There is no gainsaying that the banking sector in Nigeria like most sectors is currently feeling the strains of the covid-19 pandemic alongside their customers, employees and the society they serve. This is due to the fact that banks are at the forefront of public tension due to the financial services they render.

This first became very obvious when the lockdown was initially eased, it was observed that the banks were under pressure and it appears as if they were not ready or maybe they underestimated the reopening, judging by the abnormalities observed in various banks across the country.

The fact remains that for people who have been locked down for five weeks especially in Lagos, Ogun and Abuja, one would expect that a lot of people will want to transact with their banks. And that was the reason for the surge in depositors thronging various banks to withdraw money and especially since most of the bank branches were not opened, so there was pressure on the few ones that were opened.

The pressure on the bank and staff is however expected to continue at least for few more weeks as banks are obeying the rules of engagement released by the authorities as regards social distancing, number of people that can be in the office at a point in time.

Anyway, as investors, our primary concern is how all these would affect our investments in some of these financial institutions and finally translate into naira and kobo at the end of every investment period. Covid-19 in the first place is a pandemic with serious implications on people’s health, how badly will this virus also hit the financial health of these institutions. There is no doubt this situation will bring about increased cost of servicing, reduction in forex earnings, loan exposure among others. This will consequently impact the bottom-line of which the outcome by prediction may not be too impressive especially for quarter two performance.

Reduction in Forex Earnings

The importance of examining the effect currency fluctuation has on banks profitability cannot be over emphasized, particularly, given this era of Global financial integration. Most commercial banks are said to suffer from erosion of their profit arising from their exposure to fluctuations in international currencies, especially, when proper hedging strategies are not adopted.

Many banks with improperly matched foreign currency denominated assets and liabilities could experience a significant exposure to currency risk, resulting from the expected defaults on the foreign currency assets compounded with the recent upward adjustment of the exchange rates.

Before covid 19, there have been some hits on the foreign exchange market, because Nigeria’s major earning is from oil. Oil and Gas has been badly hit from a high of about $70 per barrel, we’ve been experiencing something in the region of $20 to $40 per barrel. Which means about 50% of our foreign earnings has gone. With that definitely, there will be pressure on foreign exchange.

Prior to January, February this year, we’ve maintained a constant rate of N360, N365 to $1. Even in the parallel market and other windows. So there is pressure in the foreign exchange, the rate as gone up or has depreciated so to say. Now we hear about N450, N460 per dollar. Definitely the banks too will be affected in terms of earnings from Foreign Exchange.

Increased cost of servicing:

Some bankers are still working remotely and this obviously will increase the use of Data, Internet and other channels. This definitely will lead to increase in the cost of servicing the customers.

Remote working conditions and adoption of digital channels have expanded the attack surface of banks’ IT network with cyber threats trying to exploit any remote access weaknesses with new attack techniques.

Loan exposure in oil and gas sector

Increased defaults resulting from curtailed economic activities, lower recoveries, higher credit exposures and credit rating downgrade of customers in heavily affected industries. The expected reduction in the value of the loan portfolio from impairment reasons may impact the banks’ ability to meet certain ratios such as Capital Adequacy Ratio (CAR), Loan to Deposit Ratio (LDR), Non Performance Loan (NPL) ratios.

The exposure of bank loans in the oil and gas sector is about 30% to 31%. Oil and gas industry was thriving well before now and most banks lend to them. There is no bank that will lend without taking adequate risk assessment and risk profiling before they did. Oil and gas customers may be challenged at the moment, what the banks may have to do at the long run is to renegotiate and restructure the repayment plan of the industry exposure.

Some of the other likely impact include:

- The combined effect of low business activities, higher impairment and possible operational and fair value losses may result in reduced profit levels and capital depletion. For some banks, CAR may drop below the regulatory threshold as a result of increase in credit exposure.

- Reduced cash inflows from loan repayment may impact banks’ liquidity position, increased cash withdrawals by depositors to meet their own funding needs and flight to quality as customers may move their funds from banks expected to be significantly impacted by the pandemic to banks less impacted.

- Banks would experience varying degrees of losses from the COVID outbreak. If such losses have been previously insured under insurance contracts, serious consideration is necessary to determine the recognition of recoveries for such losses

- Non-interest income to continue to support earnings growth through more push for digital transactions and channels

Potential Countermeasures & Response Actions

Just like an average Nigerian, Nigerian businesses are dynamic, resilience and can adjust to changing situations in minutes. Though it may be tough but regardless the realities on ground, they will adjust to the ruling situation.

Most banks in swift response to covid-19 disruption activated their business continuity plans with various initiatives and innovative solutions to prevent business disruptions and ensure continuous flow of services amidst tight conditions.

Some banks also came up with various palliative measures to ease the difficulty encountered by customers in form of moratorium.

Banks also partnered with the government on initiatives aimed at alleviating suffering brought about by COVID 19 (health, financial and otherwise).

Q2 Earnings Outlook for Banks

The outbreak of covid-19 pandemic still remain a major threat to a healthy Q2 reports. Though the first index case in Nigeria was discovered late February but the major economic disruption came at the inception of the second quarter which saw virtually all economic activities grounded.

Though the financial institution under essential services operated during lockdown but this was far below capacity and even as the economy is currently opened, we know it is still partial and businesses of course will yet not be operating in their full capacity.

In summary, Q2 financials of most quoted companies without doubt is going to be below impressive as earnings are expected to slow down.

One may want to argue that the market in the past two months amid covid 19 epidemic has experienced rally contrary to what should be expected and therefore no one can predict the market against post q2 earnings performance. The rally we saw could be linked to impressive audited reports of most quoted companies and corporate actions by this organisations in which the operations that birthed those result were pre-covid business activities earnings and such did not reflect the effect of covid-19.

However, there might be mild exception in the case of banks as the impact of covid-19 in the banking sector will be less compared to that of other sectors.

According to Mallam Kurfi, Managing Director of APT Securities Limited: “There is no doubt, the Q2 report will show the total effect of Covid-19 because this is the period that covers most of the time businesses were closed. We have no doubt, the Q2 result will be very far below our expectation. When the result comes, the market is likely to also react. So we anticipate the market will go down because of the poor result.

The only exception is the banks because most of the banks make their money from lending. Therefore the impact of covid-19 in the banking sector will be less compared to that of the manufacturing sector; but all other sector including Insurance will have poor Q2 results.

Aruna Kebira, Chief Dealer of Global View Capital, in his own opinion believes Q2 earnings for bank may slow down as compared to 2019 based on the fact that the economy has been on a partial lockdown. He said there have been under-capacity utilization for banks; they will operate one branch today, and then close it afterwards due to covid-19.

He however opined that Guaranty Trust Bank will have less impact of the covid-19 on its Q2 earnings simply because the bank is sticking around its price compared to others. It takes time to fall and it takes time to rise. The share price still touched N25 last week.

He finally advised that the Investment strategy for now above investing in fundamentally sound stocks is to be cautious.

Bright Otoghile, Managing Director of Gruene Capital Limited in his own view also pointed out that the earnings that companies are likely going to declare for the second quarter will obviously by large margin fall short of their expected margin/profit they have in mind at the beginning of the year. According to him, “Level of Income and profit will drop for the Second Quarter earnings.

Atanda Isiaka, Head of Market Control, NASD OTC Securities Exchange is of the opinion that Q2 report for banks will be marginally good compared to previous Q2 earnings.

According to him, “most of the tier 1 banks will release good Q2 result because they are saving a lot of costs. Some of the branches that are closed to each other are closed down. Everybody is still doing their transactions via other banking channels like ATM, transfer. You cannot do any transaction without involvement of banks. While they are making their money ‘cool headed’, they are saving cost.

It is therefore necessary to compare past q2 earnings of this banks in order to predict how fairly some of these institutions can perform in their q2 reports.

- ACCESS BANK

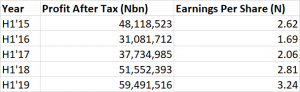

The group’s inaugural post-merger audited report was half year 2019 and the bank recorded a strong performance in the first half of the financial year, notwithstanding the slow and weak macro environment. It was a 28% growth from the previous year with a 63% increase in Customer Deposits as at date of release.

The bank has consistently grown in its earnings over the years and the price of the stock has also performed over time.

Herbert Wigwe’s name is a household name as far as banking is concerned. He is taught to be intelligent and he is a very good manager. Yes it is expected that the bank’s earnings would slow down but it will be mild considering the bank’s track record in strategic management and policy implementations. This bank has also weathered many storms and this I am sure will not be exception.

In 2019, the bank’s Gross Earnings rose 28%y/y and 3%q/q to ₦324.4bn in H1 2019 as against ₦253.0bn in H1 2018, with interest and non-interest income contributing 84% and 16% respectively.

There might be a slight shortfall in the company’s interest income due to slow business activities in the review period.

Access Bank Plc is one of those quoted companied with interim dividend history and it declared an interim dividend of 25 kobo last year. This they have done consistently over the years but we might likely see a moderated corporate action this year but not without any payment.

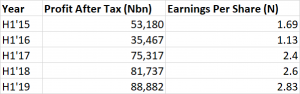

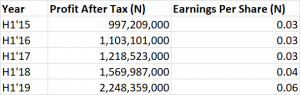

Below is half year earnings history of the bank for 5 years:

- GUARANTY TRUST BANK

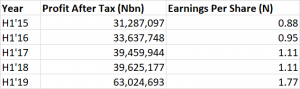

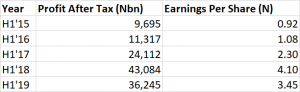

Guaranty Trust bank in the last five years has shown consistent growth in Q2 profit after tax and earnings per share.

In the second half of 2015, Guaranty trust bank achieved profit after tax of N53.37 billion with earnings per share of N1.81. Earnings per share (EPS) grew to N2.44 in the second quarter of 2016 as the profit after tax of the bank appreciated to N71.77 billion. Then in Q2 2017, the EPS of Guaranty Trust Bank grew to N2.84 as profit after tax moved to N83.68 billion. In Q2, 2018, earnings per share of the bank appreciated to N3.25 as profit grew to N95.58 billion. Earnings per share of the bank in the second quarter of 2019 appreciated to N3.37 as profit increased to N99.13 billion.

Based on the past Q2 earnings performance of the bank, Guaranty Trust Bank has the capacity to improve on its previous earnings ceteris paribus. However due to the fact that the effect of covid-19 will be felt across businesses in Nigeria; the banking sector might also be affected, though mildly.

In the second quarter earnings of 2020, we expect Guaranty Trust Bank to achieve the profit after tax of N97 billion and earnings per share of N3.30.

Guaranty Trust Bank have a very good Corporate Governance. There shareholding structure is working for them. They have grown over the years. The market is pricing Guaranty over Zenith Bank because the shareholding structure in Guaranty is not skewed to one person.

Business Continuity in Guaranty Trust Bank is higher because the shareholding structure is not listed to one man. Corporate Governance in Guaranty Trust Bank is very high as far as the market is concerned. There have been consistent growth in turnover, profit after tax and earnings per share of the bank.

Below is half year earnings history of the bank for 5 years:

FIRST BANK OF NIGERIA HOLDINGS

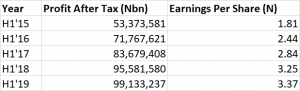

FBNH in the second quarter of 2015, achieved a profit after tax of N40.06 billion and earnings per share of N1.12. However, earnings per share dropped to N1.00 in 2016. In 2017, Q2 earnings per share dropped further to N0.81. In 2018 the earnings per share appreciated to N0.93 and eventually dropped to N0.88 in the second quarter of 2019.

Based on Q2 earnings history of FBNH in the past 5 years, we project that the bid elephant will achieve a profit after tax of N30 billion and earnings per share of N0.84 in Q2 financials of 2020.

The share price of FBNH has performed over the years and the stock is very resilient. There is hardly no portfolio that you don’t find First Bank, no matter how small the unit is. The effort the management of the bank have put into cleaning their book of non-performing loan is very credible.

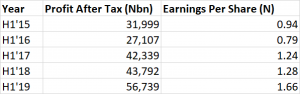

Below is half year earnings history of the bank for 5 years:

ZENITH BANK

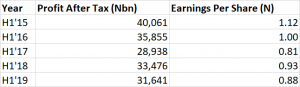

Zenith Bank is a dominant player in the Nigerian Banking Industry with a touch of Market leadership, growth capacity, solid and liquid capital base, good returns on investment and excellent customer service. When it comes to key ratio measurements, Zenith bank is among the best of its peers.

Although, its reported topline growth of just about 3% for half year 2019 calls for concern on how its projected half year 2020 would look like. It is established that the slowed business activities in the second quarter of this year would necessarily slow down companies’ earnings. Going by this, we might see Zenith topline slip slightly below a positive territory or slightly above the positive line.

However, the group’s dividend history is expected to be kept afloat. Zenith Bank has performed over the years with consistent growth in turnover, profit after tax and earnings per share especially with good dividend pay-out record. If you look at Zenith Bank’s dividend payment from 2015 to 2020. You will discover that in 2015, Zenith Bank paid the dividend of N1.77, the last dividend paid was N2.80. Their dividend yield is fantastic; it is always above 10%.They are always consistent with interim and final dividend payment.

Below is half year earnings history of the bank for 5 years:

UBA

The bank in its Audited 2019 Half Year Financial Results for half year 2019 reported a 13% YoY gross earnings growth of N293.7 billion and 29.6% profit after tax of about N56.7 billion, for the six months ended June 30, 2019.

Though it is expected the bank’s performance might drop in the expected reports but the human factor, that is, the Elumelu engender would spring hope any day any time. We might not see a woeful result par se

UBA has actually grown and they have been consistent in dividend payment. It has also performed well as far as price appreciation is concerned. The management of UBA is tight as the management of of Tony Elumelu is tight; that means that the corporate Governance will be to the utmost.

Below is half year earnings history of the bank for 5 years:

FIDELITY BANK

The second quarter earnings history of Fidelity Bank for the past five years shows consistent growth in the banks profit after tax and earnings per share.

Based on the past Q2 earnings performance and the reality of the current economic situation caused by covid-19, we project a profit after tax of N12 billion and the earnings per share in the region of 44 kobo for Q2 financials of Fidelity Bank.

Below is half year earnings history of the bank for 5 years:

FCMB

First City Monument Bank over the years have shown impressive half year result as earnings per share grew from 15 kobo in 2017 to 38 kobo in 2018.

Based on the past half year performance of the bank and the current economic reality, we project the earnings per share of 33 kobo for FCMB in the second quarter.

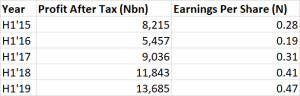

Below is half year earnings history of the bank for 5 years:

WEMA BANK

The half year earnings history of Wema Bank shows improvement in the bank’s profit after tax and earnings per share.

Based on the past half year performance of the bank and the current economic reality, we expect that Wema Bank will be able to achieve the earnings per share of 5 kobo in the second quarter.

Below is half year earnings history of the bank for 5 years:

STANBIC IBTC

Stanbic IBTC Bank in the half year of 2019 dropped in its profit after tax to N36.2 billion and earnings per share (EPS) also dropped to N3.45 from the EPS of N4.10 achieved in the second of 2018. Based on the five years earnings of the bank, we project the earnings per share of N3.00 for Stanbic IBTC in the second half of the year.

Below is half year earnings history of the bank for 5 years:

ECOBANK

The half year earnings history of Ecobank for the past five year shows consistent growth in the bank’s earnings since 2016 till date.

Based on the past performance and current economic reality, we project the earnings per share of 3.00 for Ecobank.

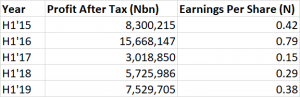

Below is half year earnings history of the bank for 5 years: