Over the past 26 years, Access Bank Plc has evolved from an obscure Nigerian Bank into a world-class African financial institution. Today, the bank is one of the five largest banks in Nigeria in terms of assets, loans, deposits and branch network.

Performance of Access Bank over the past 5 years has been impressive as consistent growth is observed in topline and bottom line figures of the bank quarter on quarter. In the last one year, the share price of Access Bank has experienced an unprecedented gyrations bringing good returns to smart investors in terms of price appreciation.

At the current share price of N9.3, with a 52 weeks high and low of N10.50 and N5.30 respectively, the share price of the group has grown by 75.47% within the mentioned period, having another 11.42% potential rally away from its noted 52 weeks high.

In first quarter of year 2020, the bank posted the gross earnings of N264.5 billion, up by 71.86% when compared to the gross earnings of N153.9 billion in first quarter of 2019.

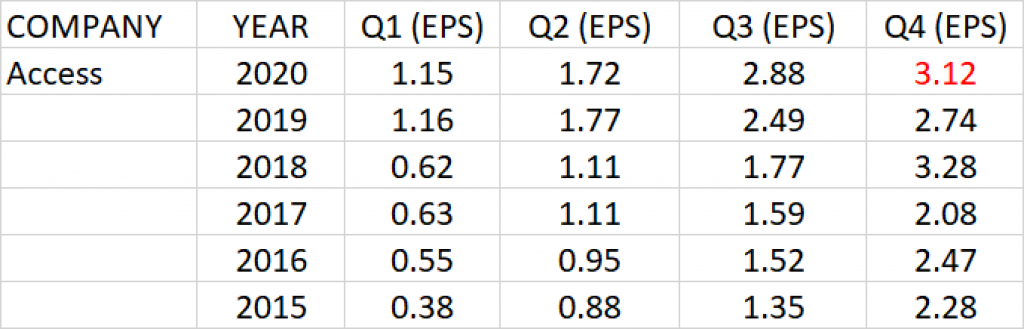

Profit after tax in Q1’20 was N40.93 billion, down by 0.53% when compared to the profit after tax of N41.15 billion reported in the first quarter of 2019. The earnings per share achieved in Q1’20 dropped to N1.15 from N1.16 achieved the previous year.

In Q2’20, the Bank reported a Gross Earnings of N396.76 billion, up by 22.31% from N324.38 billion achieved in the first half of 2019. Profit before tax grew by 1.84% to N74.31 billion from N72.96 billion reported in Half Year 2019. Profit after tax in Q2’20 was N61.03 billion, down by 1.36% from N61.87 billion reported in H1’19. Earnings per share of the bank in Q2’20 was N1.72, down by 1.36% from the EPS of N1.74.

Access Bank in Q3’20 grew its gross earnings by 15.41% year on year to N592.79 billion from N513.66 billion. Profit after tax grew by 15.68% year on year to N102.3 billion from N88.44 billion. Earnings per share grew to N2.9 which also translates to 15.68% growth year on year.

Based on the past earnings history of the bank for the 5 years, Full Year 2020 earnings of Access Bank is expected to be better than the previous year.

Using PEG ratio, FY’20 earnings per share (EPS) of Access Bank is expected to grow by 13.87% from the EPS of N2.74 achieved in FY’19. At that an EPS of about N3.12 is expected for Access Bank in its FY’20 audited report.

PEG ratio (price/earnings to growth ratio) is a valuation metric for determining the relative trade-off between the price of a stock, the earnings generated per share (EPS), and the company’s expected growth.

Access Bank is likely to pay a final dividend of 40 kobo in addition to 25 kobo interim dividend, making a total dividend of 65 kobo in 2020 financial year.