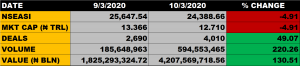

The Nigerian equities market on Tuesday closed on a negative note as the All Share Index declined further by 4.91% to settle at 24,388.66 points against the previous close of 25,647.54 points on Monday.

The Market Capitalisation sheds N656 billion to settle at N12.710 trillion against the previous close of N13.366 trillion.

Aggregate volume of traded stocks was 594.55 million units, up by 220.26% from the previous close of 185.65 million units.

The value of traded stocks grew by 130.51% close at N4.2 billion from the previous close of N1.83 billion.

Total number of deals was 4,010, up by 49.07% from the previous close of 2,690 deals.

Market Breadth

The market breadth closed negative as only 3 stocks gained while 33 stocks declined in their share prices.

Percentage Gainers

Neimeth, Honeywell Flourmills and NEM Insurance are the only equities that emerged as gainers out of 163 equities that traded on the floor of the Nigerian Stock Exchange.

- Neimeth grew its share price by 10% to close at N0.44 from the previous close of N0.40.

- Honeywell Flourmills grew its share price by 3.45% to close at N0.90 from the previous close of N0.87.

- NEM Insurance Plc grew its share price by 1.16% to close at N1.75 from the previous close of N1.73.

Percentage Losers

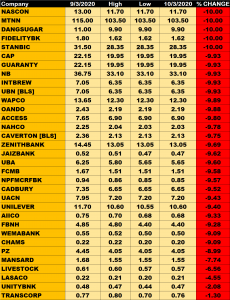

- NASCON Allied Industries, MTN Nigeria, Dangote Sugar, Fidelity Bank and Stanbic IBTC shed 10% of their share prices respectively.

- CAP Plc, Guaranty Trust Bank, Nigeria Breweries, International Breweries and Union Bank shed 9.93% of their share prices respectively.

- WAPCO, Oando, Access Bank, NAHCO, Caverton and Zenith Bank among other price decliners also shed their share prices by 9.89%, 9.88%, 9.80%, 9.78%, 9.75% and 9.69% respectively.

Volume Drivers

- UBA traded about 166.42 million units of its shares in 685 deals, valued at N942.73 million.

- FBNH traded about 163.96 million units of its shares in 488 deals, valued at N724.83 million.

- Guaranty Trust Bank traded about 54.52 million units of its shares in 366 deals, valued at N1.088 billion.