Transactions on the floor of the Nigerian Exchange last week closed in red as the All Share Index closed lower by 1.60% week on week to settle at 39,198.75 points from the previous close of 39,834.42 points the previous week. The Market Capitalisation declined by 2% week on week to close at N20.431 trillion from N20.847 trillion.

In the course of last week, 11 Plc (Formerly Mobil) and VALUE FUND were delisted from the daily official list of Nigerian Exchange (NGX). MTN and Seplat were also marked down for dividend.

An aggregate of 1.419 billion units of shares were traded in 18,459 deals, valued at N15.918 billion last week.

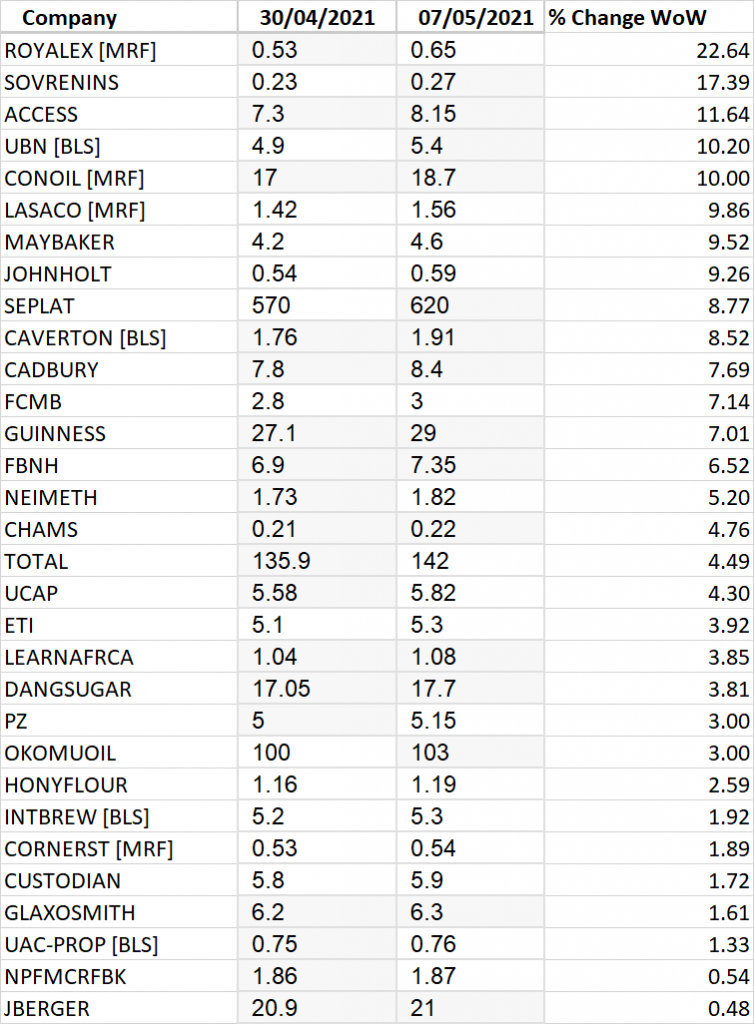

Thirty one (31) equities emerged on the gainers list against 37 equities that declined in their share prices, bringing the market breadth to a negative close.

Commenting on the market performance, the CEO of Global View Capital Limited, Aruna Kebira, stated thus:

“People need not be discouraged because the market looked down last week. Most of the highly capitalised stocks are marked down for dividend. For example, Seplat and MTN were marked down for dividend. We understand that in the market, the moment a stock is marked down for dividend, there is nothing to look forward to; and you see people trying to exit. But for discerning investors, especially when you have at your fingertips the performance of such a stock in the last quarter result. I don’t think that the effect of the Q1 result in the market has waned. I believe we will continue the see the effect. Even when the index is coming down, because of the effect of the highly capitalised stocks; when you go through the performance of Q1 earnings. Some of these companies with good earning yield are looking up and they are still doing fine”.

GAINERS

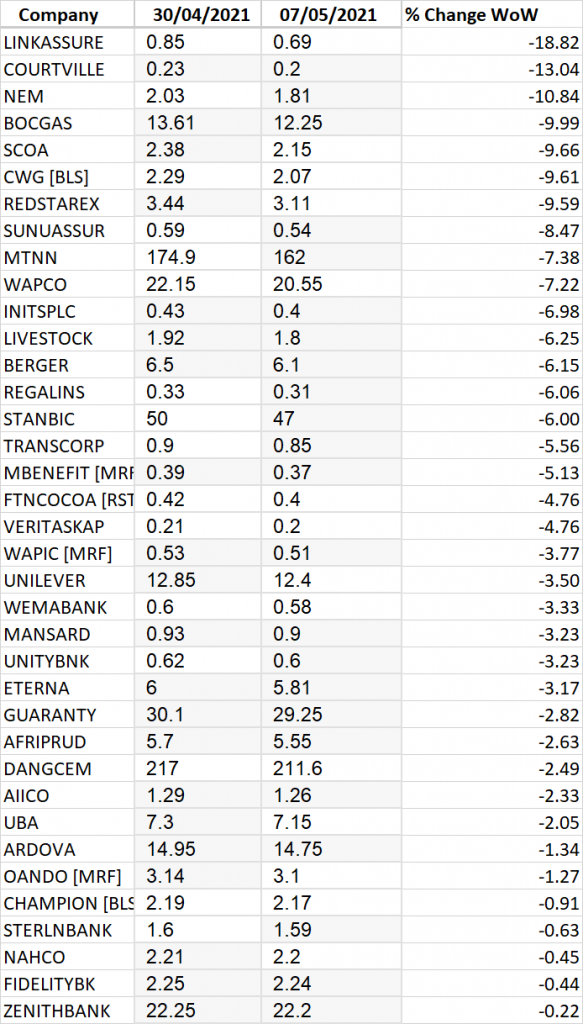

LOSERS