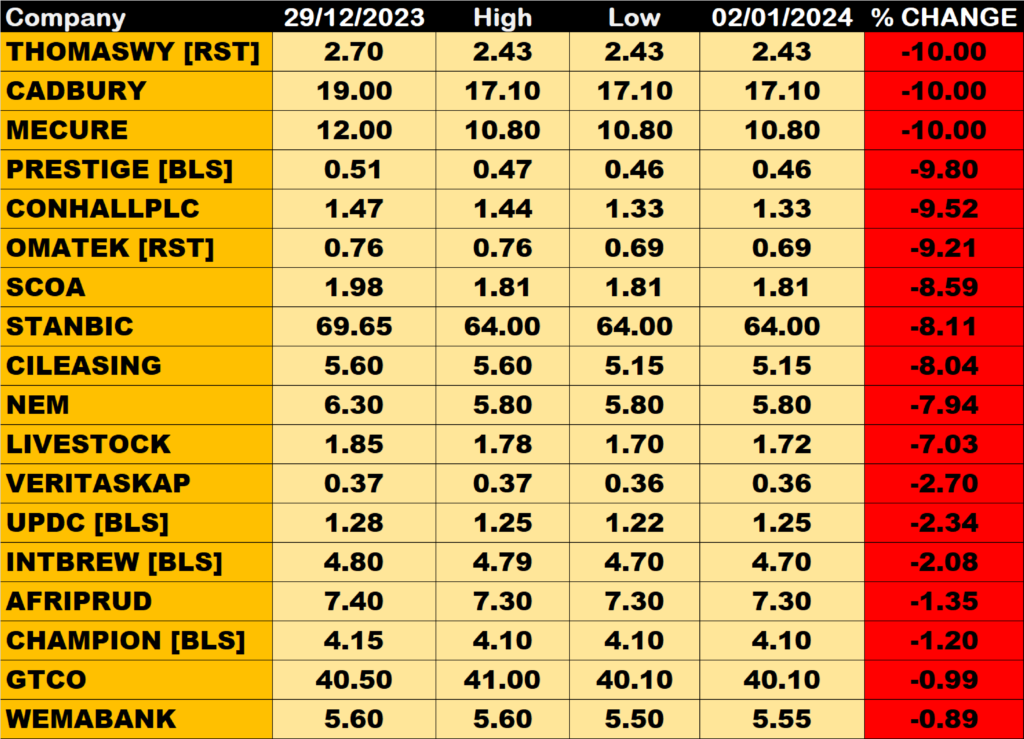

Percentage Losers

Cadbury Nigeria Mecure Industries and Thomas Wyatt Plc led other price decliners as they shed 10% each off their share price to close at N17.10, N10.80 and N2.43 from their previous close of N19.00, N12.00 and N2.70 respectively

Prestige Assurance, Scoa Nigeria, and Stanbic IBTC Holding Plc amongst other losers also shed their share prices by 9.80%, 8.59%, and 8.11% respectively.

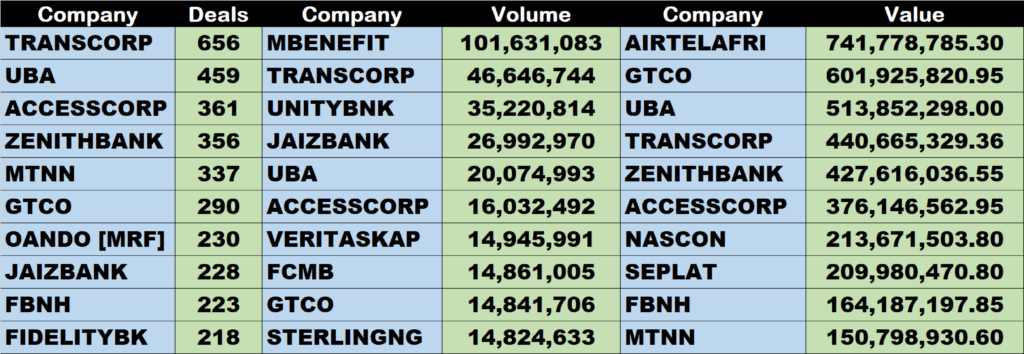

Volume Drivers

Mutual Benefit Assurance Plc traded about 101.363 million units of its shares in 161 deals, valued at N51.485 million

Transcorp Plc traded about 46.447 million units of its shares in 644 deals, valued at 438.761 million

Unity Bank Plc traded about 35.221 million units of its shares in 180 deals, valued at 61.671 million