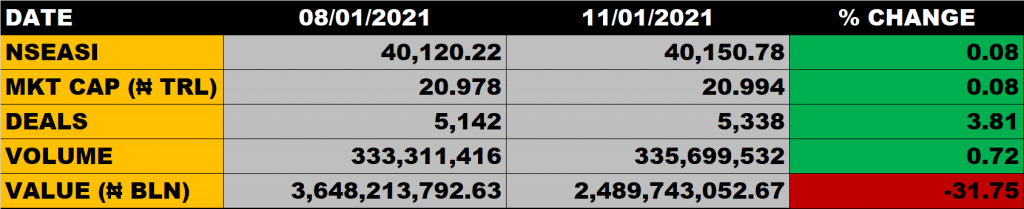

The Nigerian equity market on Monday admitted the Bulls as the All Share Index appreciated by 0.08% to settle at 40,150.78 points from the previous close of 40,120.22 points. The positive sentiment in the market is arising from uptrend in oil price and the concession by the OPEC+ to further cut back oil production output. Investors gained N16 billion as the Market Capitalisation increased by 0.08% to N20.994 trillion from the previous close of N20.978 trillion.

A positive outlook has been projected for the market in 2021 by capital market experts. The market is projected to sustain positive trajectory in the first quarter of the year.

According to Mr Aruna Kebira, Chief Dealer of Global View Capital Limited, the outlook for 2021 is a positive one, based on the positive key signals on ground.

“When we actually look at what is happening; oil price has gotten above $54 per barrel. I don’t think exchange as we speak now is anything worse than what it did in December 2020. OPEC+ has agreed for a cut back for January and February. So I’m not looking at the drop in the price of oil which to a very large extent is a benchmark to our reserve; and our reserves are also growing. So as far as I’m concerned I am not seeing any gloom in the system yet. If you talk about inflation, the boarders have been opened. What is actually causing the inflation is because of food. By the time the imported things are allowed to come into the country, it’s going to bring down there prices of our locally produced goods; so inflation will drop.

Whether CBN is still going to hold the MPR in their next meeting is left for another discussion. But I don’t think that they are going to tamper with it. Again, there stance on money market rate is not done to favour the capital market. They did it to jump start the real sector of the economy. And the real sector of the economy has not gotten to the desired level. So they are going to still keep the rate low, which will continue to work in favour of the capital market. So I’m looking at the market in bullish mood between now and when dividends are paid”.

An aggregate of 335.7 million units of shares were traded in 5,338 deals, valued at N2.49 billion.

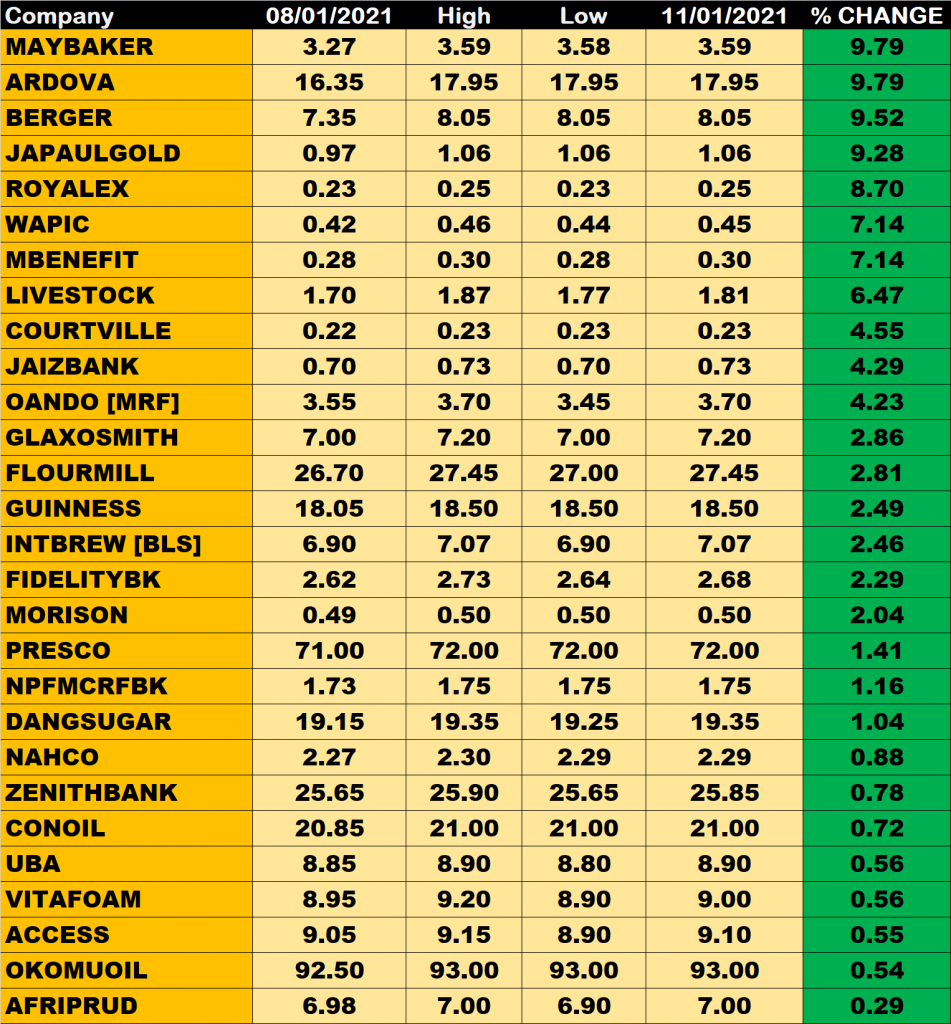

The market breadth closed positive as 28 stocks appreciated in their share prices against 24 stocks that declined in their share prices.

Stocks to Watch

- Access Bank grew to N9.1 from N9.05. It is currently trading 24.17% away from its 52 weeks high of N12. At that, there is uptrend potential in the share price of Access Bank.

- FBN Holdings dropped to N7.40 from N7.45. It is trading 17.78% away from its 52 weeks high of N9 which implies an uptrend potential for the share price of the big elephant.

- Zenith Bank grew to N25.85 from N25.65. It is trading 9.30% away from its 52 weeks high of N28.5.

- WAPCO traded flat at N22.3. It is trading 14.23% away from its 52 weeks high of N26, which implies an uptrend potential for the share price of the company.

- UBA grew to N8.90 from N8.85. It is trading 9.18% away from its 52 weeks high of N9.8.

- Guaranty Trust Bank dropped to N32.85 from N33. It is trading 14.56% away from its 52 weeks high of N38.45, which suggest an uptrend potential for the share price of Guaranty Trust Bank.

Percentage Gainers

May & Baker and Ardova Plc both led other gainers with 9.79% growth to close at N3.59 and N17.95 respectively.

Berger Paints and Japaul Gold among other gainers also grew their share prices by 9.52% and 9.28% respectively.

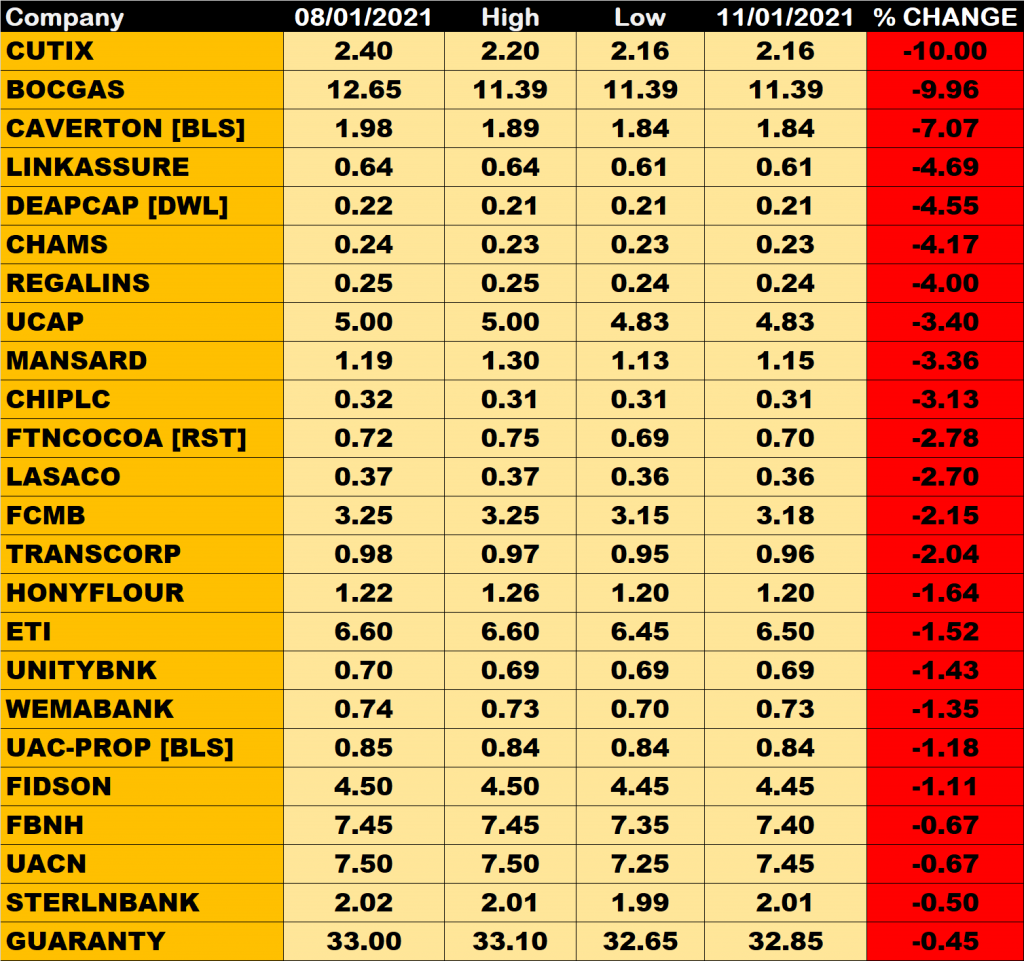

Percentage Losers

Cutix Plc led other price decliners as it shed 10% of its share price to close at N2.16 from the previous close of N2.40.

BOC Gas and Caverton among other price decliners also shed their share prices by 9.96% and 7.07% respectively.

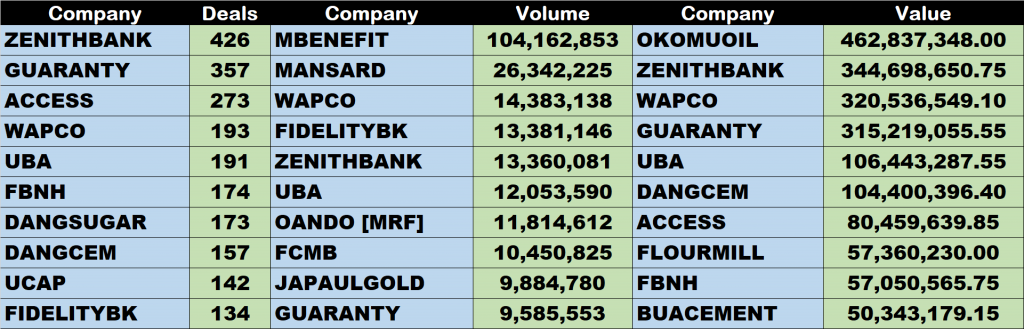

Volume Drivers

- Mutual Benefit Assuarance traded about 104.16 million units of its shares in 68 deals, valued at N31.04 million.

- AXA Mansard traded about 26.34 million units of its shares in 107 deals, valued at N30.4 million.

- Wapco traded about 14.38 million units of its shares in 193 deals, valued at N320.54 million