For five straight days this week the market has been upbeat occasioned by rally in blue chip stocks and the decision of MPC to retain key lending rates.

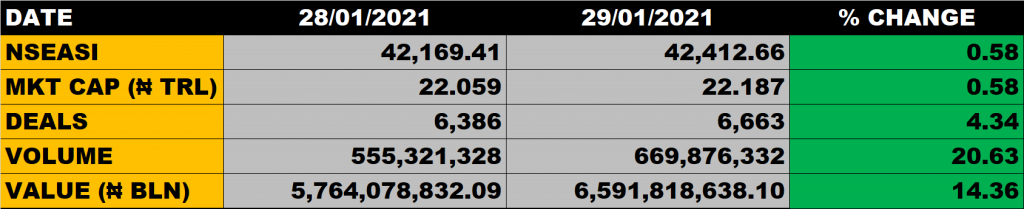

The All Share Index on Friday advanced by 0.58% to settle at 42,412.66 points from the previous close of 42,169.41 points. Week to date, the market has returned 3.44%. The Market Capitalisation grew to N22.187 trillion from the previous close of N22.059 trillion, this translates to N128 billion gain.

An aggregate of 669.876 million units of shares were traded in 6,663 deals, valued at N6.59 billion.

The Market Breadth closed positive as 29 equities emerged as gainers while 25 equities declined in their share prices.

Stocks to Watch

- Access Bank dropped to N9.30 from N9.35. It is currently trading 11.43% away from its 52 weeks high of N10.5. At that, there is uptrend potential in the share price of Access Bank. With the book value of N19.12, Access Bank is considered cheap at the current share price of N9.30.

- FBN Holdings closed flat at N7.60. It is trading 15.56% away from its 52 weeks high of N9 which implies an uptrend potential for the share price of the big elephant. Considering its book value of N19.84, relative to the current share price of N7.60, shows that FBNH is cheap at the current price and has a lot of growth potential embedded in it.

- Zenith Bank closed flat at N27.2. It is trading 4.56% away from its 52 weeks high of N28.5. With the book value of N32.94, relative to the current share price of N27.2, Zenith Bank is underpriced and has growth potentials.

- WAPCO dropped to N30 from N30.3. At a year high of N31.5, there is uptrend potential in Wapco as records have it that it has touched about N52 a few years back.

- UBA closed flat at N9.05. It is trading 7.65% away from its 52 weeks high of N9.8. With the book value of N19.16 as against its current share price of N9.05, UBA is considered cheap and has uptrend potential.

- Guaranty Trust Bank grew to N34.5 from N34. It is trading 10.27% away from its 52 weeks high of N38.45, which suggest an uptrend potential for the share price of Guaranty Trust Bank.

Percentage Gainers

Courteville, Guinea Insurance and NEM Insurance led other gainers with 10% growth, closing at N0.22, N0.22 and N2.42 respectively.

Champion Breweries, Portland Paints and Niger Insurance among other gainers also grew their share prices by 9.89%, 9.72% and 9.52% respectively.

Percentage losers

Trans-Nationwide Express led other price decliners as it shed 10% of its share price to close at N0.99 from the previous close of N1.1.

This is followed by Universal Insurance and Veritas Kapital as they both shed 9.09% of their share prices to close at N0.20 respectively.

Volume Drivers

- Union Bank traded about 76.153 million units of its shares in 62 deals, valued at N441.9 million.

- Transcorp traded about 72.679 million units of its shares in 298 deals, valued at N75.47 million.

- Japaul Gold traded about 58.597 million units of its shares in 362 deals, valued at N55.45 million.