The Nigerian stock market last week closed on a positive note as smart investors continue to take position ahead of corporate disclosure in dividend paying stocks.

In a matter of days, audited reports of quoted firms will start rolling into the market with dividend declarations. This without a doubt will bring positive vibration to the market and prices of stocks will go up.

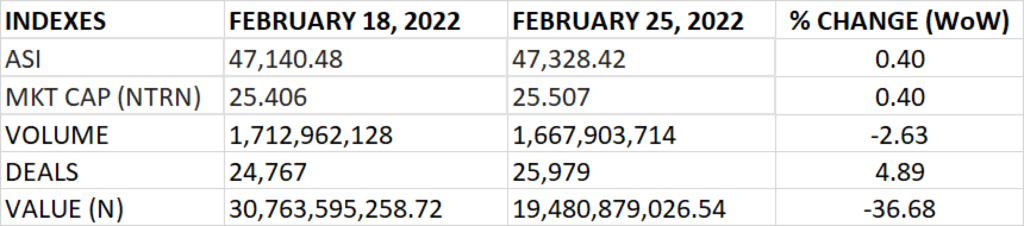

The All Share Index and the Market Capitalisation grew by 0.40% week on week to settle at 47,328.42 points and N25.507 trillion respectively.

In the course of last week, an aggregate of 1.67 billion units of shares were traded in were traded in 25,979 deals, valued at N19.48 billion.

The Market Breadth closed positive as 44 equities emerged as gainers against 22 equites that declined in their share prices.

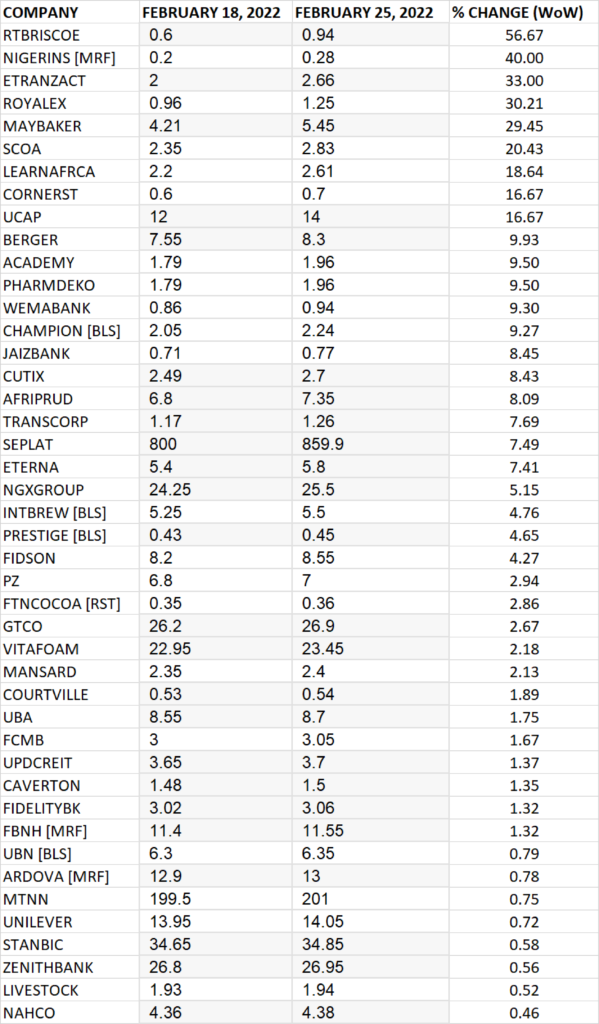

TOP 10 GAINERS

RT Briscoe led other gainers in the course of last week as it grew by 56.67%, closing at N0.94 from the previous close of N0.60.

Niger Insurance, Etranzact, Royal Exchange and May & Baker grew their share prices by 40%, 33%, 30.21% and 29.45% respectively.

Others among top 10 gainers include: SCOA (20.43%), Learn Africa (18.64%), Cornerstone Insurance (16.67%), United Capital (16.67%) and Berger Paint (9.93%) respectively.

TOP 10 LOSERS

Ellah Lakes Plc led other price decliners in the course of last week, shedding 9.88% of its share price to close at N3.83 from the previous close of N4.25.

Juli Plc, Flour Mills of Nigeria, Veritas Kapital Assurance and Multiverse shed their share prices by 9.76%, 8.83%, 8.33% and 8%.

Others among top 10 price decliners include: Honeywell Flour (-7.21%), Dangote Sugar (-7.10%), Ecobank (-5.42%), NEM Insurance (-5.24%) and Japaul Gold (-5.13%) respectively.

GAINERS

LOSERS