The Nigerian equities market began the year with a good performance as the All Share Index gained 7.46% in January, 7.94% in April and 9.76% in May. However the market recorded losses in February, March and June with a decline of 9.11%, 18.65% and 3.12% respectively.

Year to date the equities market has declined by 8.99% as the All Share Index closed at 24,427.73 points on Friday 24th, July 2020 as against the close of 26,842.07 points on the 31st December, 2019.

The Market Capitalisation likewise declined by 1.66% year to date as it closed at N12.743 trillion on Friday 24th, July 2020 as against the close of N12.958 trillion recorded on 31st December, 2019.

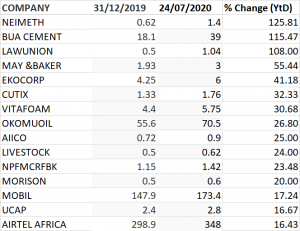

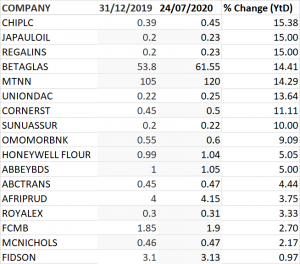

Year to date, 32 equities emerged as gainers, 81 equities declined in their share prices while 50 equities traded flat.

The year has been significantly different from other years as economic activities was practically shutdown due to the novel covid-19 pandemic. The lockdown happened in the second quarter of the year. We are now in the third quarter and a few Q2 results have been released to the market. The market is expectant to see the impact of the lockdown on Q2 results of quoted companies. Interestingly, results released so far most especially from Dangote Cement, United Capital, Africa Prudential and Lafarge were quite impressive. More results are expected to hit the market in the coming weeks and this will obviously determine the direction of the market.

NEIMETH PHARMACEUTICALS

Neimeth led all other stocks on the floor of the Nigerian Stock Exchange with 125.81% growth. The pharmaceutical firm grew its share price from N0.62 at the close of trading session in 2019 to N1.40 at the close of trade on July 24, 2020.

The stock has a 52 weeks high of N2.57 and 52 weeks low of N0.37. The firm’s share is trading at about 278.38% above it 52 weeks low and 45.52% away from its 52 weeks high price.

A position taken in the stock of Neimeth Pharmaceuticals has an upside potential of 45.52%.

BUA CEMENT

BUA Cement emerged second on the list of gainers with 115.47% growth. The share price of the firm grew from N18.1 at the close of trading session in 2019 to N39 at the close of trade on July 24, 2020.

The share price of firm has touched a 52 weeks high of N44 and 52 weeks low of N27.65. The firm’s share is trading at about 41% above it 52 weeks low and 11.36% away from its 52 weeks high price.

A position taken in the stock of BUA Cement has a downside risk of a probable 41% and an upside potential of 11.36%.

LAW UNION & ROCKS INSURANCE

Law Union & Rocks Insurance grew its share price by 108% from N0.50 to N1.04. The share price of the underwriting firm in the past 52 weeks has touched a high of N1.22 and a low of N0.33.

The firm’s share is trading at about 215 % above it 52 weeks low and 14.75% away from its 52 weeks high price. A position taken in the stock of Law Union & Rocks Insurance has an upside potential of 14.75%.

MAY & BAKER

May & Baker is in the same pharmaceutical league as Neimeth. It price moved from N1.93 it traded last on 31st December 2019 to N3, translating to a 55.44% growth.

The share price of May & Baker has a 52 weeks high of N3.39 and 52 weeks low of N1.79. The firm’s share is trading at about 67.6% above it 52 weeks low and 11.50% away from its 52 weeks high price. A position taken in the stock of May & Baker has an upside potential of 11.50%.

EKOCORPS PLC

The share price of the Ekocorps Plc appreciated by 41.18% from N4.25 at the close of trade in December 2019 to N6 as at Friday, 24th of July, 2020. In the last 52 weeks, share price of Ekocorps has a 52 weeks low of N3.40 and 52 weeks high of N6.00 which it is currently trading. The firm’s share is trading at about 76.47% above its 52 weeks low, hence has a down side risk of 76%.

CUTIX

Cutix Plc grew its share price by 32.33% from N1.33 at the close of trade in December 2019 to N1.76 as at Friday, 24th of July, 2020. The share price of the stock has touched 52 weeks high of N1.88 and 52 weeks low of N1.16.

The firm’s share is trading at about 51.72% above it 52 weeks low and 6.38% away from its 52 weeks high price. A position taken in the stock of Cutix Plc has an upside potential of 6.38% and a downside risk of 51.72%.

VITAFOAM

Vitafoam’s year end is June. What they paid last year is considered by the market as good dividend. So investors are positioning ahead of the release of their 4th quarter result.

Vitafoam began the year with a share price of N4.40 and it grew by 30.68% to N5.75 as at July 24, 2020.

The firm’s share is trading at about 64.3% above its 52 weeks low of 3.50 and 5.74% away from its 52 weeks high of N6.10. A position taken in the stock of Vitafoam has an upside potential of 5.74% and a downside risk of 64.3%.

OKOMU OIL PALM

Okomu Oil is in the Agricultural sector and it has being doing well. Okomu in their life time has paid N7 dividend in this market before and one for one bonus. This present government favours agriculture. The market believes that favourable agriculture policy would have impacted on the Oil palm company.

Its stock price grew 26.80% from N55.6 it closed last year to N70.6 it closed on July 24, 2020.

The share price of Okomu Oil has touched a 52 weeks low of 40.15 and 52 weeks high of N77.40.

It stock is currently trading high and may not be suitable for immediate entry but a slight pullback should afford a decent entry.

AIICO INSURANCE

AIICO began the year with a share price of N0.72 and grew by 25% to close at N0.90 as at July 24, 2020.

There is this recent news that a bank wants to buy over AIICO pension. Whenever there is acquisition like that, the market always believe that the acquirer after due diligence has seen value in that business. So the market will position itself before the consummation of the acquisition so that they will benefit.

The share price of AIICO Insurance has a 52 weeks high of N1.22 and 52 weeks low of N0.6. The firm’s share is trading at about 50% above its 52 weeks low of N0.6 and 26.23% away from its 52 weeks high of N1.22.

A position taken in the stock of AIICO Insurance has a downside risk of 50% and an upside potential of 26.23%

LIVESTOCK FEEDS

Livestock Feeds emerged 10th in the ranking of gainers with 24% growth. The share price of the price of the stock grew from N0.5 to N0.62.

With 52 weeks high of N0.75 and 52 weeks low of N0.36, the share price of Livestock Feeds has a downside risk of 72.2% and a growth potential of 17.3%.

GAINERS