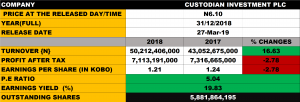

Costodian Investment Plc, audited reports for the full year ended 31th December 2018 was released to the market on 27th March 2019.

Costodian Investment Plc, audited reports for the full year ended 31th December 2018 was released to the market on 27th March 2019.

The reports of the company thst specialized in life insurance showed an appreciation in topline figures to N50 billion from N43 billion recorded in the preceding year of 2017. This represents 16.63% full year growth in revenue.

The profit after tax for the period under review marginally dropped from N7.316 billion in 2017 to N7.113 billion in the current reports, which imply 2.78% decline in (PAT).

The earnings per share also slightly fell by 2.78%, from N1.21 of 2017 to N1.24 in the period under review.

The PE Ratio for the current period stands at 5.04x and the earnings yield at 19.83%.

The Management of the company recommends 35kobo per share as dividend, subject to appropriate withholding tax and ratification will be paid to shareholders whose names appear in the Register of Members as at the close of business on the 11th April 2019.

The Register of Shareholders will be closed from Friday 12th to 17th April, 2019 both dates inclusive and the Qualification date will be 11th April 2019.

Custodian Life Assurance Limited (formerly Crusader Life Insurance Limited) is a specialist life insurance company incorporated in Nigeria and licensed by the National Insurance Commission to transact all classes of life insurance business. Custodian Life Assurance Limited (CLA) is the subsidiary of Custodian Investment Plc, the holding company which is wholly owned by Nigerians. The Company is quoted on the Nigerian Stock Exchange.

CLA started insurance business in 1956 as a foreign office of Crusader Insurance Company Ltd, Reigate UK. It became a public company in 1989 and listed on the Nigeria Stock Exchange in 1990. Following the merger of the parent company, Crusader Nigeria Plc with the Custodian and Allied Insurance Plc, it was renamed Custodian Life Assurance Limited to reflect the new brand of the emerging entity.