- Comparative analysis of select manufacturing stocks

The Bulls in the past few weeks have dominated the Nigerian stock market, triggered by sterling performance of FY 2021 and Q1 2022 results of listed companies on the Nigerian Exchange. Prices of stocks have been rewarded accordingly with some stocks hitting new 52 weeks high. Year to date, the All Share Index has grown by 24.30%, while the Market Capitalisation grew by 28.39% YtD.

Performance of manufacturers in the First Quarter of 2022 was quite impressive, compared to the figures released in the corresponding period of 2021. Just like we did comparative analysis for banking and insurance stocks in the previous articles, this edition is dedicated to manufacturing firms as we compare their Q1 2022 earnings in terms turnover size, turnover growth, profit after tax, earnings per share, P/E ratio and earnings yield.

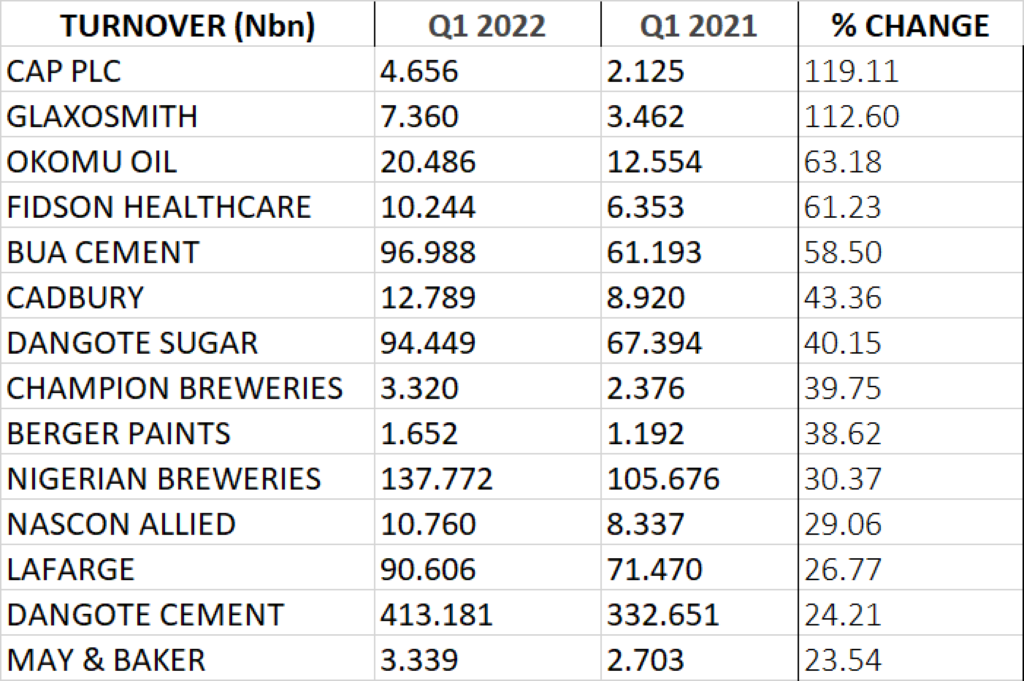

TURNOVER GROWTH

- Chemical and Allied Products Plc emerged top among others with 119.11% growth in turnover from N2.125 billion to N4.656 billion.

- Glaxosmith is second on the list in terms of turnover growth. It grew its revenue by 112.60% to N7.36 billion from N3.462 billion reported the previous year.

- Okomu Oil grew its turnover by 63.18% to N20.486 billion from N12.554 billion reported the previous year

- Fidson Healthcare grew its turnover by 61.23% to N10.244 billion from N6.353 billion reported in Q1 2021.

- BUA Cement is the fifth in ranking in terms of growth in turnover as it grew by 58.50% from N61.193 billion to N96.988 billion.

- Others in the ranking in terms of turnover growth include: Cadbury (43.36%), Dangote Sugar (40.15%), Champion Breweries (39.75%), Berger Paints (38.62%), Nigerian Breweries (30.37%), NASCON Allied Industries (29.06%), Lafarge Africa (26.77%), Dangote Cement (24.21%) and May & Baker (23.54%) respectively.

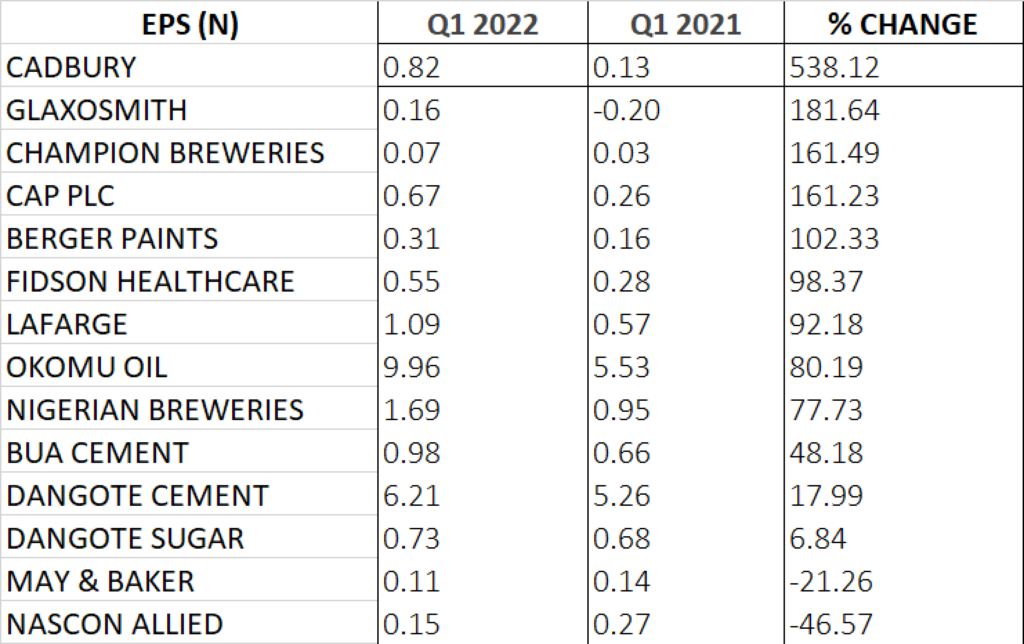

PROFIT AFTER TAX GROWTH

- Cadbury emerged top among others with 538.12% growth in profit after tax from N242 million to N1.542 billion.

- Glaxosmith is second on the list in terms of growth in profit after tax. It grew by 181.64% to N194 million from a loss after tax of N238 million reported the previous year.

- Champion Breweries grew its profit after tax by 161.49% to N554 million from N212 million reported the previous year.

- Chemical and Allied Products Plc grew its profit after tax by 161.23% to N531 million from N203 million reported in Q1 2021.

- Berger Paints grew its profit after tax by 102.33% to N91 million from N45 million reported the previous year.

- Others in the ranking as regards growth in profit after tax in Q1 2022 include: Fidson Healthcare (98.37%), Lafarge (92.18%), Okomu (80.19%), Nigerian Breweries (77.73%), BUA Cement (48.18%), Dangote Cement (17.99%) and Dangote Sugar (6.84%) respectively.

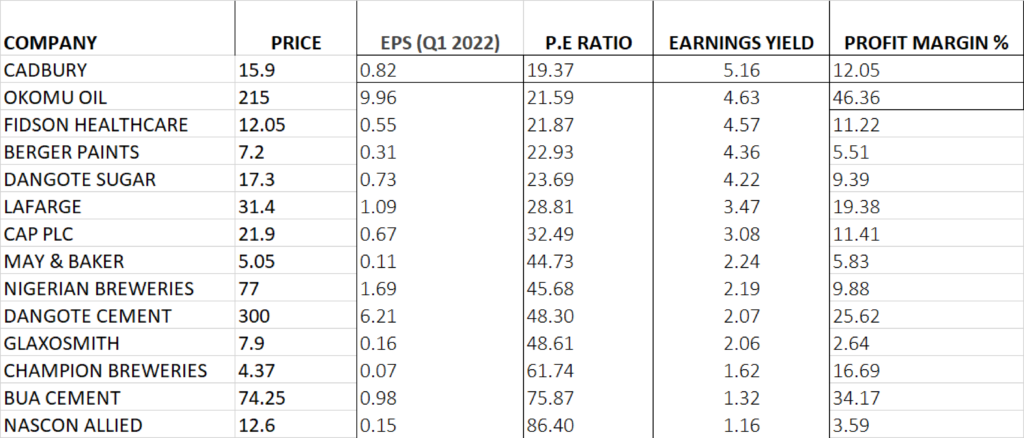

PERFOMANCE IN EARNINGS PER SHARE, P/E RATIO AND EARNINGS YIELD

- CADBURY

The Earnings per share of Cadbury increased year on year by 538.12% to 82 kobo from the EPS of 13 kobo reported in Q1 2021.

At the share price of N15.90, the P/E ratio of Cadbury Nigeria Plc stands at 19.37x with earnings yield of 5.16%.

- OKOMU OIL

The earnings per share of Okomu stands at N9.96, up by 80.19% from the EPS of N5.53 achieved the previous year.

At the share price of N215, the P/E ratio of Okomu Oil stands at 21.59x with earnings yield of 4.63%.

- FIDSON

The Earnings per share of Fidson Healthcare increased by 98.37% to 55 kobo from the EPS of 28 kobo achieved the previous year.

At the share price of N12.05, the P/E ratio of Fidson stands at 21.87x with earnings yield of 4.57%.

- LAFARGE AFRICA

The Earnings per share of Lafarge Africa increased by 92.18% to N1.09 from the EPS of N0.57 achieved the previous year.

At the share price of N31.0, the P/E ratio of Lafarge Africa stands at 28.81x with earnings yield of 3.47%.

- NIGERIAN BREWERIES

The Earnings per share of Nigerian Breweries increased by 77.33% to N1.69 from the EPS of N0.95 achieved the previous year.

At the share price of N77, the P/E ratio of Nigerian Breweries stands at 45.68x with earnings yield of 2.19%.

- DANGOTE CEMENT

The Earnings per share of Dangote Cement increased by 17.99% to N6.21 from the EPS of N5.26 achieved the previous year.

At the share price of N300, the P/E ratio of Dangote Cement stands at 48.30x with earnings yield of 2.07%.

But i disagree with this where do you put multiverse in all of this, they have tremendously increased their turnover by over 300% even their button line. Really don’t know the negative sentiments towards this company.

Note that Multiverse is not into manufacturing, hence it does not fit into the comparative analysis. This report is on manufacturing stocks. Multiverse is into mining.

This report is incorrect as multiverse grew revenue by 300% and Same with bottom Line.

Note that Multiverse is not into manufacturing, hence it does not fit into the comparative analysis. This report is on manufacturing stocks. Multiverse is into mining.