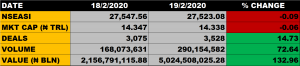

The Nigerian equities market on Wednesday closed on a negative note as the All Share Index closed lower by 0.09% to settle at 27,523.08 points against the previous close of 27,547.56 points on Tuesday.

Market Capitalisation declined by 0.06% to close at N14.338 trillion from the previous close of N14.347 trillion, thereby shedding N9 billion.

Aggregate volume of traded stocks closed at 290 million units, up by 72.64% from the previous close of 168 million units.

Value of traded stocks grew by 132.96% to close at N5.02 billion away from the previous close of N2.16 billion.

Total number of deals at the close of trade was 3,528, up by 14.73% from the previous close of 3,075 deals.

Market Breadth

The Market Breadth closed negative as 13 stocks gained while 17 stocks declined in their share prices.

Percentage Gainers

United Capital led the percentage gainers list with 9.90% growth, closing at N3.22 from the previous close of N3.93. The rally in the share price of United Capital Plc can be attributed to the recent proposed dividend payout of 50 kobo which obviously surpassed the expectations of investors.

Africa Prudential Plc followed suit with 9.87% growth to close at N5.12 from the previous close of N4.66.

AIICO Insurance, C&I Leasing and Unity Bank among other gainers also grew their share prices by 9.76%, 9.48% and 9.26% respectively.

Percentage Losers

Axa Mansard Insurance led the percentage decliners list, shedding 10% of its share price to close at N1.8 from the previous close of N2.00.

Forte Oil, Custodian Investment, NCR Nigeria Plc and Law Union and Rocks Insurance among other price decliners also shed their share prices by 9.97%, 9.92%, 9.40% and 9.09% respectively.

Volume Drivers

Guaranty Trust Bank traded about 79.35 million units of its shares in 233 deals, valued at N2.26 billion.

Zenith Bank traded about 39.99 million units of its shares in 553 deals, valued at N780 million.