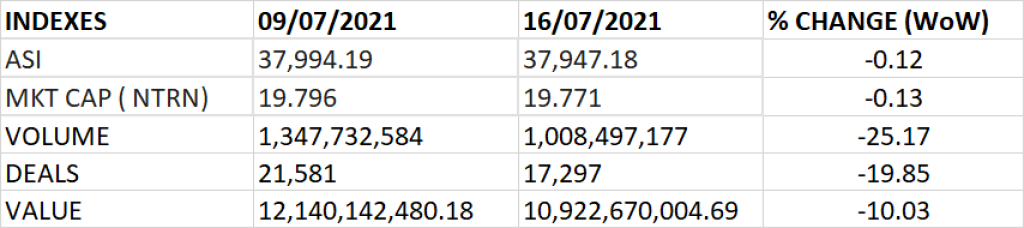

The Nigerian equity market last week closed on a bearish note as the All Share Index declined by 0.12% week on week to settle at 37,947.18 points from 37,994.19 points it closed the previous week.

The Market Capitalisation depreciated week on week by 0.13% to N19.771 trillion from the previous close of N19.796 trillion, shedding N25 billion.

An aggregate of N1.008 billion units of shares were traded in 17,297 deals, valued at N10.922 billion.

The Market Breadth closed negative as 29 equities appreciated in their share prices against 32 equities that declined in their share prices.

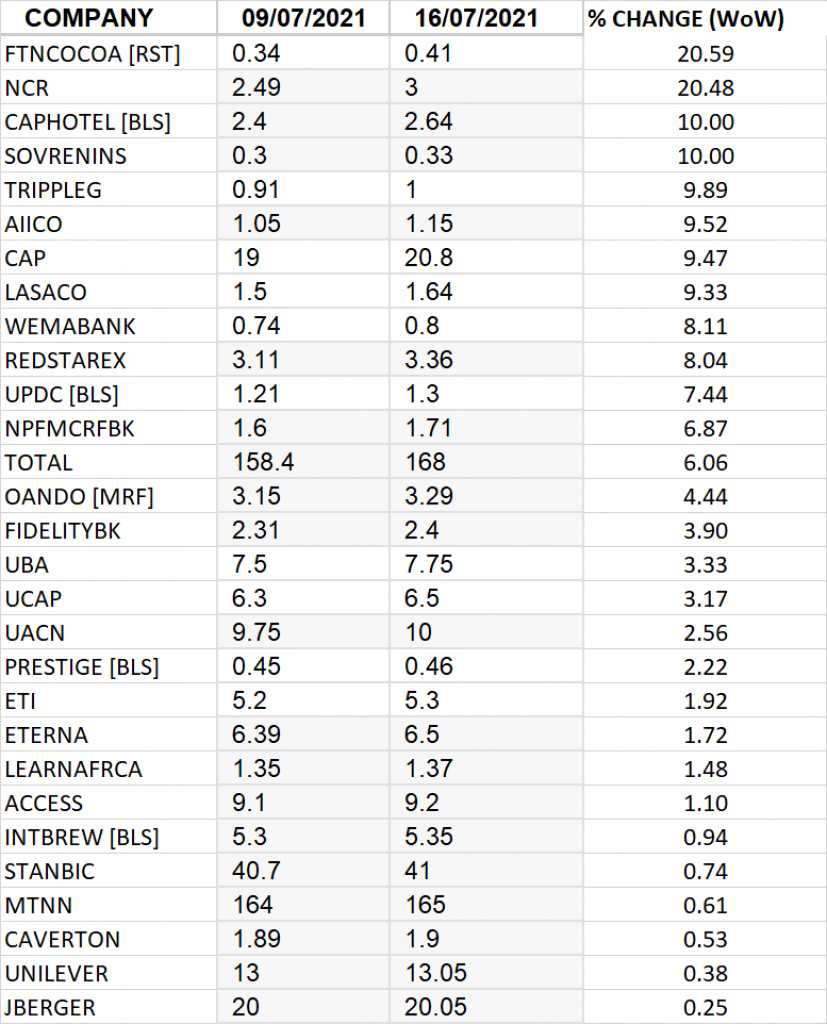

Top 10 Gainers

FTN Cocoa led other gainers with 20.59% growth, closing at N0.41 from the previous close of N0.34. This is followed by NCR Nigeria Plc as it grew its share price by 20.48% to close at N3 from N2.49.

Capital Hotel and Sovereign Trust Insurance both grew their share prices by 10% respectively.

Other top ten gainers include: Tripple Gee (9.89%), AIICO (9.52%), CAP Plc (9.47%), LASACO (9.33%), Wema Bank (8.11%) and Red Star Express (8.04%) respectively.

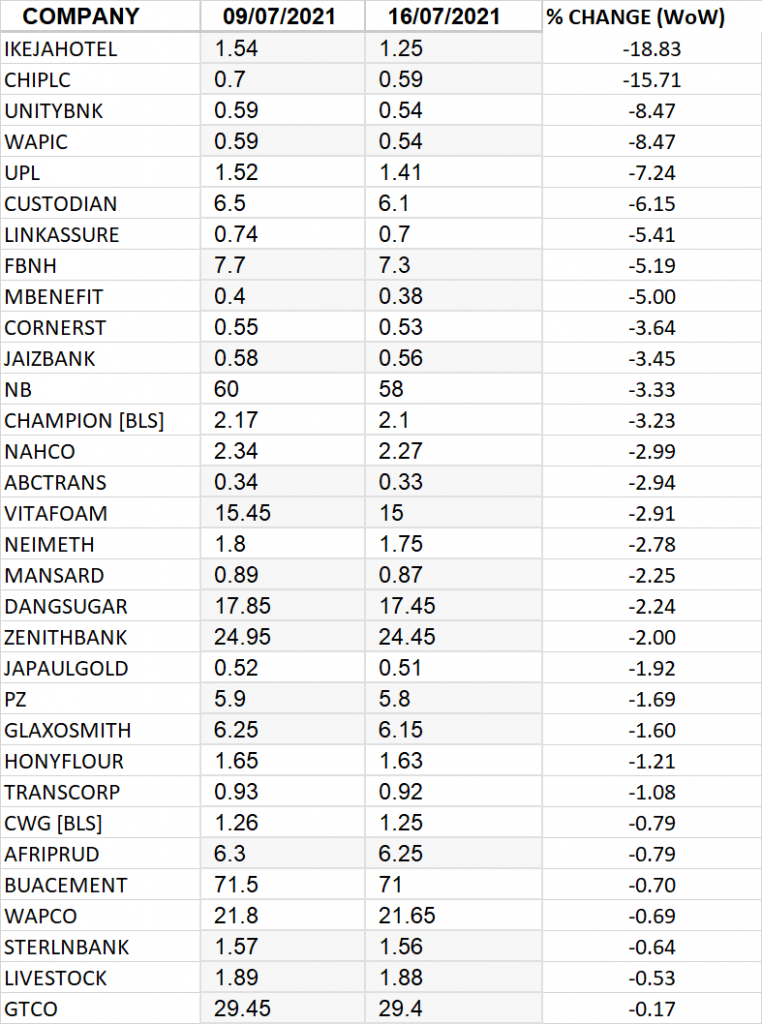

Per Top 10 Losers

Ikeja Hotel led other price decliners, week on week as it shed 18.83% of its share price to close at N1.25 from the previous close of N1.54. This is followed by Consolidated Hallmark Insurance shedding 15.17% of its share price.

Unity Bank and Coronation Insurance both shed 8.47% of their share prices respectively.

Other top ten price decliners include: University Press (-7.24%), Custodian Investment (-6.15%), Linkage Assurance (-5.41%), FBNH (-5.19%), Mutual Benefit (-5.00%) and Cornerstone Insurance (-3.64%) respectively.

GAINERS

LOSERS