- Market rises further by 2.19% WtD

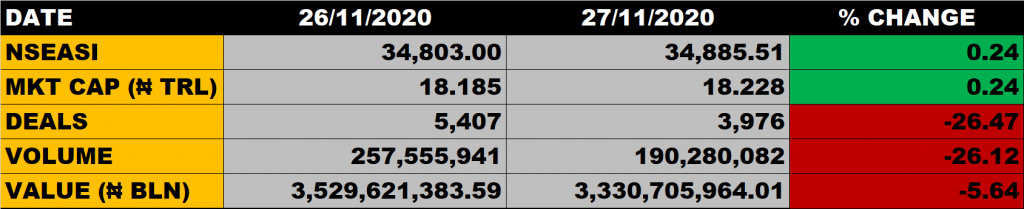

The Bulls are still resident on the floor of the Nigerian Stock Exchange as the All Share Index on Friday appreciated further by 0.24% to settle at 34,885.51 points from the previous close of 34,803.00 points. Investors gain N43 billion as market capitalisation grew to N18.228 trillion from the previous close of N18.185 trillion. Week to date, the market has grown by 2.2% and year to date, the market has advanced by 29.97%.

The market breadth closed firm as 18 equities gained while 16 equities declined in their share prices.

An aggregate of 190.28 million units of shares were traded in 3,976 deals, valued at N3.33 billion.

Stocks to Watch

Fundamentally sound stocks should be at the back on investors’ mind.

Access, UBA and First Bank, Zenith, FCMB, Fidelity, Guaranty Trust Bank and WAPCO are still trading around their axis.

Percentage Gainers

ABC Transport and NAHCO both led other gainers with 9.09% to close at N0.36 and N2.40 respectively.

Royal Exchange, Fidson Healthcare and Unilever among other gainers also grew their share prices by 8.33%, 7.25% and 5.77% respectively.

Percentage Losers

Portland Paints led other price decliners as it shed 8.42% of its share price to close at N2.61 from the previous close of N2.85.

AXA Mansard and Honeywell Flour among other price decliners also shed their share prices by 6.40% and 5.31% respectively.

Volume Drivers

- Transcorp Plc traded about 37.49 million units of its shares in 182 deals, valued at N37.646 million.

- Access Bank traded about 22.87 million units of its shares in 190 deals, valued at N195.907 million.

- FBN Holdings Plc traded about 19.79 million units of its shares in 222 deals, valued at N145.66 million.

The market breadth turned positive but weak for the week as the number of advancers ’ outpaced decliners in the ratio of 35:31 on improved volume of trade with more buying positions as against the previous week s. Meanwhile, global markets closed the period under review on a positive note, with the U.S markets and Germany‘s DAX in the green while Britain’s FTSE and Japan’s Nikkei were in the red. The U.S markets indexes moved mixed as Federal Reserve opted to keep interest rates unchanged. Also economic indicators are pointing to the fact there is improvement in the U.S economy on the strength of positive employment data and increasing home sales to reflect strong consumer spending. Investors cautious trading was as a result of overpriced equities as revealed by the Price Earnings Ratio, and if corporate earnings fall below investors expectations it may led to more profit taking in the days ahead. International equity prices were in the mixed direction as European zone economic performance for second quarter were not strong economy.