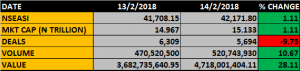

The Nigerian Stocks market rebounded 1.11 percent on Wednesday after seven straight sessions of losses, buoyed by gains in Banking Sector, with the NSEBanking Index clearly outperformed the lead market Indicator. The Financial Service subsector witnessed sharp price rallies across different counters as a renewed bullish sentiment was felt in the market with more patronage in the banking sector.

The All-Share Index closed at 42,171.80, up 463.65 points, or 1.11 percent away from the previous 41,708.15 points, while the market capitalization closed at N15.133trillion, adding N166billion which is also 1.11% above the N14.967trillion it closed on Tuesday.

Volume of shares traded was up 10.67% to 520.743units when compared to the 470.570units traded the previous session. Consequently, N4.718 billion worth of transaction was recorded against the previous N3.682billion, which represents 28.11% improvement. The numbers of deals however decline 9.75% from 6,308 to5, 694 in the corresponding sessions.

Sectors Performance

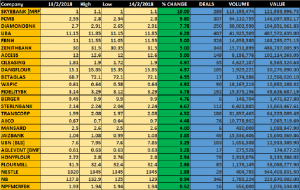

All sector indices but for The NSE Oil and Gas index closed positive.

The NSE Banking Sector index rallied 2.74% as investors were bullish on bellwether stocks like ZENITHBANK and FBNH. Furthermore, investors bought the dips on a number of tier two counters like FCMB, FIDELITYBK and SKYEBANK.

The bulls also overrides the bears in the NSE Insurance, resulting in a 1.27% advancement at the close of trades. However, AIICO (+4.48%) and MANSARD (+4.00%) were the only tickers to record gains in the session.

The NSE Oil and Gas index closed as the lone loser after declining 0.29%.

Other sectors closed in the positive territory. The 0.12% dip in the price of the bourse’s bellwether- DANGCEM to NGN258.40 (vs. NGN258.70 recorded yesterday), was insufficient to make the bears rule in the session.

MARKET BREADTH

With 25 of its components ending in green against 19 which ended otherwise, the market traded positive through the day, as calm returned after 7 volatile downbeat sessions.

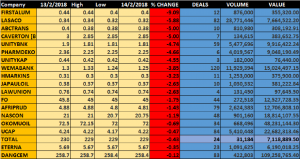

PERCENTAGE GAINERS

Banks’ stocks occupy the first seven space on the percentage gainers list with Skye leading with 10% to close at N1.1, FCMB followed by 9.8% to close at N2.80, followed by Diamond which gained 7.78% to close at N2.91. UBA, FBNH, ZENITH and access also made the list.

PERCENTAGE LOSERS

On the other side, First Aluminum, Lasaco and ABC Transport, all affected by the new pricing rule fell further below the former pricing value by 9.09%, 5.88% and 5% respectively. Others on the list are, Caverton, Unity Bank, pharmdeko, unitykap and Wema Bank among others.

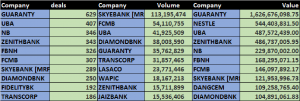

Banks stocks hold the ace as all tiers of financial services sector are well represented on the performance metric measured by deals, volume and value.

GTB records the highest deals and value of 629 and N1.626billion, while SKYE Bank traded the highest volume of shares at 113.195million unit.