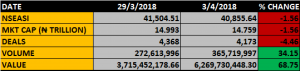

Trading activities on the floor of the Nigeria Stock Exchange opened the week on Tuesday with a decline of 1.56%. The reason cannot be far fetched as lots of results were released on the last trading day of March. As expected, the market would obviously react to these results in the first week of April.

The All Share Index closed at 40,855.64 points as against the previous close of 41,504.51 points implying a decline of 1.56%.

Market capitalization also declined by 1.56% closing at 14.759 trillion as against 14.993 trillion of the last trading session shedding about N234 billion.

Volume and value of traded stocks grew by 34.15% and 68.75% settling at

365.7 million units and N6.3 billion respectively.

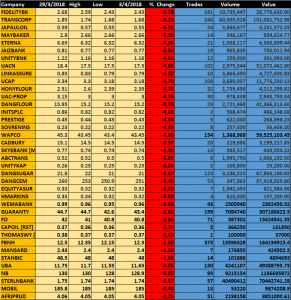

Market Breadth

The market breadth closed week as only 11 stocks closed positive against 38 that lost.

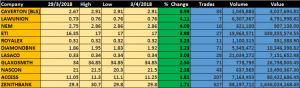

Percentage Gainers

Caverton led the other percentage gainers as it rose 8.99% above the previous close of N2.67 to settle at N2.91

Law Union grew 4.11% and NEM grew 4% ahead other stocks like ETI, Royal Exchange Assurance and Diamond Bank.

Percentage Losers

Fidelity Bank tops the losers’ chart losing 9.33% of its share price, while Transcorp and Japaul oil both shed 9.19% and 6.78% respectively.

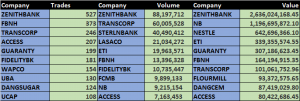

Zenith is the most actively traded stocks of the day trading about 88.2 million units of its shares in 527 deals, worth about N2.6 billion.