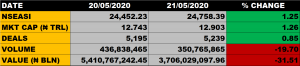

The Nigerian equities market on Thursday closed on a positive note as the All Share Index appreciated further by 1.25% to settle at 24,758.39 points from the previous close of 24,452.23 points on Wednesday.

Market Capitalisation grew by 1.26% to close at N12.903 trillion from the previous close of N12.743 trillion, thereby gaining N160 billion.

An aggregate of 350.77 million units of shares were traded in 5,239 deals, valued at N3.71 billion.

Market Breadth

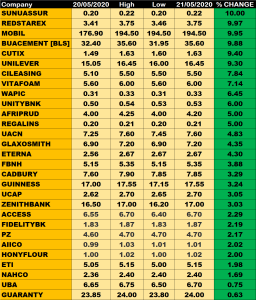

The market breadth closed positive as 29 equities appreciated in their share prices while 9 equities declined in their share prices.

Percentage Gainers

Sunu Assurance Plc led other percentage gainers, closing at N0.22 from the previous close of N0.20.

Red Star Express Plc, Mobil, BUA Cement, Cutix Plc and Unilever among other gainers also grew their share prices by 9.97%, 9.95%, 9.88%, 9.40% and 9.30% respectively.

Percentage Losers

Arbico Plc led other price decliners, shedding 9.91% of its share price to close at N2.09 from the previous close of N2.32.

Other equities on the price decliners’ list include: Oando (-5.76%), Flour Mills of Nigeria (-4.76%), NPF Microfinance Bank (3.55%), Jaiz Bank (3.33%), Union Diagnostic (3.33%), NEM Insurance (2.44%), Fidson Healthcare (1.54%) and Dangote Sugar (0.39%) respectively.

Volume Drivers

- Zenith Bank traded about 57.42 million units of its shares in 723 deals, valued at N961.4 million.

- Ecokorps Plc traded about 57 million units of its shares in 2 deals, valued at N342 million.

- First Bank of Nigeria Holdings (FBNH) traded about 44.36 million units of its shares in 398 deals, valued at N230.97 million.