The Nigerian stock market last week closed on a negative note as the All Share Index and Market Capitalisation was down by 0.62% week on week. The month of February closed on a positive note with a growth of 3.18%. Year to date, the market has returned 4.76% with the All Share Index and Market Capitalisation at 107,821.39 points and N67.193 trillion respectively.

A total turnover of 1.848 billion shares worth N51.387 billion in 63,090 deals was traded this week by investors on the floor of the Exchange, in contrast to a total of 2.001 billion shares valued at N49.486 billion that exchanged hands last week in 70,853 deals.

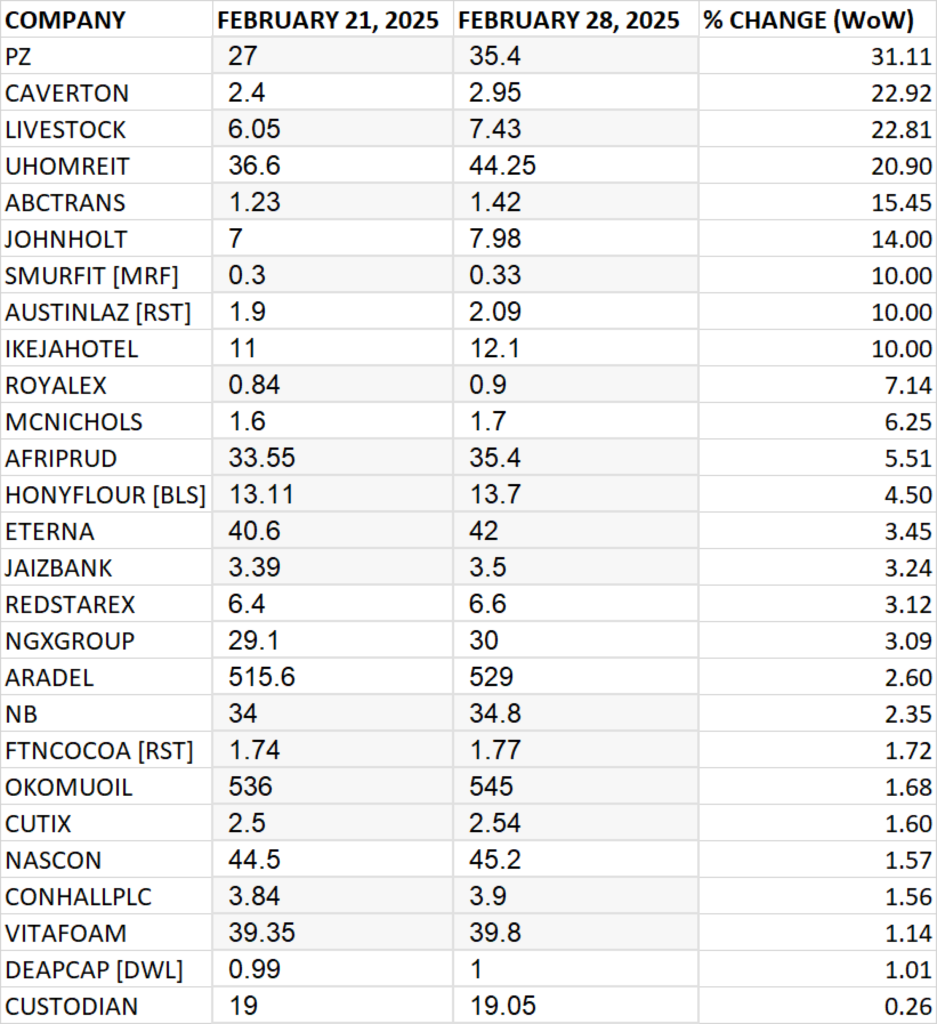

Twenty-seven (27) equities appreciated in price during the week, lower than twenty-eight (28) equities in the previous week. Sixty (60) equities depreciated in price, higher than fifty-eight (58) in the previous week, while sixty-three (63) equities remained unchanged, lower than sixty-four (64) recorded in the previous week.

The Financial Services Industry (measured by volume) led the activity chart with 1.296 billion shares valued at N26.914 billion traded in 29,140 deals; thus contributing 70.13% and 52.38% to the total equity turnover volume and value respectively. The Services industry followed with 129.443 million shares worth N719.218 million in 3,657 deals. Third place was the Consumer Goods Industry, with a turnover of 116.696 million shares worth N4.185 billion in 7,452 deals.

Trading in the top three equities namely Zenith Bank Plc, FCMB Group Plc and Access Holdings Plc (measured by volume) accounted for 539.768 million shares worth N16.528 billion in 7,392 deals, contributing 29.21% and 32.16% to the total equity turnover volume and value respectively.

GAINERS

LOSERS