Wole Olajide

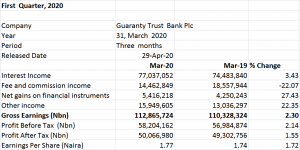

Guaranty Trust Bank reported a profit after tax of N50.07 billion in its financial statement for the period ended, 31 March, 2020. The unaudited financial report of the tier 1 bank for Q1 2020 revealed gross earnings of N112.87 billion, up by 2.30% when compared to the gross earnings of N110.33 billion in the first quarter of 2019.

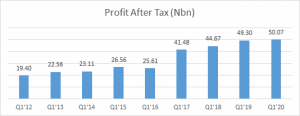

Profit before tax rose by 2.14% to N58.2 billion from the N56.98 billion reported in the first quarter of 2019. Profit after tax grew by 1.55% to settle at N50.07 billion when compared to the profit after tax of N49.30 billion reported in the first quarter of 2019.

The earnings per share of the financial giant stands at N1.77, up by 1.72% when compared earnings per share of N1.74 in Q1, 2019.

In full year 2019 audited financial report, Guaranty Trust Bank reported gross earnings of N435. 31 billion, up by 0.14% compared to N434.70 billion recorded in 2018. Profit before tax grew by 7.48% to settle at N231.71 billion away from from N215.59 billion reported in 2018. The bank posted a profit after tax of N196.85 billion, up by 6.57% away from N184.71 billion reported in 2018. The bank at the end of 2019 financial year gave a total dividend of N2.80 to shareholders.

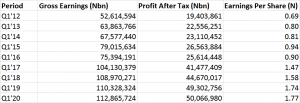

Trend in Gross Earnings, PAT and EPS

Note:

- The Gross Earnings of Guaranty Trust Bank used for this report is obtained by the summation of the following: Interest Income; Fees and Commission Income; Net gains on financial instruments; and Other Income.

- The earnings per share of Guaranty Trust Bank for the reporting period was based on the profit attributable to ordinary shareholders and a weighted average number of ordinary shares outstanding of 28,084,989,000.

Since 2012 till date, Guaranty Trust Bank consistently grew its topline and bottom line figures; except for 2016 when the bank declined in gross earnings, profit after tax and earnings per share which is obviously due to recession that affected every sector in the Nigerian economy. In 2017, the bounced back and has never looked back as regards performance in its Q1 earnings.

Disclosure on the Impact of COVID-19 pandemic

Guaranty Trust Bank in the notes to the financial statement for first quarter 2020, gave an update on proactive measures taken by the group against the covid-19 pandemic which according to the bank triggered a significant disruption to economic activities as well as reduction in social interaction.

The Group responded to the pandemic by activating its Business Continuity Plans, coming up with various initiatives and innovative solutions to prevent business disruptions and ensure continuous flow of services amidst tight conditions. The Group also came up with various palliative measures to ease the difficulty encountered by obligors in identified vulnerable segments and contributes to and Partner with Government on initiatives aimed at alleviating suffering brought about by COVID 19 (health, financial and otherwise).

The Group has identified vulnerable segments and is assessing the impact of Covid-19 on its earnings, liquidity, capital, employee, customers, service providers, regulators and other stakeholders at Normal and Downturn levels. The outcome of the evaluation which is ongoing, in terms of numbers, would be duly disclosed in the subsequent audited financial statements to be issued by the Group.

Also, in response to COVID 19, International Accounting Standard Board, Financial Reporting Council of Nigeria (FRC), Central Bank of Nigeria (CBN), Securities and Exchange Commission (SEC) have all issued pronouncements to guide Entities on disclosures and valuations of Financial Assets. In line with the directives, the Group has put in measures to meet the requirements specified by these bodies e.g. Central Bank of Nigeria that has requested Banks to provide quarterly impact assessment report while SEC requires Public Entities to submit their business continuity plan. FRC on its part issued a guidance note for external auditors on matters to consider during Covid-19 pandemic period which include the fact that management should assess an entity’s ability to continue as a going concern.

The Group will continue to closely monitor the status of the fight against the pandemic and its impact on the Groups’ business. However, based on current assessment, the Directors are confident that the Going Concern of the Group will not be threatened and would be able to continue to operate in Post COVID- 19.

Guaranty Trust Bank is a foremost Financial Institution with business outlays spanning Anglophone and Francophone West Africa, East Africa and Europe. The Bank presently has an Asset Base of over N3.287trillion and employs over 10,000 professionals in Nigeria, Cote D’Ivoire, Gambia, Ghana, Liberia, Kenya, Rwanda, Uganda, Sierra Leone, Tanzania and the United Kingdom.

Established in 1990, on a foundation of excellence, professionalism and best practices, the Bank’s consistent delivery of innovative financial solutions and exceptional customer experiences has enabled it to record year on year growth in clientele base and key financial indices since inception. The Bank’s operation style, staff conduct and service delivery models are built on 8 core principles; Simplicity, Professionalism, Service, Friendliness, Excellence, Trustworthiness, Social Responsibility and Innovation. These Principles are known as the Orange Rules which reflects the Bank’s vibrant Orange corporate colour.

GTBank believes that of far greater importance, beyond providing first class service, is the role it plays in developing the host communities. Hence, Social Responsibility forms a critical part of the GTBank business model and a significant share of our annual profit is channelled to strategic high impact projects that improve Education, Community Development, the Art and Environment.

The vision of the bank is to build an enduring Proudly African and Truly International Institution that plays a fundamental role as a Platform for Enriching Lives by building strong, value adding relationships with our customers, stakeholders and the host communities.