- BUA Cement emerge top in profit margin

- Comparative analysis of manufacturing stocks in FY 2020

The worst hit sector by coronavirus pandemic in year 2020 was the manufacturing sector as majority were affected by lockdown. The market was not expecting much in the performance of manufacturing firms in their 2020 Audited Reports as the pandemic would definitely affect their operations. Interestingly, beyond market expectation, their performance was fairly good as most of them declared dividend despite the tight operating condition in year 2020.

Comparative analysis of stocks in terms of profitability, turnover, dividend growth, dividend yield, earnings growth, earnings yield and profit margin is essential to help investors to gauge performance and know where to pitch their tent in future investment decision.

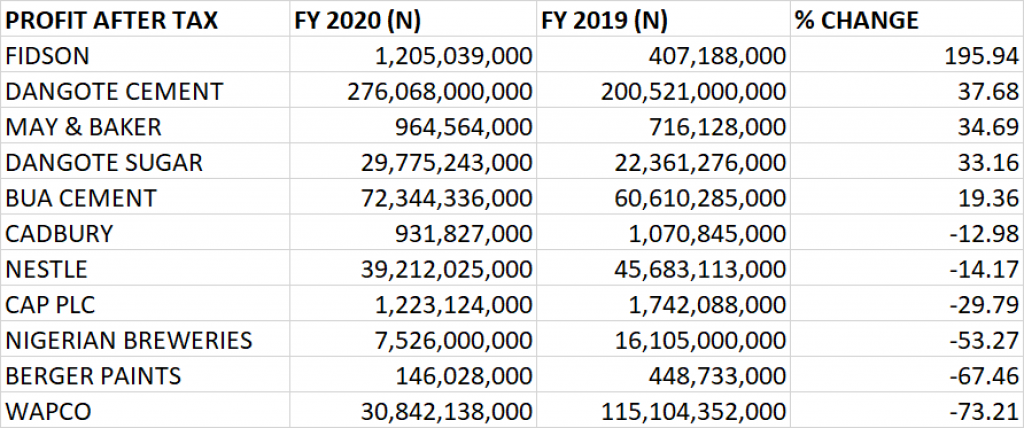

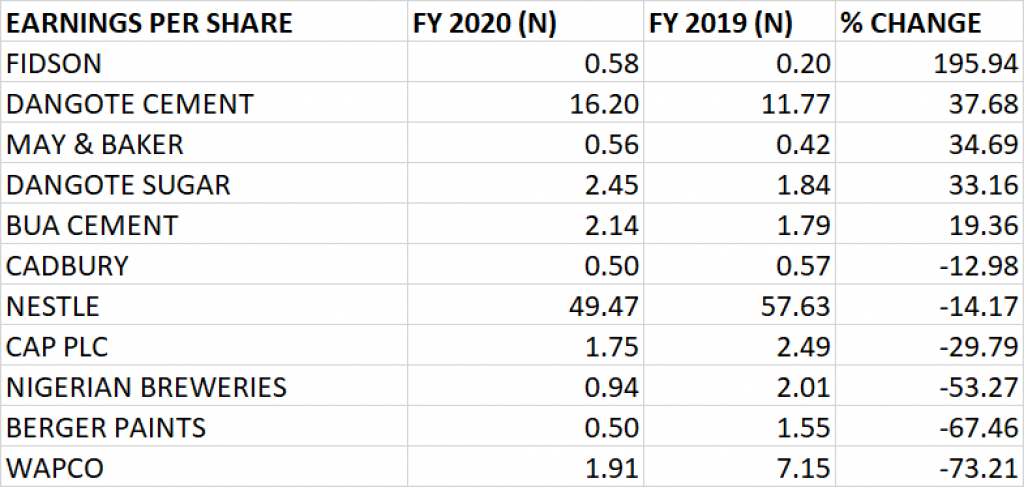

PERFORMANCE IN PROFIT AFTER TAX (PAT)

- Fidson Healthcare Plc grew its profit after tax by 195.94% year on year from N407.118 million to N1.205 billion, emerging best in terms of growth in profit after tax among others in the manufacturing sector.

- Dangote Cement emerged second best in terms of growth in profit after tax as profit grew by 37.68% year on year from N200.52 billion to N276.068 billion.

- May & Baker grew its profit after tax by 34.69% to N964.564 million from N716.128 million, emerging third on the ranking in terms of growth in profit after tax.

- Dangote Sugar achieved profit after tax of N29.775 billion, up by 33.16% from N22.361 billion achieved in 2019, emerging fourth in ranking in terms growth in PAT.

- BUA Cement grew its profit after tax by 19.36% from N60.610 billion to N72.344 billion.

- Cadbury declined in profit after tax by 12.98% year on year to N931.827 million from N1.071 billion.

- Nestle achieved profit after tax of N39.212 billion, down by 14.17% from N45.683 billion achieved the previous year.

- Chemical and Allied Products Plc declined in profit after tax by 29.79% year on year to N1.223 billion from N1.742 billion reported in 2019.

- Nigerian Breweries declined in profit after tax by 53.27% to N7.526 billion from N16.105 billion reported the previous year.

- Berger Paints declined in profit after tax by 67.46% to N146.028 million from N448.733 million.

- Lafarge Africa (Wapco) declined in profit after tax by 73.21% to N30.842 billion from N115.104 billion.

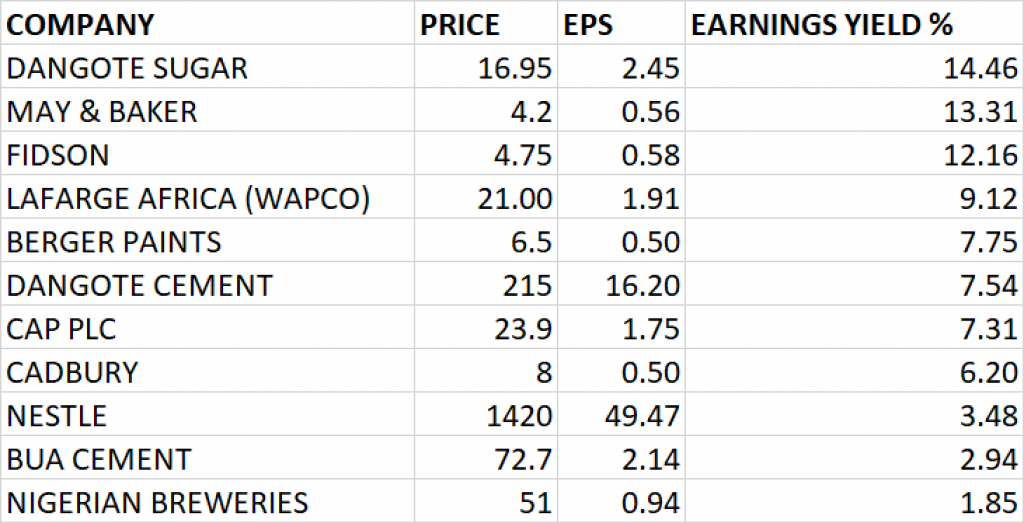

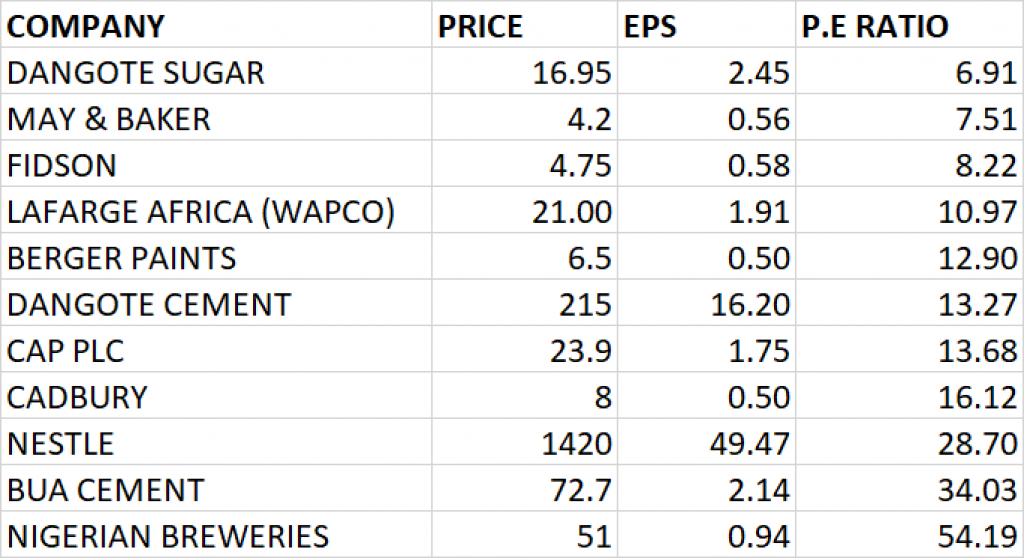

PERFORMANCE IN EARNINGS PER SHARE, P.E RATIO & EARNING’S YIELD

- Earnings per share of Fidson Healthcare increased by 195.94% to 58 kobo from 20 kobo, emerging as overall best in terms of growth in earnings per share in the banking sector. At the share price of N4.75, the P.E ratio of Fidson Healthcare stands at 8.22x with earnings yield of 12.16%.

- Dangote Cement emerged second best in terms of growth in earnings per share as EPS grew by 37.68% year on year from N11.77 to N16.20. At the share price of N215, Dangote Cement has a P.E ratio of 13.27x with earnings yield of 7.54%.

- May & Baker grew its earnings per share by 34.69% to 56 kobo from N42 kobo, emerging third on the ranking in EPS growth. At the share price of N4.2, the P.E ratio of May & Baker stands at 7.51x with earnings yield of 13.31%.

- Dangote Sugar achieved earnings per share of N2.45, up by 33.16% from the EPS of N1.84 achieved in 2019, emerging fourth in ranking in terms of growth. At the share price of N16.95, P.E ratio of Dangote Sugar stands at 6.91x with earnings yield of 14.46%.

- BUA Cement grew its earnings per share by 19.36% to N2.14 from N1.79. At the share price of N72.7, the P.E ratio of BUA Cement stands at 34.03x with earnings yield of 2.94%.

- Cadbury declined in earnings per share by 12.98% year on year to 50 kobo from 57 kobo. At the share price of N8, the P.E ratio of Cadbury stands at 16.12x with earnings yield of 6.2%.

- Nestle achieved the earnings per share of N49.47, down by 14.17% from the EPS of N57.63 achieved the previous year. At the share price of N1420, the P.E ratio of Nestle stands at 28.70x with earnings yield of 3.48%.

- Chemical and Allied Products (CAP) Plc declined in earnings per share by 29.79% year on year to N1.75 from N2.49 reported in 2019. At the share price of N23.90, the P.E ratio of CAP Plc stands at 13.68x with earnings yield of 7.31%.

- Nigerian Breweries declined in earnings per share by 53.27% to 94 kobo from N2.01 reported the previous year. At the share price of N51, the P.E ratio of Nigerian Breweries stands at 54.19x with earnings yield of 1.85%.

- Berger Paints declined in earnings per share by 67.46% to 50 kobo from N1.55. At the share price of N6.5, the P.E ratio of Berger paints stands at 12.90x with earnings yield of 7.75%

- Lafarge Africa (Wapco) declined in earnings per share by 73.21% to N1.91 from N7.15. At the share price of N21, the P.E ratio of Lafarge Africa stands at 10.97x with earnings yield of 9.12%.

- Overall, Dangote Sugar emerged top among others with earnings yield of 14.46%.

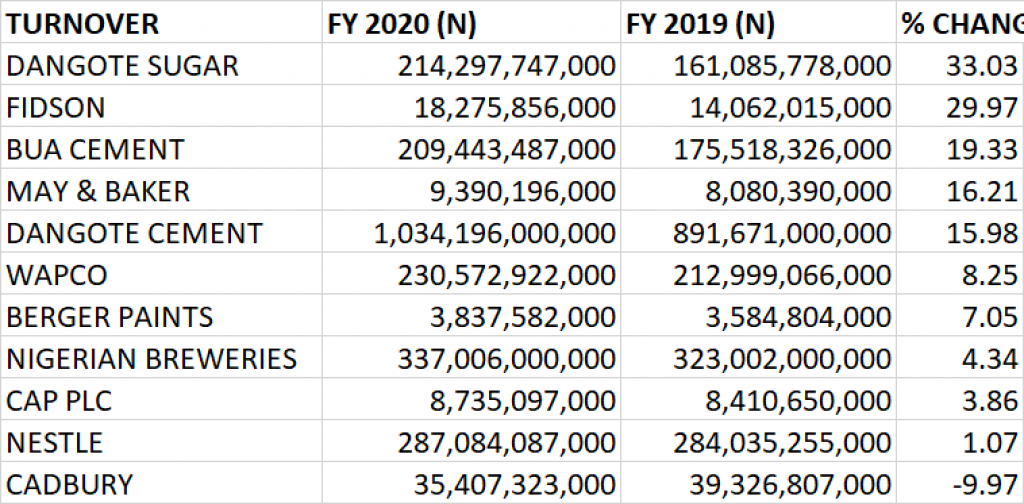

PERFORMANCE IN TURNOVER GROWTH

- Dangote Sugar emerged top in terms of turnover growth among others in the manufacturing sector as it grew its turnover by 33.03% year on year to N214.3 billion from N161.086 billion.

- Second on the list is Fidson Healthcare with a turnover of N18.276 billion, up by 29.97% from N14.062 billion in 2019.

- BUA Cement is third among banks that grew their turnover in year 2020. The revenue of BUA increased by 19.33% year on year to N209.443 billion from N175.518 billion.

- May & Baker is fourth in ranking of turnover growth as it grew its revenue by 16.21% to N9.39 billion from N8.08 billion.

- Dangote Cement emerged fifth in terms of turnover growth as revenue increased by 15.98% to N1.034 trillion from N891.671 billion.

- Lafarge Africa (Wapco) grew its turnover by 8.25% to N230.573 billion from N212.999 billion.

- Berger Paints grew turnover by 7.05% to N3.84 billion from N3.58 billion.

- Nigerian Breweries increased its revenue by 4.34% to N337 billion from N323 billion.

- CAP Plc grew its turnover by 3.86% to N8.735 billion from N8.410 billion.

- Nestle grew its turnover by 1.07% to N287 billion from N284 billion.

- Cadbury declined in its turnover by 9.97% year on year to N35.407 billion from N39.327 billion.

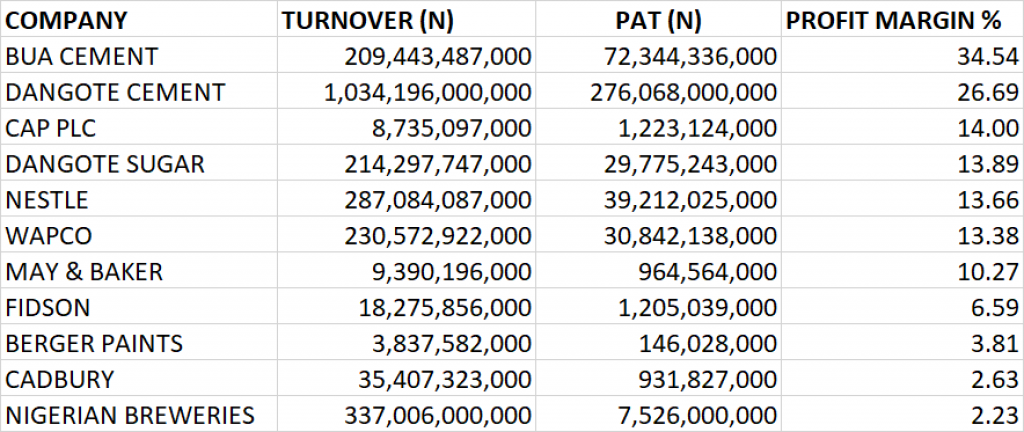

PROFIT MARGIN

- BUA Cement emerged top among others with a profit margin of 34.54% in year 2020.

- Dangote Cement achieved a profit margin of 26.69%, emerging second among others in the manufacturing sector in terms of profit margin.

- CAP Plc in 2020 financial year achieved a profit margin of 14%, emerging third among others.

- Dangote Sugar achieved a profit margin of 13.89% emerging fourth among others.

- Nestle made a profit margin of 13.66% in 2020 financial year.

- Wapco has a profit margin of 13.38%

- May & Baker has a profit margin of 10.27%

- Fidson has a profit margin of 6.59%.

- Berger Paint has a profit margin of 3.81%

- Cadbury has a profit margin of 2.63%

- Nigerian Breweries has a profit margin of 2.23%

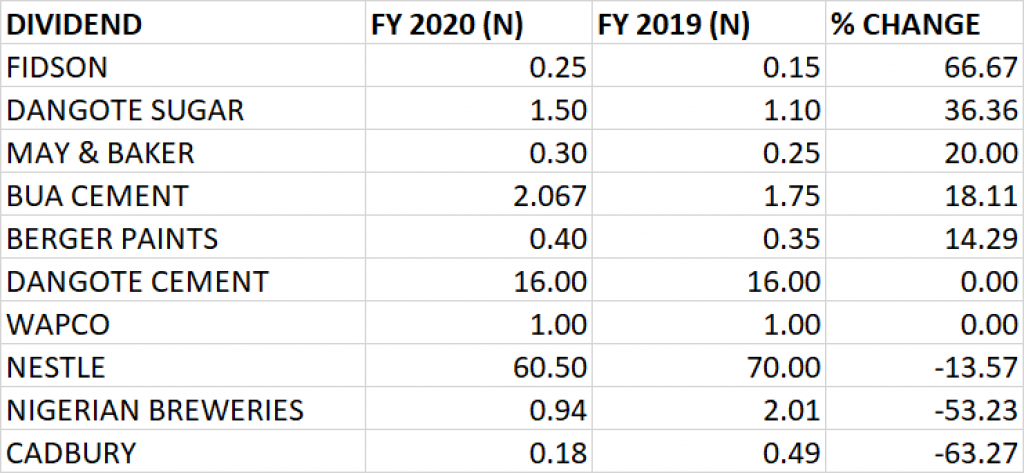

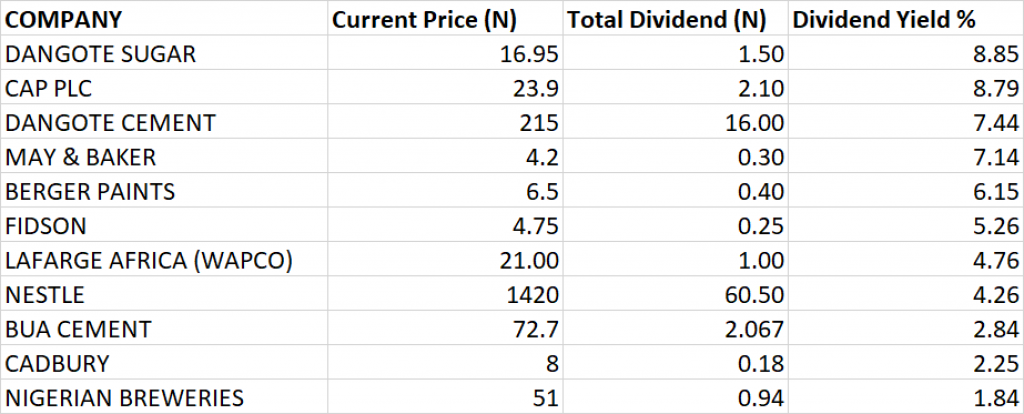

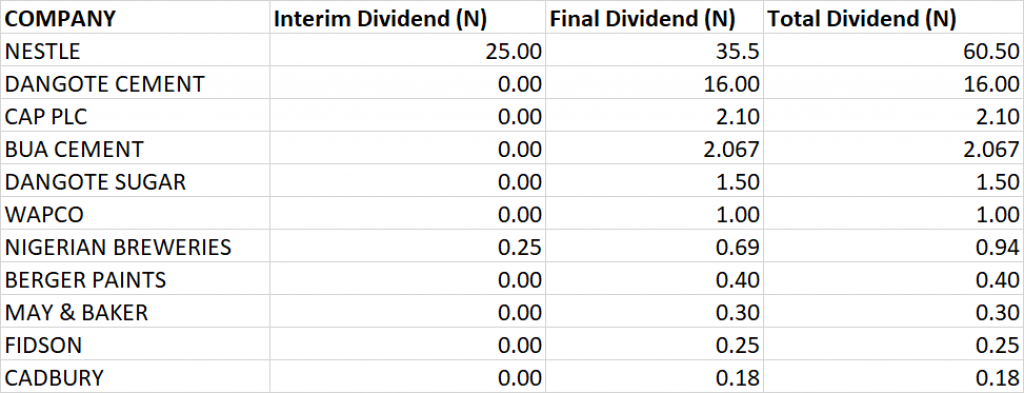

DIVIDEND GROWTH & DIVIDEND YIELD

- Fidson increased their dividend pay-out by 66.67% to 25kobo from 15 kobo, emerging top in dividend growth. At the share price of N4.75, Fidson has a dividend yield of 5.26%.

- Dangote Sugar increased their dividend pay-out by 36.36% to N1.50 from N1.10. At the share price of N16.95, dividend yield of Dangote Sugar stands at 7.85%.

- May & Baker increased their dividend by 20% to 30 kobo from 25 kobo. At the share price of N4.2, the dividend yield of May & Baker stands at 7.14%.

- BUA Cement increased their dividend by 18.11% to N2.067 from N1.75. At the share price of N72.7, the dividend yield of BUA Cement stands at 2.84%.

- Berger Paints increased their dividend by 14.29% to 40 kobo from 35 kobo. At the share price of N6.5, the dividend yield of Berger Paints stands at 6.15%.

- Dangote Cement retained their dividend pay-out of N16 in year 2020, same as the previous year. At the share price of N215, the dividend yield of Dangote Cement stands at 7.44%.

- Lafarge Africa (Wapco) retained their dividend pay-out of N1, same as the previous year. At the share price of N21, Lafarge Africa has a dividend yield of 4.76%.

- Nestle reduced their dividend by 13.57% to N60.50 from N70. At the share price of N1420, the dividend yield of Nestle stands at 4.26%.

- CAP Plc declared N2.10 dividend but did not pay dividend in 2019 stating reasons is due to the future uncertainty of Coronavirus pandemic. However, if we are to compare dividend paid in 2020 with N2.90 paid in 2018, then the company reduced their dividend pay-out by 27.59%.

- Nigerian Breweries reduced their dividend by 53.23% to 94 kobo from N2.01. At the share price of N51, the dividend yield of Nigerian Breweries stands at 1.84%.

- Cadbury reduced their dividend by 63.27% to 18 kobo from 49 kobo. At the share price of N8, the dividend yield of Nigerian Breweries stands at 2.25%.

- Overall, Dangote Sugar has the highest dividend yield of 8.85%. This is followed by CAP Plc and Dangote Cement with dividend yield of 8.79% and 7.44% respectively.