The stock market in the last couple of days has been trending up as smart investors are taking position against the expected Q3 2021 earnings. The market has actually recovered from its loss position as the NGXASI returned 1.48% year to date.

Just like we have earlier advised that investment in stocks is done against expectation and not on realities. It is worthy to note that expectation is the mother of all investment strategies.

In the last edition, we did Q3 earnings forecast for banking stocks. Our projections for this edition is for the manufacturing firms.

Our projections of Q3 earnings for manufacturing firms is based on their PEG ratios. PEG ratio (price/earnings to growth ratio) is a valuation metric for determining the relative trade-off between the price of a stock, the earnings per share (EPS), and the company’s expected growth. In other words, it is not enough for anyone to invest on just the strength of a company’s previous or latest earnings but these in addition to the expected earnings.

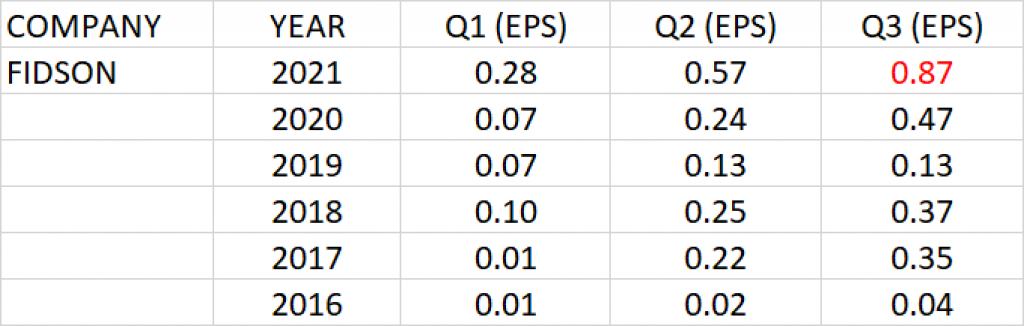

FIDSON HEALTHCARE

Q3 earnings per share of Fidson Healthcare over the last 5 years ranged between 47 kobo and 4 kobo with earnings growth rate of 85.14%.

At the current share price of N6.06 and Q3’20 earnings per share of 47 kobo, its P.E ratio is estimated at 12.89x.

PEG ratio against the expected Q3 2021 earnings is 0.15.

Q3 earnings per share of about N0.87 is projected for Fidson Healthcare.

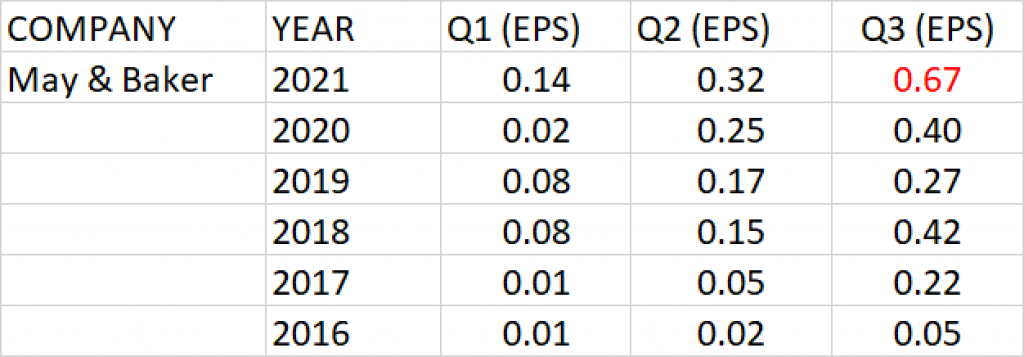

MAY & BAKER

Q3 earnings per share of May & Baker over the last 5 years ranged between 40 kobo and 5 kobo with earnings growth rate of 68.18%.

At the current share price of N4.74 and Q3’20 earnings per share of 40 kobo, its P.E ratio is estimated at 11.85x.

PEG ratio against the expected Q3 2021 earnings is 0.17.

Q3 Earnings per share of about N0.67 is projected for May & Baker.

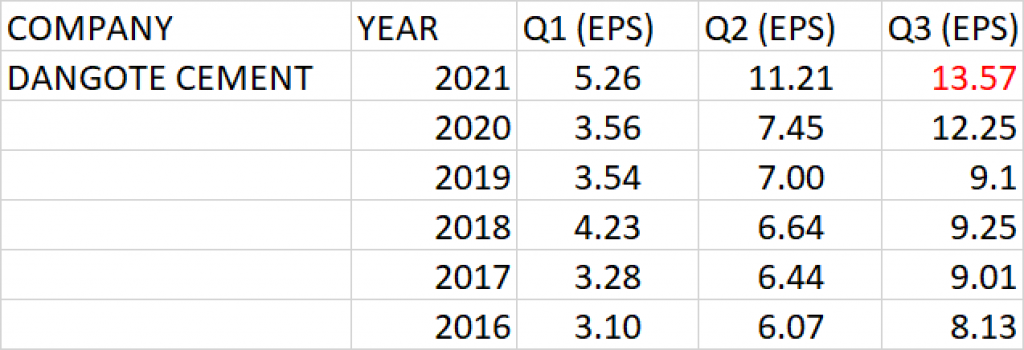

DANGOTE CEMENT

Dangote Cement over the last 5 years has Q3 earnings per share (EPS) ranging between N12.25 and N8.13 with earnings growth rate of 10.79%.

At the current share price of N280 and Q3’20 earnings per share of N12.25, its P.E ratio is estimated at 22.86x.

PEG ratio against the expected Q3 2021 earnings is 2.12.

Q3 earnings per share of about N13.57 is projected for Dangote Cement.

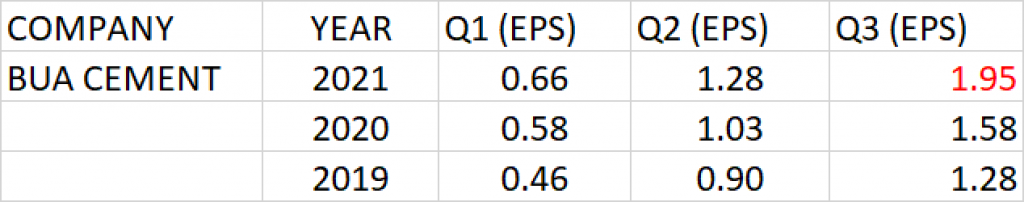

BUA CEMENT

BUA Cement over the last 2 years has Q3 earnings per share (EPS) ranging between N1.58 and N1.28 with earnings growth rate of 23.44%.

At the current share price of N66 and Q3’20 earnings per share of N1.58, its P.E ratio is estimated at 41.77x.

PEG ratio against the expected Q3 2021 earnings is 1.78.

Q3 earnings per share of about N1.95 is projected for BUA Cement.

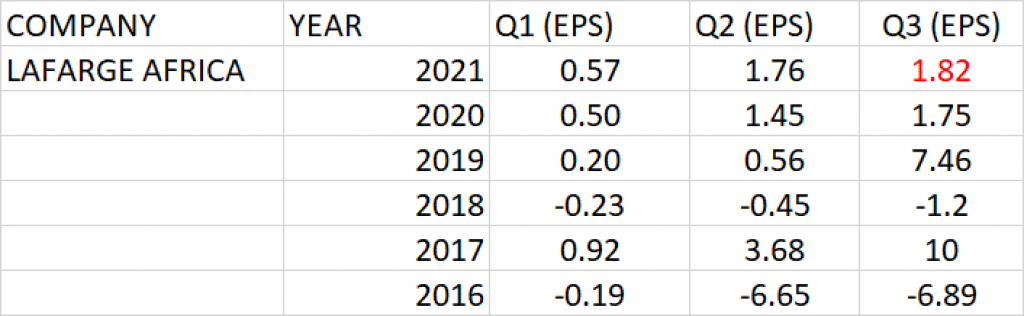

LAFARGE AFRICA (WAPCO)

Q3 earnings per share of Lafarge Africa over the last 5 years ranged between N1.75 and –N6.89 with earnings growth rate of 4.28%.

At the current share price of N23.35 and Q3’20 earnings per share of N1.75, its P.E ratio is estimated at 13.34x.

PEG ratio against the expected Q3 2021 earnings is 3.12.

Q3 earnings per share of about N1.82 is projected for Lafarge Africa.

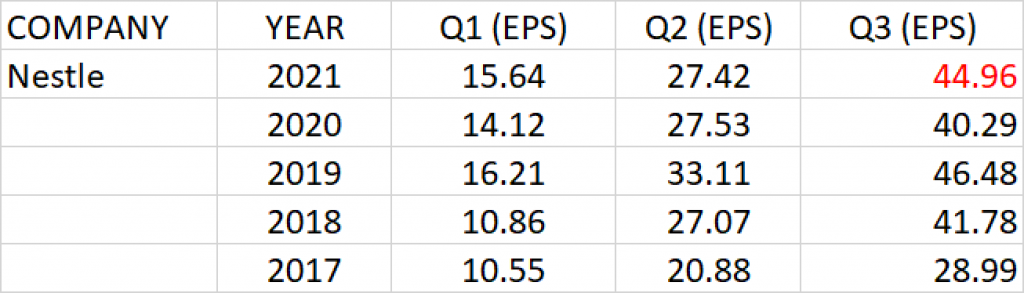

NESTLE

Q3 earnings per share of Nestle over the last 4 years ranged between N40.29 and N28.99 with earnings growth rate of 11.6%.

At the current share price of N1480 and Q3’20 earnings per share of N40.29, its P.E ratio is estimated at 36.73x.

PEG ratio against the expected Q3 2021 earnings is 3.17.

Q3 Earnings per share of about N44.96 is projected for Nestle.

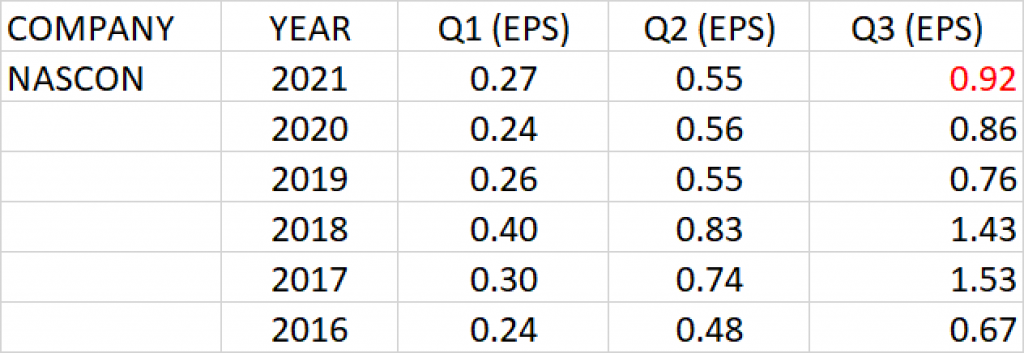

NASCON ALLIED INDUSTRIES

Q3 earnings per share of Nascon Allied Industries over the last 5 years ranged between 86 kobo and 67 kobo with earnings growth rate of 6.44%.

At the current share price of N15.2 and Q3’20 earnings per share of N0.86, its P.E ratio is estimated at 17.67x.

PEG ratio against the expected Q3 2021 earnings is 2.74.

Q3 Earnings per share of about N0.92 is projected for Nascon Allied Industries.

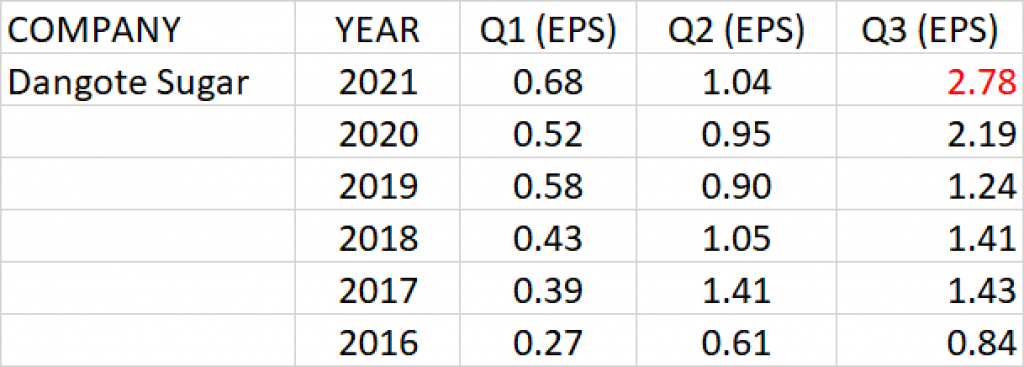

DANGOTE SUGAR

Q3 earnings per share of Dangote Sugar over the last 5 years ranged between N2.19 and 84 kobo with earnings growth rate of 27.07%.

At the current share price of N17.4 and Q3’20 earnings per share of N2.19, its P.E ratio is estimated at 7.95x.

PEG ratio against the expected Q3 2021 earnings is 0.29.

Q3 earnings per share of about N2.78 is projected for Dangote Sugar.

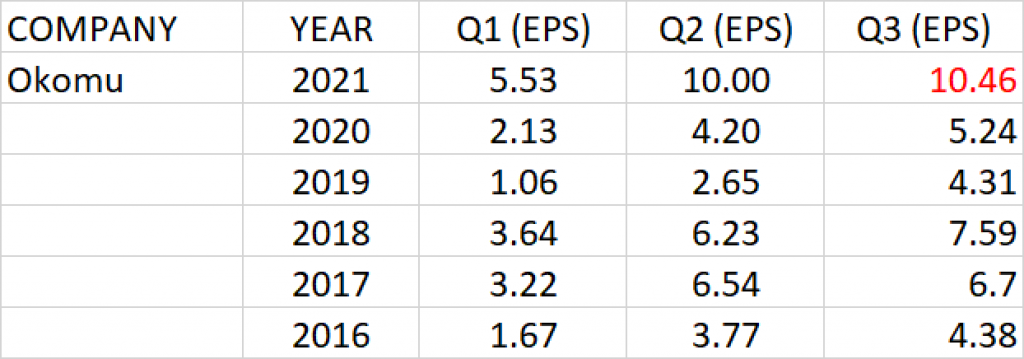

OKOMU

Q3 earnings per share of Okomu Oil Palm Company over the last 5 years ranged between N5.24 and N4.28 with earnings growth rate of 4.58%.

At the current share price of N115.5 and Q3’20 earnings per share of N5.24, its P.E ratio is estimated at 22.04x.

PEG ratio against the expected Q3 2021 earnings is 4.81.

Q3 Earnings per share of about N10.46 is projected for Okomu Oil.

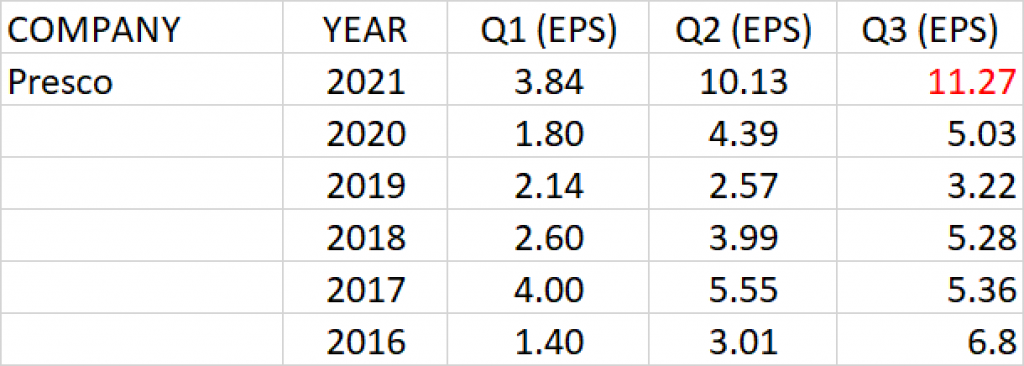

PRESCO

Q3 earnings per share of Presco over the last 5 years ranged between N5.03 and N6.8.

At the current share price of N85 and Q3’20 earnings per share of N5.03, its P.E ratio is estimated at 16.9x.

Based on its Q2 2021 earnings performance, a growth of 11.24% is projected for Presco in its Q3 earnings per share.

PEG ratio against the expected Q3 2021 earnings is 1.5.

Q3 Earnings per share of about N11.27 is projected for Presco.

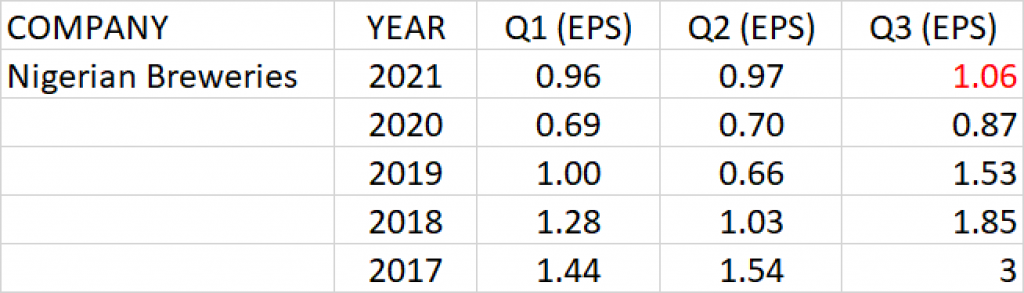

NIGERIAN BREWERIES

Q3 earnings per share of Nigerian Breweries over the last 4 years ranged between 87 kobo and N3. Earnings has been trending down since the last four years.

At the current share price of N49.5 and Q3’20 earnings per share of N5.24, its P.E ratio is estimated at 56.9x.

Based on its Q2 2021 earnings performance, a growth of 9.64% is projected for Nigerian Breweries for Q3.

PEG ratio against the expected Q3 2021 earnings is 5.90.

Q3 Earnings per share of about N1.06 is projected for Nigerian Breweries.

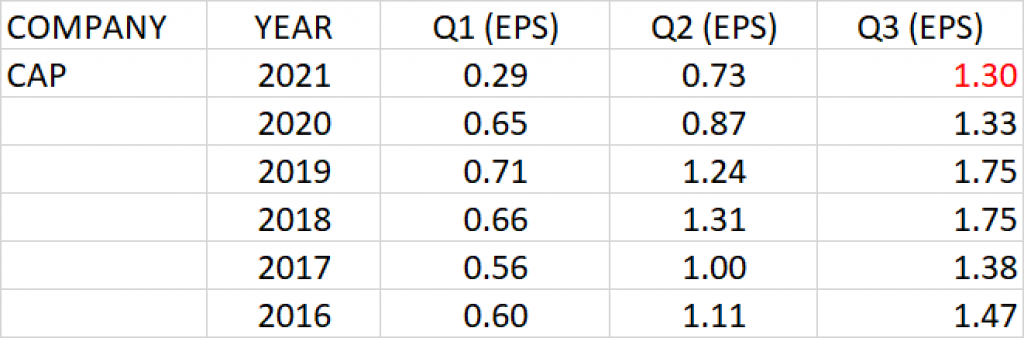

CAP PLC

Q3 earnings per share of CAP Plc over the last 5 years ranged between N1.33 and N1.47 with earnings growth rate of -2.47%.

At the current share price of N19.45 and Q3’20 earnings per share of N1.33, its P.E ratio is estimated at 14.62x.

PEG ratio against the expected Q3 2021 earnings is -5.92.

Q3 Earnings per share of about N1.30 is projected for CAP Plc.