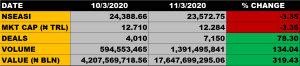

The Nigerian stock market on Wednesday closed on a negative note as the All Share Index declined further by 3.35% to settle at 23,572.75 points against the previous close of 24,388.66 points on Tuesday.

The Market Capitalisation sheds N426 billion to settle at N12.284 trillion against the previous close of N12.710 trillion.

Aggregate volume of traded stocks was 1.39 billion, up by 134% from the previous close of 594.55 million units.

The value of traded stocks grew by 319.43% to close at N17.65 billion from the previous close of N4.2 billion.

Total number of deals was 7,150, up by 78.30% from the previous close of 4,010 deals.

Market Breadth

The market breadth closed negative as 18 stocks gained while 20 stocks declined in their share prices.

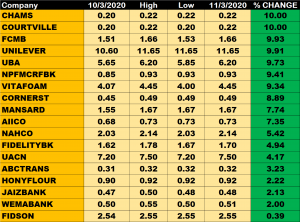

Percentage Gainers

- Chams Plc and Courtville both led the percentage gainers with 10% growth, closing at N0.22 respectively.

- FCMB, Unilever, UBA, NPF Microfinance Bank and Vitafoam among others also grew their share prices by 9.93%, 9.91%, 9.73%, 9.41% and 9.34% respectively.

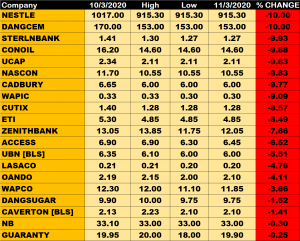

Percentage Losers

- Nestle and Dangote Cement both led the price decliners list, shedding 10% of their share prices to close at N915.3 and N153 respectively.

- Sterling Bank and Conoil among others also shed their share prices by 9.93% and 9.88% respectively.

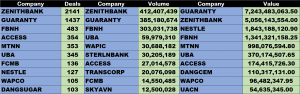

Volume Drivers

- Zenith Bank traded about 412.4 million units of its shares in 2,141 deals, valued at N5.056 billion.

- Guaranty Trust Bank traded about 385 million units of its shares in 1,437 deals, valued at N7.24 billion.

- FBNH traded about 303 million units of its shares in 483 deals, valued at N1.34 billion.