The Nigerian stock market last week closed on a bullish note as investors take position ahead of Q3 earnings of listed firms on NGX.

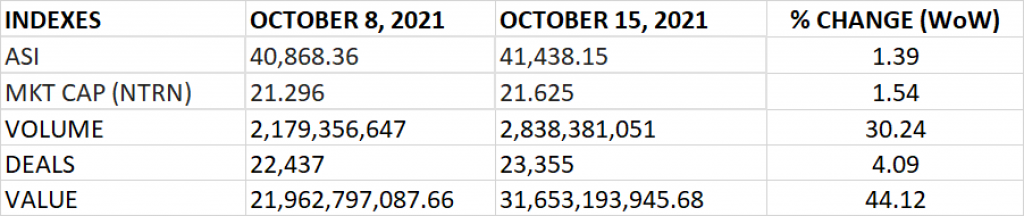

The All Share Index appreciated by 1.39% week on week to close at 41,438.15 points from the previous close of 40,868.36 points. Year to date, the market has returned 2.90%.

The Market Capitalisation grew by 1.54% week on week, to close at N21.625 trillion from the previous close of N21.296 trillion, thereby gaining N329 billion.

An aggregate of 2.838 billion units of shares were traded in 23,355 deals, valued at N31.65 billion.

The Market Breadth closed positive as 45 equities emerged as gainers against 15 equities that declined in their share prices.

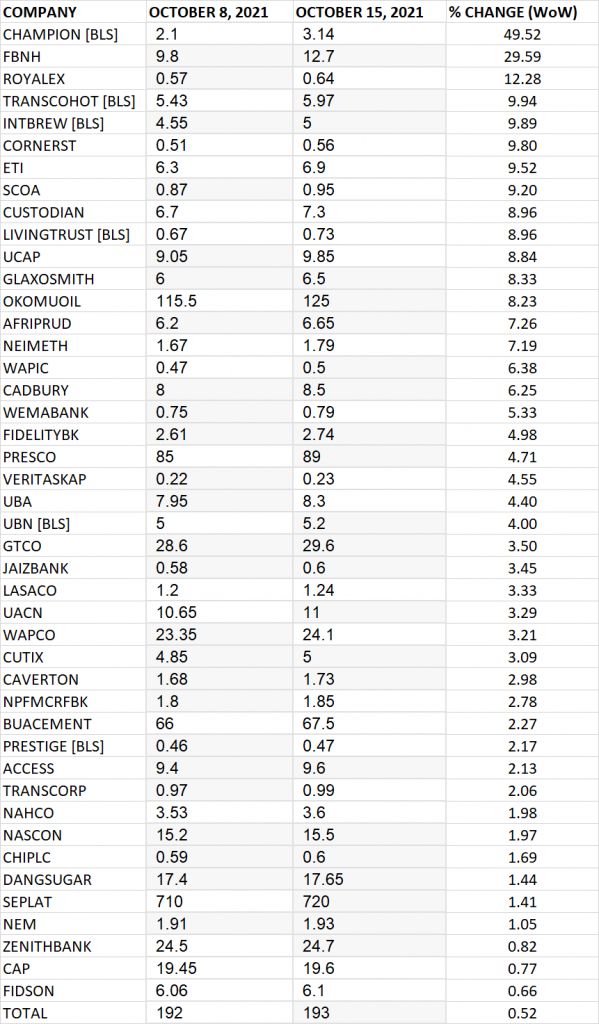

Top 10 Gainers

Champion Breweries led other gainers with 49.52% growth to close at N3.14 from the previous close of N2.1.

First Bank of Nigeria Holdings, Royal Exchange, Transcorp Hotel and International Breweries grew their share prices by 29.59%, 12.28%, 9.94% and 9.89% respectively.

Other top ten gainers include: Cornerstone Insurance (9.80%), Ecobank (9.52%), SCOA (9.20%), Custodian Investment (8.96%) and Living Trust Mortgage Bank (8.96%) respectively.

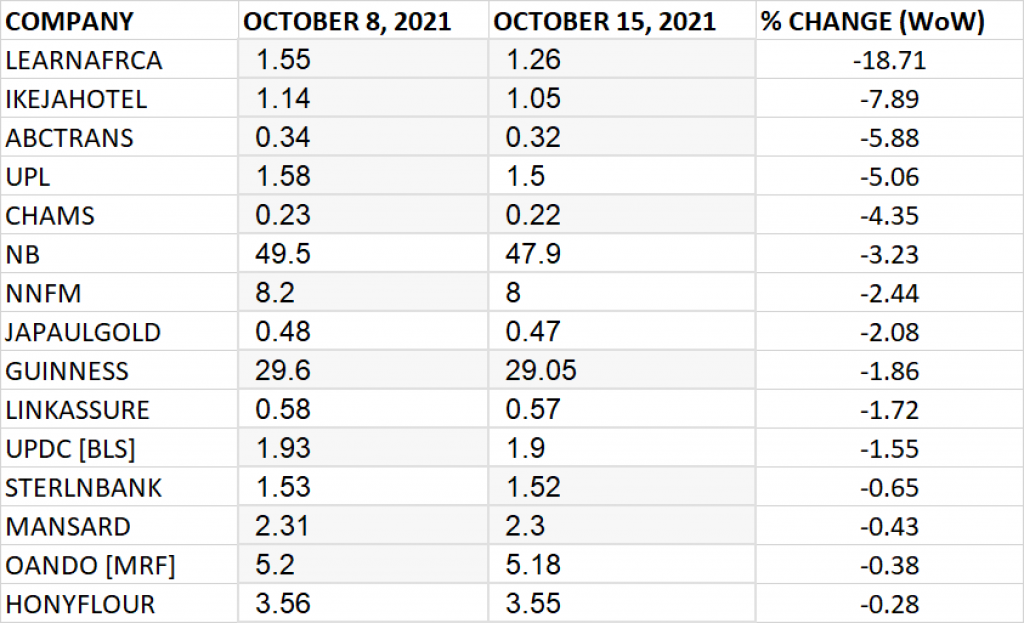

Top 10 Losers

Learn Africa led other price decliners as it sheds 18.71% of its share price to close at N1.26 from the previous close of N1.55.

Ikeja Hotel, ABC Transport, University Press and Chams Plc shed their share prices by 7.89%, 5.88%, 5.06% and 4.35% respectively.

Other top ten price decliners include: Nigerian Breweries (-3.23%), Northern Nigerian Flour Mills (-2.44%), Japaul Gold (-2.08%), Guinness (-1.86%) and Linkage Assurance (-1.72%) respectively.

GAINERS

LOSERS