Wole Olajide

The Nigerian stock market in the first half of 2023 closed on a bullish note with 18.96% growth, year to date. As at June 30, 2023, the All Share Index and Market Capitalisation stand at 60,968.27 points and N33.198 trillion respectively.

Within the last 6 months, prices of stocks have moved up significantly, creating new 52 weeks high. This growth cuts across every sectors captured on the floor of the Nigerian Exchange. Worthy of note is the rally that started on the 30th of May, a day after President Bola Tinubu assumed office. The positive vibration continued till the end of June 30, 2023.

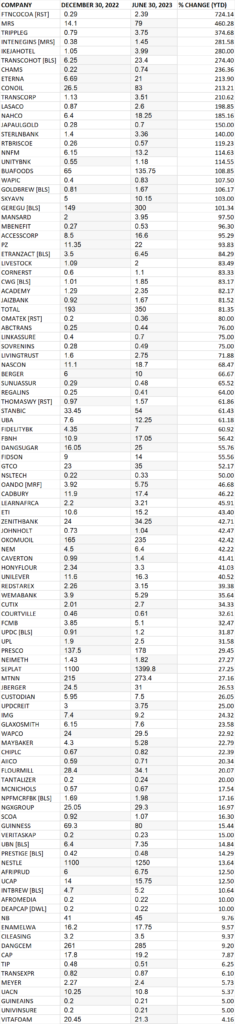

110 stocks emerged as gainers within the last 6 months, while 15 stocks declined in their share prices.

Going forward into the Second Half of the year, the outlook for the capital market is positive, because the new government hit ground running from day one of inauguration, giving investors the confidence that all will be well with the economy.

TOP 10 GAINERS WITHIN THE LAST 6 MONTHS

FTN COCOA:

FTN Cocoa Processors Plc in 6 months gained 724.14% in price appreciation. The price moved from N0.29 recorded on December 30, 2022 to N2.39 as at 30th of June 2023. The positive vibration started just after the company obtained a convertible loan of $ 6.35 million from OH Ecosystems LLC.

According to Capital Market experts, the facility gotten by the company has not started making any impact on the operations of the company. Hence, the positive vibration in price of the stock is futuristic and since the price has enjoyed so much appreciation, it may likely see a reverse action.

The Company has a negative Shareholders Fund of N1.64 billion, which translates to a negative book value of 42 kobo. At that, there is no fundamentals backing the price surge in FTN Cocoa.

MRS PLC

The share price of MRS Plc grew by 460.28% in the first half of 2023 from N14.1 to N79. Stocks in the oil sector started their rally immediately after removal of fuel subsidy was announced by President Bola Tinubu. As far removal of fuel subsidy has come to stay, prices of stocks in the Oil & Gas sector will continue to enjoy upward movement.

TRIPPLE GEE PLC

The price of the stock grew by 374.68% within 6 months from N0.79 to N3.75. The Company’s financial statement for for the year ended 31 March 2023 showed that the Company grew its turn over by 110.9%. Profit after tax also grew by 98%.

Though dividend has not yet been declared, there is tendency of the Company paying more than 6 kobo declared the previous year.

Before this current rally, the price of this stock had always been stagnant. A position in this stock could be a trap for the new entrants.

INTERNATIONAL ENERGY INSURANCE

The price of the International Energy Insurance moved from N0.38 to N1.45, which translates to 281.58% growth.

Norrenberger in August 2022 obtained approval from NAICOM to acquire 100% equity holding in the Company. As at now, 50.6% equity of the Company has been acquired by Norrenberger. As a matter of fact, Norrenbeger is already processing approval from SEC of the Mandatory Takeover Bid to be able to acquire the remaining holdings of the Company. The Company may eventually delist from NGX after complete acquisition by the new owner.

IKEJA HOTEL

Ikeja Hotel Plc grew from N1.05 to N3.99 within the space of 6 months. This translates to 280% growth year to date. Currently trading at its 52 weeks high. There is possibilities of profit taking in the stock.

TRANSCORP HOTEL

The share price of Transcorp Hotel Plc grew by 274.4% to N23.74 from N6.25. Currently trading at its 52 weeks of N23.4, there is possibility of profit taking this week. At that the price is expected to go down.

CHAMS HOLDING COMPANY

Chams Holding Company Plc grew its share price significantly from 22 kobo to 74 kobo, which represents 236.36% growth, year to date. The price of the stock has not looked back after the restructuring of Chams Plc into a Holding Company. The stock is currently trading at its 52 weeks high of 74 kobo.

ETERNA PLC

Eterna Plc is currently trading at its 52 weeks high of N21. The Oil & Gas Company grew its share price by 213.9% from N6.69 to N21. In as much as the removal of fuel subsidy has come to stay, prices of stocks in the Oil & Gas sector will continue to enjoy upward movement.

CONOIL PLC

Conoil Plc grew its share price by 213.21% from N26.5 to N83 in 6 months. Currently trading at N83, it has touched a 52 weeks high of N86.5. There is uptrend potential for Conoil as Oil & Gas Companies are benefiting from the positive sentiment of fuel subsidy removal.

TRANSCORP PLC

The share price of Transnational Corporation (Transcorp) grew by 210.62% within the space of 6 months from N1.13 to N3.51.

The upward journey of Transcorp began this year when Femi Otedola entered to become one of the substantial majority shareholder. The news pushed the price of the stock up significantly. Even after Otedola eventually left his position, the price of the stock has not looked back.

Currently trading at N3.51, Transcorp has touched a 52 weeks of N3.87. There is an uptrend potential of 9.3% for Transcorp, relative to its 52 weeks high of N3.87.

GAINERS

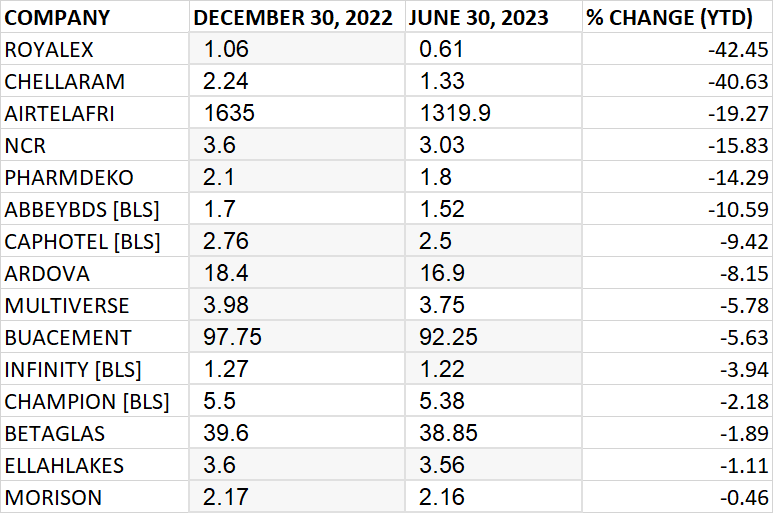

LOSERS