The Banking sector in 2019 went through a lot of hurdles, most especially from their Apex regulator, CBN. Loan to Deposit ratio was initial increased to 60% and sanctions was given to defaulting banks that did not meet deadline. Almost immediately after the deadline, Loan to Deposit ratio was jacked up again to 65%, putting most banks under pressure.

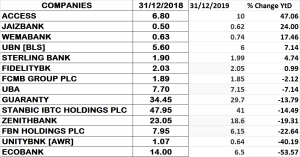

Price performance of Bank stocks on the floor of the Nigerian Stock Exchange in 2019 could be rated low as only 6 out of 14 Banks listed on the Nigerian Stock Exchange appreciated in their price performance year to date.

In the review year 2019, Access Bank emerged as top gainer in the banking sector with 47.06% growth from N6.80 to close for the year at N10.

Within this period, Access bank traded as low as N5.65 and peaked at N10 which it closed for the year. The stock closed yesterday at N10.80, surpassing its 2019 high already.

Zenith Bank shed 19.31% of its share price in 2019 to close the year at N18.6 from N23.05.

The stock also traded as low as N16.27 and as high as N25.31. It closed yesterday at N20.

Guaranty Trust Bank closed the year 2019 at N29.70, shedding 13.79% of its share price from N34.45 it traded last year.

Within same year, the stock traded lowest at N25.68 and traded as high as N38.56, closing yesterday at N31.

First Bank of Nigeria Holdings (FBNH) shed 22.64% of its share price in 2019 to close the year at N6.15 against its previous reference price of N7.95.

It closed yesterday at N6.95 gaining about 5%. The lowest it traded last year was N6.64 with a high of N8.24.

UBA shed 7.14% of its share price closing the year 2019 at N7.15 from N7.70, with N7.92 high and N5.53 low in 2019, Closing N8.05 yesterday.

FCMB closed the year 2019 with the share price of N1.85, shedding 2.12% from N1.89. The year high was N2.36 while the year low was N1.55. It closed maximum 10% higher yesterday at N2.09.

Wema Bank which came third on the percentage gainers’ list with 17.46% growth year to date had it share price moved from N0.63 in the beginning of 2019 to close at N0.74 at the close of trade in 2019. It has a high of 92kobo and 58kobo low within the year. It also closed 74 kobo yesterday.

Union Bank is the fourth on the percentage gainers list with 7.14% growth as the price moved from N5.60 to N6.00 within the review period, traded as low as N5.71 with N7.11 high.

Sterling Bank grew its share price by 4.74%, closing the year at the share price of N1.99 from N1.90.

It traded high at N2.72 and went as low as N1.81. It closed N2.04 yesterday.

Fidelity Bank grew its share price by 0.99%, closing the year 2019 at N2.05 from N2.03 at the beginning of the year 2019.

It has a high of N2.62 and low of N1.46 closing yesterday at N2.23.

Jaiz Bank, grew its share price by 24% from N0.50 to N0.62 at the close of trade in 2019.

It has an high of 74 kobo and low of 36kobo.

Ecobank top the percentage price decliners list in the banking sector for the year shedding 53.57% of its share price to close at N6.5 from N14.00.

It’s high for the year under review was N14.80 while the low was N6.30. It closed yesterday at N7.40.

Stanbic IBTC shed its share price by 14.49% to close at N41 from N47.95. It has an high of N48.79 and low of N34.06.

Unity Bank shed 40.19% if it’s share price in the year, closing at N0.64 from N1.07, with a high of N1.06 and low of 56kobo.