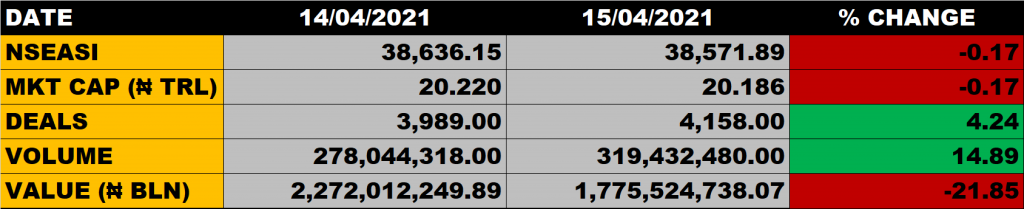

Transactions on the floor of the Nigerian Stock Exchange on Thursday closed on a bearish note as the All Share Index depreciated by 0.17% to settle at 38,571.89 points from the previous close of 38,636.15 points.

The Market Capitalisation declined by 0.17% to close at N20.186 trillion from the previous close N20.220 trillion, thereby shedding N34 billion.

An aggregate of 319.43 million units of shares were traded in 4,158 deals valued at N1.776 billion.

The market breadth closed negative as 16 equities emerged on the gainers list while 27 equities declined in their share prices.

Percentage Gainers

Guinness again led other gainers with 10% growth to close at N29.15 from the previous close of N26.5.

This is followed by FTN Cocoa and Morrison Industries as they both gained 9.30% to close at N0.47 and N0.94 respectively.

Honeywell Flour and Livestock Feeds among other gainers also grew their share prices by 9.17% and 6.74% respectively.

Percentage Losers

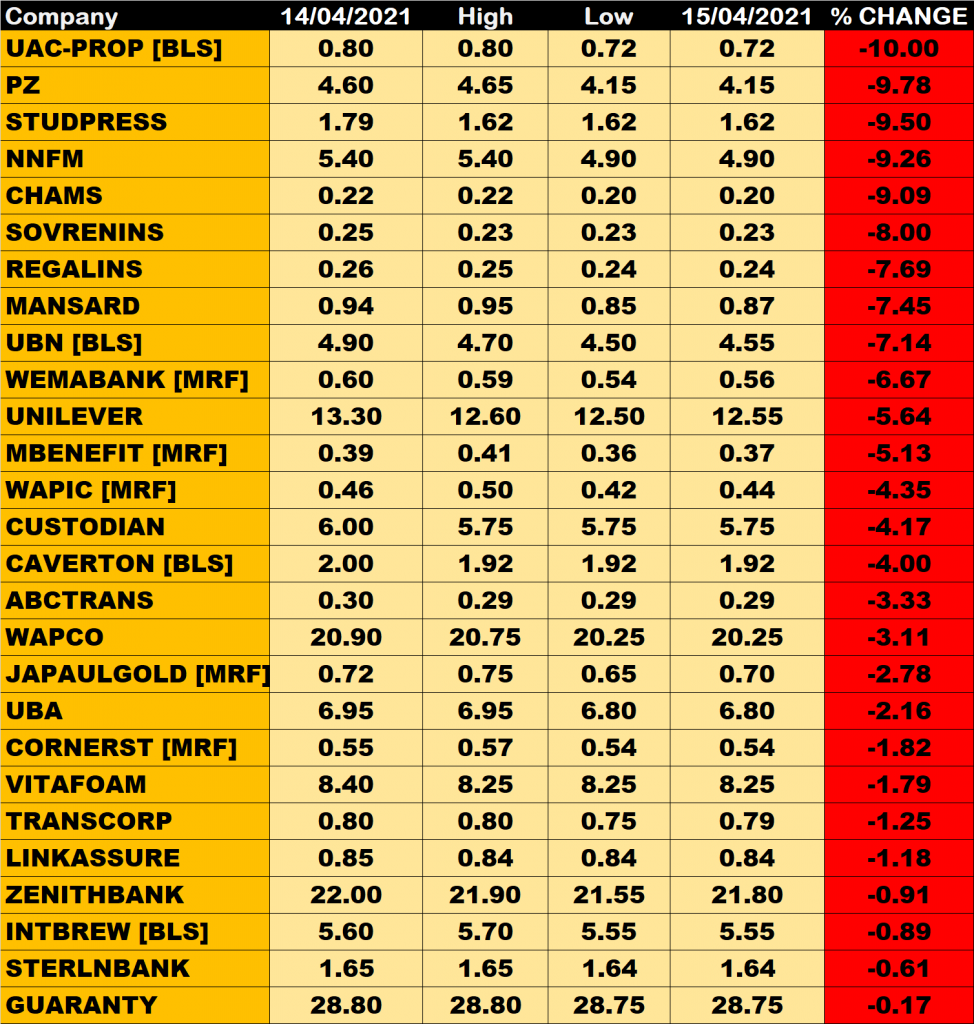

UAC Property led other price decliners as it sheds 10% of its share price to close at N0.72 from the previous close of N0.80.

PZ, Studio Press and Northern Nigerian Flour Mills (NNFM) among other price decliners also shed their share prices by 9.78%, 9.50% and 9.26% respectively.

Volume Drivers

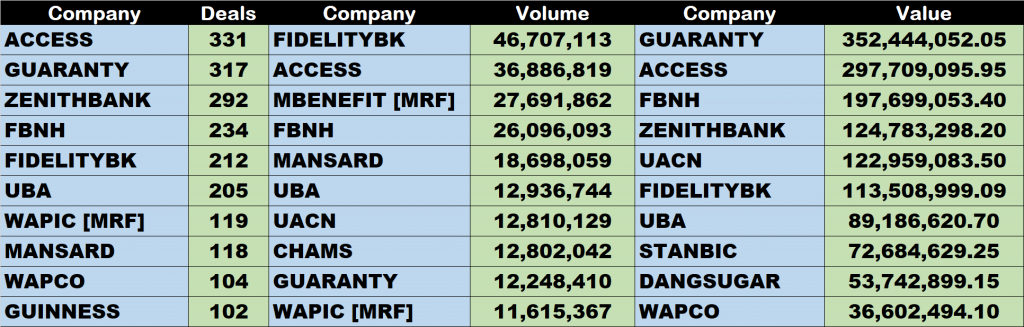

- Fidelity Bank traded about 46.71 million units of its shares in 212 deals, valued at N113.51 million.

- Access Bank traded about 36.89 million units of its shares in 331 deals, valued at N297.71 million.

- Mutual Benefit Assurance traded about 27.69 million units of its shares in 55 deals, valued at N10.168 million.

Stocks to Watch

- Access Bank traded flat at N8.1. It is trading 22.86% away from its 52 weeks high of N10.5, hence there is uptrend potential in Access Bank. With the book value of N21.13, Access Bank is considered cheap at the current share price.

- FBN Holdings grew to N7.6 from N7.55. It is trading 15.56% away from its 52 weeks high of N9 which implies an uptrend potential for the share price of the big elephant. Considering its book value of N21.32, relative to the current share price, shows that FBNH is cheap at the current price and has a lot of growth potential embedded in it.

- Zenith Bank dropped to N21.80 from N22. It is trading 23.51% away from its 52 weeks high of N28.5. There is uptrend potential in the share price of Zenith Bank. With the book value of N35.59 relative to the current share price, Zenith Bank is considered cheap.

- UBA dropped to N6.8 from N6.95. It is trading 30.61% away from its 52 weeks high of N9.8. With the book value of N21.17 as against its current share price, UBA is considered cheap and has uptrend potential.

- Guaranty Trust Bank dropped to N28.75 from N28.80. It is trading 25.23% away from its 52 weeks high of N38.45 and this implies an uptrend potential for the bank.

- Lafarge Africa (WAPCO) dropped to N20.25 from N20.90. It is trading 35.71% away from its 52 weeks high of N31.5. At that, there is uptrend potential in the share price of Wapco.