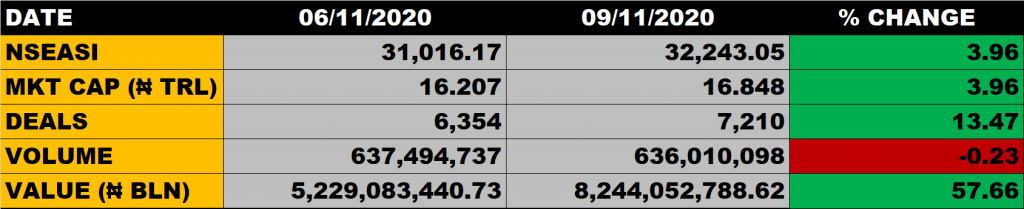

The Nigerian equity market on Monday, 9 November 2020 closed on a positive note as the All Share Index appreciated by 3.96%to settle at 32,243.05 points from the previous close of 31,016.17 points.

Investors gain N641 billion as Market Capitalization grew by 0.90% to close at N16.848 trillion from the previous close of N16.207 trillion.

An aggregate of 636 million units of shares were traded in 7,210 deals, valued at N8.24 billion.

Market Breadth

The market breadth closed positive as 49 equities gained while 11 equities declined in their share prices.

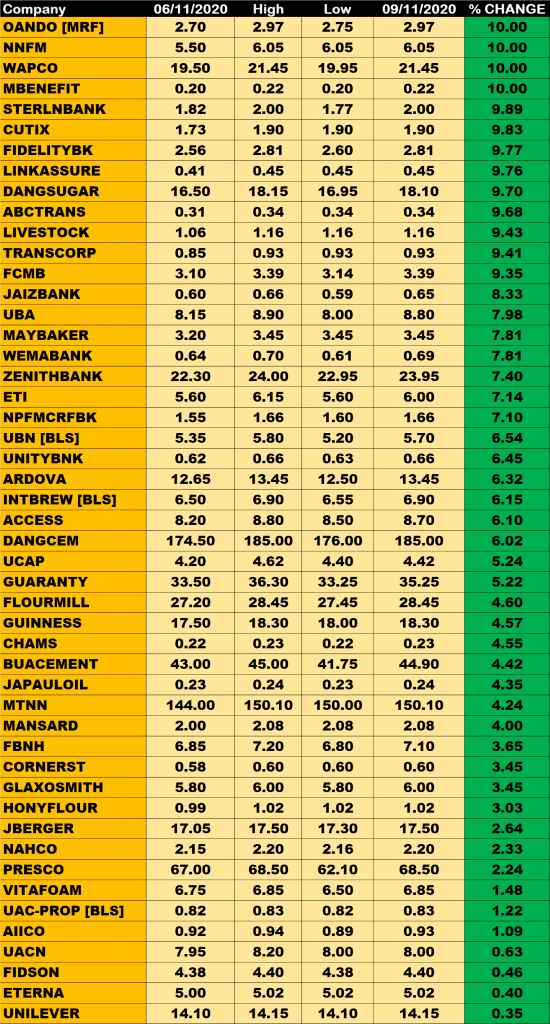

Percentage Gainers

Oando, Northern Nigeria Flour Mills (NNFM), WAPCO (Lafarge) and Mutual Benefit Assurance all grew their share prices by 10% respectively.

Sterling Bank, Cutix Plc and Fidelity Bank among other gainers also grew their share prices by 9.89%, 9.83% and 9.77% respectively.

Percentage Losers

NCR Nigeria Plc led other price decliners as it shed 10% of its share price to close at N1.80 from the previous close of N2.

Learn Africa and Conoil among other price decliners also shed their share prices by 8.70% and 6.30 respectively.

Volume Drivers

Zenith Bank traded about 70.22 million units of its shares in 1 deal, valued at N1.66 billion.

First Bank of Nigeria Holdings traded about 67.65 million units of its shares in 549 deals, valued at N474.57 million.

Access Bank traded about 58.02 million units of its shares in 497 deals, valued at N500.23 million.