The equity market on Friday closed in red as the major players that determines the direction of the market which include Dangote Cement, MTN and BUA Cement shed their weights to profit taking.

The much anticipated Q3 results of the tier one banks also hit the market today and we could say the performance is mixed as FBNH grew its bottom line by 31.71%, Access Bank grew its bottom line by 15.68% and Zenith grew its bottom line by 5.70%. Guaranty Trust Bank and UBA declined their bottom line figures by 3.20% and 5.51% respectively. The performance is fair based on the current economic reality caused by corona virus pandemic. Share prices of banking stocks might come down initially based on market sentiment, but by the time the market begin to look at the figures very well, comparing them with the realities on ground, then share prices of banking stocks are bound to move up again.

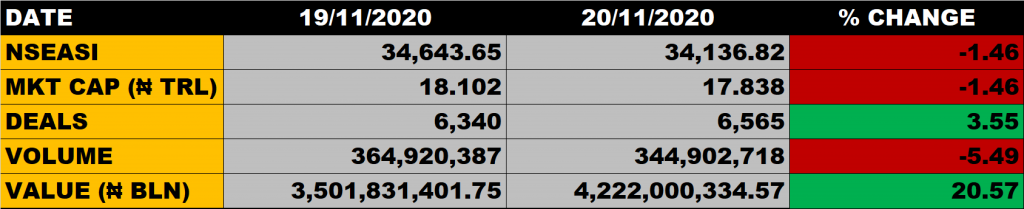

At the close of trade on Friday, the All Share Index declined by 1.46% to settle at 34,136.82 points from the previous close of 34,643.65 points. Market capitalization declined by 1.46% to N17.838 trillion from the previous close of N18.102 trillion.

An aggregate of 344.9 million units of shares were traded in 6,565 deals, valued at N4.2 billion.

Market Breadth

The market breadth closed negative as 14 equities gained while 34 equities declined in their share prices.

Percentage Gainers

Ikeja Hotel, Linkage Assurance and Tripple G led other gainers with 10% growth respectively.

NEM Insurance, AIICO Insurance and UPDC Real Estate Investment Trust among other gainers also grew 9.79%, 9.78% and 9.21% respectively.

Percentage Losers

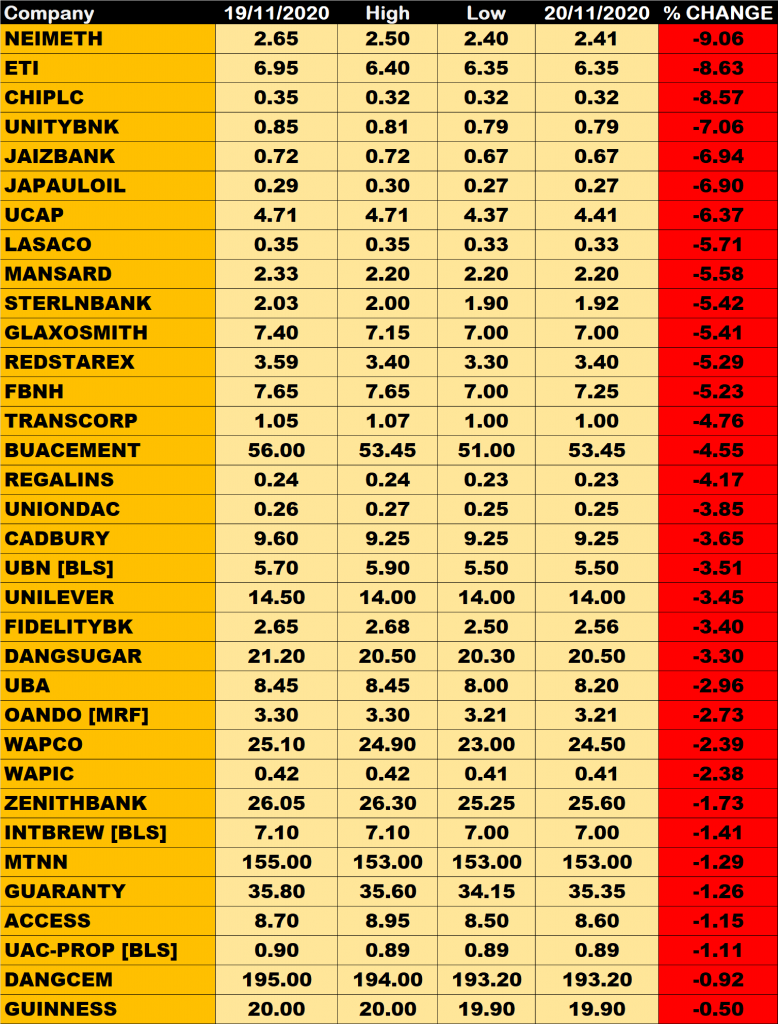

Neimeth led other price decliners as it shed 9.06% of its share price to close at N2.41 from the previous close of N2.65.

Ecobank, Consolidated Hallmark Insurance and Unity Bank among other gainers also shed their share prices by 8.63%, 8.57% and 7.06% respectively.

Volume Drivers

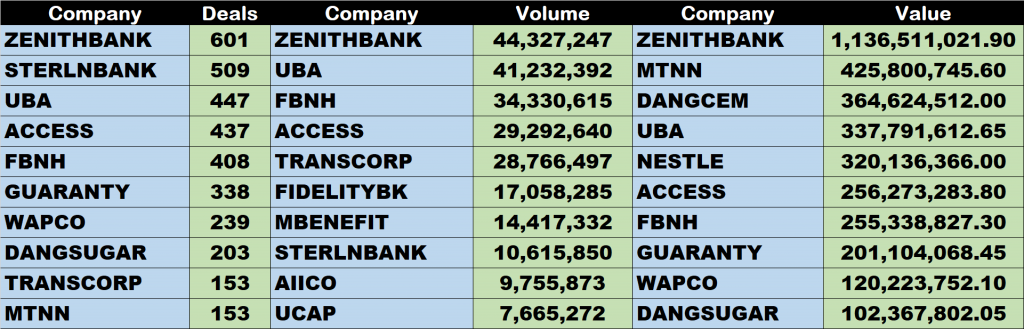

- Zenith Bank traded about 44.33 million units of its shares in 601 deals, valued at N1.137 billion.

- UBA traded about 41.23 million units of its shares in 447 deals, valued at N337.79 million.

- FBN Holdings traded about 34.33 million units of its shares in 408 deals, valued at N255.34 million.