Fbnh on Friday 19th of January 2018, after an unprecedented 4 days rally opened and closed below the previous day’s closing price of N14.75, with 5.76% loss, after it shed 85kobo to close the week at N13.90.

The Bank’s share price has within one year period made several historical actions, traded as low as N2.95, which it touched around March 2017, and also traded as high as N15.16, which was the price it last touched around September 2014. The bank has evidently enjoyed so much of positive sentiment from investors and traders especially since the beginning of the New Year having a Year to date return which stood above 50%.

Fbnh is currently trading close to an immediate resistant price of N14.40, of which a brake of such may likely push the price to test another record high of N16.52. However, if the pull back is successively sustained, we might in the near term see a major correction to as low as N12.10 0r N9.50 before another major upturn.

Note that on the short term, the market enthusiasm as revealed by the Momentum gauge is on the decline.

On the medium and long time frame, the investor’s bias on Fbnh share is still largely bullish with the market momentum aiming higher. We anticipate a break of N16.52 for a fresh high above a major resistant price of N20.

CAUTION: All major oscillating tools signals that the stock is dwelling within an overbought region, but we believe that in the recent manner the market has performed, stock prices can scale fresh highs if the prevailing factors subsist.

Strength and threats

On the back of expected full year earnings and strong economic boost, there are large possibilities that the market 0n the overall might see better days. The prevailing economic policies somewhat favour the capital market as the government reduces stake in Treasury Bill Instrument. Again, the Nation’s external reserves is rising in consonant with the rising all price and all these if sustained will trickle down to Economic buoyancy.

The resilient and tactful management of FBNH has of recent won the shareholders’ admiration, especially in their approach to tackling the depressive NPL.

However, investors should be watchful of any disruptive happenings in the political and economic space, especially the pre-election buildups that is usually characterized by many tensions and threats.

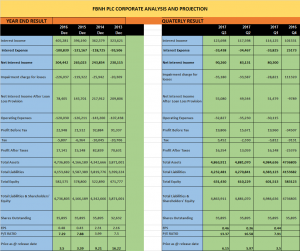

Projections

Cautions on fresh buy at the current oscillating price. A fresh entry could be considered around the 2 major support levels stated above, especially for the risk averse.

With a decent entry level, the stock is good for a medium and long term investment, on the premise of the current administrative prowess and recent improved financial reports.

Lastly, let us seek to understand the peculiarity of our market to be able to play safe and fine.