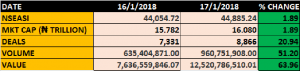

The Nigeria equities market continue to enjoy a recharged optimism as the bourse keeps logging fresh highs across all sectors. The Nigerian Stock Exchange’s combined equity capitalisation on Wednesday January 17, 2018 hit a fresh record, closing at N16.080 trillion, which is 1.89 percent higher than the N15.782 trillion it closed on Tuesday. The market All Share Index also extends gain by 1.89 percent closing at 44,885.24 away from the 44,054.72 it close the previous day.

Technical experts have recently warned that many bulls is expected to welcome a near-term pullback and skepticism remains over whether recent gains signal that the bull market has crossed the line from optimism to mere euphoria, as number of respected indicators are flashing warning signs of market reversal.

Going forward, 960.751 million shares traded hands today in 8,866 deals, worth about N12.520billion. This signals an increasing money flow into the market, especially when compared with the previous day’s performance. It could be that after nearly nine years, many long-skeptical investors are finally beginning to take notice of a post-financial crisis bull market that had previously been described as the most dreaded history.

However, as always advised, let us be cautious of testing the Shark River with two feet. The current development may not mean that the investors are yet stampeding into the market in the fashion that has marked other bouts of euphoria, yet let us all remember John Templeton’s observations that bull markets are “born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

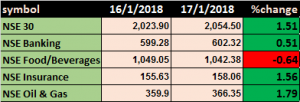

Sector Performance

All sector Index moved up but NSE Food/Beverages & Tobacco, as share prices of Nasco, Cadbury, Nigeria Breweries, Dangote Flour and few others in this sector dropped.

Market Breadth

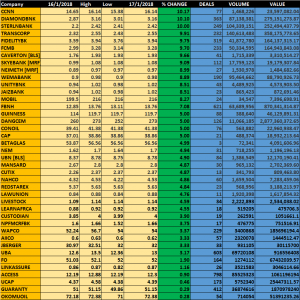

40 stocks out of 107 traded advanced, for the day, while 17 stocks lost for the day under review.

Percentage Gainers(40)

CCNN led the percentage gainers, closing at N16.14, which is 10% growth away from N14.65 it previously closed. 1,468,226 units of the stock exchanged hands in 77 deals, worth about N23.597 million.

DIAMOND BANK followed the rank by adding 10%, closing at N3.16 from the previous close of N2.87.

Sterling bank, Transcorp, Fidelity and others also grew significantly to help the bourse stay bullish.

Percentage Gainers(17)

On the percentage losers list is Nascon leading others by dropping 4.98% of its previous N22.10 previous close, which brings it share price down to its intra-day N21 low.

Cadbury and UPL in the same range closed 4.9 percent lower than the previous close.

Others on the list are Airservice, Agleventis UAC-PROP, Zenith and host of others.

Best Stock

Access Bank plc again attracted more gaze maintaining advantaged positions in all metric’s space. The bank in most deals traded 85.525million units of shares worth N1.061 billion.