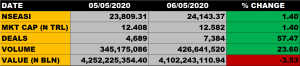

The Nigerian equities market on Wednesday closed on a positive note as the All Share Index grew further by 1.40% to settle at 24,143.37 points from the previous close of 23,809.31 points on Tuesday.

Investors gain N174 billion as market capitalisation rose further by 1.40% to close at N12.582 trillion from the previous close of N12.408.

Aggregate volume of about 426.6 million units of stocks were traded in 7,384 deals, valued at N4.1 billion.

Market Breadth

The market breadth closed positive as 35 equities appreciated in their share prices while only 4 equities declined in their share prices.

Percentage Gainers

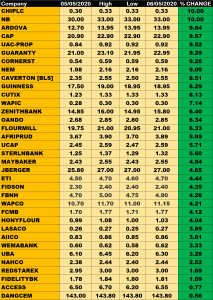

Consolidated Hallmark Insurance and Nigerian Breweries both led other percentage gainers with 10% growth to close at N0.33 and N33 respectively.

Ardova Plc (formerly Forte Oil), CAP Plc, UAC Properties, Guaranty Trust Bank, Cornerstone Insurance and NEM Insurance among other gainers also grew their share prices by 9.84%, 9.57%, 9.52%, 9.29%, 9.26% and 9.09% respectively.

Percentage Losers

C&I Leasing led other price decliners, shedding 6% of its share price to close at N4.70 from the previous close of N5.00.

Other price decliners include UACN (-3.47%), Union Diagnostics (-3.13%) and International Breweries (-2.00%) respectively.

Volume Drivers

First Bank of Nigeria Holdings (FBNH) traded about 91.92 million units of its shares in 454 deals, valued at N448 million.

Zenith Bank traded about 63.39 million units of its shares in 854 deals, valued at N994.76 million.

Access Bank traded about 55.94 million units of its shares in 465 deals, valued at N365.49 million.

Guaranty Trust Bank traded about 45.88 million units of its shares in 550 deals, valued at N1.05 billion.