Manufacturing has generally been described and accepted as an engine of growth and development of any country. In modern economies, industrialization is widely conceived as critical tool for accelerating economic growth and development. In as much as individuals have taken the bull by the horns to dabble, investors had got lower than encouraging cash dividend payout over the years.

To a large extent, manufacturing companies in Nigeria have over the years scaled through several hurdles and obvious challenges to remain in business, top of these is financing while others include infrastructure, low purchasing power and Government policies.

A quick glimpse into the Half Year 2019 financial report of manufacturing companies revealed that most manufacturing companies in Nigeria survive majorly on credit facilities. Unfortunately, high cost of financing had largely impacted negatively on profitability.

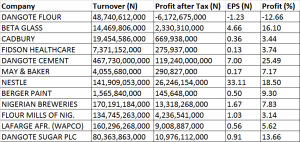

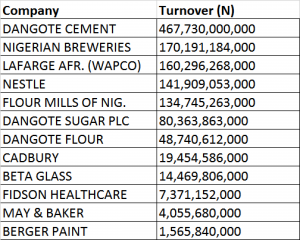

TURNOVER

In half year 2019 financial report, Dangote Cement has the largest turnover with a revenue of N467.73 billion; this is followed by Nigerian Breweries with a turnover of 170.19 billion. Third on the list in terms of turnover is Lafarge Africa (WAPCO) with turnover of N160.3 billion. Nestle made a turnover of N141.9 billion emerging as fourth while Flour Mills of Nigeria came fifth with a turnover of N134.75 billion.

In that ranking order, list of manufacturing companies and their turnover include: Dangote Sugar Plc (N80.36bn), Dangote Flour (N48.74bn), Cadbury (N19.45bn), Beta Glass (N14.47bn), Fidson Healthcare (N7.37bn), May & Baker (N4.06bn), and Berger Paints (N1.57 bn).

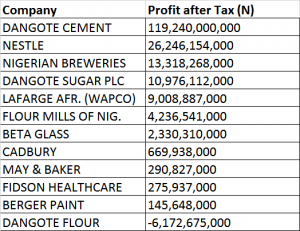

PROFIT AFTER TAX

Dangote Cement emerged top on this list with a profit after tax of N119.24 billion in the second quarter of 2019. This is followed by Nestle Nigeria Plc which made N26.25 billion as profit after tax. Nigeria Breweries emerge third on this list with profit after tax of N13.32 billion.

Dangote Sugar and Lafarge Africa came fourth and fifth on this list with profit after tax of N10.98 billion and N9 billion respectively.

The profit after tax of other firms in the manufacturing sector include: Flour Mills of Nigeria (N4.24bn), Beta Glass (N2.33bn), Cadbury Nigeria (N669.94 million), May & Baker (N290.83 million), Fidson Healthcare (N275.94 million), and Berger Paints (N145.65 million). The last on this list is Dangote flour which reported a loss of N6.17 billion.

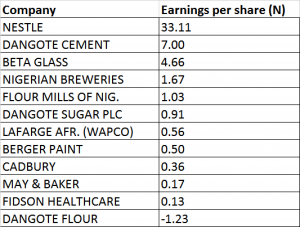

PERFORMANCE IN EARNINGS PER SHARE (EPS)

- Nestle Nigeria grew its earnings per share by 22% to N33.11 from N27.07 recorded in the half year of 2018.

- Dangote Cement grew its earnings per share by 5% from N6.64 to N7.00 in half year 2019.

- Beta Glass recorded earnings per share of N4.66, down by 2.7% from the previous earnings per share of N4.79.

- The earnings per share of Nigerian Breweries dropped to N1.67 from the previous earnings per share of N2.30 in half year 2018.

- Flourmills of Nigeria grew its earnings per share by 16.09%, from N0.89 of 2018 to N1.03

- Earnings per Share (EPS) of Dangote Sugar came down to N0.91 as against the previous EPS of N1.06 in the first half of 2018.

- Lafarge Africa (WAPCO) grew its earnings per share grew to 56 kobo from the negative earnings per share of 24kobo.

- The earnings per share of Berger Paint grew by 19% to 50 kobo from 42 kobo in half year 2018.

- Cadbury Nigeria Plc grew its earnings per share by 258%, from negative 23kobo in half year 2018 to 36kobo in 2019.

- The earnings per share of May & Baker grew to 17kobo from the previous earnings per share of 15.33 kobo in half year 2018.

- Fidson Healthcare’s earnings per share dropped to 13kobo from 25kobo reported in the half year of 2018.

- Dangote Flour reported a negative earnings per share of N1.23, which is actually a decline of 289.85% from 65 kobo reported in half year 2018

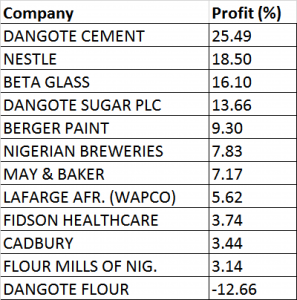

PROFITABILITY

Profit made by manufacturing firms in half year 2019 was evaluated as a ratio of TURNOVER to PROFIT AFTER TAX.

- Dangote Cemnet emerged first among others with a profit of 25.49%. Second on this list is Nestle with 18.50% profit.

- Beta Glass came third with a profit of 16.10%. Dangote Sugar came fourth on the list in terms of profitability with 13.66%. Berger Paint emerged fifth on the list, making 9.30% as profit. Nigerian Breweries made a profit of 7.83% emerging as sixth on the profit ranking.

- May & Baker is the seventh on this rank with a profit of 7.17%, while Lafarge Africa emerged as eighth with a profit of 5.62%.

- Fidson emerged ninth on the list with a profit of 3.74% while Cadbury made a profit of 3.44% ranking as tenth on the list.

- Flour Mills of Nigeria made a profit of 8.93% emerging as eleventh on the rank.

- Dangote Flour however made a loss of 12.66%

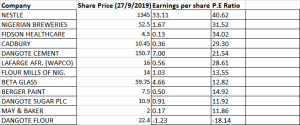

PRICE-EARNINGS RATIO (P/E RATIO)

Generally, the P/E ratio of manufacturing companies is relatively high when compared with the P/E ratio of firms in other sectors.

The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

Dangote Flour has a negative P.E ratio of 18.14x due to its negative earnings for the period under review.

DANGOTE CEMENT

Dangote Cement is the largest cement production company in Africa, with a market capitalization of almost N2.57 trillion on the Nigeria Stock Exchange. The firm posted a turnover of N467.7bn in its half year report for 2019. Though it was a decline of 3.05% from N482.4bn reported in half year 2019.

Profit after tax (PAT) rose by 5.37% from N113bn to about N119bn in half year 2019. The company’s earnings per share grew by 5% from N6.64 in 2018 to N7.00. Relative to the share price of N150.7, the P/E ratio of Dangote Cement stands at 21.54x.

MAY & BAKER

May & Baker Nigeria Plc in its half year financial report for the period ended June 30, 2019 recorded a profit after tax (PAT) of N290.83 million, implying a growth of 9.97% compared to the N264.45 million recorded the previous year.

Turnover was N4.06 billion, down by 12.01% against the previous close of N4.61 billion in half year 2018.

Profit before tax grew by 9.97%, to settle at N427.69 million from the previous close of N388.9 million the previous year.

Earnings per share for the period under review grew to 17 kobo from the previous earnings per share of 15.33 kobo in half year 2018.

With reference to the share price of N2. P.E ratio of May &Baker Nigeria Plc stands at 11.86x.

NIGERIAN BREWERIES

Nigerian Breweries reported a turnover of N170.19 billion in the half year of 2019, down by 1.43% from N172.66 billion. Profit after tax (PAT) declined by 27.76% to settle at N13.32 billion from N18.43 billion recorded in half year 2018.

Earnings per share of the firm in half year 2019 was N1.67, down by 27% from N2.30 recorded in half year 2018.

With reference to the share price of N52.5, P.E ratio of Nigerian Breweries stands at 31.52x.

FLOUR MILLS OF NIGERIA PLC

The half year report of Flour Mills of Nigeria plc revealed an improvement of 1.29% in topline figures to close the period at N134.7 billion away from N133bn reported same period in 2018.

The first six months financial reports shows a growth of about 6% in Profit before Tax to N5.5bn, away from N5.2bn recorded in the preceding period in 2018.

The profit after tax for the period under review also rose from N3.649bn in 2018 to N4.236bn in the current report, which implies a growth of about 16% in (PAT).

The earnings per share grew by 16.09%, from 89kobo of 2018 to 103kobo in the period under review.

The PE Ratio stands at 13.55x relative to the share price of N14.

LAFARGE AFRICA (WAPCO)

Lafarge Africa Plc (WAPCO) recorded a growth of 330.86% in its profit after tax as it posted N9 billion against N3.9 billion previously reported in half year 2018.

The company’s turnover in the first half of 2019 stands at N160 billion, reflecting a decline in revenue by 1.23%, away from N126 billion reported for half year 2018.

Earnings per grew to 56kobo from a negative 24kobo reported in half year 2018, implying growth of 330%.

At a reference share price of N16, the company’s price to earnings ratio stands at 28.61x.

CADBURY NIGERIA PLC

The half year report of Cadbury for 2019 revealed an improvement of 10.82% in topline figures to close the period at N19.454 billion away from N17.554bn reported same period the previous year in 2018.

The first six months financial reports showed a growth of about 300% in Profit before Tax to N957million, form a loss before tax of N423million reported in half year 2018.

The profit after tax rose from a loss of N423.767million to N669.938 million in half year 2019.

The earnings per share consequently grew by 258%, from a negative earnings of 23kobo to 36kobo in the period under review.

The P/E Ratio of Cadbury Nigeria Plc stands at 29.30x relative to the share price of N10.45.

DANGOTE SUGAR

Dangote Sugar Refinery reported a turnover of N80.363 billion, down by 4.42% from the previous close of 84.077 billion in half year 2018.

Profit after Tax (PAT) closed at N10.9 billion dropping by about 13% from N12.7 billion previously recorded in 2018.

The earning per share of the group dropped to N0.91 against the previous EPS of N1.06 in 2018.

With reference to its share price of N10.90, the PE ratio of the company stands at 11.92x.

DANGOTE FLOUR

The half year 2019 report of Dangote Flour showed a decline of 13.57% in its revenue to close at N48.74 billion from N56.39 billion reported in half year 2018.

The company reported a loss after tax of about N6 billion which is around 280% decline when compared to N3.25 billion reported in half year 2018.

The Company reported a negative earnings per share of 123 kobo t for the period ended June 30, 2019 compared to 65 kobo reported in half year 2018.

With reference to the share price of N22.4, the PE Ratio of Dangote Flour stands at -18.14x.

BETA GLASS

BETA Glass grew its turnover by 10.14% from N13.137 billion in 2018 to N14.469 billion in half year 2019.

The company declined in Profit after Tax by 2.70% to N2.330 billion from N2.394 billion in half year 2019.

Earnings per share dropped by 2.70% to N4.66 from N4.79 reported in half year 2018. At a price of N59.75, the company’s PE Ratio stands at 12.82x.

FIDSON HEALTHCARE

Fidson Healthcare Plc reported a turnover of N7.371bn, down by 0.83% from N7.432bn reported in the half year of 2018. The profit after tax also declined by 47.08% from the previous N521.4 million to N275.9 million.

Earnings per share of the firm likewise dropped to 13kobo from 25kobo. Relative to the share price of N4.5, the PE Ratio of Fidson Healthcare stands at 34.02x.

NESTLE NIGERIA PLC

The half year 2019 financial report of Nestle Nigeria showed a growth of 4.89% in its turnover from from N135 billion to N141 billion.

The profit after tax of N26 billion reported grew by 22.32% when compared to N21 billion reported in half year 2018.

The earnings per share grew to N33.11 from N27.07 recorded reported in 2018,

Relative to the current share price of N1345, the PE Ratio of the firm stands at 40.62x.

BERGER PAINTS

Berger Paints Plc reported a turnover of N1.565bn in its half year report for 2019. That was actually a decline of 1.14% from N1.583 billion reported in half year 2018.

The profit after tax of the firm grew by 119.42% to settle at at N145million from N121million reported in 2018. Earnings per share grew to 50kobo form 42kobo reported in 2018.

The P/E Ratio of the firm stands at 14.92x relative to the share price of N7.5.