- Fidelity, Access, UBA, cheap at current prices

The Second Quarter earnings of Banks, most especially those that were audited hit the market between the middle of August and the first week of September 2019. The slight delay in the release of these results was due to the fact that banking sector is heavily regulated and approval would be done by the Central Bank of Nigeria before they are eventually released to the general public. Bank stocks on the floor of the Nigerian Stock Exchange can be said to be one of the key drivers of liquidity as some of them most times emerge as actively traded stocks in terms of volume, value and deals.

Out of 14 banks listed on the floor the Nigerian Stock Exchange, only 5 gave interim dividend in the second quarter of 2019, which obviously gave investors at least reason to smile to the bank.

Banks that gave interim dividend include Access Bank (N0.25), Guaranty Trust Bank (N0.30), Stanbic IBTC (N1), United Bank for Africa (N0.20) and Zenith Bank (N0.30).

In this article, we shall be analyzing the performance of banks in their half year 2019 report with keen interest in their turnover, profitability and their earnings per share.

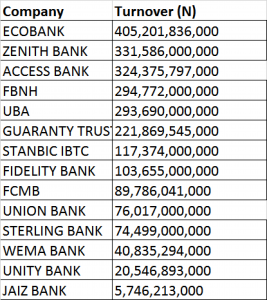

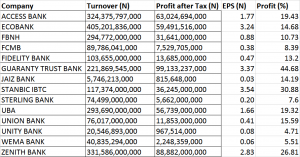

TURNOVER

For the half year financial report, Ecobank Transnational Incorporated (ETI) has the largest turnover as it posted a gross earnings of N405.2 billion; this is followed by Zenith Bank with gross earnings of 331.59 billion. Third on the list in terms of turnover is Access Bank with gross earnings of N324.38 billion. FBNH made gross earnings of N294.77 billion emerging as fourth while UBA came fifth with gross earnings of N293.69 billion.

In that ranking order, list of other banks and their turnover include: Guaranty Trust Bank (N221.87bn), Stanbic IBTC (N117.37bn), Fidelity Bank (N103.66bn), FCMB (N89.79bn), Union Bank (N76.02bn), Sterling Bank (N74.50bn), Wema Bank (N40.84bn), Unity Bank (N20.55bn) and Jaiz Bank (N5.75 bn).

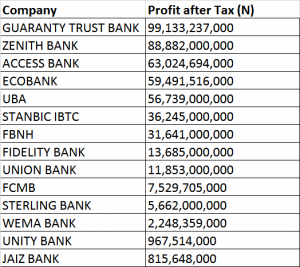

PROFIT AFTER TAX

Guaranty Trust Bank emerged top on this list with a profit after tax of N99.13 billion in the second quarter of 2019. This is followed by Zenith Bank which made N88.88 billion as profit after tax. Access Bank merge third on this list with profit after tax of N63.02 billion.

Ecobank and UBA came fourth and fifth on this list with profit after tax of N59.49bn and N56.74 billion respectively.

The profit after tax of other banks include: Stanbic IBTC (N36.25bn), FBNH (N31.64bn), Fidelity Bank (N13.69bn), Union Bank (N11.85bn), FCMB (N7.53bn), Sterling Bank (N5.66bn), Wema Bank (N2.25bn), Unity Bank (N967 million) and Jaiz Bank (N815 million).

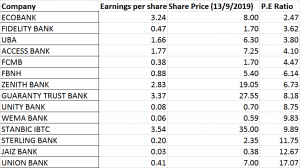

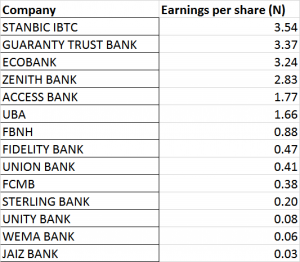

PERFORMANCE IN EARNINGS PER SHARE (EPS)

- Stanbic IBTC has the highest earnings per share (EPS) which is N3.54, though it declined by 15.87% from the previous EPS of N4.21.

- The earnings per share of Guaranty Trust Bank grew to N3.37, up by 3.72% from the previous earnings per share of N3.25.

- Ecobank grew its earnings per share by 15.4% from N2.81 recorded in 2018 to N3.24.

- Zenith Bank recorded earnings per share of N2.83, which is a growth of 8.85% from the previous earnings per share of N2.60 in the half year of 2018.

- The earnings per share of Access Bank grew to N1.77 from the previous earnings per share of N1.11 in half year 2018.

- UBA grew earnings per share to N1.66 from N1.28 in half year 2018.

- Earnings per Share (EPS) of First Bank Nigeria Holdings (FBNH) came down to N0.88 as against the previous EPS of N0.93 in the first half of 2018.

- Fidelity Bank’s earnings per share grew to 47 kobo from the previous earnings per share of 41 kobo in half year 2018.

- The earnings per share of Union Bank grew by 3.45% to N0.41 from N0.39 in half year 2018.

- FCMB grew earning per share to 38kobo from 29kobo reported in 2018.

- The earnings per share of Sterling Bank was down from 22kobo to 20kobo.

- Unity Bank grew its earnings per share from 4kobo in half year 2018 to 8 kobo.

- Earnings per share (EPS) of Wema Bank grew to N0.06 form the previous EPS of N0.04.

- Jaiz Bank grew its earnings per share to 3 kobo from 1 kobo reported in half year 2018.

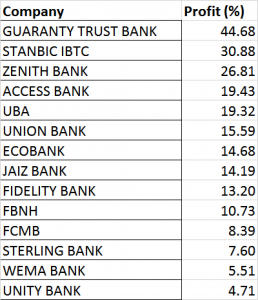

PROFITABILITY

Profit made by these financial institution in half year 2019 was evaluated as a ratio of TURNOVER to PROFIT AFTER TAX.

Guaranty Trust Bank emerged first with a profit of 44.68%, implying the wealth of the company as increased by 44.68%.

Second on this list is Stanbic IBTC with 30.88%. Zenith Bank came third with a profit of 26.81%. Access Bank came fourth on the list in terms of profitability with 19.43%. UBA emerged fifth on the list, making 19.32% as profit. Union Bank made a profit of 15.59% emerging as sixth on the profit ranking.

Ecobank is the seventh on this rank with a profit of 14.68%, while Jaiz Bank emerged as eighth with a profit of 14.19%.

Fidelity Bank emerged ninth on the list with a profit of 13.20% while FBNH made a profit of 10.73% ranking as tenth on the list.

The next is FCMB with 8.93% profit emerging as eleventh on the rank. Sterling Bank is number twelve on the rank with 7.60% profit. Wema Bank is number thirteen on the rank with 5.51% profit, while Unity Bank is last on the rank with 4.71% profit.

ACCESS BANK PLC

Access Bank Plc in its half year audited financial report for the period ended June 30, 2019 recorded a profit after tax (PAT) of N63.02 billion, implying a growth of 59.05% compared to the N39.63 billion recorded the previous year.

Gross Earnings was N324.4 billion, up by 28.2% against the previous close of N253.02 billion in half year 2018.

Profit before tax grew by 61.67%, to settle at N74.12 billion from the previous close of N45.84 billion the previous year.

Earnings per share for the period under review grew to N1.77 from the previous earnings per share of N1.11 in half year 2018.

With reference to the share price of N6.45, P.E ratio of Access Bank Plc stands at 3.64x with earnings yield of 27.44%.

ZENITH BANK PLC

Zenith Bank Plc grew its topline figure by 2.91% with Gross Earnings of N331.6 billion against the previous Gross Earnings of N322.2 billion in Half Year 2018.

Profit before tax closed at 111.68 billion, up by 4.02%, when compared to its previous close of N107.36 billion in half year 2018.

Profit after tax closed at 88.88 billion, up by 8.74%, when compared to its previous close of N81.74 billion in half year 2018.

The bank gave 30 kobo interim dividend to its shareholders.

Earnings per share in half year 2019 grew to N2.83, up by 8.85% from the previous earnings per share of N2.60.

With reference to the share price of N16.25, P.E ratio of Zenith Bank stands at stands at 5.74x with earnings yield of 17.42%.

FBNH

In the Second Quarter report of First Bank of Nigeria Holdings (FBNH) for the period ended June 30th 2019, the holding company recorded N294.8 billion as gross earnings up marginally by 0.33% from the previous gross earnings of N293.8 billion in Half Year 2018.

Profit before Tax (PBT) was N39.871 billion, up by 2.56% from the previous PBT of N38.876 billion recorded in HY’18.

The Profit after Tax (PAT) was N31.641 billion, down by 5.48% from the previous Profit after Tax in Half Year, 2018.

Earnings per Share (EPS) of the holding company came down to N0.88 as against the previous EPS of N0.93 in the first half of 2018.

At a reference price of N5.55, PE ratio of FBNH was at 6.30x with earnings yield of 15.86%.

ECOBANK TRANSNATIONAL INCORPORATED

Ecobank Transnational Incorporated Plc, in its 2019 Half Year financial results showed that the Financial Institution made a growth of 5.36% in its topline figures as gross earnings closed at N405 billion from N384 billion reported in half year 2018.

The Bank also recorded a growth of 15.40% in Profit after Tax from N51.5 billion to N59.4 billion.

The earnings per share grew by over 15% from N2.81 to N3.24.

The Bank’s PE Ratio with reference to the share price of N9.00 was 2.78x and has earnings yield at 36.02%.

FCMB

In the half year report of FCMB Group Plc, the group recorded a growth of 6.98% in Gross Earnings which closed at N89.7 billion from N83.9 billion rein 2018.

The Profit after Tax (PAT) was also up by 31.50% to arrive at N7.5 billion above N5.7 billion recorded in HY’18.

The company grew its shareholders’ Earning per Share (EPS) by 31.50%, closing at 38kobo away from 29kobo reported in 2018.

At a reference price of N1.65, the financial institution’s PE Ratio stood at 4.34x with earnings yield of 23.04%.

FIDELITY BANK

Fidelity Bank Plc grew its Gross Earnings by 12.31, closing the half year period with N103.66 billion against the previous close of N92.3 billion in Half Year 2018.

Profit before tax closed at 15.05 billion, up by 15.69%, when compared to its previous close of N13.01 billion in half year 2018.

Profit after tax was up by 15.55% to close at N13.685 billion away from the previous close of N11.843 billion in half year 2018.

Earnings per share for the period under review grew to 47 kobo from the previous earnings per share of 41 kobo in half year 2018.

With reference to the share price of N1.66, P.E ratio of Fidelity Bank Plc stands at 3.53x with earnings yield of 28.31%.

GUARANTY TRUST BANK

The audited half year financial report of Guaranty Trust Bank for the period ended June 30th, 2019 revealed a growth of 3.72% in its gross earnings closing at N99.13 billion against the previous close of N95.58 billion in half year 2018.

Profit before tax closed at 115.8 billion, up by 5.61%, when compared to its previous close of N109 billion in half year 2018.

Guaranty Trust Bank gave interim dividend of 30 kobo to its shareholders.

Earnings per share for half year 2019 grew to N3.37, up by 3.72% from the previous earnings per share of N3.25.

With reference to the share price of N25.75, the PE Ratio was 7.64x with earnings yield of 13.09%.

STANBIC IBTC

Stanbic IBTC Holdings its Gross Earnings by 2.77%, closing the half year period with 117.37 billion against the previous close of N114.2 billion in Half Year 2018.

Profit before tax closed at 44.65 billion, down by 11.99%, when compared to its previous close of N50.73 billion in half year 2018.

Profit after tax was down by 15.87% to close at N36.245 billion away from the previous close of N43.084 billion in half year 2018.

Stanbic IBTC Holdings proposes N1 interim dividend to its shareholders, which is the highest dividend payout among other five banks that gave interim dividend.

Earnings per share of Stanbic IBTC for half year 2019 declined to N3.54 from the previous earnings per share of N4.21 in half year 2018.

With reference to the share price of N35, P.E ratio of Stanbic IBTC Holdings was 9.89x with earnings yield of 10.11%.

UNITED BANK FOR AFRICA

United Bank for Africa in its half year audited financial report for the period ended June 30, 2019 recorded a profit after tax (PAT) of N56.739bn, implying a growth of 29.56% compared to what was made the previous year.

Gross Earnings was N293.69 billion, up by 13.87% against the previous gross earnings of N257.92 billion in half year 2018.

Interest Income was 204.89 billion, up by 9.39% against the previous close of N187.29 billion in half year 2018.

Profit before tax grew by 20.87%, to settle at N70.27 billion from the previous close of N58.14 billion the previous year.

Earnings per share for the period under review grew to N1.66 from the previous earnings per share of N1.28 in half year 2018.

With reference to the share price of N5.85, P.E ratio of United Bank for Africa stands at 3.52x with earnings yield of 28.38%.

WEMA BANK

Wema Bank, creators of ALAT, Nigeria’s first digital bank posted a profit before tax of N2.61billion for the half year ended 30 June 2019, a significant increase from N1.81 billion posted in 2018.

Gross Earnings of the bank increased by 27.47% to N40.83billion from N32.03billion reported in H1 2018 driven by double-digit growth in Interest and Fee-based income. Profit before Tax was N2.61billion, a 43.64% growth when compared to N1.82billion reported in H1 2018.

Profit after tax was N2.25bn, up by 43.21% from N1.57 billion reported in half year 2018.

Earnings per share (EPS) grew to N0.06 form the previous EPS of N0.04. With reference to the share price of N0.65, P.E ratio of Wema Bank was 11.15x with earnings yield of 8.97%.

STERLING BANK

The Bank’s half year result of Sterling Bank Plc revealed a decline of 4.01% in Gross Earnings to N74.449 billion from N77.608 billion recorded in half year 2018.

The Bank dropped in its Profit after Tax by 8.88 % to settle at N5.6 billion form N6.2 billion recorded in 2018.

The profit before tax during the period under review also dropped by 5.69%, closing at N6.001 billion as against N6.363 billion in the corresponding period.

The earnings per share was down by over 8.00% from previous year’s N0.22 to N0.20

The current period’s PE Ratio is at 11.39x; while the earnings yield stands at 8.78% with a reference stock price of N2.24 at the released date of computation.

UNION BANK

Union Bank of Nigeria recorded a turnover of N76.018bn, down by 8.78% from N83.33bn reported in the half year of 2018.

The financial institution recorded 3.45% growth in Profit after Tax for the first six months of 2019.

The report revealed a growth in profit before tax of N11.6bn recorded in the same period the previous year to arrive at N12.1bn recorded in the current period under review, which is a growth of 3.96% year on year.

The earnings per share grew by 3.45% while the current period’s PE Ratio is at 16.83x and the earnings yield stands at 5.94% with a reference price of N6.85 at the close of trading on the day of computation

The management of the company disclosed no information about interim dividend to the shareholders as at the released day of the result.

UNITY BANK

The First half financial report of Unity Bank Plc for the period ended June 30th, 2019 reveals that the group soared by 17.47% in gross earnings closing at N20.546bn above the previous close of N17.491bn in 2018.

The Profit after Tax (PAT), was up by 96.33% to arrive at N967mn from N492mn recorded in FY’18.

With about 11bn share outstanding, the Shareholders’ earnings per share inched by 96% from N0.04 of the corresponding period in 2018 to N0.08 in the period under review.

At a reference price of N0.63, as the released date, the company’s PE Ratio stood at 7.61x with earnings yield of 13.14%.

JAIZ BANK

Jaiz Bank Plc has grown its second quarter Turnover in 2019 to N5.746bn which is about 55% better than N3.688bn reported same period in 2018.

The company’s profit after tax (PAT) for the period under review stood at N815mn which is massively 294% better than N206mn reported last same period in 2018.

The shareholders’ earnings per share of N0.03 kobo for the period under review when compared with N0.01kobo reported for the comparative period of 2018, represented 294.62% growth.

As at when computed at a price of N0.42, Jaiz Bank PE Ratio stood at 15.17x with about 6% earnings yield.